Maryland Inheritance Tax Waiver Form For California

Description

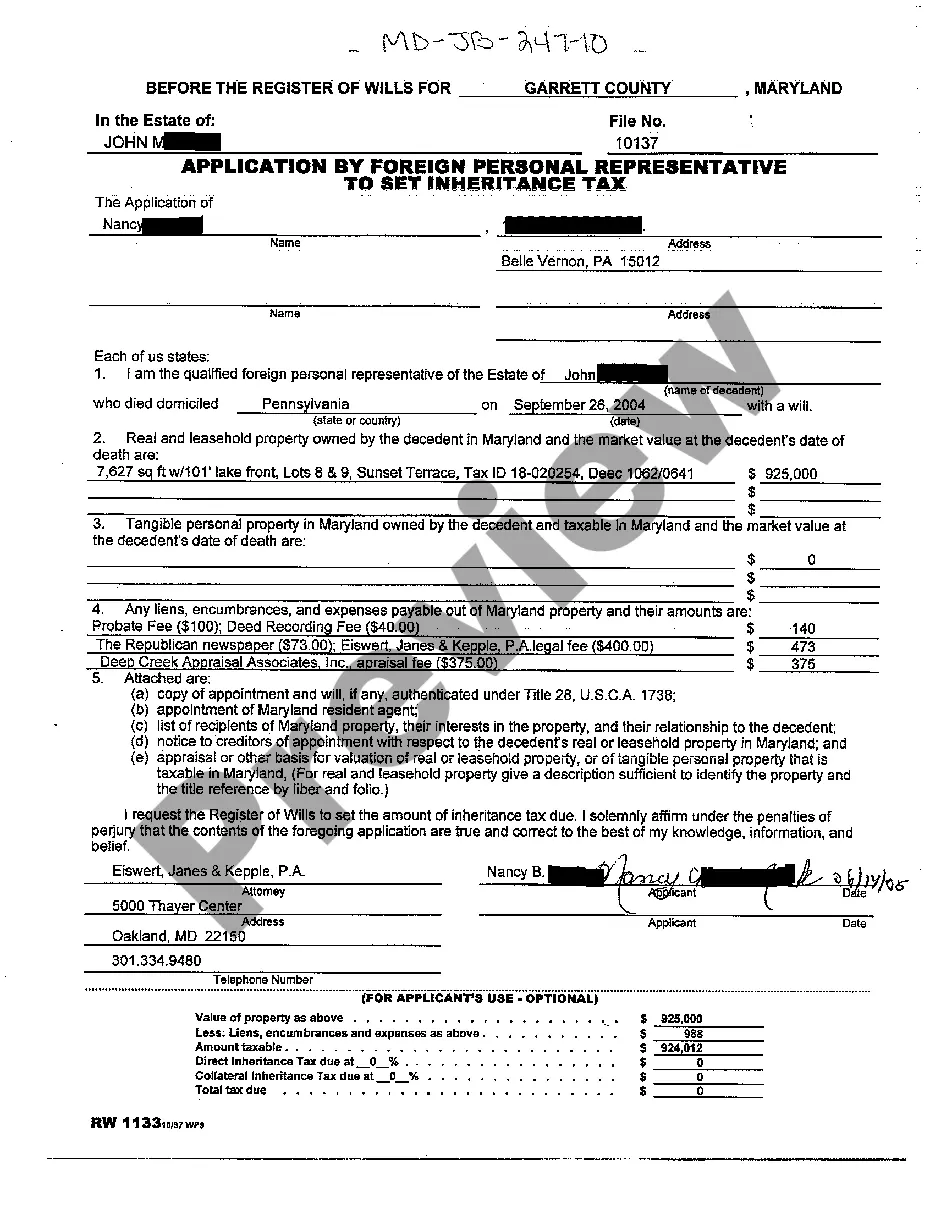

How to fill out Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

Dealing with legal paperwork and processes can be a lengthy addition to your overall day.

Maryland Inheritance Tax Waiver Form For California and similar forms typically necessitate searching for them and figuring out how to complete them accurately.

As a result, whether you are managing financial, legal, or personal issues, utilizing a comprehensive and efficient online directory of forms will be advantageous.

US Legal Forms is the leading digital platform for legal templates, boasting over 85,000 state-specific forms and various tools to assist you in completing your documents swiftly.

Simply Log In to your account, find Maryland Inheritance Tax Waiver Form For California, and download it immediately from the My documents section. You can also retrieve previously stored forms.

- Explore the collection of relevant documents available to you with a single click.

- US Legal Forms offers you state- and county-specific forms accessible at any time for download.

- Safeguard your documentation handling processes with high-quality services that enable you to prepare any form in a few minutes without any extra or concealed fees.

Form popularity

FAQ

California does not tax out-of-state inheritances. However, it’s essential to understand how the inheritance interacts with California’s estate laws, especially if you inherit real property. You might incur other taxes or fees depending on the specifics of the estate and the Maryland inheritance tax laws. Using the Maryland inheritance tax waiver form for California can help alleviate confusion regarding your tax liabilities.

To avoid Maryland inheritance tax on property, you should explore the Maryland inheritance tax waiver form for California. This form can help exempt certain kinds of property transfers from taxation. Additionally, consider properly structuring your estate and utilizing any available deductions or exemptions. Consulting with a professional can also guide you in making informed decisions about your inheritance.

