This is one of the official Workers' Compensation forms for the state of Maine.

Maine Workers Comp Settlement Without

Description

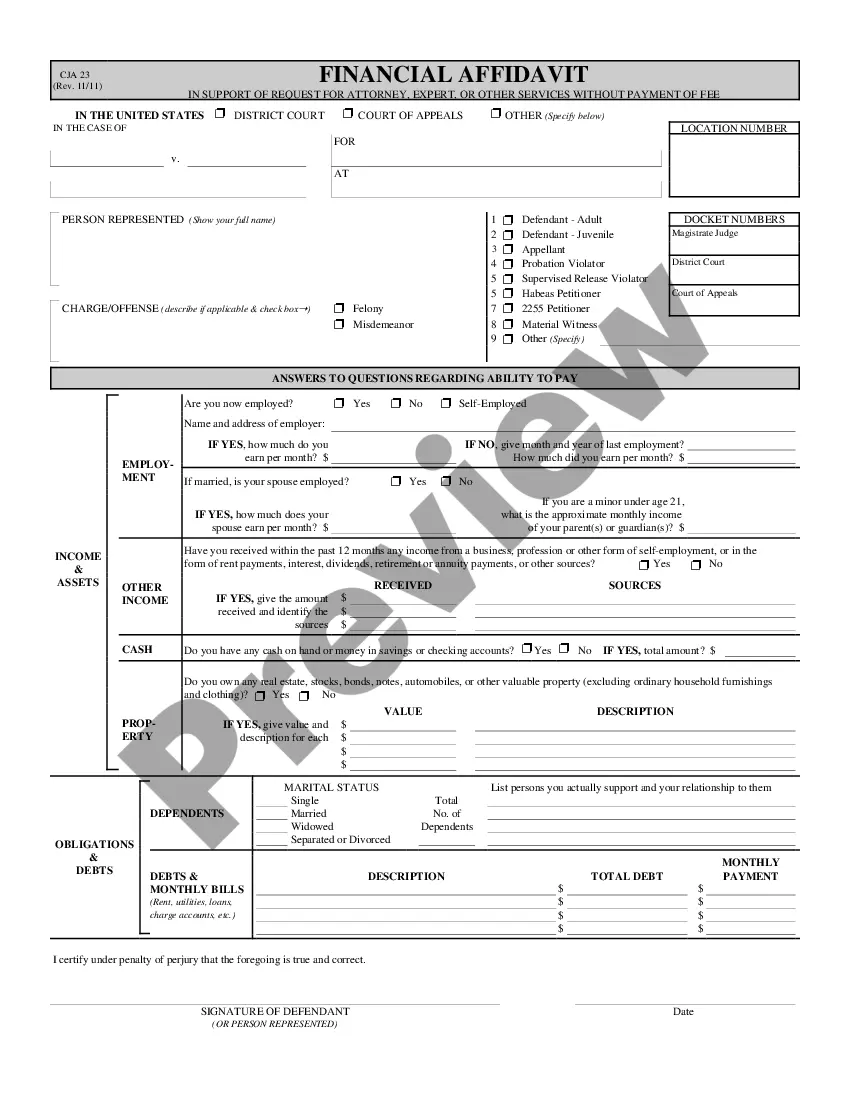

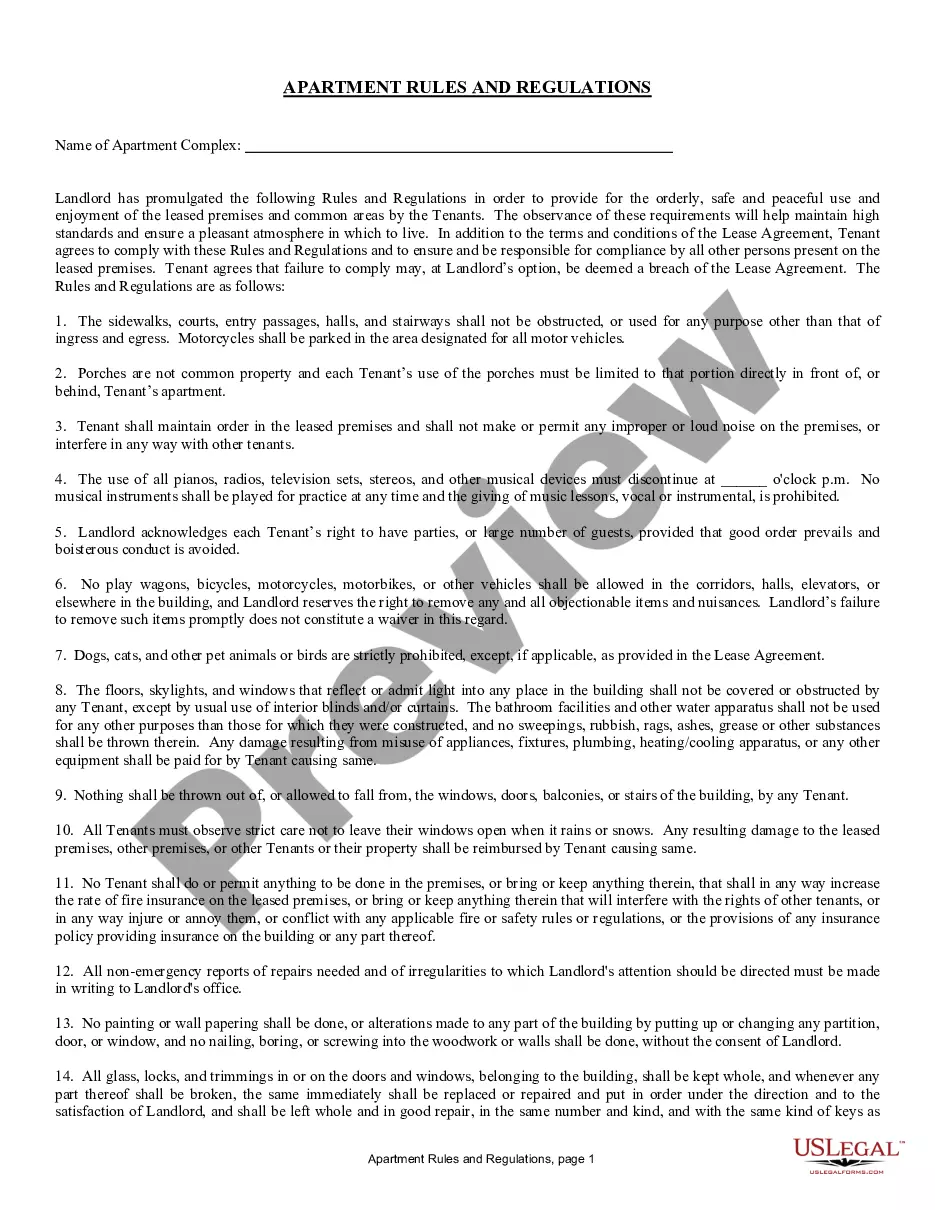

How to fill out Maine Lump Sum Settlement For Workers' Compensation?

Managing legal paperwork and processes can be a lengthy addition to your schedule. Maine Workers Comp Settlement Without and similar forms generally necessitate that you search for them and comprehend how to fill them out correctly. Thus, if you are dealing with financial, legal, or personal issues, utilizing a thorough and accessible online library of forms at your fingertips will be greatly beneficial.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific forms and an array of resources to help you complete your documents swiftly. Investigate the collection of relevant documents available with just one click.

US Legal Forms provides you with state- and county-specific forms available for download at any time. Protect your document management processes by utilizing a high-quality service that enables you to prepare any form in minutes without any extra or hidden charges. Simply Log In to your account, locate Maine Workers Comp Settlement Without, and download it instantly from the My documents section. You can also access forms you have saved previously.

Is it your first time using US Legal Forms? Register and create an account in a few minutes, and you’ll gain access to the form library and Maine Workers Comp Settlement Without. Then, follow the steps below to fill out your form.

US Legal Forms has 25 years of experience aiding clients in managing their legal documents. Find the form you need today and simplify any process effortlessly.

- Ensure you have the correct form by using the Review feature and examining the form description.

- Select Buy Now when ready, and choose the subscription plan that suits your requirements.

- Click Download, then fill out, sign, and print the form.

Form popularity

FAQ

Typically, if your new job pays you less than you were making prior to your injury, you can still receive payment for the difference in wages. You can also continue to receive medical benefits for all healthcare costs related to your injury. If you're disabled, you can still receive disability benefits.

Do you have to pay taxes on your workers' compensation payments? The answer is no. Whether you received wage loss benefits on a weekly basis or a lump sum settlement, workers' compensation is not taxable. IRS Publication 907 reads as follows: ?The following payments are not taxable ?

The maximum compensation rate for injuries on or after January 1, 2020 is 125% of the State Average Weekly Wage. Update for 2022: the state average weekly wage (SAWW) to $1,036.13. Provides that the maximum for injuries occurring July 1, 2022, through June 30, 2023, is $1295.16. States that the multiplier is 1.05298.

Regardless of your date of injury, if your incapacity is total, you may receive benefits for as long as you are unable to work.