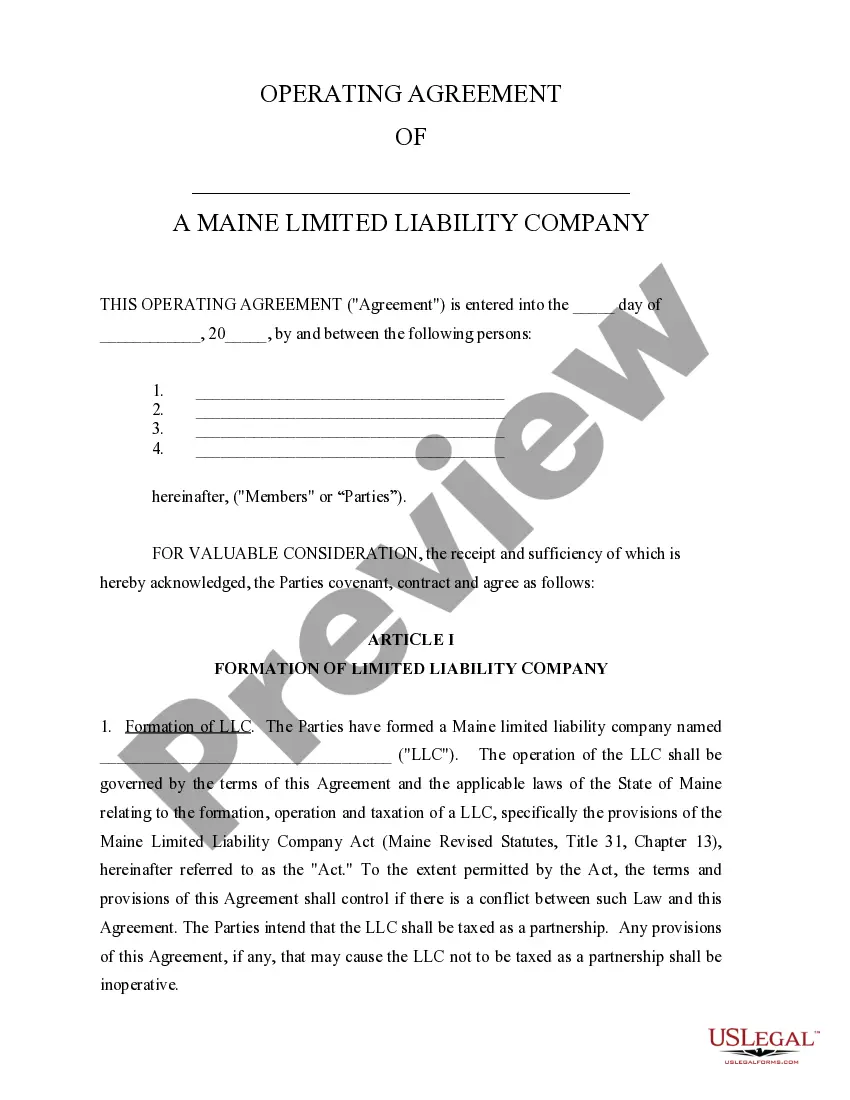

Llc Operating Agreement Maine Without

Description

How to fill out Maine Limited Liability Company LLC Operating Agreement?

There’s no additional justification to squander time searching for legal paperwork to meet your local state obligations.

US Legal Forms has gathered all of them in one location and enhanced their accessibility.

Our site offers over 85,000 templates for any business and personal legal matters organized by state and area of application. All forms are properly drafted and verified for accuracy, so you can be confident in acquiring a current Llc Operating Agreement Maine Without.

Creating official documents under federal and state laws is quick and simple with our platform. Try US Legal Forms today to keep your records organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active prior to accessing any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all saved documents whenever necessary by clicking the My documents tab in your profile.

- If you haven't used our platform before, the process will require a few extra steps to finalize.

- Here’s how new users can locate the Llc Operating Agreement Maine Without in our catalog.

- Examine the page content thoroughly to ensure it includes the sample you need.

- To do so, utilize the form description and preview options if available.

- Use the Search field above to find another template if the previous one didn't meet your needs.

- Click Buy Now next to the template title once you discover the correct one.

- Choose your preferred pricing plan and register for an account or Log In.

- Complete your subscription payment using a card or via PayPal to proceed.

- Select the file format for your Llc Operating Agreement Maine Without and download it to your device.

- Print your form to fill it out manually or upload the sample if you prefer to complete it in an online editor.

Form popularity

FAQ

Maine is one of the few states that require an operating agreement. As the state's LLC Act §1531 states, a limited liability company agreement must be entered into or otherwise existing at the time that you file the Certificate of Formation.

How Your LLC Will Be Taxed. Owners pay self-employment tax on business profits. Owners pay state income tax on any profits, minus state allowances or deductions. Owners pay federal income tax on any profits, minus federal allowances or deductions.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

