Affiliation Real Estate Withholding: Understanding the Basics and Types Affiliation real estate withholding is a statutory process that involves the retention of a certain percentage of the sale proceeds of an immovable property by a buyer or escrow agent, which is subsequently remitted to the relevant tax authorities. This mechanism ensures tax compliance and helps guarantee that the seller fulfills their real estate tax obligations. In essence, affiliation real estate withholding serves as a safeguard against potential tax liabilities that may arise from the sale of a property. It acts as a protective measure to prevent the seller from evading their tax responsibilities. Types of Affiliation Real Estate Withholding: 1. Foreign Investment in Real Property Tax Act (FIR PTA) Withholding: FIR PTA withholding refers specifically to the withholding of taxes for properties owned by foreign sellers. This measure ensures that non-resident sellers pay their fair share of taxes on any gains derived from the sale of real estate located in the United States. The buyer or escrow agent is responsible for determining the withholding amount, which is usually a percentage of the sale price. 2. State Tax Withholding: Some states may require the imposition of affiliation real estate withholding to cover potential state tax liabilities associated with the real estate transaction. These state-level withholding requirements vary, and it is essential for buyers and escrow agents to be knowledgeable about the specific regulations in their respective state. 3. Municipal or Local Tax Withholding: In addition to state taxes, certain municipalities or local jurisdictions may have their own affiliation real estate withholding requirements. These local tax withholding are often in addition to any state withholding and are mandated to ensure local tax compliance. 4. Capital Gains Tax Withholding: Depending on the jurisdiction, affiliation real estate withholding may also encompass capital gains taxes. In some countries, a certain percentage of the total sale price is withheld to cover potential capital gains tax obligations. By implementing affiliation real estate withholding, governments can ensure that taxes associated with property sales are paid promptly, reducing tax evasion risks and maintaining a fair tax ecosystem. Property buyers and escrow agents should familiarize themselves with the specific types of withholding applicable to their location to ensure compliance with legal obligations while facilitating a smooth property transaction process.

