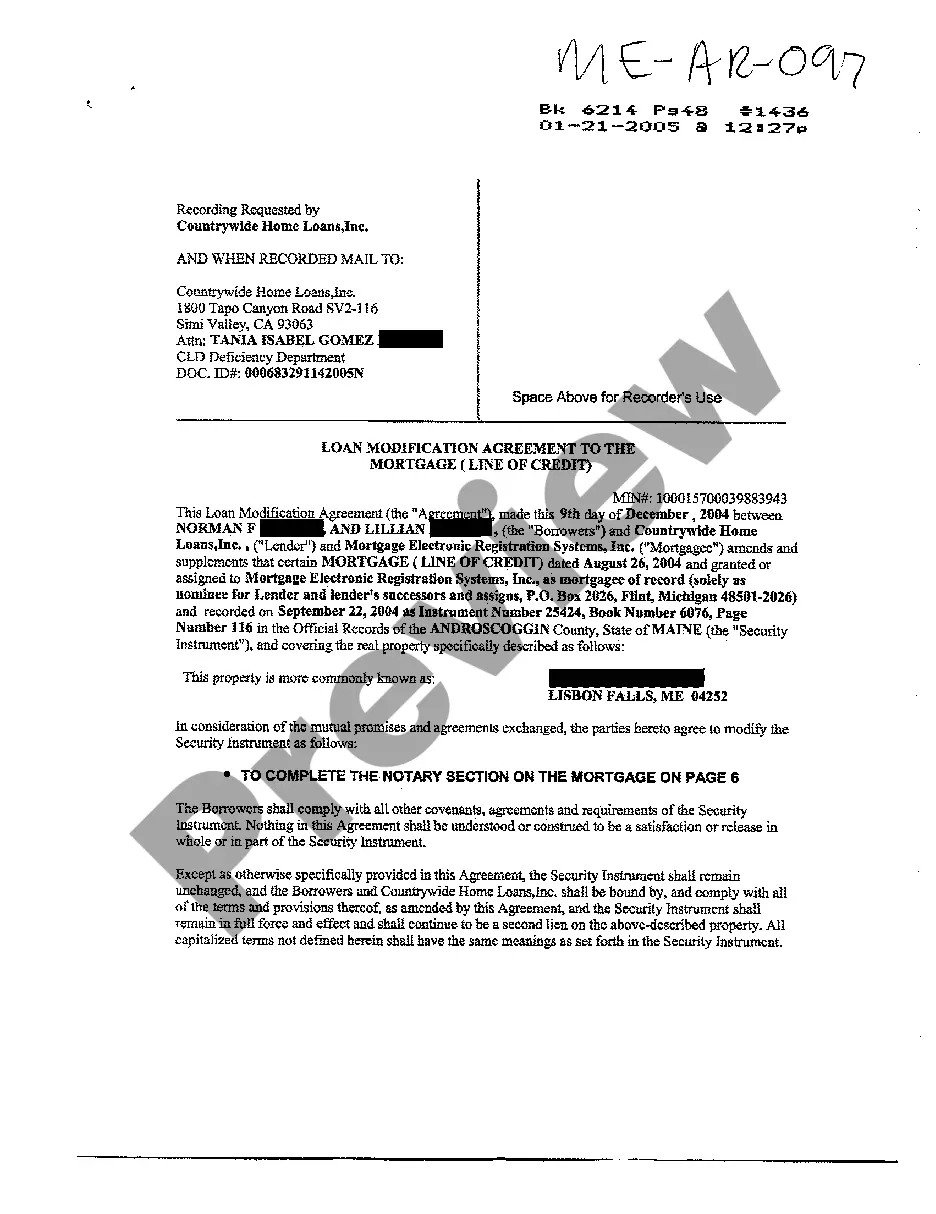

Mortgage Modification Agreement Maine For Sale

Description

