Transfer Deed When Someone Dies

Description

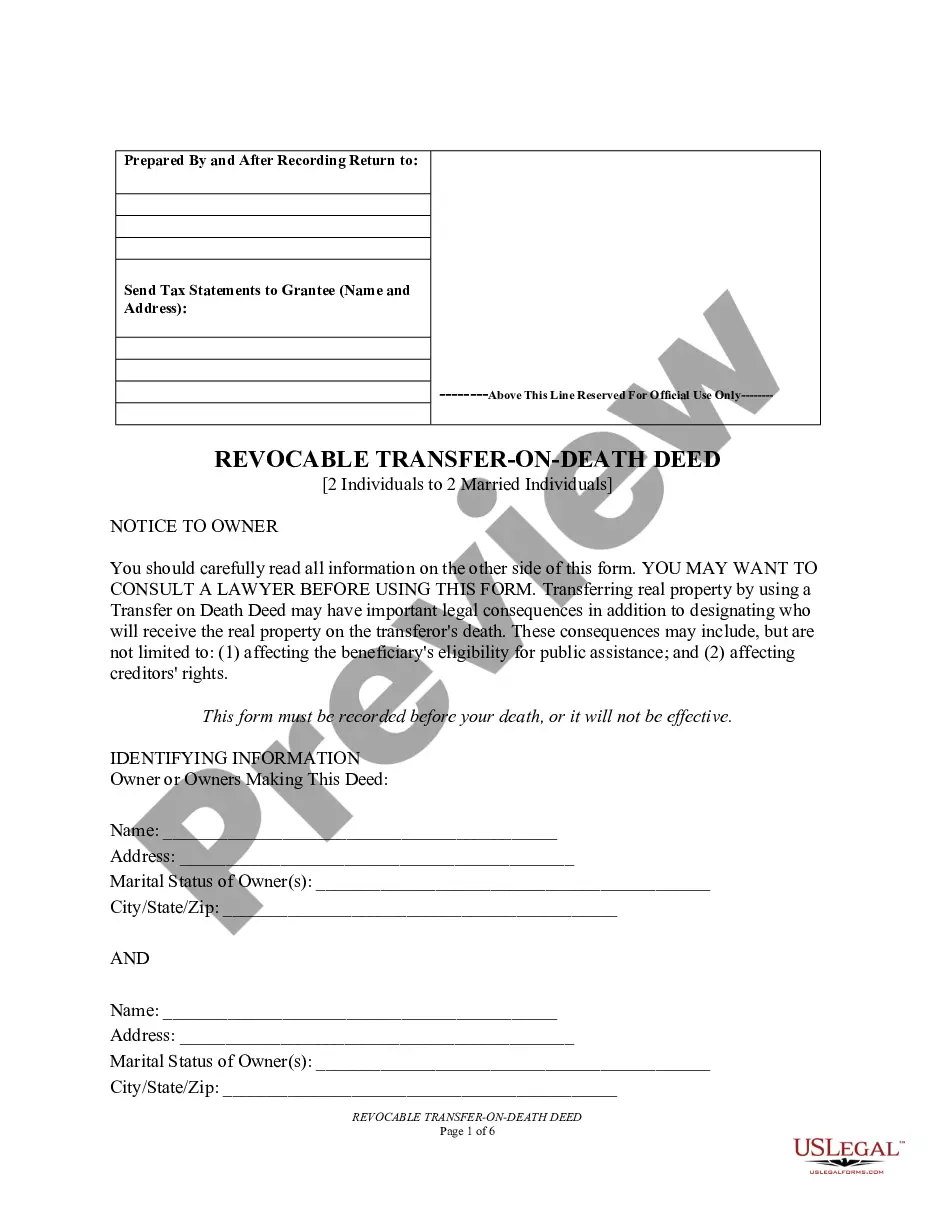

How to fill out Maine Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To Married Beneficiaries?

Identifying a reliable source to obtain the latest and pertinent legal documents is a significant part of navigating bureaucracy. Recognizing the necessary legal documentation demands precision and meticulousness, which is why it is essential to obtain samples of Transfer Deed When Someone Dies solely from trustworthy providers, such as US Legal Forms. An incorrect document can squander your time and hinder your current situation. With US Legal Forms, your concerns are greatly minimized. You can access and review all the information regarding the document’s applicability and significance for your situation and within your jurisdiction.

Follow these steps to finalize your Transfer Deed When Someone Dies.

Once you have the form on your device, you can modify it using the editor or print it out and fill it in by hand. Eliminate the complications associated with your legal documents. Explore the comprehensive US Legal Forms library where you can discover legal templates, assess their applicability to your situation, and download them immediately.

- Utilize the library navigation or search bar to find your template.

- Examine the form’s description to confirm it meets your state and county’s requirements.

- Preview the form, if possible, to verify it is indeed the one you wish to use.

- Return to the search and identify the correct template if the Transfer Deed When Someone Dies does not match your needs.

