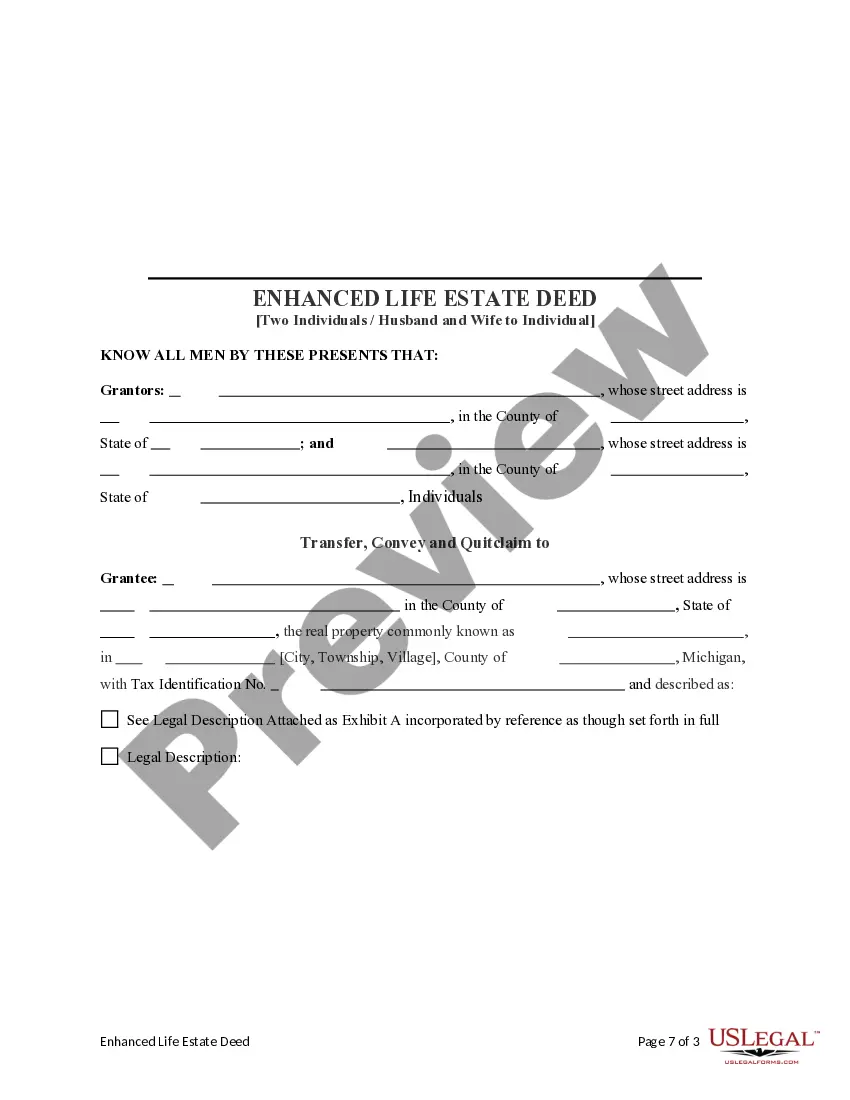

Enhanced Life Estate Deed

Description

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Two Individuals / Husband And Wife To An Individual?

- If you have an existing account, log in and download the necessary form template directly to your device by clicking the Download button. Ensure your subscription remains active, or renew it as per your selected payment plan.

- For first-time users, start by checking the Preview mode and description of the form. Make sure it's the right one that aligns with your requirements and complies with local jurisdiction.

- If the form doesn’t meet your needs, utilize the Search tab to find another template that fits your criteria. Once you’re satisfied with your choice, you can move to the next step.

- Purchase your document by clicking the Buy Now button and selecting your preferred subscription plan. You will need to create an account to access the extensive library.

- Complete your purchase by entering your credit card details or opting for PayPal for your subscription payment.

- Download your enhanced life estate deed form and save it on your device. You can also access it anytime from the My Forms section of your profile.

In conclusion, US Legal Forms offers a user-friendly approach to obtaining legal documents like the enhanced life estate deed. From a vast collection of forms to expert assistance, our platform ensures you have everything you need for precise documentation.

Ready to get started? Visit US Legal Forms today and empower your legal journey!