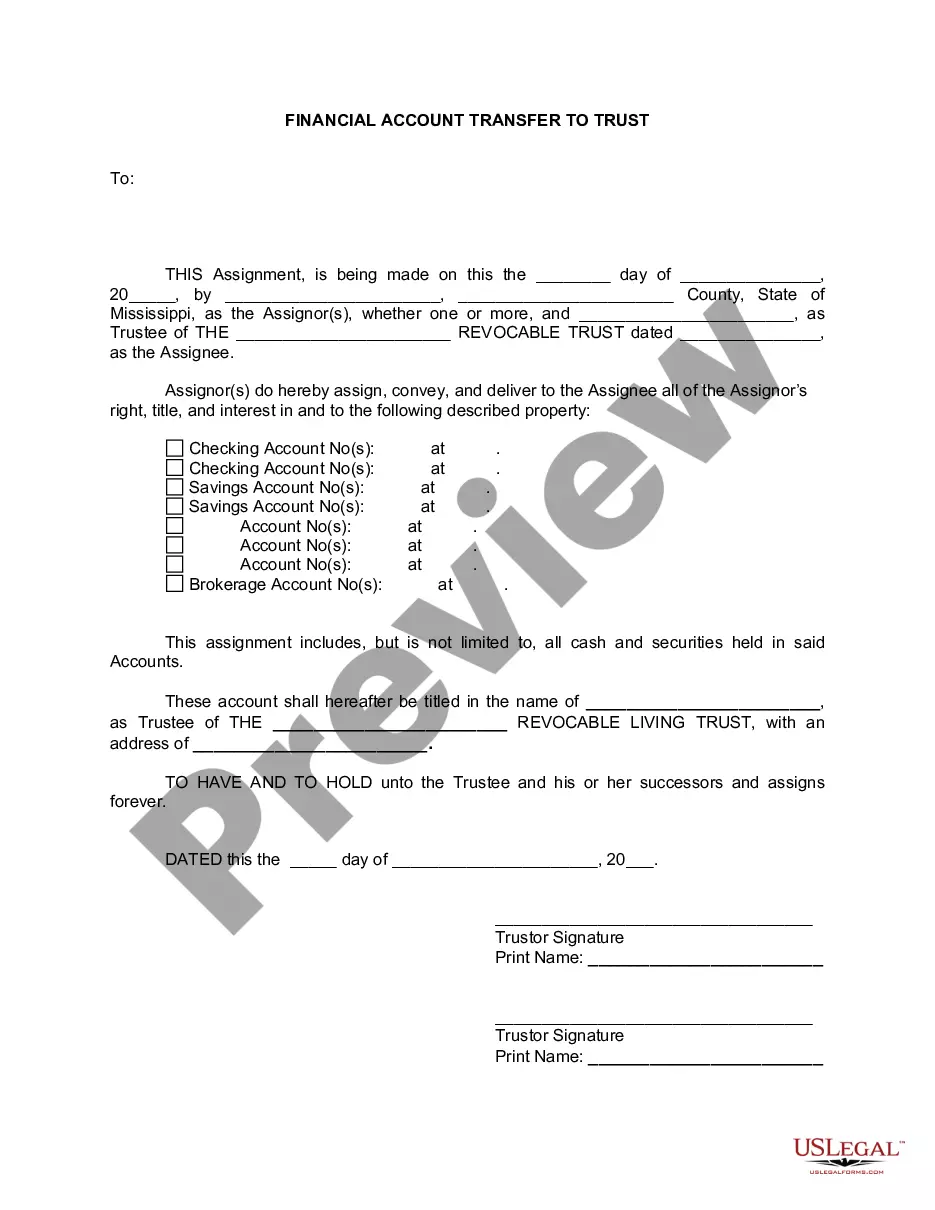

How to fill out Maine Loan Modification Agreement To The Mortgage?

