Michigan Probate Personal Representative Form

Description

Form popularity

FAQ

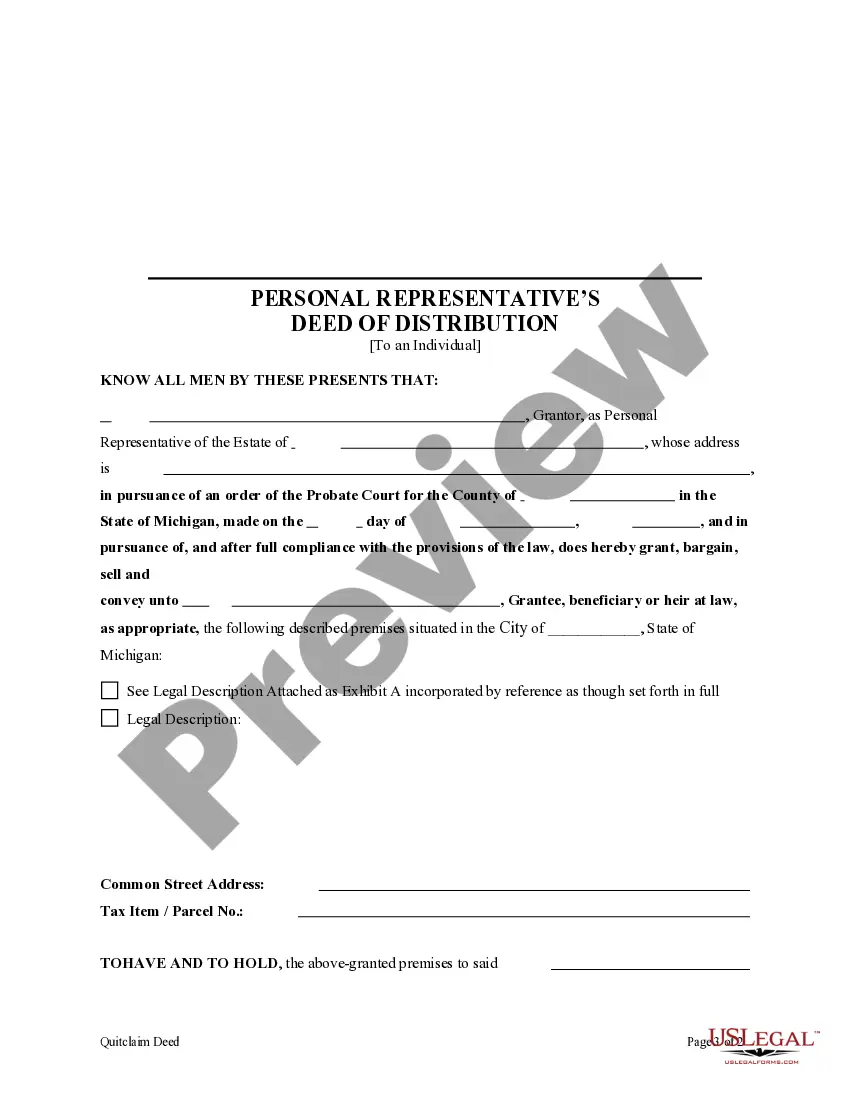

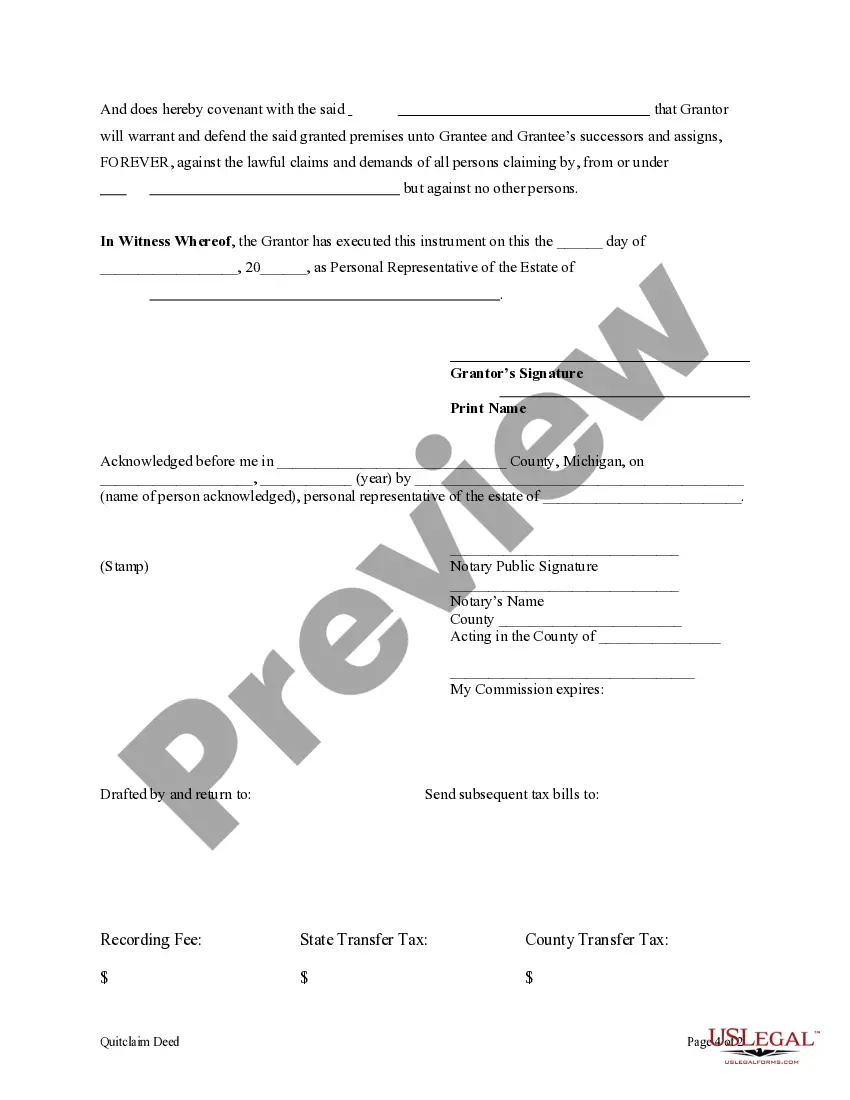

In Michigan, the term 'personal representative' is commonly used instead of 'executor.' The role of the personal representative involves managing the estate according to the decedent’s wishes and state laws. If you need to designate or confirm this role, the Michigan probate personal representative form is essential for the process. It's designed to streamline your responsibilities and ensure compliance with legal standards.

In Michigan, there is no strict deadline for transferring property after death, but it is generally advisable to do so within a reasonable time frame. After obtaining the Michigan probate personal representative form, you should work promptly to ensure all assets are administered according to the will or intestacy laws. Delays can complicate matters and potentially lead to disputes among heirs. Therefore, timely actions are beneficial.

In many situations, an executor can sell property without all beneficiaries' approval as long as they act within the authority granted by the will or by the court. However, it’s essential to review the terms of the will, as some wills may require consent from all beneficiaries. Using the Michigan probate personal representative form can clarify the executor's powers in these matters. If in doubt, consult a legal professional for guidance.

To complete the Michigan Small Estate Affidavit, you need to gather necessary information about the deceased and their assets. Begin by obtaining the Michigan probate personal representative form, which provides the framework for the affidavit. Accurately detail the assets, debts, and heirs involved. If you encounter any confusion, consider using uslegalforms to help you navigate the process.

Section 700.3715 of the Michigan probate code addresses the powers and duties of personal representatives of estates. It outlines the responsibilities they hold regarding the management and distribution of estate assets. Understanding this section is vital when filling out your Michigan probate personal representative form, as it ensures compliance with state laws. This knowledge helps you navigate the probate process efficiently.