The disadvantages of portability include potential complications and the need for timely election on tax returns. Additionally, if the surviving spouse remarries, it could affect the use of the exemption. Having clarity on these aspects is vital for effective estate planning. Using the Maryland inheritance tax waiver form for California through uslegalforms can provide guidance to navigate these issues.

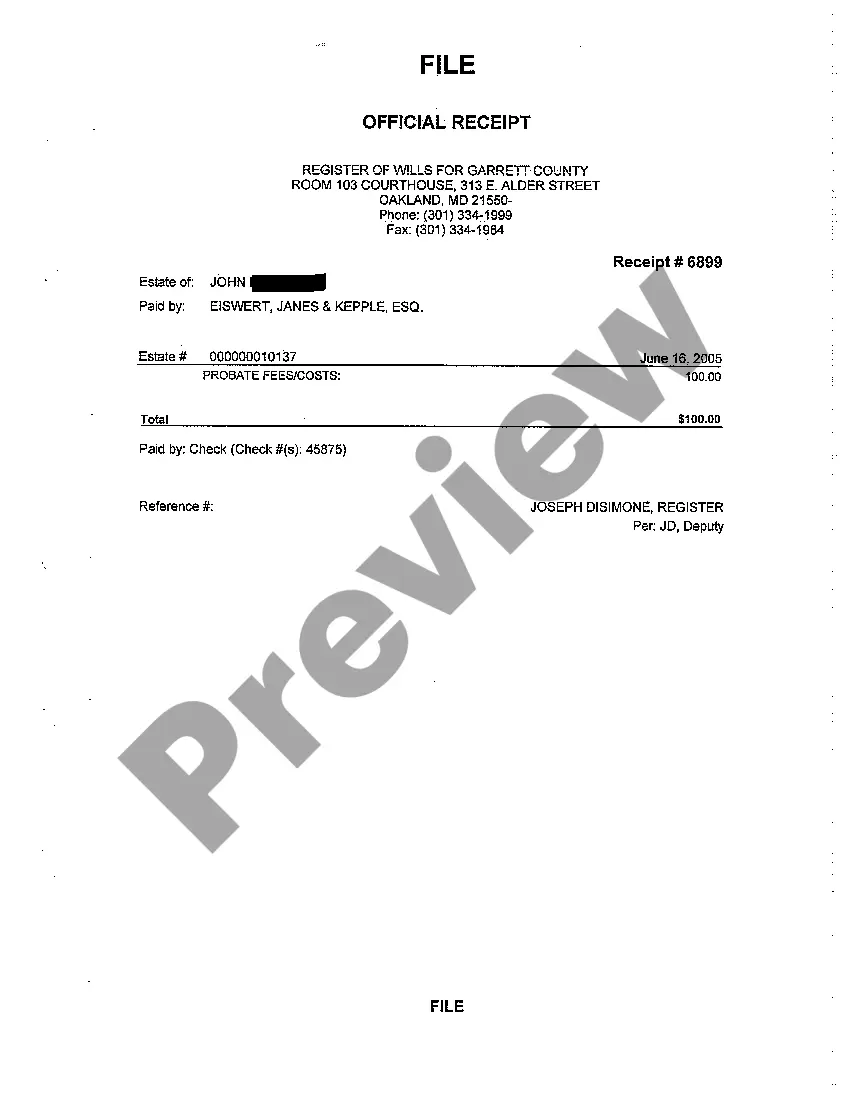

Yes, Maryland generally requires an inheritance tax waiver for the transfer of property to beneficiaries. This waiver ensures that any inheritance taxes due are settled prior to the transfer. It's essential to obtain the necessary documentation to avoid complications. You can find the Maryland inheritance tax waiver form for California on uslegalforms, simplifying the process considerably.

The new portability rule allows the deceased spouse's unused estate tax exemption to be transferred to the surviving spouse. This provision helps maximize tax benefits when planning estates. Understanding this rule can empower you to make the most of estate planning strategies. Be sure to consult the Maryland inheritance tax waiver form for California to ensure compliance.

Estate tax exemption portability works by allowing the surviving spouse to use any unused exemption of the deceased spouse. Upon the death of the first spouse, they must elect portability on a timely filed estate tax return. This election can make a significant difference in reducing future estate tax liabilities. For those dealing with California inheritance, having the Maryland inheritance tax waiver form for California is crucial.

The Maryland estate tax exemption is indeed portable between spouses. When one spouse dies, the surviving spouse can claim the deceased spouse's unused exemption amount. This portability can help reduce overall estate taxes in the surviving spouse’s estate. Utilizing the Maryland inheritance tax waiver form for California can streamline your requirements.

Yes, Maryland allows for estate tax exemption portability. This means that if a spouse passes away, their unused estate tax exemption can be transferred to the surviving spouse. This can be particularly beneficial for planning and managing estates. Ensure you have the right Maryland inheritance tax waiver form for California to facilitate this process.

In Maryland, certain individuals are exempt from inheritance tax, including spouses, children, and other close relatives. This exemption helps ensure that family members are not disproportionately burdened with taxes upon a loved one's passing. Utilizing the Maryland inheritance tax waiver form for California can help clarify exemptions and streamline the inheritance process. For detailed guidance, consider seeking assistance from resources like US Legal Forms.

Avoiding Maryland inheritance tax largely depends on proactive estate planning. Establishing a trust or making gifts during your lifetime can help decrease your estate's value, potentially reducing tax liability. Additionally, completing the Maryland inheritance tax waiver form for California can assist in safeguarding certain assets. It's recommended to work with an estate professional to explore the best options for your circumstances.