Firpta Form 8288-a

Description

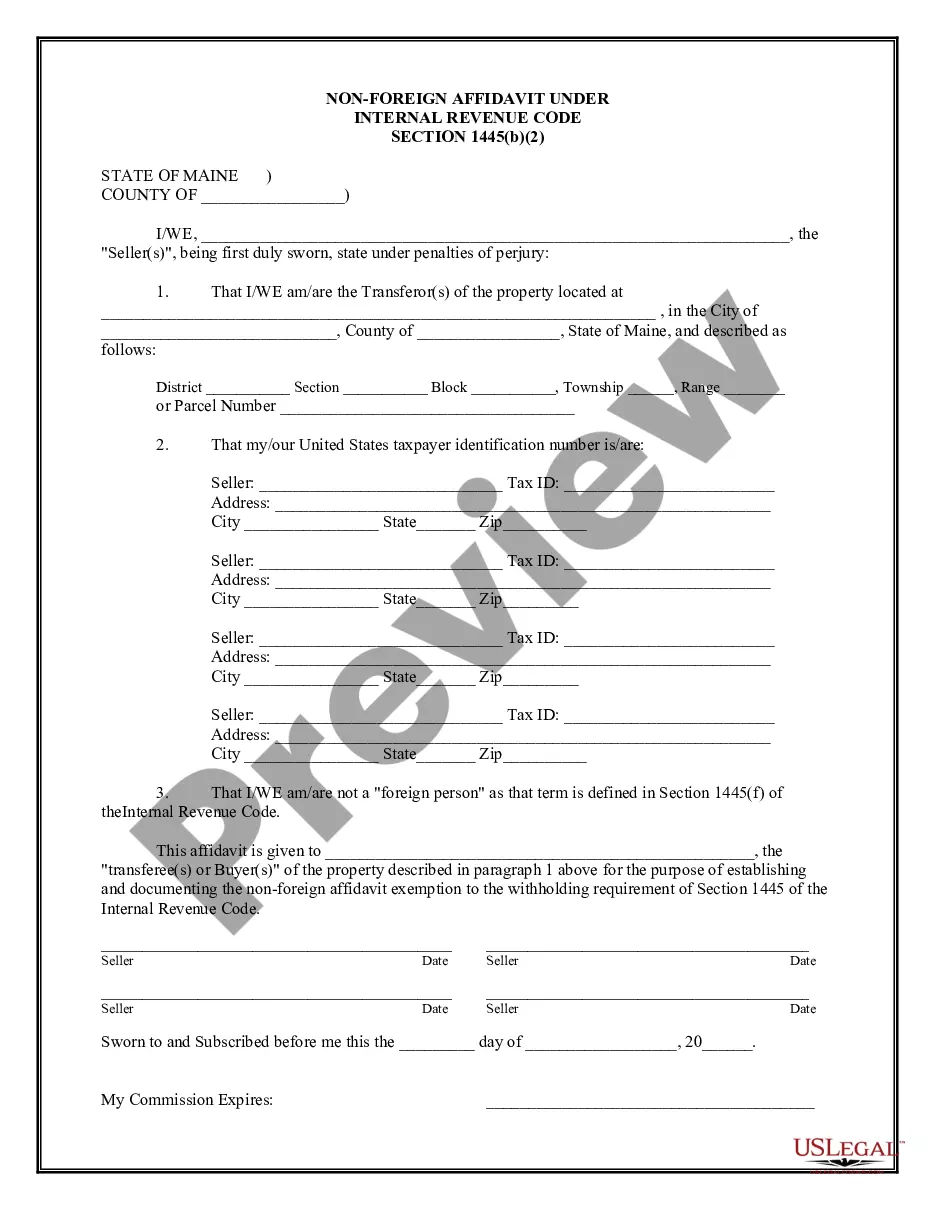

How to fill out Maine Non-Foreign Affidavit Under IRC 1445?

Whether for corporate reasons or for individual matters, everyone must deal with legal circumstances at some point in their lives.

Completing legal documents necessitates meticulous care, beginning with selecting the suitable form template.

With a comprehensive catalog at US Legal Forms, you do not have to waste time searching for the correct template online. Utilize the library's straightforward navigation to find the right form for any situation.