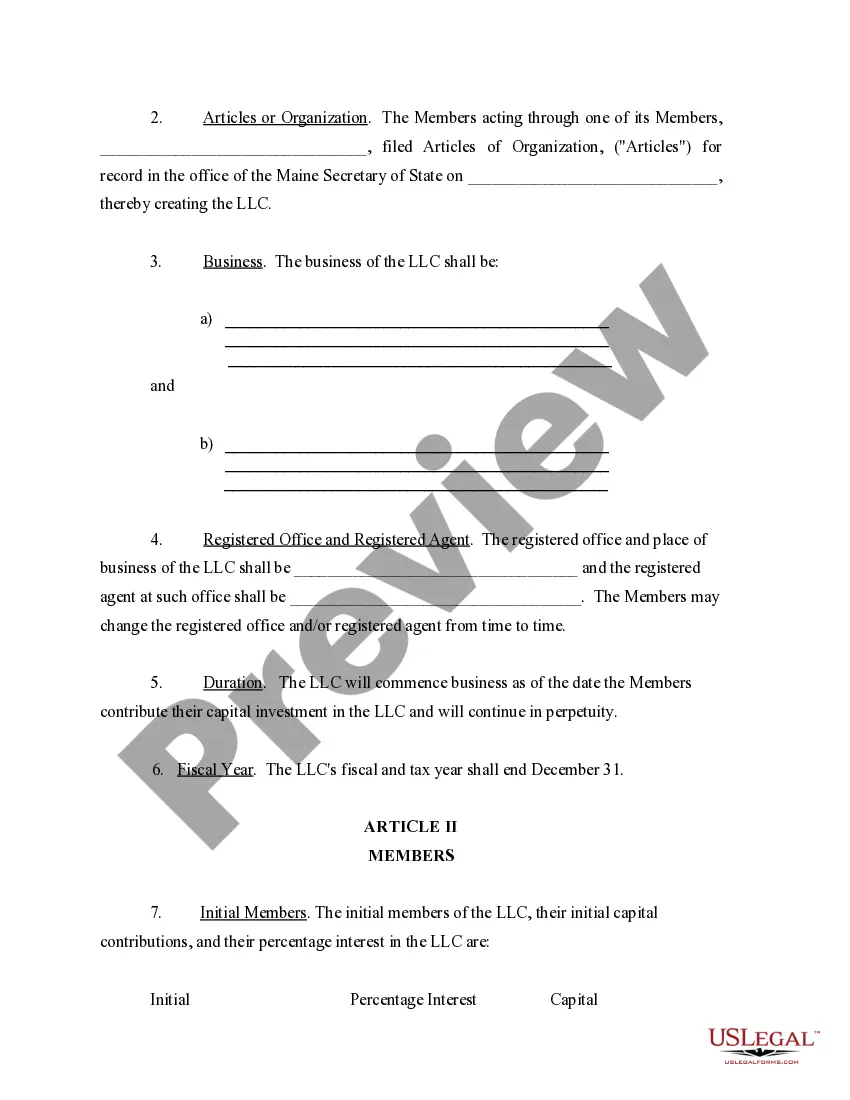

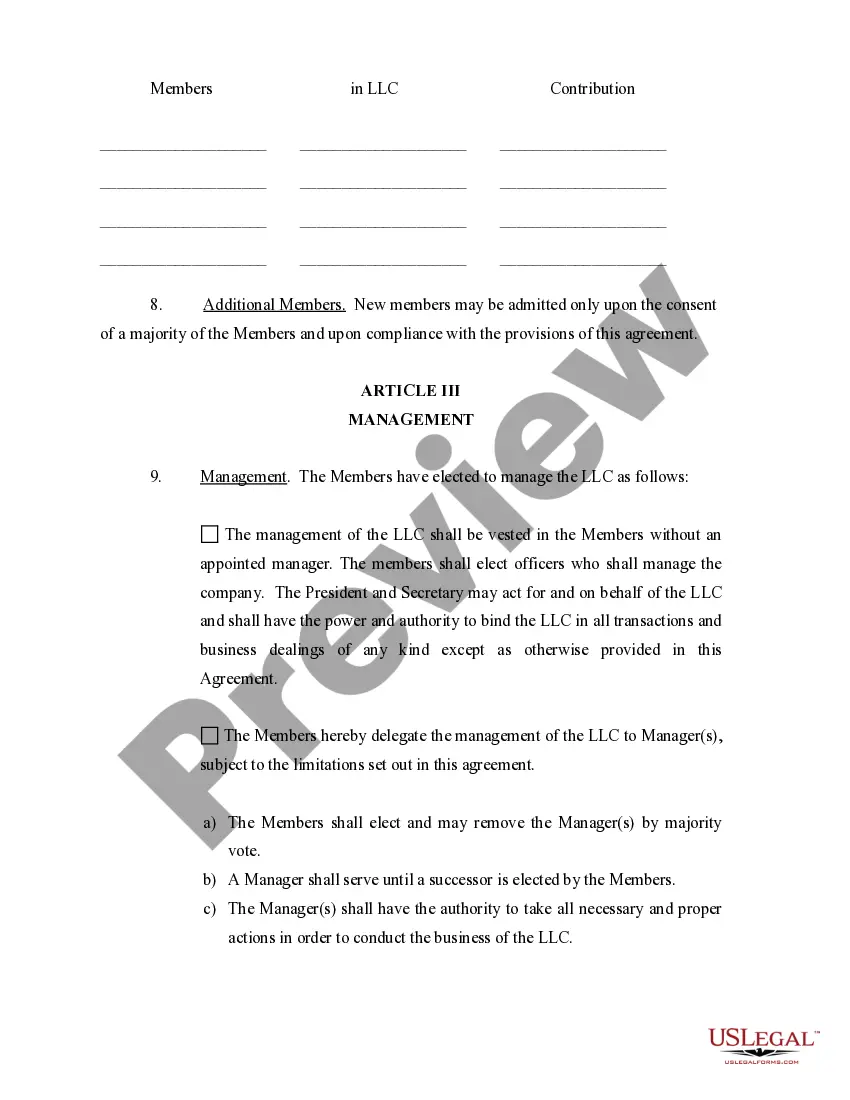

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?