Power Attorney Poa Form For Finances

Description

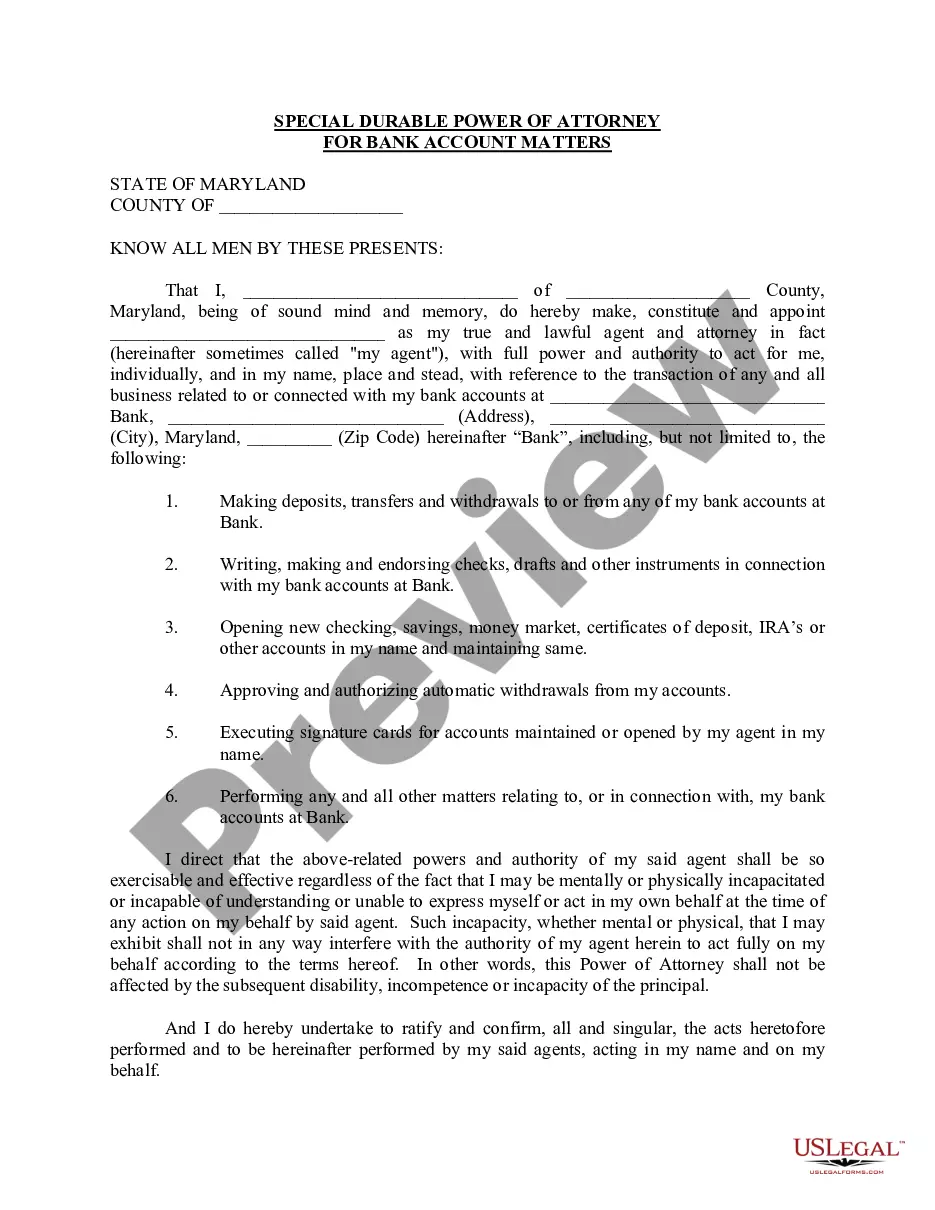

How to fill out Maryland Special Durable Power Of Attorney For Bank Account Matters?