Form popularity

FAQ

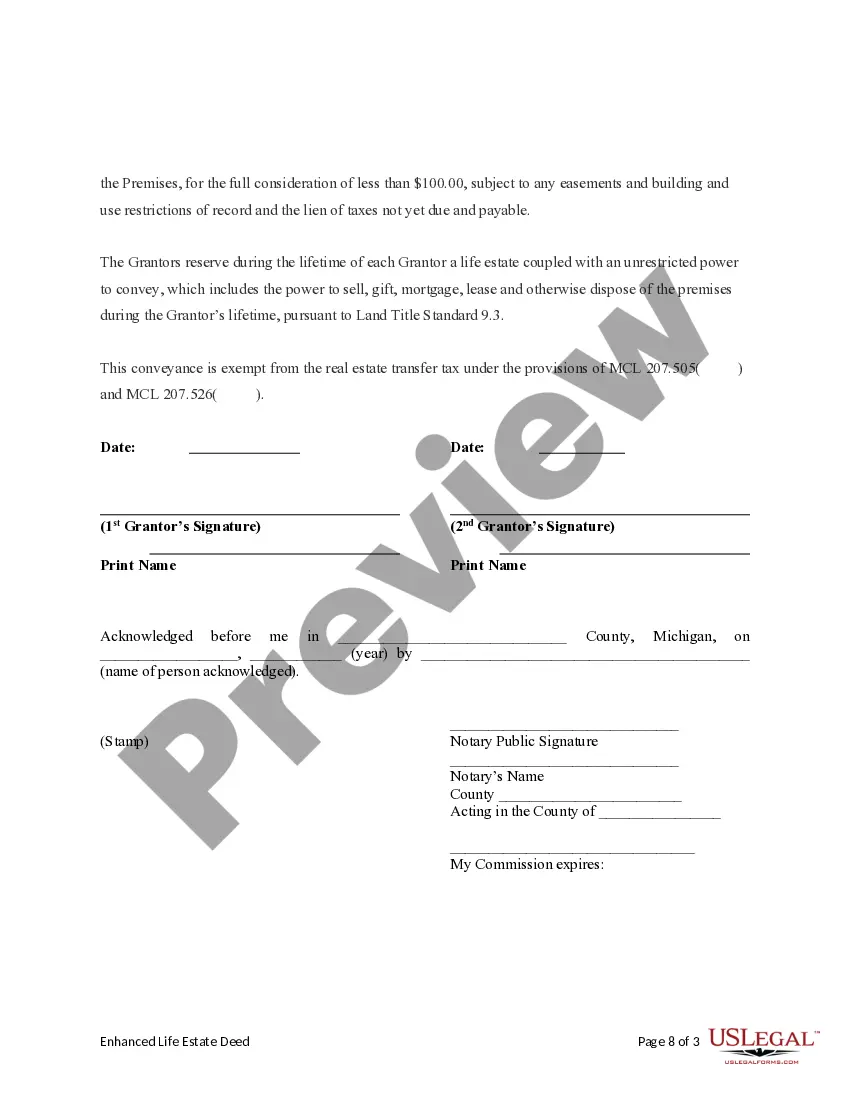

An enhanced life estate deed allows an individual, known as the grantor, to retain the rights to live in their property during their lifetime while designating beneficiaries who will inherit the property after their death. For example, a homeowner may create an enhanced life estate deed to transfer their home to their children, ensuring they can live there until they pass away. This deed simplifies the transfer process and avoids probate, providing a clear plan for property distribution. Using services like US Legal Forms can help you create an enhanced life estate deed that fits your unique needs.

There are several potential downsides to a life estate, particularly with an enhanced life estate deed. For instance, once you create this type of deed, you relinquish control over the property after your passing, which may not align with future family dynamics. Additionally, creditors can still make claims against the property, and tax implications may arise, making it essential to thoroughly evaluate your options with a qualified legal advisor.

Getting around a life estate typically involves understanding the limitations imposed by the deed. While you cannot sell or transfer the property without the consent of all beneficiaries, you can consider alternative strategies such as negotiating an agreement with the remainder beneficiaries. However, it's crucial to consult with legal experts or utilize platforms like US Legal Forms to explore options that align with your specific circumstances and goals.

An enhanced life estate deed is a unique type of deed that allows property owners to maintain their rights to use and benefit from their property during their lifetime. With this deed, the owner can designate beneficiaries who will automatically receive the property upon their passing, bypassing the probate process. This deed enhances the traditional life estate by offering increased flexibility and potential tax benefits, making it an attractive option for many property owners.

People create life estates primarily to retain control over their property during their lifetime while ensuring that the property will pass directly to their chosen beneficiaries after their death. This arrangement can simplify the transfer process and potentially avoid probate. Additionally, an enhanced life estate deed can provide benefits related to Medicaid eligibility, allowing the owner to protect their assets while receiving necessary care.

States that have enhanced life estate deeds include Florida, Texas, Michigan, and a few others. These states offer distinctive provisions that facilitate smoother transfers of property upon the owner's passing. Utilizing platforms like USLegalForms can simplify your search for specific state requirements and help you create the right documents for your needs.

Many states across the U.S. recognize enhanced life estate deeds, including Florida, Michigan, and Texas. These states provide the legal framework that allows homeowners to retain control over their property while benefiting loved ones after their death. As laws may change, it's important to stay informed and consult with a legal professional when considering the enhanced life estate deed for your estate planning.

Ladybird deeds, also known as enhanced life estate deeds, are primarily available in a handful of states including Michigan, Texas, and Florida. These states recognize the unique benefits of enhanced life estate deeds, such as avoiding probate and providing more control to the homeowner during their lifetime. If you're looking to utilize this type of deed, consulting with a knowledgeable real estate attorney familiar with local laws is advisable.

One major disadvantage of a life estate deed is that it can limit your ability to make decisions about the property. The remainderman generally has a claim to the property after the life tenant’s death, which can complicate sales or transfers. Additionally, estate tax implications may arise, and your heirs may face challenges if the property needs to be sold to cover debts or medical expenses.

A life estate deed allows a person to retain the right to live in a property during their lifetime, while transferring ownership to another party after their death. In contrast, an enhanced life estate deed provides added flexibility by allowing the property owner to sell, mortgage, or change the beneficiaries without needing consent from them. This added flexibility is often appealing, making the enhanced life estate deed a preferred choice for many individuals.