- Identify the template you require by utilizing the search bar or browsing through the catalog.

- Review the description of the form to confirm it corresponds with your situation, state, and locality.

- Click on the preview of the form to inspect it.

- If it is the incorrect document, return to the search option to find the Firpta Form 8288-a sample you require.

- Download the file if it meets your criteria.

- If you already possess a US Legal Forms account, click Log in to access documents you have previously saved in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the profile registration form.

- Select your payment method: you may use a credit card or PayPal account.

- Choose the document format you prefer and download the Firpta Form 8288-a.

- Once it has been downloaded, you can fill out the form with editing software or print it and complete it manually.

Form popularity

FAQ

You should send the Firpta form 8288-a to the appropriate address listed in the IRS instructions. Typically, you will mail the completed form to the IRS at the address designated for your specific filing situation. Always double-check the latest IRS guidelines to ensure accurate submission. If you're unsure, uslegalforms can assist you in navigating the process and ensuring compliance.

To report foreign withholding, you need to fill out the Firpta form 8288-a. This form helps you disclose the amount of tax withheld on the sale of U.S. real property by foreign buyers. Ensure that you gather the necessary information, including the details of the transaction and the parties involved. After completion, you can submit the form alongside any required payments to the IRS.

The FIRPTA form refers to various forms associated with the Foreign Investment in Real Property Tax Act, including the Firpta form 8288 and 8288-A. These forms play essential roles in ensuring compliance for foreign sellers of U.S. real estate. They allow the IRS to collect tax on gains from these transactions. When purchasing property, it’s vital to understand these forms to navigate the complexities of U.S. tax laws effectively.

The 8828 form is not directly related to the Firpta form 8288. Instead, it is specifically focused on reporting tax liabilities associated with the disposition of U.S. real property interests by foreign persons. While it is crucial for certain transactions, the primary focus for buyers and sellers involved in real estate transactions is to accurately complete forms 8288 and 8288-A. Utilizing platforms like uslegalforms can simplify the process of understanding and completing these forms.

The Firpta form 8288-A should be filed by the withholding agent, typically the buyer, when purchasing U.S. real estate from a foreign seller. This form is essential for documenting the tax withholding process and reporting the sale to the IRS. Buyers must ensure they file this form accurately to avoid penalties or complications in the transaction. Proper filing reflects responsible tax practices that benefit all parties involved.

Form 8288 A is used in conjunction with the Firpta form 8288 to report the amount realized and the withholding tax information. This form provides detailed information about the property sold, the seller, and the withholding agent. It ensures that the IRS has a clear understanding of the transaction and the taxes owed. By completing both forms accurately, parties can ensure compliance with federal tax requirements.

The amount realized on the Firpta form 8288 refers to the total amount received by the seller from the sale of the property, minus any selling expenses. This figure plays a critical role in determining the tax withholding that the buyer must remit to the IRS. Accurately calculating this amount ensures compliance with U.S. tax regulations and helps streamline the transaction process. It's important for buyers to be diligent when assessing this figure to avoid penalties.

Form 8288 is often prepared by the buyer of U.S. real estate, especially when the seller is a foreign national. This form reports the required withholding tax under FIRPTA. When completing the Firpta form 8288-A, it is crucial for buyers to understand their responsibilities thoroughly. If you need assistance in this process, platforms such as Uslegalforms can help streamline the preparation and filing of these essential forms.

Form 8949 is typically prepared by U.S. taxpayers reporting the sale of capital assets, including real estate. Taxpayers or their designated tax preparers need to include all relevant transactions to ensure accurate reporting. If your transactions involve the Firpta form 8288-A, it’s important to include these assets in your calculations. Utilizing services like Uslegalforms can aid in the preparation of this and related forms.

Form 8288 is used to report the withholding tax due when a foreign seller disposes of U.S. real property, while Form 8288-A serves as a statement to report the transaction details. Both forms play critical roles in FIRPTA compliance, but they serve different purposes. When dealing with the Firpta form 8288-A, understanding these differences is key to accurate filing. Resources on Uslegalforms can clarify the distinct functions of each form for effective tax reporting.