State Of Michigan Lady Bird Deed Form With Trust

Description

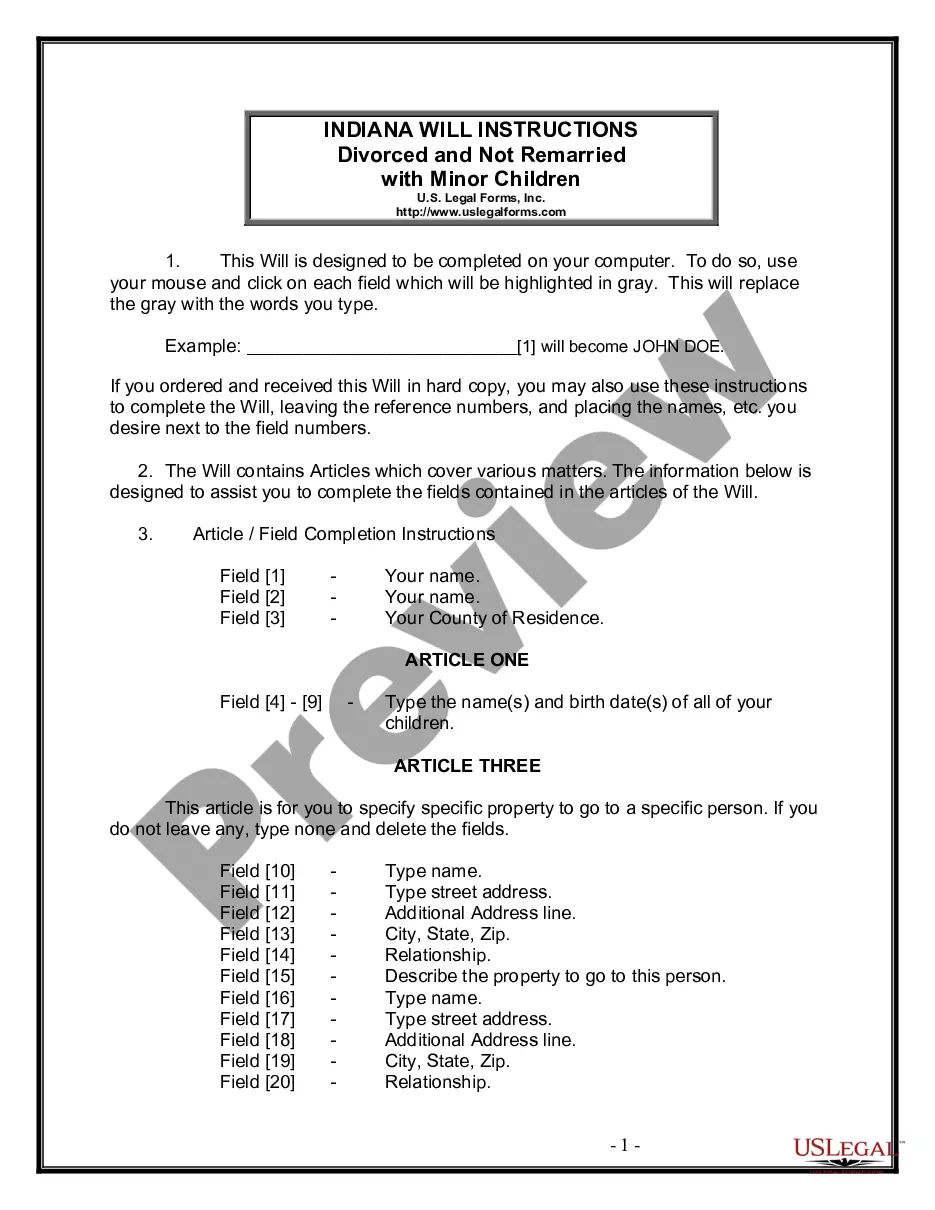

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Three Individuals?

Whether for business purposes or for personal affairs, everybody has to handle legal situations sooner or later in their life. Completing legal paperwork requires careful attention, beginning from choosing the appropriate form sample. For example, if you select a wrong version of a State Of Michigan Lady Bird Deed Form With Trust, it will be declined once you submit it. It is therefore important to get a trustworthy source of legal files like US Legal Forms.

If you need to obtain a State Of Michigan Lady Bird Deed Form With Trust sample, stick to these simple steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Look through the form’s description to make sure it suits your situation, state, and county.

