Limited Business

Description

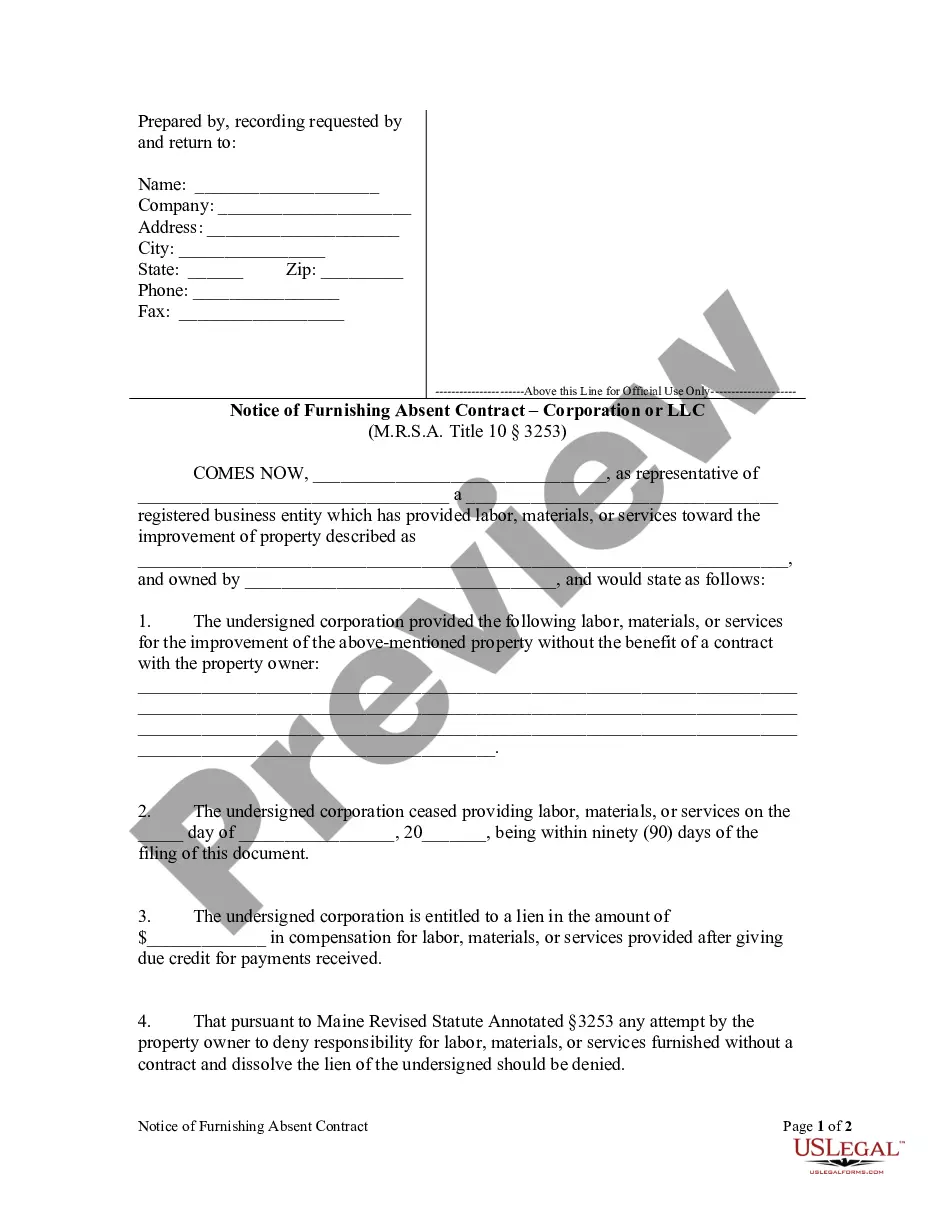

How to fill out Maine Notice Of Furnishing Absent Contract - Corporation Or LLC?

- If you already have an account, log in and ensure your subscription is current. Then, simply locate and download your required form by clicking the Download button.

- For first-time users, begin by browsing the Preview mode to review the form description closely. This step ensures that the chosen document aligns with your needs and adheres to local jurisdiction requirements.

- Should you need a different template, utilize the Search tab to find the correct form. If satisfied, you can advance to the next step.

- Select your document by clicking the Buy Now button and choose a suitable subscription plan. Register for an account to access the diverse resources within the library.

- Complete your purchase by entering your payment information—either credit card details or through your PayPal account.

- Finally, download your completed form. It will be accessible for future use in the My Forms section of your profile.

In conclusion, US Legal Forms streamlines the process of securing legal documents for limited businesses. With thousands of editable and fillable forms at your fingertips, achieving compliance has never been easier.

Explore US Legal Forms today and ensure your business operates smoothly with the proper legal documentation!

Form popularity

FAQ

Filing LLC taxes with personal taxes is not the norm. Limited businesses often require distinct tax forms to reflect their status properly. This separation allows you to document business expenses precisely and helps avoid potential liabilities. For clarity and security, it’s advisable to maintain these filings independently, supporting better financial management.

In most cases, you should not file your LLC and personal taxes together. Each entity serves a different purpose, and consolidating them can lead to confusion in your financial reporting. Keeping these filings separate helps clarify your limited business's performance. If you have questions about your specific situation, consider reaching out to a tax advisor for guidance.

Filing separately typically benefits owners of limited businesses organized as LLCs. This allows for a more straightforward reflection of your business finances and personal income. By separating these, you can allocate expenses accurately and potentially maximize deductions. It's essential to understand your filing options to make an informed decision.

Yes, you must report all business income, even if it is under $600. The IRS requires you to disclose every dollar you earn from your limited business. Failing to report such income can lead to penalties down the line, so it's best to maintain thorough records. Being proactive ensures that you stay compliant with legal requirements.

Filing separately for your limited business and personal taxes is the standard approach for LLC owners. This separation can simplify the tracking of business expenses and income, enhancing clarity in your financial records. While some business structures allow combined filing, it's often more transparent to keep them distinct. Understanding these differences is crucial for effective financial management.

Choosing how to be taxed can significantly impact your limited business's finances. Taxing as an LLC can provide flexibility, allowing for pass-through taxation, which means profits are taxed only at the personal level. This can lead to lower overall taxes compared to individual taxation, especially as your business grows. Consulting with a financial expert can help clarify which option works best for your situation.

All small business owners, regardless of income, must report their earnings to the IRS. Even if your limited business generates little revenue, filing ensures that you remain compliant with tax laws. For many, filing taxes helps maintain accurate records and can facilitate access to loans or grants in the future. It's wise to consult with a tax professional to understand your specific obligations.

You do not need an LLC to run a small business, but forming one can provide legal safeguards. An LLC, or Limited Liability Company, offers personal protection from business debts and liabilities. Moreover, it can enhance your credibility with customers and suppliers. Ultimately, whether to establish an LLC depends on your business goals and preferences.

While a private limited company and an LLC share similarities, they are not the same. A private limited company, often found in the UK, has distinct regulatory frameworks and may impose limitations on share transfers. Conversely, an LLC is prevalent in the U.S. and provides flexible management and tax options. If you are exploring structures for your limited business, gaining clarity on these differences will empower you to make informed decisions. UsLegalForms can assist you in understanding the nuances of each structure.

A limited company typically qualifies as a separate legal entity that limits the liability of its owners. In general, this means that the personal assets of shareholders or members are protected from the company's debts. To qualify, a business must meet specific registration requirements and follow certain operational regulations in its jurisdiction. If you are considering forming a limited business, understanding these qualifications can help you navigate the process successfully.