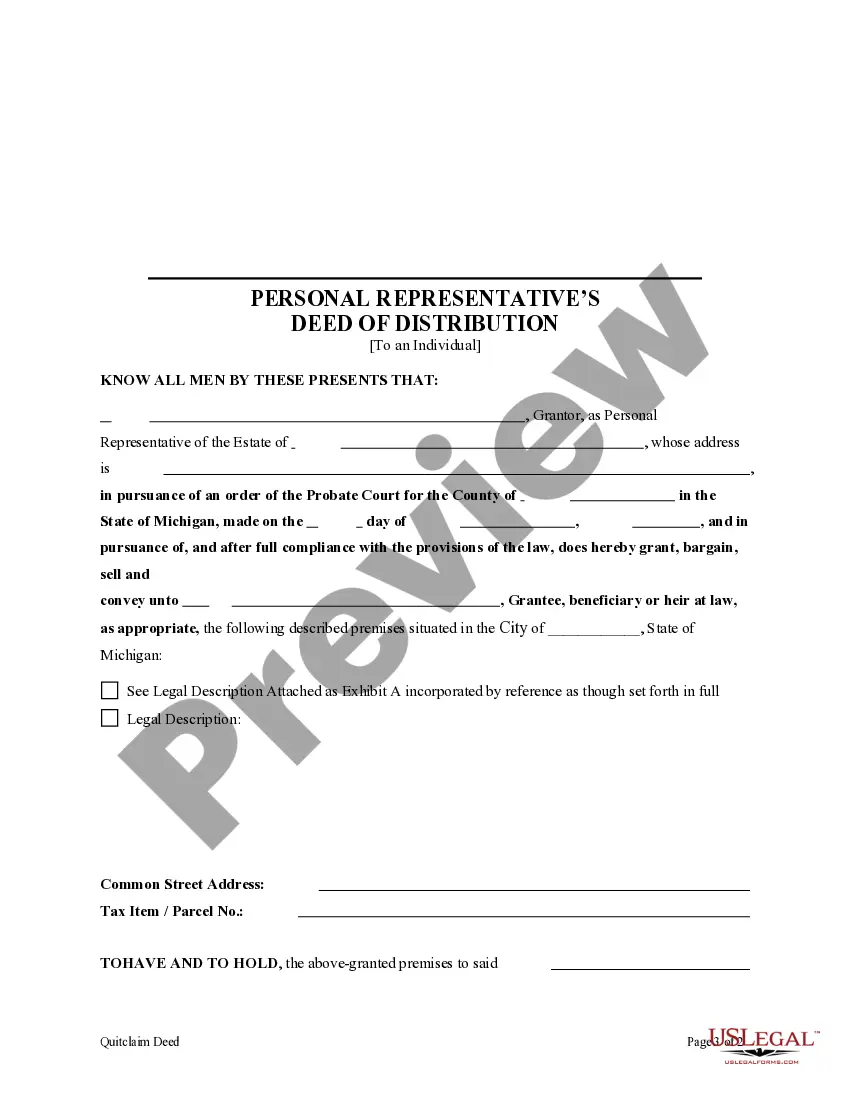

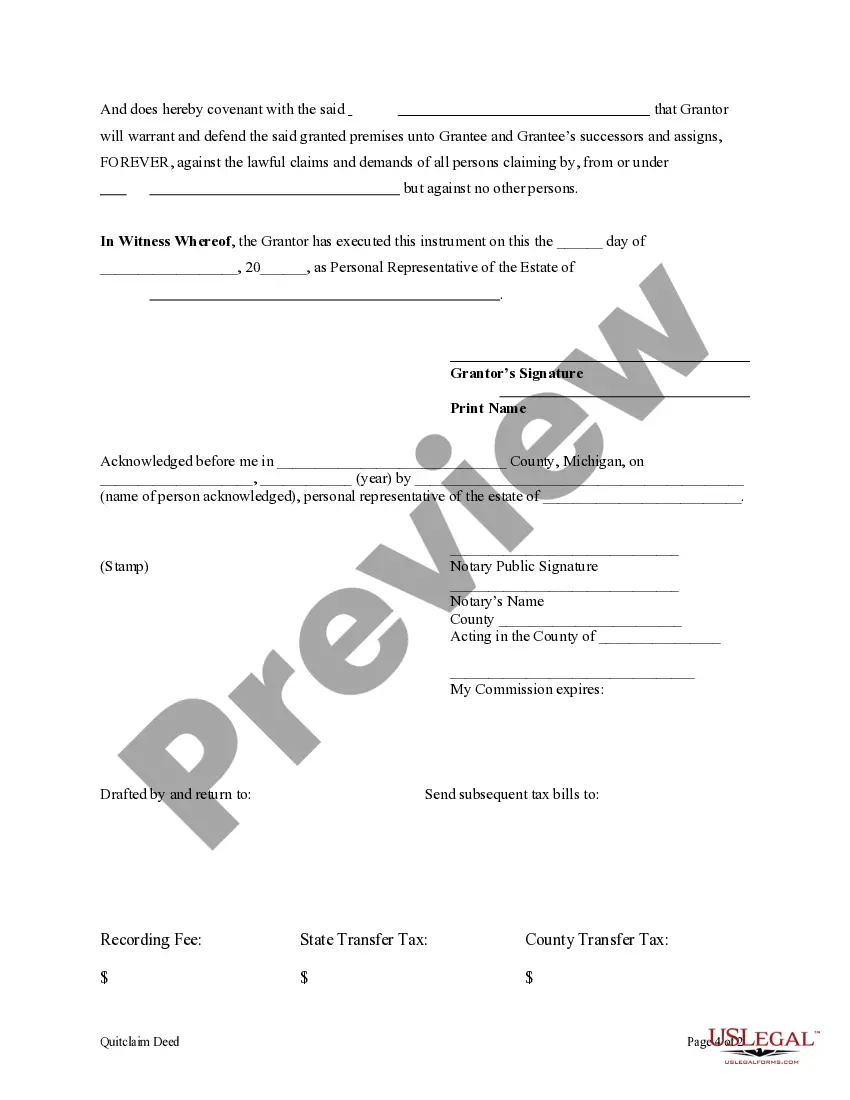

This form is a Personal Representative's Deed where the grantor is the individual appointed as Personal Represenative of an estate and the grantee is the beneficiary or heir at law of the real property from the estate. Grantor conveys the described property to grantee and only covenants that the transfer is authorized by the Court, that the grantor has done nothing while serving as administrator to encumber the property, an dthat the Grantor will defend title but only as to individuals claimanting by, through and under Grantor. This deed complies with all state statutory laws.

Personal Representative Of Estate Form Michigan

Description

How to fill out Personal Representative Of Estate Form Michigan?

There's no longer a need to squander time searching for legal documents to satisfy your local state regulations.

US Legal Forms has gathered all of them in one location and simplified their availability.

Our platform offers over 85,000 templates for various business and personal legal situations sorted by state and area of application.

Utilize the search field above to find another sample if the previous one did not meet your needs. Click Buy Now next to the template name once you find the suitable one. Select the desired subscription plan and register for an account or Log In. Make payment for your subscription using a credit card or via PayPal to proceed. Choose the file format for your Personal Representative Of Estate Form Michigan and download it to your device. Print your form to complete it by hand or upload the sample if you prefer to use an online editor. Preparing official documents under federal and state laws and regulations is quick and easy with our platform. Try US Legal Forms today to maintain your documentation organized!

- All forms are expertly drafted and reviewed for accuracy, so you can be assured of receiving a current Personal Representative Of Estate Form Michigan.

- If you are acquainted with our service and already possess an account, you must verify your subscription status before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents whenever necessary by accessing the My documents section in your profile.

- If you are a first-time user of our service, completing the process will require additional steps.

- Here’s how new users can find the Personal Representative Of Estate Form Michigan in our catalog.

- Carefully read the page content to ensure it contains the sample you need.

- To achieve this, make use of the form description and preview options if available.

Form popularity

FAQ

Assets that typically do not go through probate include joint bank accounts, life insurance policies with named beneficiaries, and assets held in a living trust. These assets transfer directly to the designated individuals outside of the probate process. As a personal representative in Michigan, understanding which assets bypass probate can help streamline your responsibilities and expedite the distribution to beneficiaries.