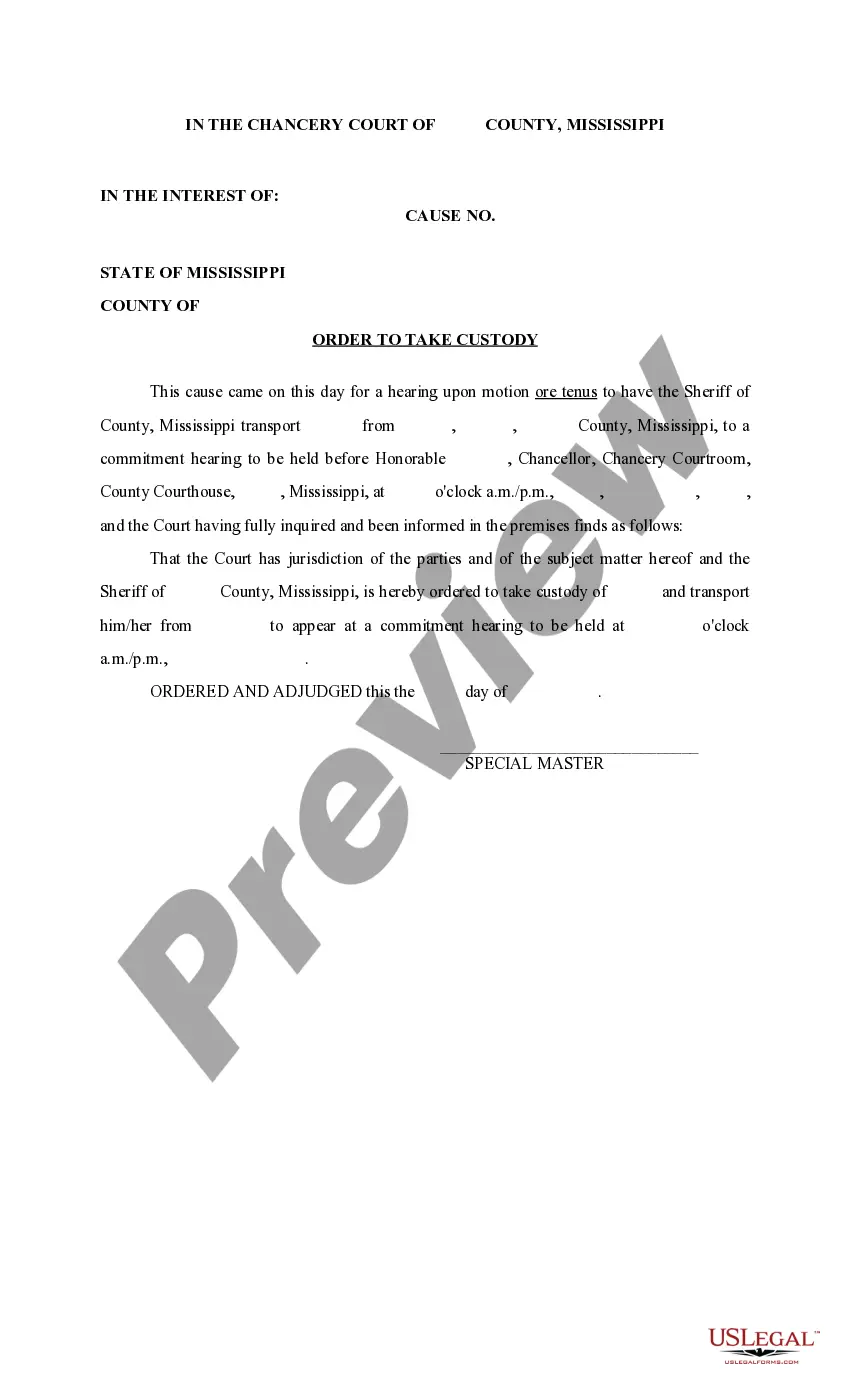

- Click on the form’s preview to view it.

- If it is the wrong form, get back to the search function to locate the State Of Michigan Lady Bird Deed Form With Trust sample you require.

- Get the file when it meets your requirements.

- If you already have a US Legal Forms account, simply click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Finish the account registration form.

- Pick your payment method: you can use a credit card or PayPal account.

- Choose the file format you want and download the State Of Michigan Lady Bird Deed Form With Trust.

