Firpta For Dummies

Description

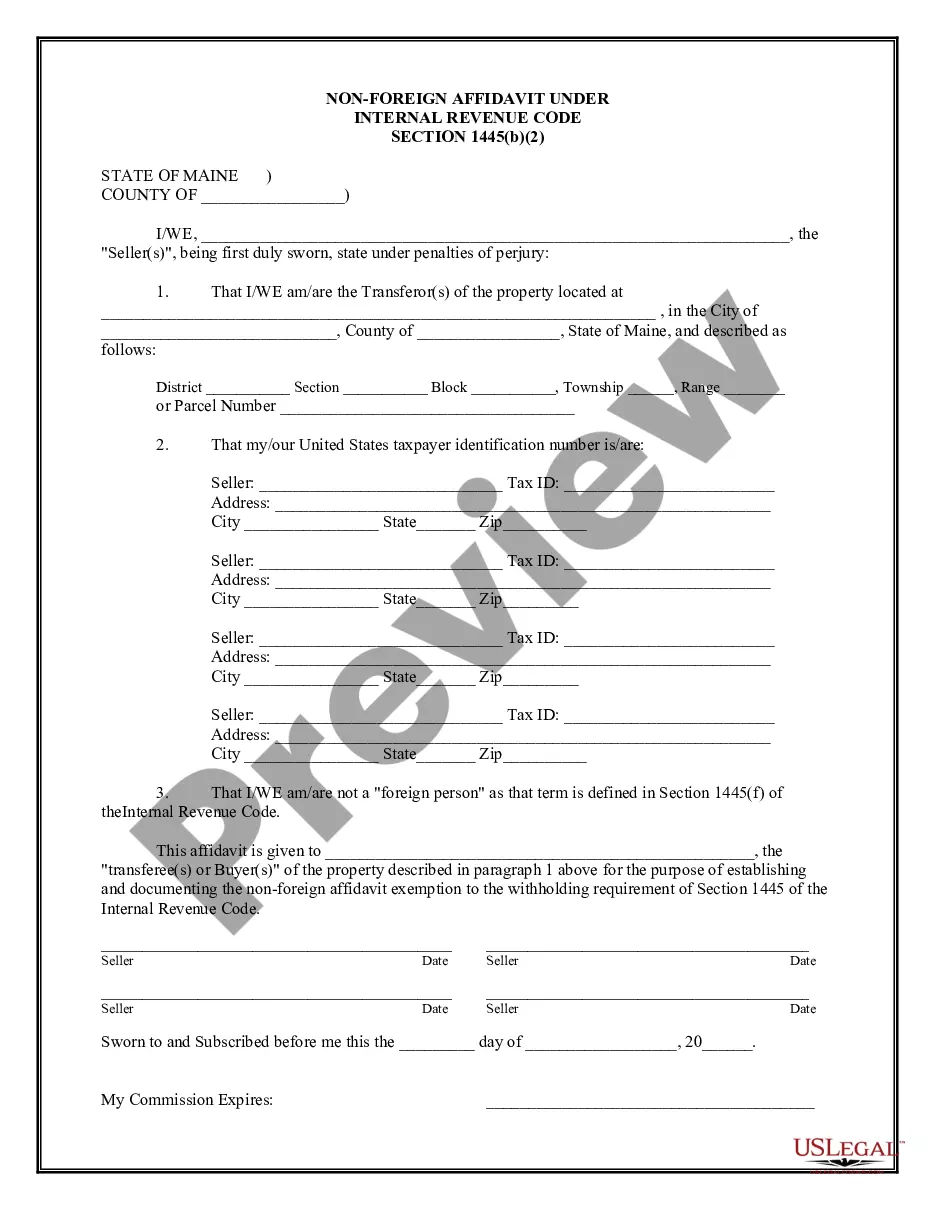

How to fill out Maine Non-Foreign Affidavit Under IRC 1445?

Accessing legal documents that comply with federal and state regulations is crucial, and the web provides numerous options to select from.