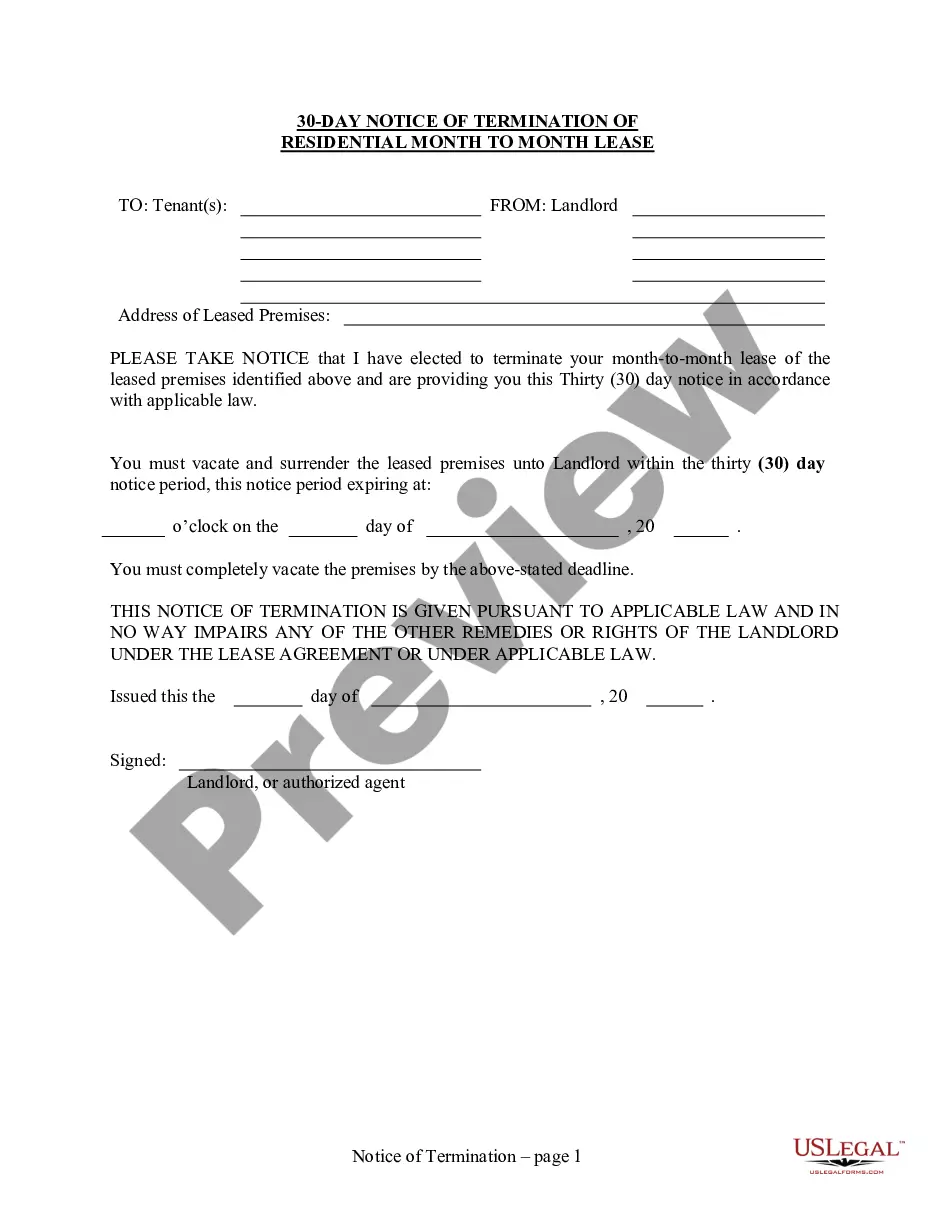

When you have to complete a Mortgage Modification Agreement Maine For Sale that aligns with your local state's laws and regulations, there may be numerous options to choose from.

There's no need to examine every document to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any subject.

Browse the recommended page and verify it for alignment with your needs.

- US Legal Forms is the most extensive online catalog featuring an archive of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state's laws and regulations.

- Thus, when downloading the Mortgage Modification Agreement Maine For Sale from our platform, you can be assured that you possess a valid and current document.

- Accessing the necessary sample from our platform is remarkably easy.

- If you already have an account, simply Log In to the system, ensure your subscription remains valid, and save the chosen file.

- Later, you can visit the My documents section in your profile and maintain access to the Mortgage Modification Agreement Maine For Sale at any moment.

- If it's your first encounter with our library, please follow the instructions below.

Form popularity

FAQ

There is some confusion about how loan modifications affect home sales. Taking a loan modification changes the terms of your loan, but does not impact your ability to sell your home. You can still sell your home even after a loan modification.

