Proof Of Child Care Expenses Letter Sample For Job

Description

How to fill out Maine Child Care Services Package?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may require extensive research and significant financial investment.

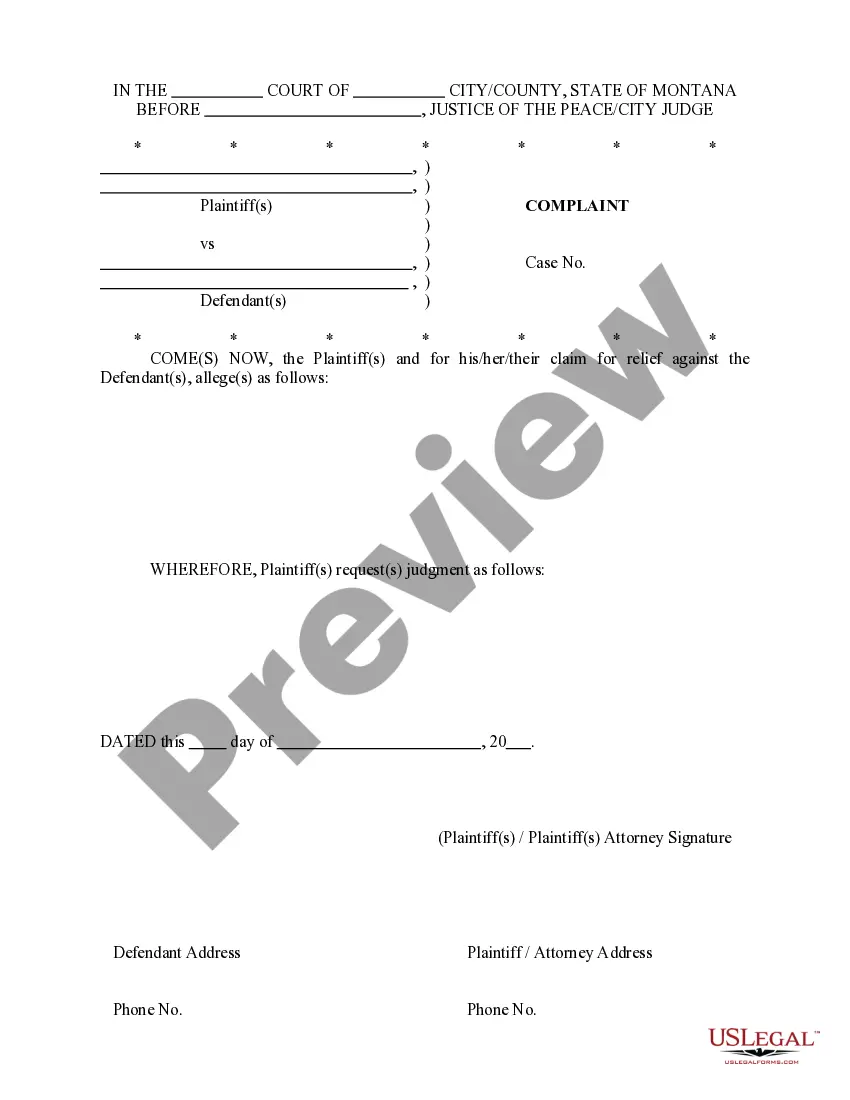

If you're looking for a simpler and more budget-friendly method to generate a Proof Of Child Care Expenses Letter Sample For Job or other documents without unnecessary complications, US Legal Forms is readily accessible.

Our online repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs.

However, before you rush to download the Proof Of Child Care Expenses Letter Sample For Job, consider these suggestions: Ensure you review the form preview and descriptions to confirm you have the correct document. Verify that the template you choose meets your state and county's requirements. Select the appropriate subscription plan to purchase the Proof Of Child Care Expenses Letter Sample For Job. Download the form, then fill it out, validate, and print it. US Legal Forms has a pristine reputation and over 25 years of experience. Join us now and make document handling simple and efficient!

- With just a few clicks, you can quickly access state- and county-specific templates professionally crafted by our legal experts.

- Utilize our platform whenever you require trustworthy and dependable services to easily find and download the Proof Of Child Care Expenses Letter Sample For Job.

- If you’re a returning visitor and have already created an account with us, simply Log In to your account, select the form, and download it instantly or retrieve it later in the My documents section.

- Not signed up yet? No worries. Setting up an account takes minimal time, and you can explore the library.

Form popularity

FAQ

The most common way to transfer property is through a general warranty deed (sometimes called a "grant deed"). A general warranty deed guarantees good title from the beginning of time.

The Process of Transferring Property Identify the recipient or donee. Discuss the terms and conditions of the transfer with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Delaware taxes real estate transfers at 4% of the purchase price for the property being transferred. However, Delaware law has a provision that allows for the county where the property being sold to levy a real estate transfer tax of 1.5%.

Gifts of real property in Delaware are, however, subject to the federal gift tax. The person or entity making the gift (grantor or donor) is responsible for paying the federal gift tax; however, if the donor does not pay the gift tax, the donee will be held liable [1].

When committing to a general warranty deed, the seller is promising there are no liens against the property, and if there were, the seller would compensate the buyer for those claims. Mainly for this reason, general warranty deeds are the most commonly used type of deed in real estate sales.

Quitclaim Deed There are no covenants or warranties by the grantor and this deed offers the lowest amount of protection to the grantee.

In order for a deed to be valid and enforceable, it must be in writing; describe with specificity the property conveyed; specify the names of the grantor and grantee; be signed; be sealed; be acknowledged; and be delivered.