Maryland Inheritance Tax Waiver Form With Ohio

Description

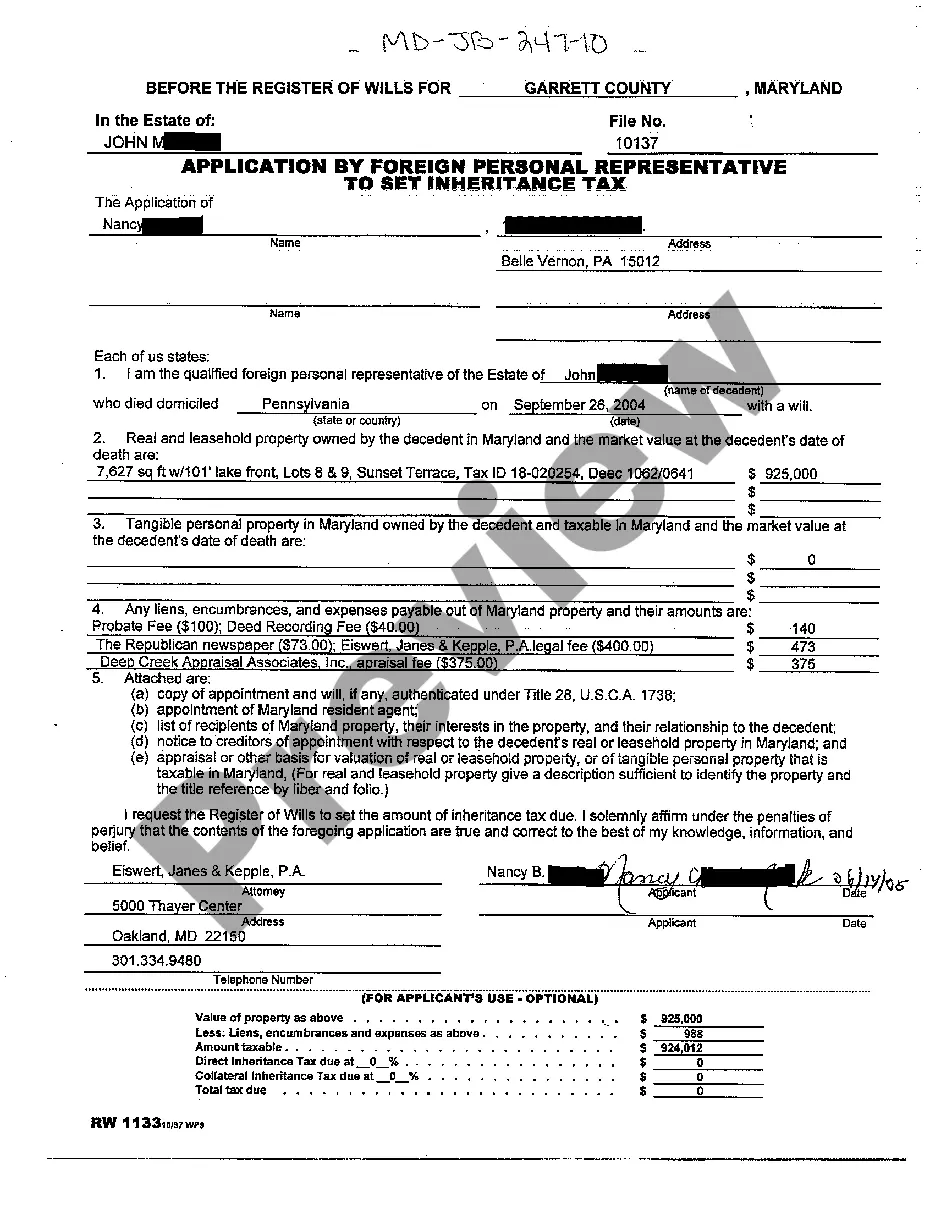

How to fill out Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

Whether for corporate needs or personal issues, everyone must handle legal matters at some point during their life.

Completing legal documents requires meticulous focus, beginning with selecting the right form template.

With an extensive US Legal Forms catalog available, you do not need to waste time searching for the suitable template online. Utilize the library’s user-friendly navigation to discover the correct form for any occasion.

- Obtain the template you require by utilizing the search field or catalog navigation.

- Review the form’s details to ensure it aligns with your situation, state, and locality.

- Select the form’s preview to examine it.

- If it is the incorrect document, return to the search option to locate the Maryland Inheritance Tax Waiver Form With Ohio sample you need.

- Download the file if it corresponds with your specifications.

- If you possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you don’t have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you desire and download the Maryland Inheritance Tax Waiver Form With Ohio.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Ohio has no inheritance tax, which means residents do not need to worry about taxes when they inherit property or assets. This tax repeal simplifies the process for families during difficult times. If you're dealing with estates involving Maryland and Ohio, the Maryland inheritance tax waiver form with Ohio can assist in ensuring you meet all required legal standards. Utilizing this form can lead to a more efficient handling of inheritance across state lines.

Ohio abolished its inheritance tax on January 1, 2013, making it simpler for residents to inherit without the burden of additional taxes. This decision has greatly benefited many families, allowing them to focus on their loved ones instead of navigating complex tax codes. If you are managing an estate that may involve both Maryland and Ohio, be sure to use the Maryland inheritance tax waiver form with Ohio to streamline the process. This form can help clarify any potential tax obligations and expedite estate settlements.

In Maryland, you can inherit up to $50,000 without incurring any inheritance tax, but this can vary based on the relationship to the deceased. For residents of Ohio, there is no inheritance tax at all due to the repeal in 2013. To ensure a smooth process, consider using the Maryland inheritance tax waiver form with Ohio to manage any necessary documentation. Understanding these specifics helps you better navigate the legal landscape of inheritance.

Maryland inheritance laws dictate how assets are distributed after an individual passes away. These laws specify tax obligations and exemptions for various inheritors. Familiarizing yourself with these laws and utilizing the Maryland inheritance tax waiver form with Ohio can simplify your experience and ensure compliance with state regulations.

In Maryland, certain individuals are exempt from the inheritance tax, including spouses, children, and other close relatives. Additionally, charitable organizations are also exempt from paying this tax. Understanding these exemptions is crucial, and using the Maryland inheritance tax waiver form with Ohio can help clarify your status and streamline the process.

To avoid the Maryland inheritance tax on property, beneficiaries can utilize strategies such as gifting assets during the owner's lifetime or establishing certain types of trusts. Another effective method is to ensure the property passes to exempt individuals, like spouses or charities. Completing the Maryland inheritance tax waiver form with Ohio can streamline the process if managed correctly.

Yes, Maryland does have a mechanism for an inheritance tax waiver. This waiver allows certain individuals to avoid the tax when inheriting property from a deceased person. To apply for this waiver, beneficiaries need to complete the Maryland inheritance tax waiver form with Ohio specifications. It's essential to understand the eligibility criteria before submitting this form.

The new portability rule enhances the ability for spouses to benefit from unused estate tax exemptions. This change aims to ease the estate planning process and provide financial relief to many families. By completing the Maryland inheritance tax waiver form with Ohio correctly, you can better leverage the benefits of this new rule.

Maryland's estate tax exemption is indeed portable, allowing a surviving spouse to claim the unused exemption. This feature can simplify estate tax planning and provide significant savings. It is helpful to work through the Maryland inheritance tax waiver form with Ohio to take full advantage of these laws.

While portability can be beneficial, it has some drawbacks, such as complexity in execution and potential state tax implications. Additionally, the portability election must be timely filed, or it may be lost. Understanding these factors is crucial, especially when dealing with a Maryland inheritance tax waiver form with Ohio.