Michigan Llc Operating Agreement With S Corp Election

Description

How to fill out Michigan Limited Liability Company LLC Operating Agreement?

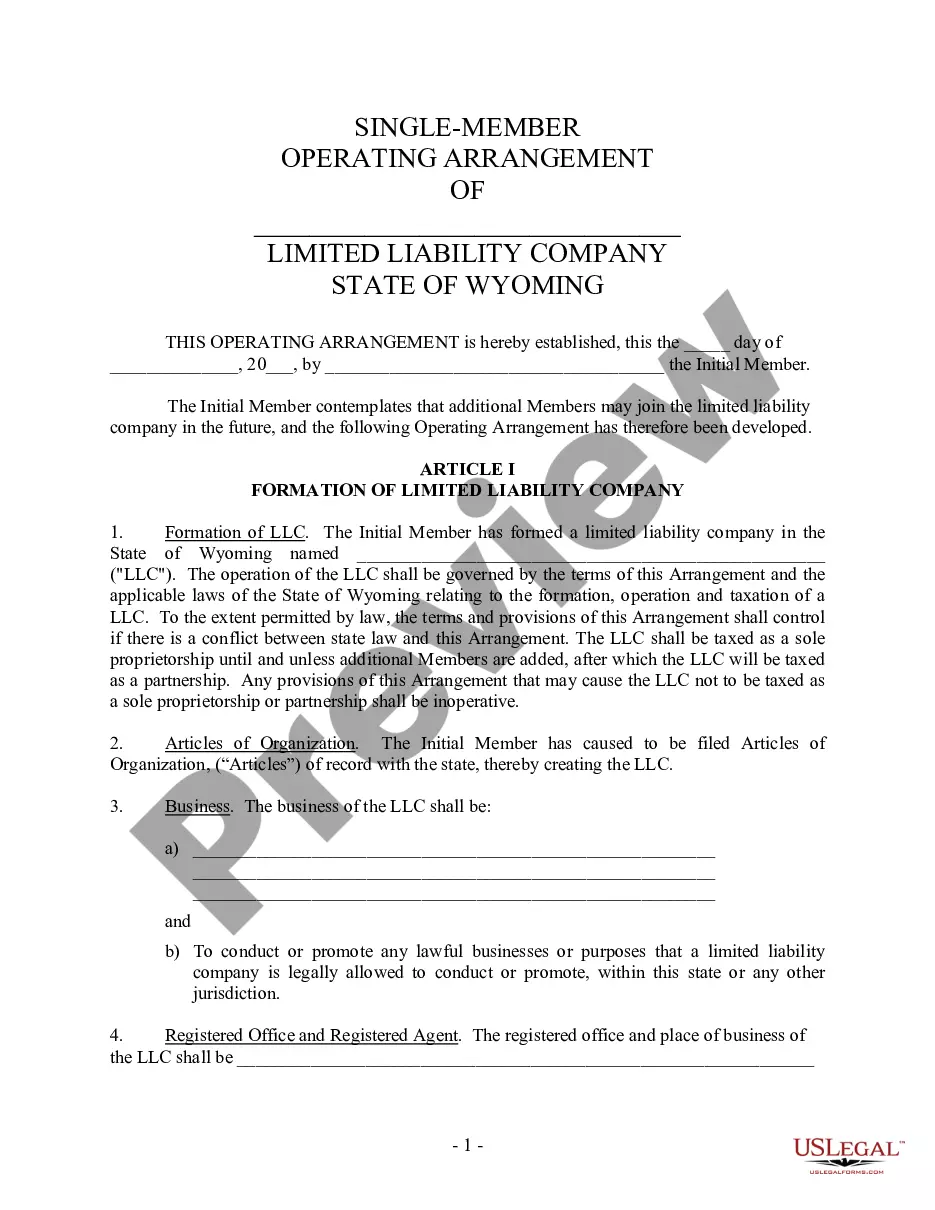

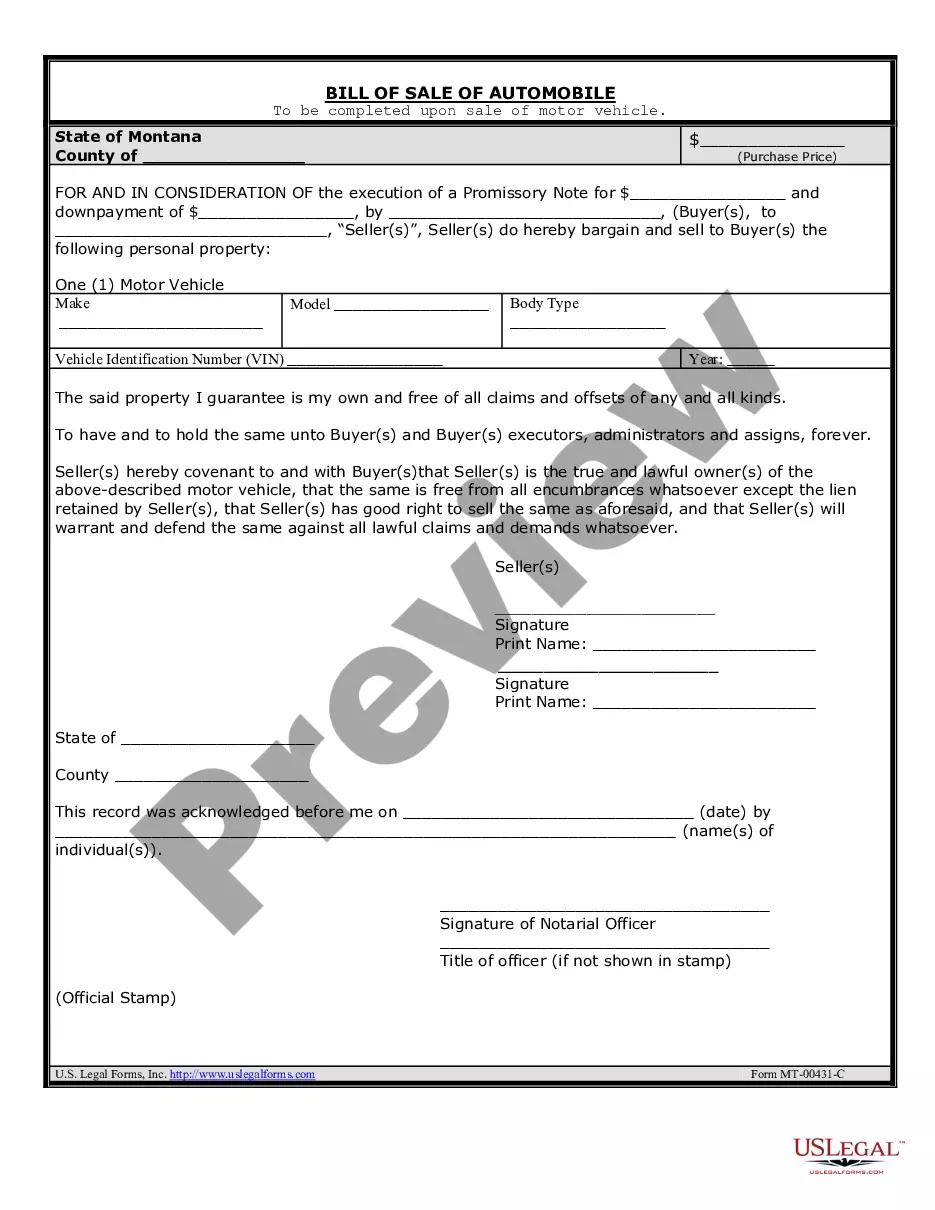

Drafting legal documents from scratch can sometimes be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for a more straightforward and more affordable way of creating Michigan Llc Operating Agreement With S Corp Election or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual collection of over 85,000 up-to-date legal documents addresses almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-specific templates carefully prepared for you by our legal experts.

Use our website whenever you need a trustworthy and reliable services through which you can quickly find and download the Michigan Llc Operating Agreement With S Corp Election. If you’re not new to our website and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and navigate the library. But before jumping directly to downloading Michigan Llc Operating Agreement With S Corp Election, follow these tips:

- Check the form preview and descriptions to ensure that you have found the document you are looking for.

- Check if form you choose complies with the requirements of your state and county.

- Choose the right subscription option to get the Michigan Llc Operating Agreement With S Corp Election.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us now and turn form execution into something simple and streamlined!

Form popularity

FAQ

Then, you can choose S Corp tax status by filing an election with the IRS (Internal Revenue Service). If you're in California, this means that if you form an LLC or corporation, you have the option of using S corporation status for taxation.

Key Components of an S-Corp Operating Agreement Identification of Parties. ... Management Structure. ... Ownership and Equity. ... Shareholder Rights and Obligations. ... Distributions and Allocations. ... Financial Matters. ... Meetings and Decision-Making. ... Amendments and Dissolution.

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553PDF for all required information and to determine where to file the form.

There is no state law in Michigan that requires LLCs to have an operating agreement.

An LLC can choose to be treated as an S corporation in a two-step process: File a Form 8832, Entity Classification Election. This causes the business to be taxed as a C corporation. Then file Form 2553 to elect an S corporation tax structure.