This is one of the official Workers' Compensation forms for the state of Maine.

Certificate Of Discontinuance Form

Description

How to fill out Certificate Of Discontinuance Form?

Properly constructed formal papers serve as a key assurance against issues and legal disputes, but acquiring them without legal assistance may require time.

Whether you seek to swiftly locate a current Certificate Of Discontinuance Form or various other templates for job, family, or business purposes, US Legal Forms is always available to assist.

The process is even simpler for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button near the chosen document. Moreover, you can access the Certificate Of Discontinuance Form at any time later, as all documents obtained on the platform can be found in the My documents section of your account. Save both time and money on the preparation of official documents. Experience US Legal Forms today!

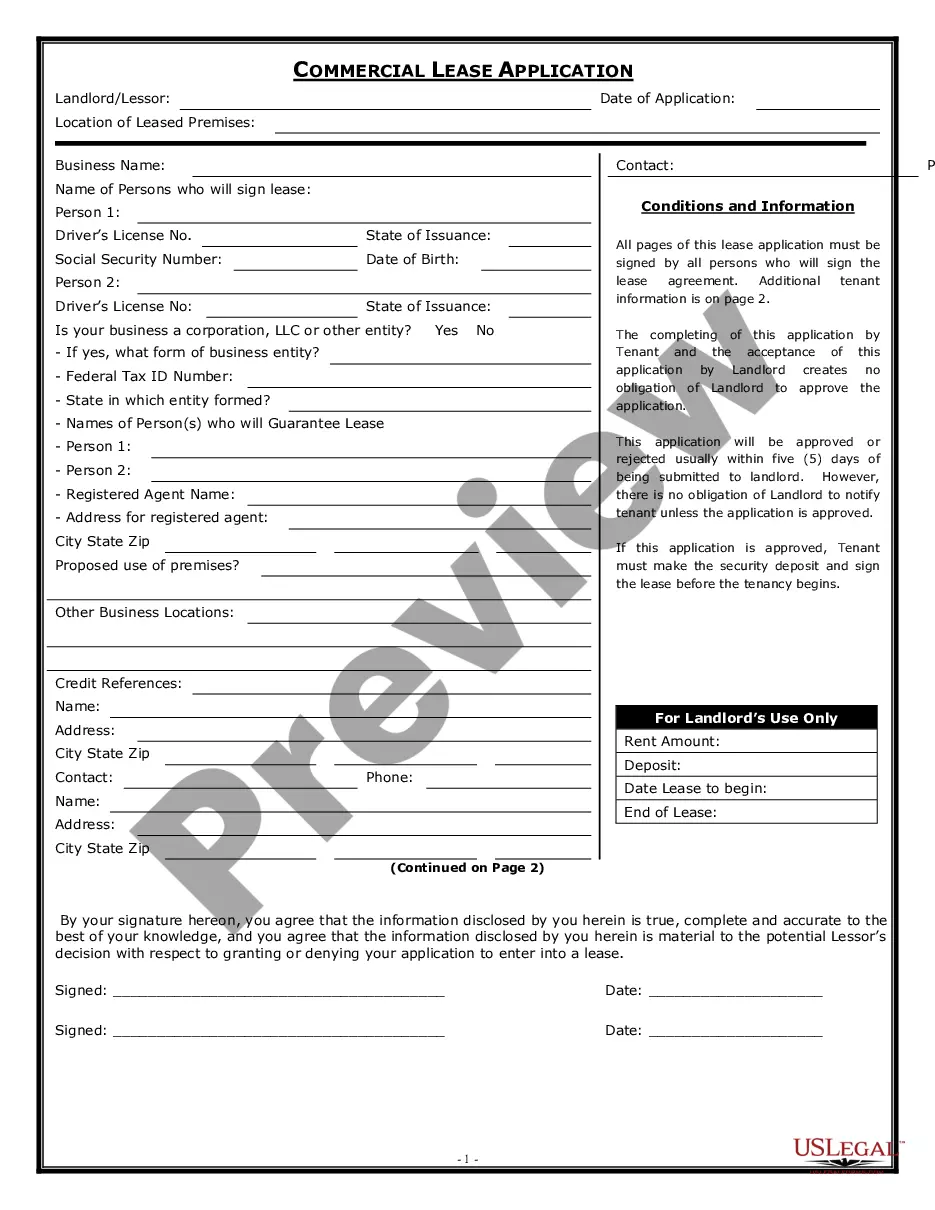

- Verify that the form aligns with your circumstances and jurisdiction by reviewing the description and preview.

- Search for an alternative sample (if necessary) using the Search bar located in the page header.

- Click on Buy Now upon finding the appropriate template.

- Select a pricing plan, either Log Into your account or create a new one.

- Choose your preferred payment method to buy the subscription plan (using a credit card or PayPal).

- Select PDF or DOCX format for your Certificate Of Discontinuance Form.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Choosing between an LLC and a DBA largely depends on your business needs. An LLC offers personal liability protection, while a DBA allows you to operate under a different name without creating a separate legal entity. If you opt for a DBA, ensure you have a plan in place should you ever need to discontinue it; you can achieve this through a Certificate of discontinuance form. We recommend exploring UsLegalForms to find the best solution tailored to your situation.

Yes, you can file Texas form 424 online through the Texas Secretary of State's website. This online filing option provides convenience and efficiency, saving you time and effort. However, if you prefer assistance, UsLegalForms offers a user-friendly interface to guide you through the preparation of your filing, including any necessary Certificate of discontinuance form you may require in the future.

To file a Texas PIR, you must complete the appropriate form and submit it to the Texas Secretary of State. You can choose to file by mail or in person. Using UsLegalForms can streamline this process, as we provide clear instructions and templates to help you fill out the document accurately. If you ever need to discontinue a filing, a Certificate of discontinuance form is also available on our platform.

To shut down your LLC in South Carolina, you must first file a certificate of cancellation with the Secretary of State. This form formally dissolves your company and helps prevent any further legal obligations. Additionally, if you previously faced any legal challenges, filing a certificate of discontinuance form can be a crucial step in the process.

Yes, you can close your LLC yourself, but it involves specific steps to ensure compliance with state laws. You will need to file the necessary dissolution paperwork, such as the certificate of dissolution, and handle any outstanding liabilities. Having a certificate of discontinuance form ready is vital if your LLC has any legal entanglements.

To obtain a certificate of incorporation in the USA, you must file the required paperwork with the Secretary of State in your chosen state. This typically includes the Articles of Incorporation and associated fees. If you're considering shutting down an LLC later, remember that using a certificate of discontinuance form is also necessary to ensure legal compliance.

Yes, notifying the IRS is essential if you decide to close your LLC. You should file the final tax return and indicate that it is the last return for the business. Additionally, if you need to submit a certificate of discontinuance form, keeping the IRS informed helps avoid any potential tax issues down the road.

To close your LLC in South Carolina, you must file a certificate of dissolution with the Secretary of State. This document will formally terminate your business and ensure that you are no longer liable for any future obligations. Don’t forget that filing a certificate of discontinuance form is also an important step if your business is facing legal challenges or ceasing operation.

An LLC does not receive a certificate of incorporation; instead, it obtains a certificate of formation. This document officially recognizes the LLC as a legal entity within your state. It is important to mix this up as you consider the steps for closing an LLC, which may involve filing a certificate of discontinuance form to dissolve the entity.

To end a DBA in New York State, you must complete a certificate of discontinuance form. This form officially removes your assumed name from public records. Ensure you file this document with the necessary state or local authority, as failure to do so could result in legal complications. For assistance with this process, consider utilizing uslegalforms, which offers clear guidance and templates.