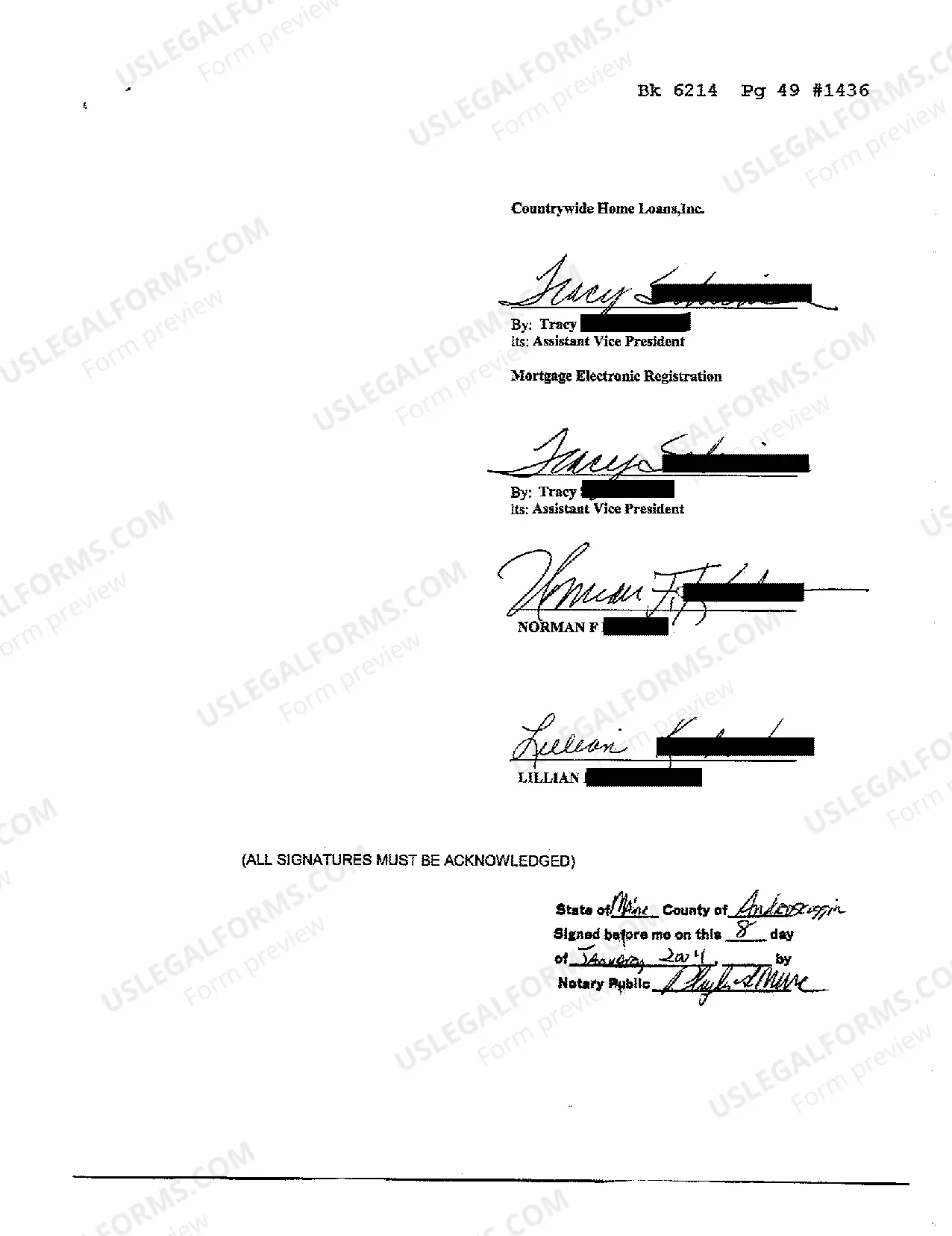

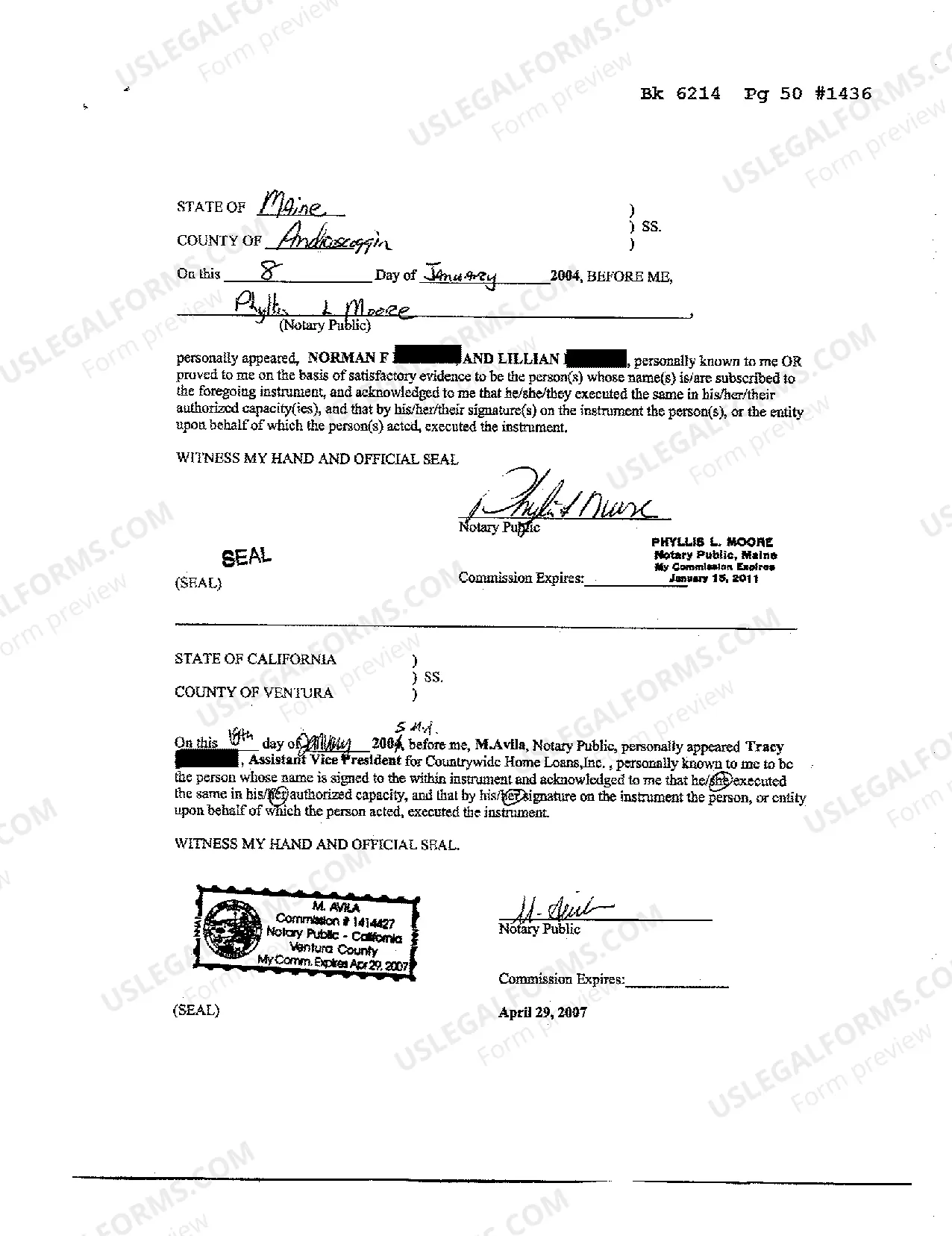

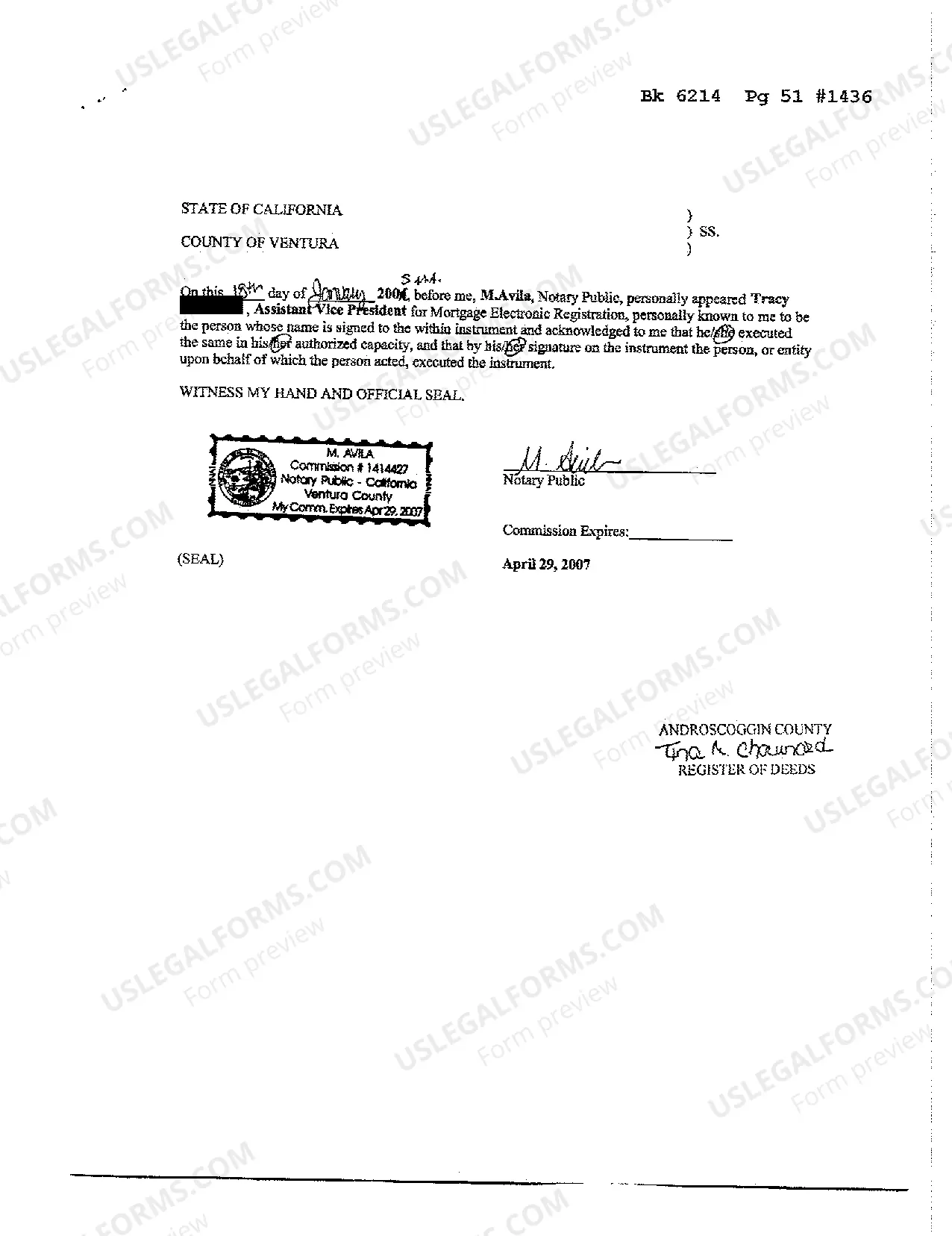

When you've successfully completed your trial modification payments, your mortgage loan servicer will send you a loan modification agreement. That agreement needs to be signed by you, stamped and signed by a notary, and sent back to your servicer.

Yes, you can sell your house as soon as the permanent loan modification is in effect. Your lender can't prevent you from selling your house after a permanent loan modification. However, there may be a prepayment penalty attached to the loan modification.

Fannie Mae will execute the mortgage loan modification agreement and return it to the servicer, regardless of whether the executed mortgage loan modification agreement needs to be recorded. Note: If the mortgage loan modification agreement needs to be recorded, the servicer must submit it for recordation.

You can only get a loan modification through your current lender because they must approve the terms. Some of the things a modification may adjust include: Loan term changes: If you're having trouble making your monthly payments, you may be able to modify your loan and extend your term.