However, what's the use of squandering time searching for the right Firpta For Dummies example online when the US Legal Forms digital archive already has such documents compiled in one location.

US Legal Forms is the largest virtual legal directory featuring over 85,000 fillable forms created by attorneys for any business or personal situation. They are straightforward to navigate with all files categorized by state and intended use.

Use the search functionality at the top of the page if you need to find another sample.

- Our specialists keep up with legal changes, ensuring you can always trust that your form is current and compliant when obtaining a Firpta For Dummies from our site.

- Acquiring a Firpta For Dummies is quick and easy for both existing and new users.

- If you possess an account with an active subscription, Log In to download the document template you require in the preferred format.

- If you are a newcomer to our site, follow these steps.

- Review the template using the Preview feature or the text outline to confirm it meets your needs.

Form popularity

FAQ

While FIRPTA primarily affects sellers, buyers play an essential role in the withholding process. Buyers must understand the implications of FIRPTA for dummies to ensure they comply with tax requirements upon purchasing property. The law protects the IRS's interests by requiring buyers to withhold the tax on behalf of foreign sellers. Therefore, it’s wise to engage services like uslegalforms for step-by-step guidance.

You can avoid FIRPTA withholding by ensuring that the seller qualifies for an exemption, such as selling a property for less than $300,000 to an owner-occupied buyer. Familiarizing yourself with FIRPTA for dummies can help you identify potential exemptions. Additionally, working with legal professionals or using uslegalforms may guide you through the details to maintain compliance without unnecessary costs.

Yes, the seller is subject to FIRPTA if they are a foreign person or entity selling real estate in the United States. This law mandates withholding on the sale proceeds to ensure tax obligations are met. Understanding FIRPTA for dummies can clarify this complex requirement, allowing sellers to be aware of their responsibilities. Utilizing services from uslegalforms can offer further clarity on these provisions.

To submit FIRPTA withholding to the IRS, the buyer must file IRS Form 8288 and remit the withheld amount within 20 days of the sale. It's crucial to understand FIRPTA for dummies to follow the correct submission procedure. This form serves as a notice of the withholding and helps prevent potential penalties. For straightforward guidance, think about using platforms like uslegalforms.

When it comes to FIRPTA, the buyer of the property holds the responsibility for withholding and remitting the appropriate amount to the IRS. This tax applies when the seller is a foreign individual or entity. Buyers must ensure they understand FIRPTA for dummies to avoid costly mistakes during the property transfer process. Consider consulting resources like uslegalforms to navigate this requirement with ease.

To file FIRPTA withholding, you need to fill out Form 8288 and submit it along with the withheld tax payment. Ensure you include the correct identification information for both the buyer and seller. This process can be daunting, but using platforms like uslegalforms can help you simplify the filing. Mastering this step is crucial in your journey to understand FIRPTA for dummies.

To claim back FIRPTA withholding, you must file a U.S. tax return and submit Form 843 for a refund request. Keep in mind that you will need to provide all necessary documentation, including a copy of the FIRPTA withholding payment. Your tax return will determine if you are eligible for a refund, depending on various factors. This process is part of understanding FIRPTA for dummies and ensuring you receive any excess withholding back.

A FIRPTA statement is a declaration made by the seller regarding their foreign status. For example, it may state, 'I, John Doe, affirm that I am a foreign national for the purposes of FIRPTA.' This statement needs to be part of the closing documents. Familiarizing yourself with this concept is essential if you are diving into FIRPTA for dummies.

Under FIRPTA, the seller is typically responsible for the withholding tax. However, it becomes a shared responsibility if the buyer agrees to take on this obligation in the transaction. This arrangement should be clearly stated in the sales contract to avoid confusion. Knowing this distinction can simplify your understanding of FIRPTA for dummies.

To submit withholding to the IRS, you must complete Form 8288 and any necessary payment. This form details the amount withheld due to FIRPTA and identifies the foreign seller of the property. You can submit this form along with your payment electronically or by mail. Understanding the process is essential, especially if you're approaching FIRPTA for dummies.