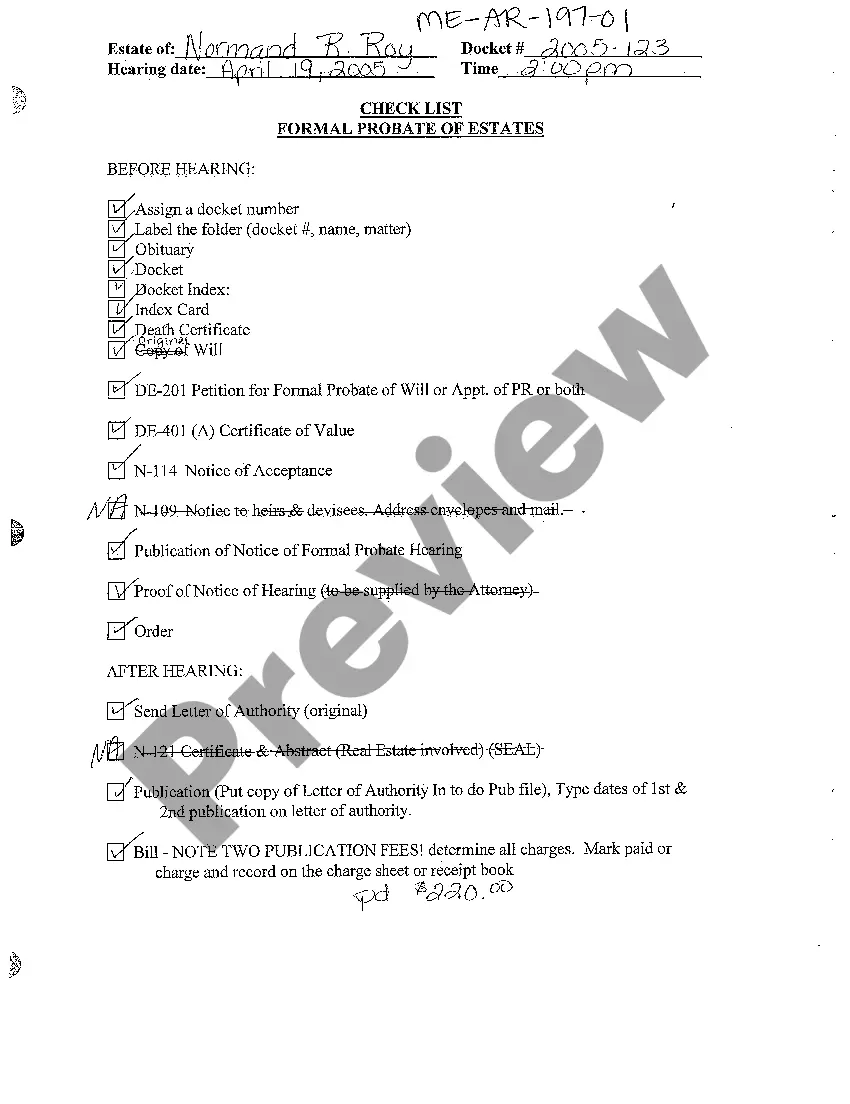

Maine Probate Checklist Without A Lawyer

Description

How to fill out Maine Checklist - Formal Probate Of Estates?

Securing a reliable source for the most up-to-date and applicable legal templates is half the battle of navigating bureaucracy.

Finding the appropriate legal documents requires accuracy and careful consideration, which is why it is essential to obtain templates of the Maine Probate Checklist Without A Lawyer solely from trustworthy outlets, like US Legal Forms. A flawed form will waste your time and delay your proceedings.

Eliminate the hassle that comes with your legal documentation. Explore the comprehensive US Legal Forms catalog to find legal templates, evaluate their relevance to your circumstances, and download them instantly.

- Use the catalog browsing or search option to locate your template.

- Check the form’s description to determine if it meets the criteria of your state and locality.

- Review the form preview, if available, to confirm that the template is what you are looking for.

- Return to the search to find the correct template if the Maine Probate Checklist Without A Lawyer does not suit your requirements.

- When you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Choose the pricing plan that aligns with your needs.

- Proceed to the registration to finalize your order.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Select the file format for downloading the Maine Probate Checklist Without A Lawyer.

- After you have the form on your device, you can edit it with the editor or print it out and complete it manually.

Form popularity

FAQ

In California, contractors and suppliers cannot waive their lien rights in their contract before work begins. They can waive their rights after they have been paid for work completed. Unconditional lien waivers are valid, but only if they follow the form provided by Californian statutes.

Ing to California State Law, documents can only be viewed in the Clerk Recorder office. You will be able to view the images of recorded documents involving your name to find out if a lien has been placed against you or if a recorded lien has been released.

No, California lien waivers do not need to be notarized, even though it's common for businesses to ask that waivers be notarized.

A lien expires 10 years from the date of recording or filing, unless we extend it. If we extend the lien, we will send a new Notice of State Tax Lien and record or file it with the county recorder or California Secretary of State. We will not release expired liens.

A lien can result when the prime contractor (referred to as a "direct contractor" in mechanics lien revision statutes, effective July 1, 2012) has not paid subcontractors, laborers, or suppliers. Legally, the homeowner is ultimately responsible for payment ? even if they already have paid the direct contractor.

The direct contractor is required to get release signatures for you from the potential lien claimants. After you pay, the contractor should provide you with an unconditional release signed by each of the claimants paid for the portion of the work being released.

A lien waiver is a document from a contractor, subcontractor, material supplier, equipment lessor or other party to the construction project regarding payment. This document waives lien rights on the owner's property for stated amounts and time periods.