- Once it is saved, you can complete the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time seeking for the right sample across the internet. Utilize the library’s straightforward navigation to get the appropriate form for any occasion.

Form popularity

FAQ

A Lady Bird did will not uncap or affect your property tax and does not increase your property's taxable value. The Lady Bird deed does not transfer until the owner's death and therefore, since there is no transfer until death, the property tax is not uncapped.

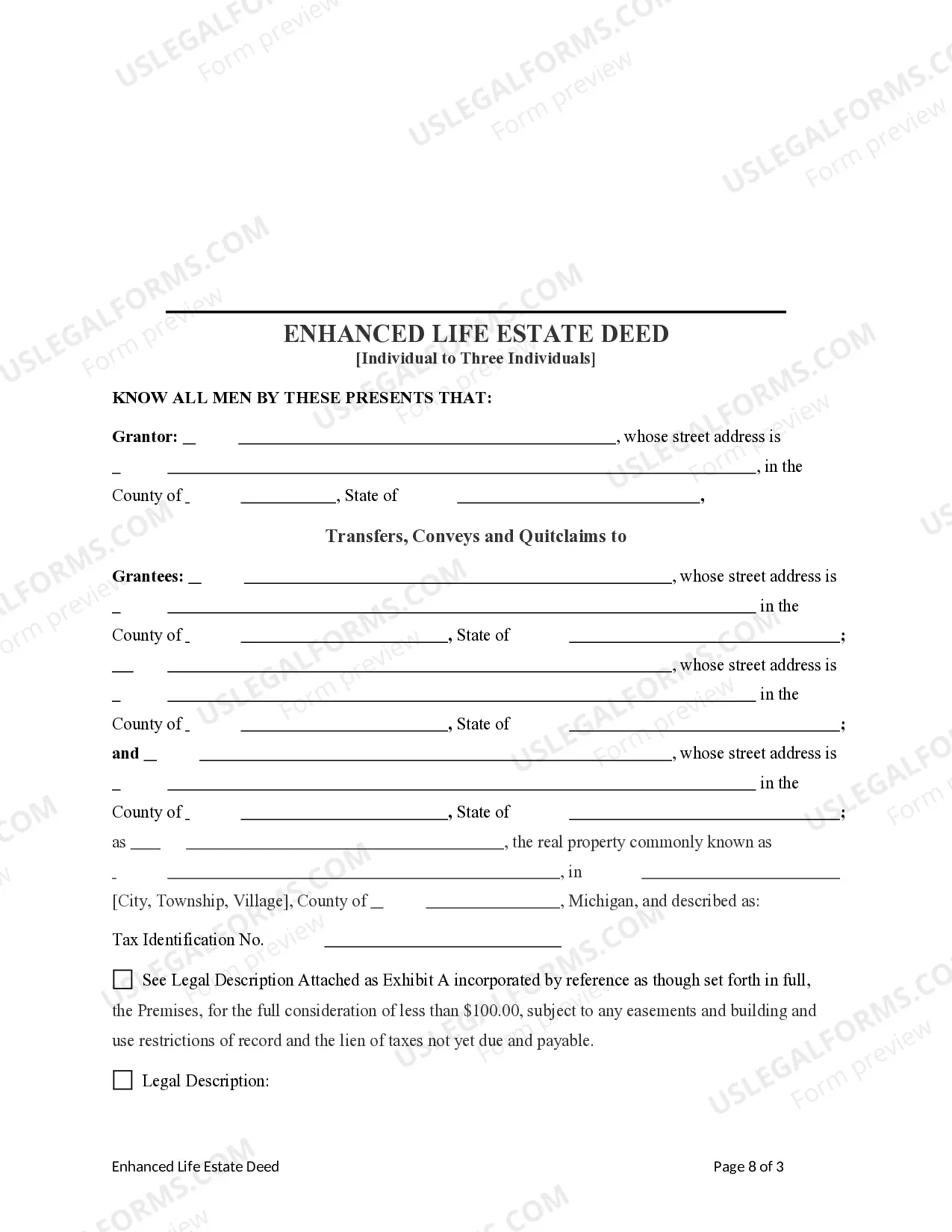

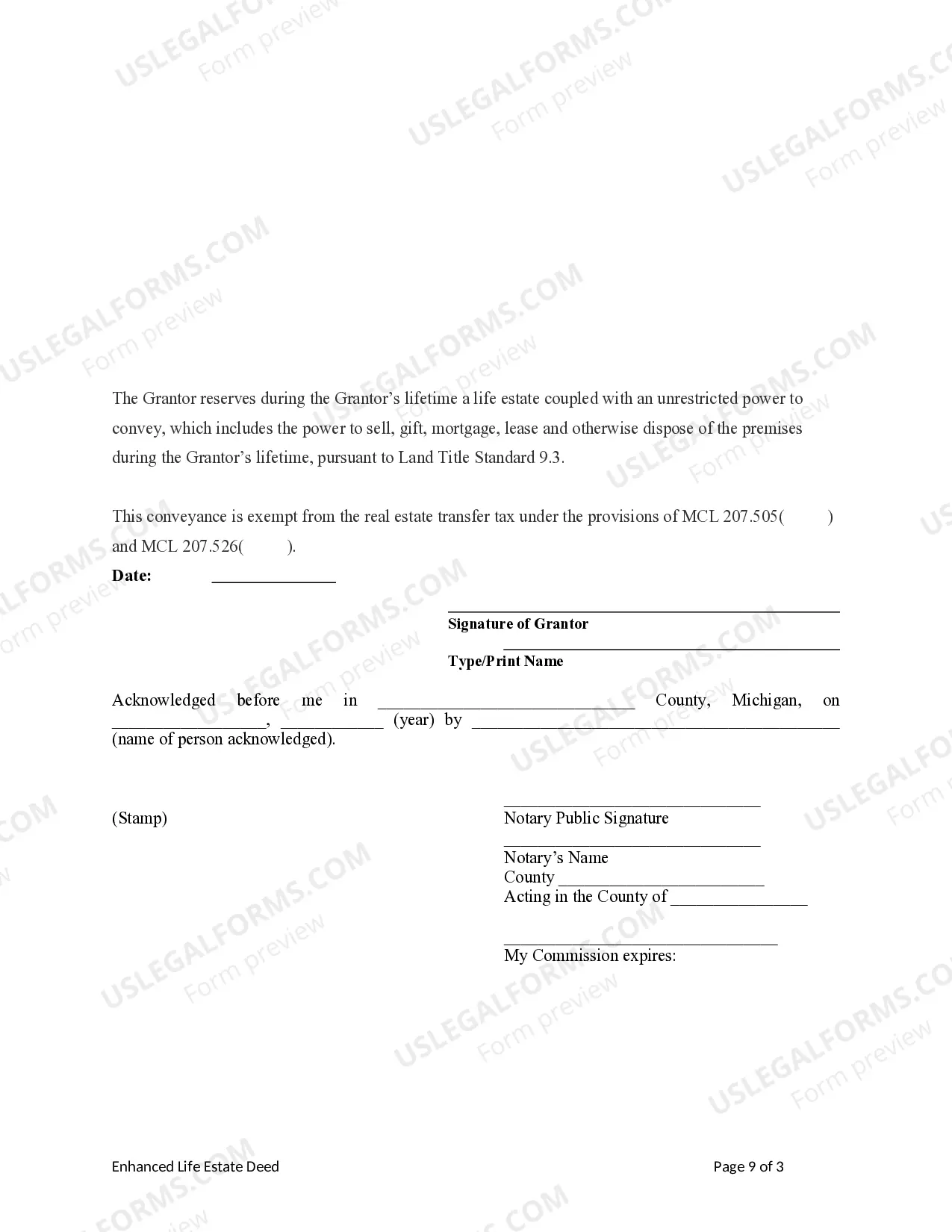

A Lady Bird Deed (also known as an enhanced life estate deed) is a special type of deed which allows real estate to be transferred to one or more individuals (or a trust) upon your passing. Essentially, it allows you to add a ?beneficiary? to the real estate you own.

A Lady Bird Deed is a tool used to pass real property, such as your home or land, to your heirs upon your death. A Lady Bird Deed avoids probate. Meaning, the real property passes to your named heirs automatically?without court involvement.

Like a Lady Bird Deed, a trust avoids probate. Unlike a Lady Bird Deed, however, the assets that can be in a trust are more than just the family home. So, for those who have extensive assets or want to protect more than just the family home, a trust can be a good estate planning tool to use.

Benefits of Michigan Lady Bird Deeds There is no due on sale or acceleration of the mortgage note with a lady bird deed. A married couple retains tenancy by the entireties protection. You can use it to avoid probate, including the legal fees, court cost, and time involved.