Trust Termination With State

Description

Form popularity

FAQ

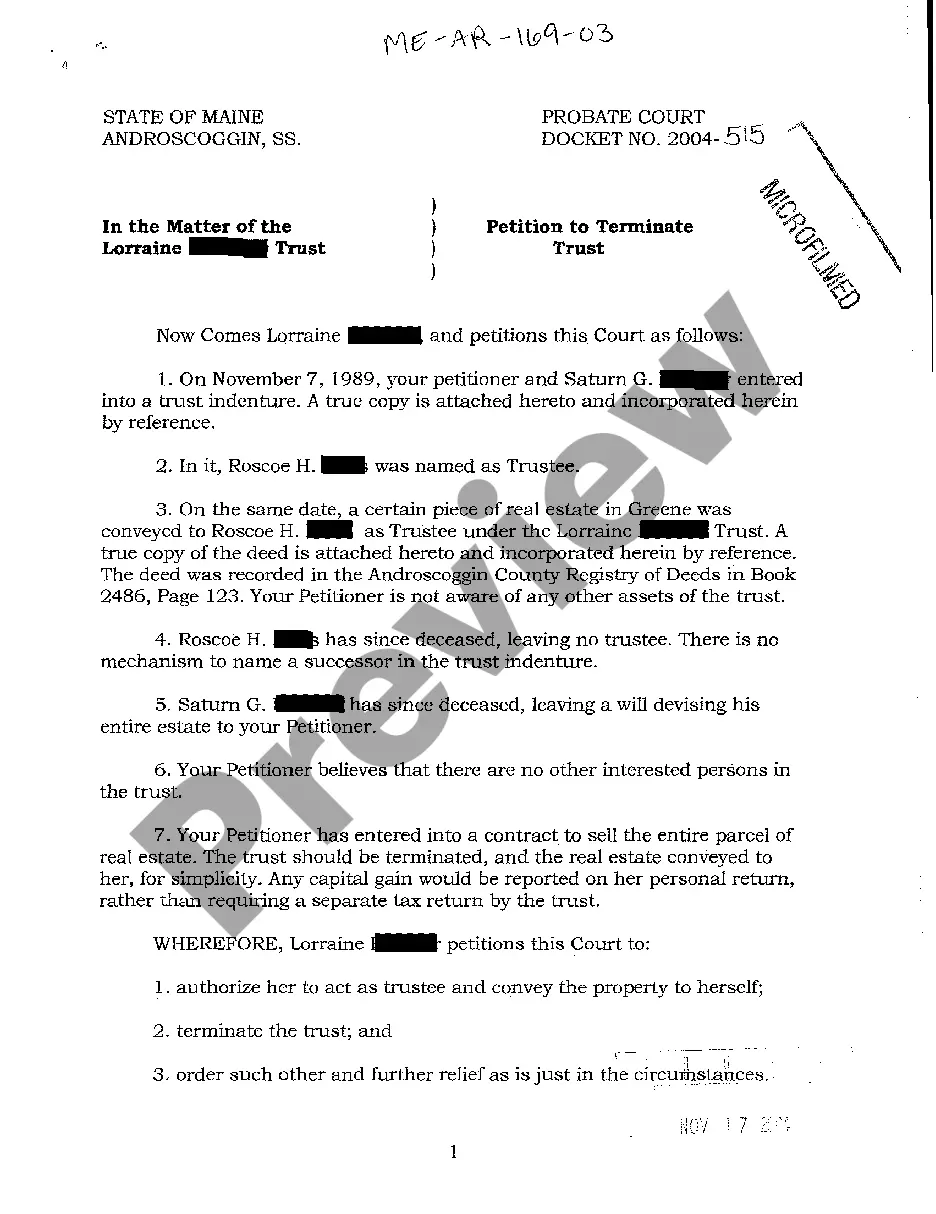

To shut down a trust, you need to follow the specific terms outlined in the trust document. This typically involves distributing the remaining assets to beneficiaries and formally documenting the trust termination with state. Using a reliable platform like uslegalforms can make this process easier, ensuring all legal bases are covered.

A common mistake parents make when establishing a trust fund is failing to communicate their intentions clearly to their beneficiaries. This can lead to misunderstandings at the time of trust termination with state. Open discussions about the trust's purpose can ensure that your wishes are honored and your beneficiaries are prepared.

The 5 year rule regarding trust termination with state refers to the potential tax implications for assets transferred into irrevocable trusts. If assets are transferred and not fully utilized within five years, they may be subject to gift tax. It is essential to plan ahead and understand the long-term effects of trust decisions.

