Selling An Unsecured Promissory Note Form

Description

How to fill out Maryland Complaint For Breach Of Promissory Note By Selling Collateral Security?

Bureaucracy demands exactness and correctness.

If you do not manage filling out forms like the Selling An Unsecured Promissory Note Form on a regular basis, it may lead to some misunderstanding.

Selecting the right example from the outset will ensure that your document submission proceeds smoothly and avert any hassles of having to re-submit a document or repeat the same task from scratch.

If you are not a subscribed user, finding the needed template would require a few additional steps.

- Find the accurate example for your paperwork through US Legal Forms.

- US Legal Forms is the largest online repository of forms that houses over 85 thousand templates for various fields.

- You can easily access the latest and most pertinent version of the Selling An Unsecured Promissory Note Form by simply searching on the platform.

- Identify, save, and download templates in your account or review the description to confirm you have the proper one available.

- With an account on US Legal Forms, you can efficiently gather, consolidate, and manage the templates you store for quick access.

- Once on the website, click the Log In button to authenticate.

- Next, navigate to the My documents page, where your document list is maintained.

- Browse through the descriptions of the forms and download what you need at any time.

Form popularity

FAQ

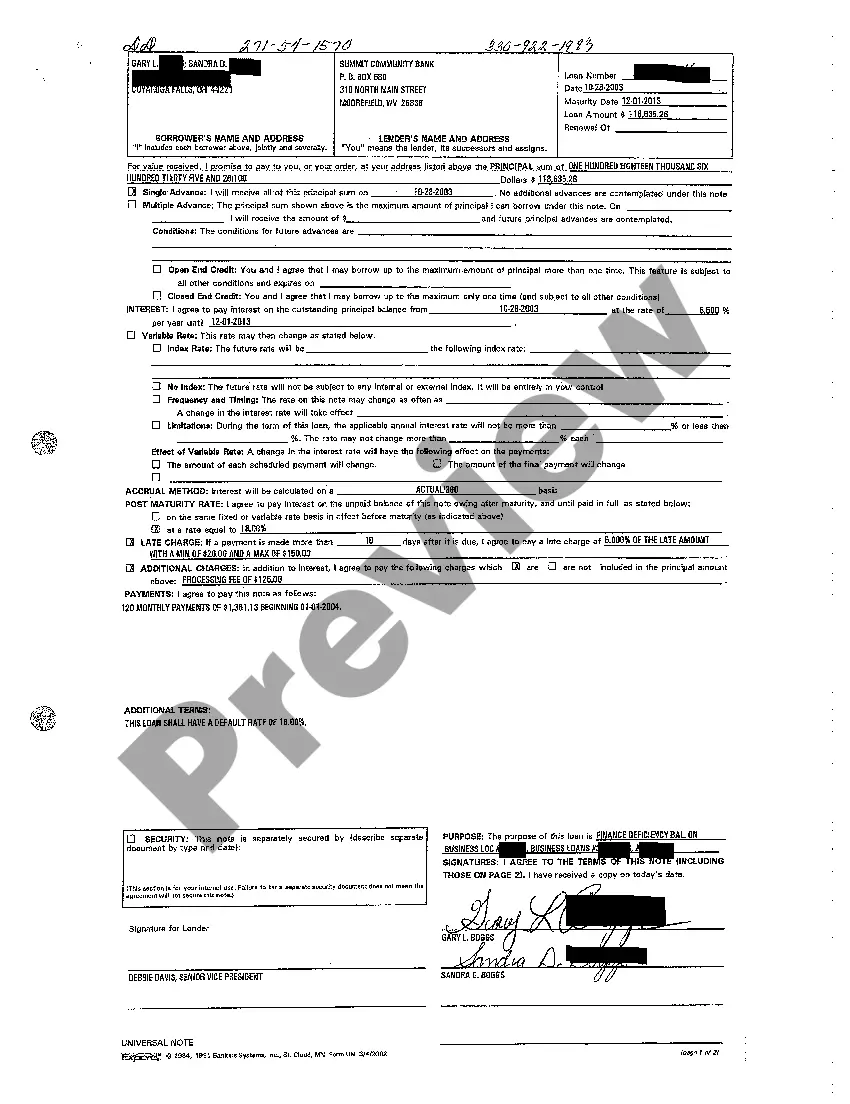

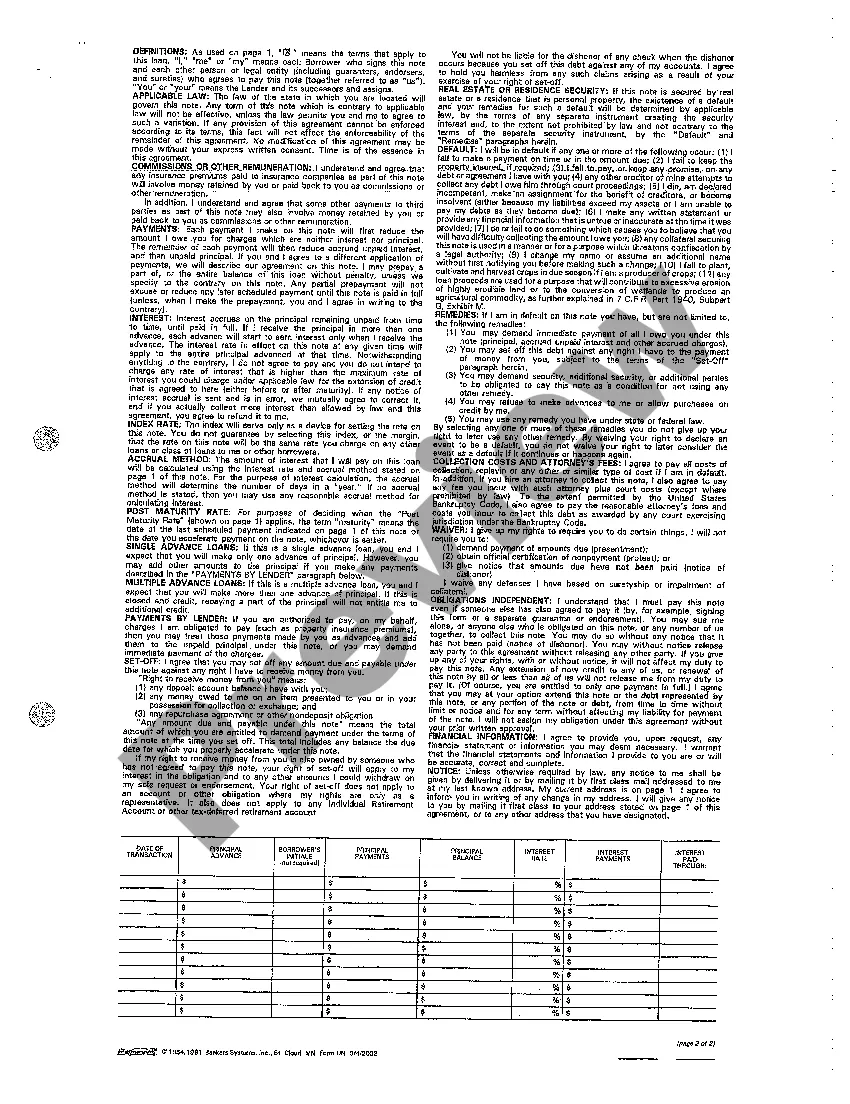

Promissory notes and titles can be sold. The person who owns the promissory note may sell it. Lenders typically sell promissory notes when they no longer want to be responsible for the loan or they need a lump sum of cash. The buyer of the note assumes the responsibility of collecting the money.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

When valuing a promissory note, it's necessary to examine the factors that affect its perceived risk, including: Interest rate and duration. Generally, the shorter a note's term, and the higher the interest rate relative to market rates, the greater its value.

If you are the holder of a promissory note, you may be able to sell the note for cash. However, you will be selling the note for less than the face value. Generally, a note buyer will discount the note by 10 to 35 percent.

Unsecured Promissory NotesAn unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.