To fill out an estate document, start by clearly understanding the purpose of the document and the information required. Gather relevant details about the deceased and their assets, debts, and beneficiaries. Using the personal representative of estate form Michigan can simplify the process, providing a guide for each section to avoid common mistakes.

Choosing an estate process over a will can streamline asset distribution and provide a clearer path for managing debts and taxes. An estate allows for probate court supervision, which can help avoid disputes among heirs. Additionally, the personal representative of estate form Michigan can facilitate a more structured approach to settling final affairs, ensuring compliance with state laws.

The 3-year rule in Michigan states that claims against a deceased person's estate must generally be filed within three years of the date of death. After this period, creditors may lose their right to pursue claims against the estate. Understanding this rule is vital for personal representatives, as it impacts the estate's liabilities.

To file as a personal representative in Michigan, you must first gather the necessary legal documents, including the will, if available. Next, submit the personal representative of estate form Michigan to the probate court in the county where the deceased lived. This form officially appoints you as the fiduciary responsible for managing the estate, so ensure that all information is correct and complete.

Income for an estate typically includes any earnings generated after the death of the individual, such as rental income, interest, dividends, or profits from the sale of assets. This income may be subject to taxation. When managing an estate, it’s crucial to account for this income accurately, as it affects the overall financial standing of the estate during probate proceedings.

To fill out a personal representative deed in Michigan, start by gathering necessary details about the estate and the deceased. You must include the name of the deceased, date of death, and a legal description of the property. Use the personal representative of estate form Michigan to guide you and ensure you understand the fields required for accurate completion.

A personal representative is the initial appointee tasked with managing the estate, while a successor personal representative takes over if the original representative cannot fulfill their duties. This could be due to death, resignation, or incapacity. Understanding these roles, including the Personal Representative of Estate Form Michigan, is crucial for ensuring smooth estate administration.

A personal representative in Michigan possesses various powers to manage the estate effectively. These powers include gathering and managing estate assets, settling debts, and making distributions to beneficiaries. Importantly, the personal representative must act in the best interests of the estate and follow legal obligations outlined in state laws.

To become a legal representative of a deceased person, file a petition to open probate in the appropriate court. You will need to include details about the deceased and their estate, along with a completed Personal Representative of Estate Form Michigan. The court will assess your petition and may appoint you as the legal representative if deemed suitable.