A trust may be deemed void if it lacks a lawful purpose, lacks proper legal formalities, or if the grantor was not competent at the time of creation. Trust termination with state also occurs if the trust violates public policy. Being aware of these factors can save potential legal complications in the future.

Trust termination with state can happen through various avenues such as the expiration of the trust term, mutual agreement among the beneficiaries, or judicial decree. Additionally, the trust may terminate upon the fulfillment of its purpose. Understanding these options can help you navigate trust transitions effectively.

When trust termination with state occurs, tax consequences may arise. Generally, the assets of the trust may be subject to capital gains tax at termination. It's crucial to consult a tax professional to navigate these complexities and understand the implications for both the trustors and beneficiaries.

A trust can be terminated in three primary ways: by expiration, revocation, or judicial decree. Expiration occurs when the purpose of the trust has been fulfilled, while revocation solidifies the trust creator's choice to end the trust. Additionally, a court may decree a trust's termination for reasons such as improper management. Knowledge of trust termination with state will guide you through this process efficiently.

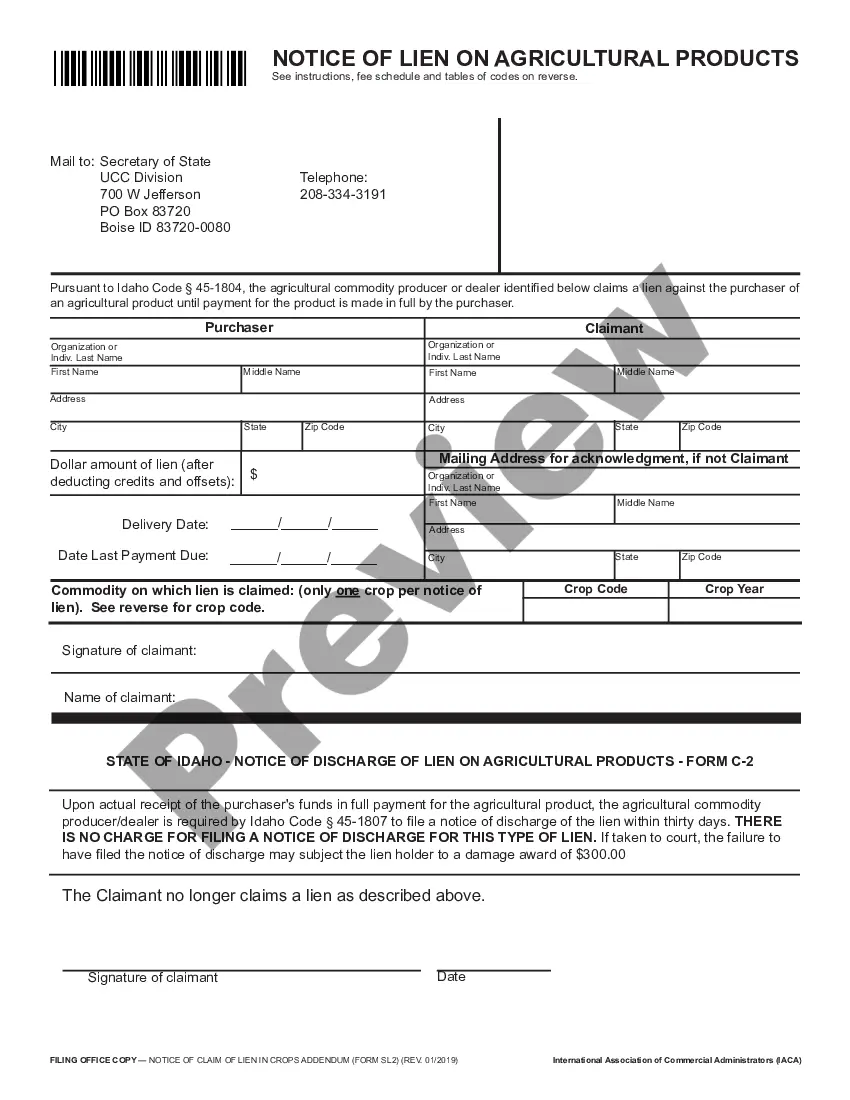

No, trusts typically do not need to register with the Secretary of State unless they fall under certain categories that require registration. This varies from state to state, so it's vital to check your specific state's regulations. When considering trust termination with state, always confirm whether registration is necessary.

Yes, a trust is closely tied to a state, particularly in terms of its administration and termination. Each state has its own laws that govern how trusts operate, making it crucial to be aware of these rules. Understanding how trust termination with state works ensures proper handling of your trust according to local laws.

In most cases, trusts do not need to be filed with the state; however, specific types might require registration. For instance, irrevocable trusts may have different rules regarding filing. Understanding the local requirements for trust termination with state will help you determine if your trust needs filing or registration.