The best way to avoid probate in Michigan includes establishing living trusts, using payable-on-death designations for bank accounts, and ensuring joint ownership of property. These methods allow your assets to pass directly to beneficiaries without undergoing the probate process. By incorporating the Michigan probate personal representative form for assets that do require probate, you can better manage your estate. It is proactive planning that provides peace of mind.

Not all wills have to go through probate in Michigan. If the estate's value is below a certain threshold or if assets are held in a trust, probate may not be necessary. However, for those wills that do require probate, completing a Michigan probate personal representative form ensures you follow the proper legal procedures. It's advisable to consult with a legal professional to understand your specific situation.

To obtain a letter of testamentary in Michigan, you must file the will and a petition with the probate court in the county where the deceased lived. Once the court approves your petition, it will issue the letters, allowing you to act on behalf of the estate. Utilizing a Michigan probate personal representative form can help ensure you submit the required documents correctly and comprehensively. This letter is essential for managing estate assets.

In Michigan, an executor generally has up to one year to settle an estate, but this timeline can vary based on the complexity of the estate and any disputes that arise. It is crucial for the executor to manage estate matters efficiently to avoid delays. Using a Michigan probate personal representative form can help streamline the required documentation and processes. Ensure you keep beneficiaries informed during the process.

In Michigan, certain assets are exempt from probate, including life insurance policies with designated beneficiaries, retirement accounts, and assets held in joint tenancy. These types of assets pass directly to the beneficiaries without going through probate. This can simplify the estate settlement process. When you prepare a Michigan probate personal representative form, it is essential to identify these exempt assets.