- When you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected forms in My documents.

- If you do not possess an account yet, click Buy now to acquire the template.

- Choose the pricing plan that fits your requirements.

- Proceed to registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Transfer Deed When Someone Dies.

Form popularity

FAQ

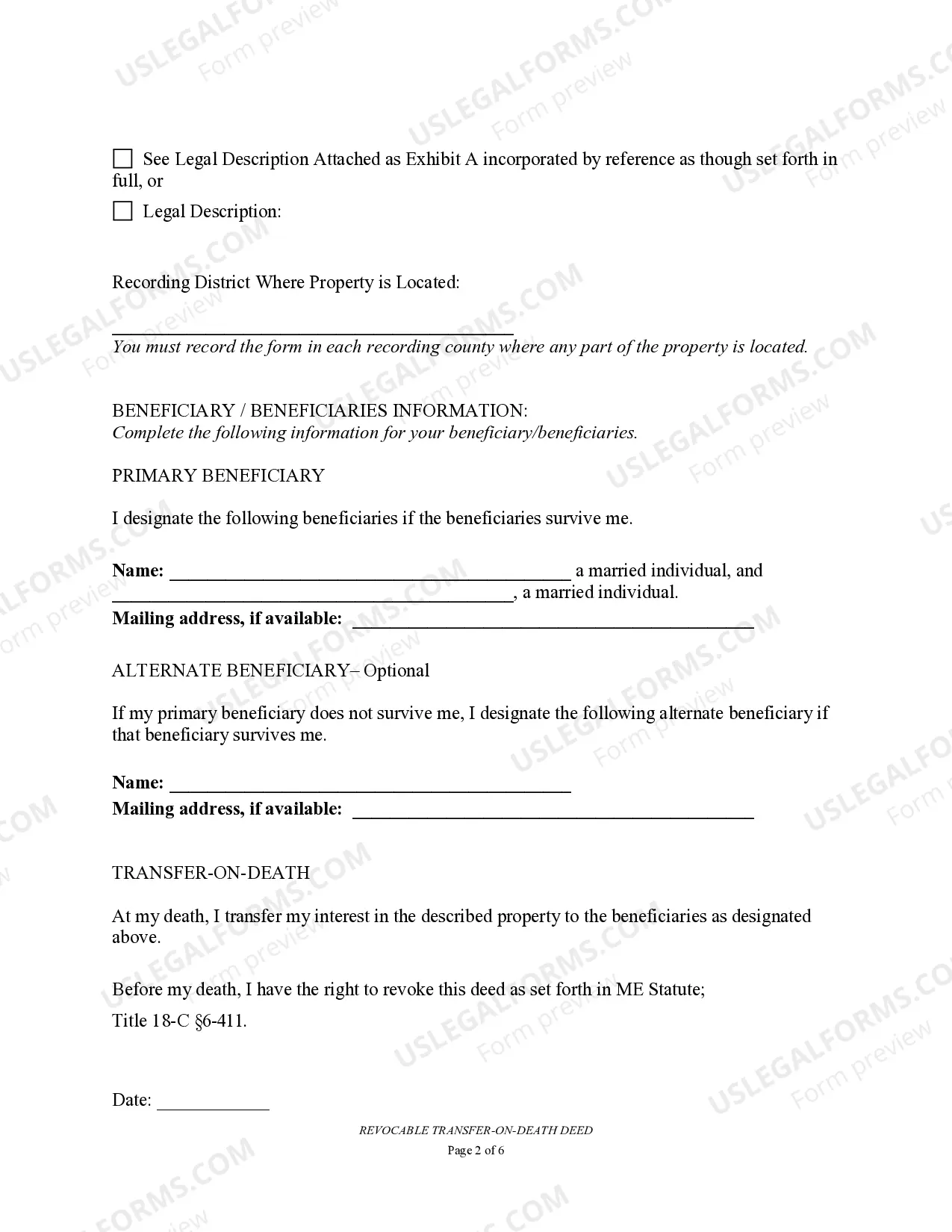

Meanwhile, our fee to prepare a Transfer on Death Deed is $195. Good to know: Since the Transfer upon Death Deed conveys property outside of Probate, it avoids incurring costs to transfer the property to your beneficiaries upon your death.

How to Minimize Capital Gains Tax on Inherited Property Sell the inherited property quickly. ... Make the inherited property your primary residence. ... Rent the inherited property. ... Qualify for a partial exclusion. ... Disclaim the inherited property. ... Deduct Selling Expenses from Capital Gains.

After one year, if the executor doesn't complete their duties, beneficiaries may demand payment (possibly with interest) by taking the executor to court.

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

The deed could get complicated, and its validity contested if it is not recorded correctly or if the legal criteria are not met. If there is no provision for a contingent beneficiary, the transfer on the death deed is rendered ineffective if the named beneficiary passes away before the property owner.