- If you are a returning user, log in to your account and navigate to your document library to download the necessary POA form. Ensure your subscription is active; renew it if needed.

- For new users, start by browsing the extensive library and preview the POA form you need. Confirm that it aligns with your jurisdiction's requirements.

- If you don't find the right template, use the search function to explore our diverse offerings for alternatives.

- Once you've identified the correct form, click the buy button and select your preferred subscription plan. Registration is required for access.

- Complete your purchase using a credit card or PayPal, and once processed, download your POA form to your device.

- Access your downloaded documents anytime through the 'My Forms' section in your profile.

Using US Legal Forms not only simplifies the document acquisition process but also provides confidence in the legal validity of your forms. With over 85,000 templates, you’re guaranteed to find what you need.

Take advantage of US Legal Forms today to secure your financial powers of attorney with ease. Start now and protect your interests!

Form popularity

FAQ

You can obtain a financial power of attorney by visiting websites that specialize in legal forms, such as USLegalForms. These platforms offer templates that comply with state laws, making it easier for you to create a valid document. Additionally, consider checking with local government offices or libraries, which may provide resources. Remember, using a reliable source ensures that your power attorney POA form for finances is accurate.

In Illinois, you do not necessarily need a lawyer to create a power attorney POA form for finances. However, having legal guidance can ensure that the document is correctly drafted and meets all local regulations. If your financial situation is complex or if you're unsure about the process, consulting a lawyer might be beneficial. For straightforward needs, you can access user-friendly forms through USLegalForms.

Many banks do not offer their own power attorney POA form for finances. Instead, they often accept forms created by legal services or individuals, as long as they meet state requirements. It is important to verify that the form you choose is valid for your specific banking institution. For added convenience, you can find comprehensive POA forms through platforms like USLegalForms.

To write a financial power of attorney, start by choosing a trustworthy individual to serve as your agent. Use a well-structured power attorney poa form for finances, clearly outlining the powers you wish to grant, such as managing bank accounts and investments. You should include specific details about transactions you permit and any limitations you desire. Lastly, ensure the document complies with state laws for it to be legally binding, and consider consulting a legal expert if needed.

No, a financial power of attorney is not the same as a general POA. A general POA allows the agent to make decisions in many areas of your life, including healthcare and legal matters, while a financial POA limits authority strictly to financial decisions. Understanding these distinctions helps you select the appropriate power attorney poa form for finances so that your agent's authority aligns with your wishes. This clarity is vital for effective management.

The key difference lies in the scope of authority. A standard power of attorney grants broad powers, which may include various decision-making areas, while a financial power of attorney focuses explicitly on financial matters. Thus, using a power attorney poa form for finances allows for clear expectations about financial decision-making. It is crucial to choose the correct form based on your specific needs and intent.

To submit your power attorney poa form for finances to the IRS, you should file it along with your tax returns if you are representing someone’s financial interests. You can attach a copy of the POA to Form 2848, Power of Attorney and Declaration of Representative, to provide the IRS with necessary documentation. Additionally, ensure all information is accurate and current to avoid delays or issues with processing. This practice will help streamline your communications with the IRS.

A financial power of attorney cannot make healthcare decisions on your behalf, even though it covers financial matters. It also cannot override any rights or decisions made by you if you are still capable of making them. Moreover, a financial POA cannot engage in actions that violate any laws or act against your best interests. It’s important to understand these limitations to ensure you choose the correct form for your needs.

Yes, a power of attorney can be responsible for managing a person’s financial affairs if the document grants them that authority. This responsibility includes paying bills, managing assets, and conducting transactions on behalf of the principal. When using a power attorney POA form for finances, it’s essential to clearly outline the financial powers given to avoid any confusion.

In Minnesota, a power of attorney must be signed and notarized to be legally effective. This notary requirement ensures that the document is verified and prevents any future disputes regarding its authenticity. When you use a power attorney POA form for finances in Minnesota, make sure to include notarization for validity.