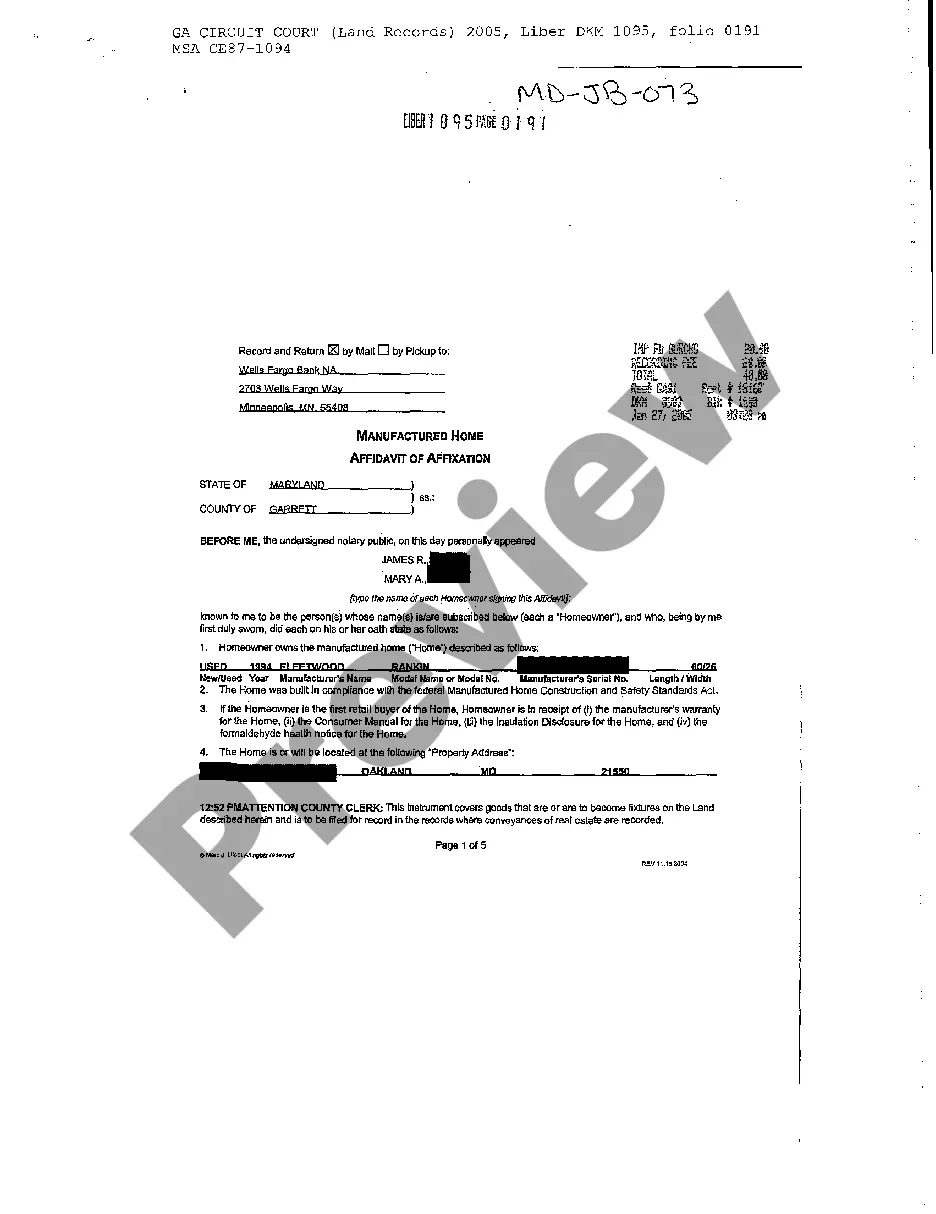

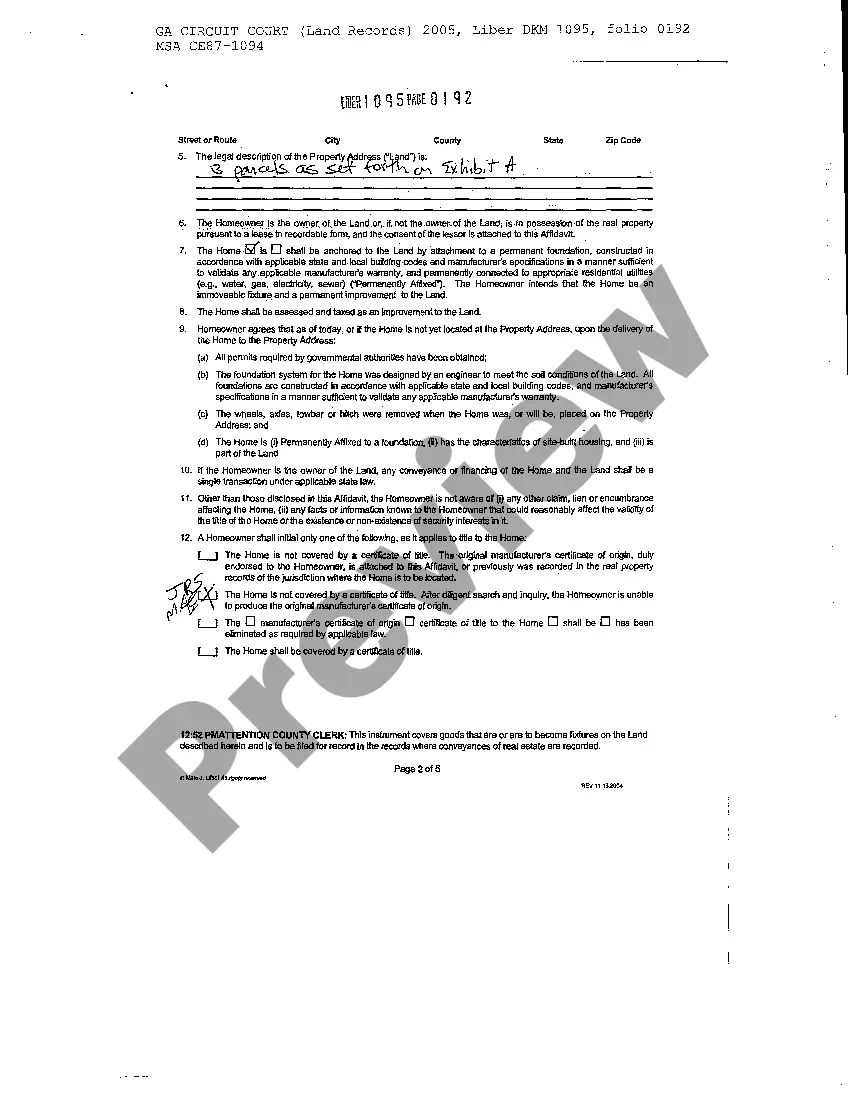

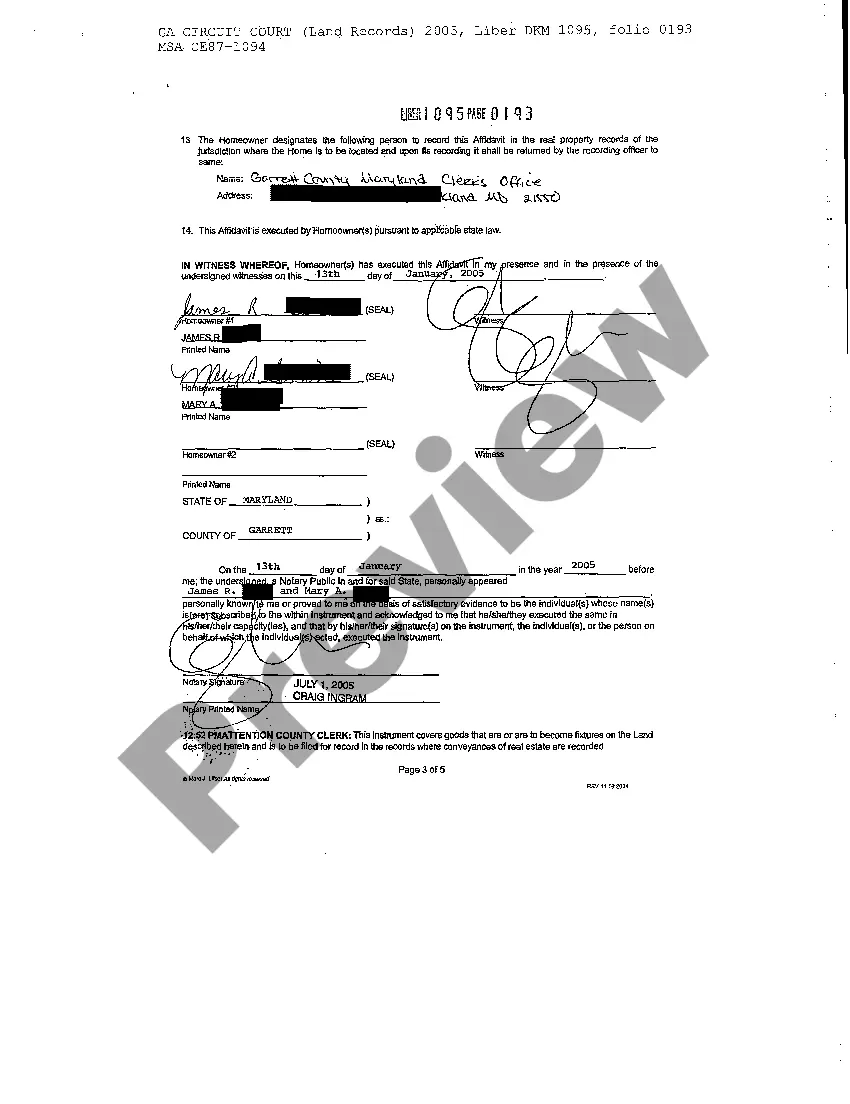

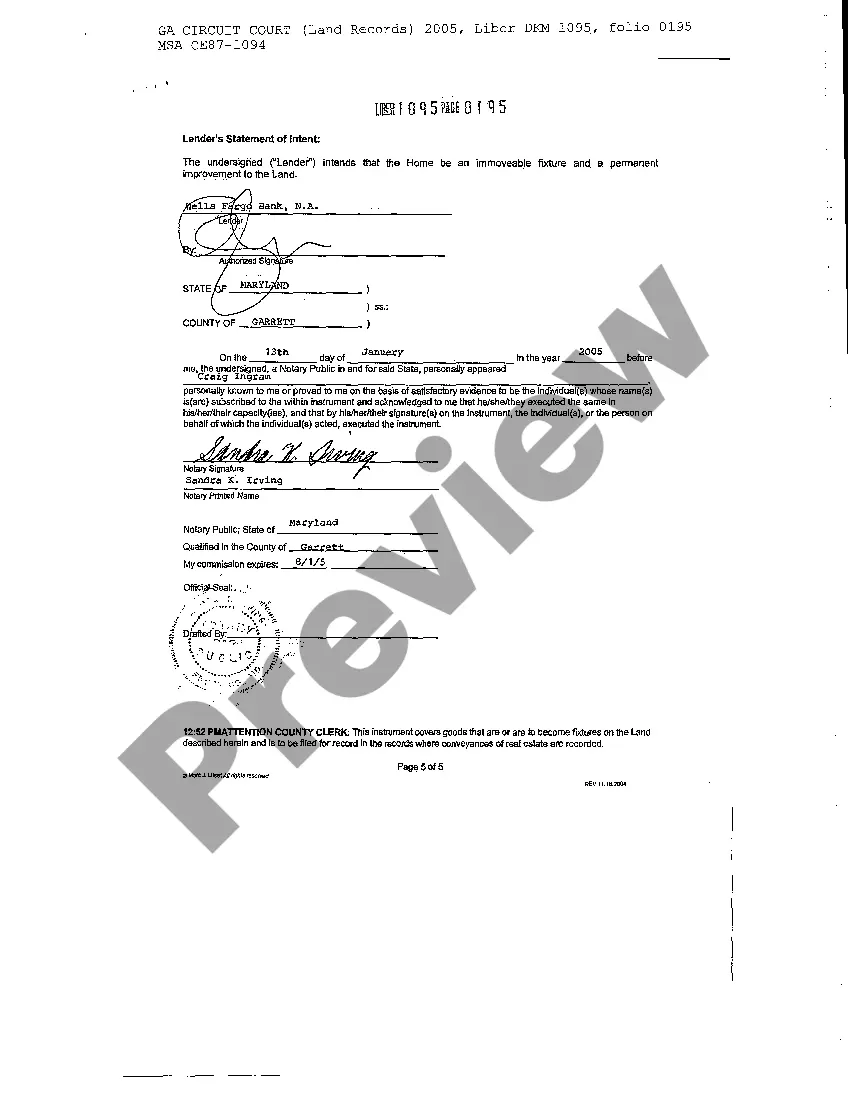

Affixation Real Estate Withholding

Description

How to fill out Affixation Real Estate Withholding?

Obtaining legal document samples that comply with federal and local regulations is crucial, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the correctly drafted Affixation Real Estate Withholding sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal scenario. They are easy to browse with all documents arranged by state and purpose of use. Our specialists stay up with legislative updates, so you can always be sure your paperwork is up to date and compliant when getting a Affixation Real Estate Withholding from our website.

Obtaining a Affixation Real Estate Withholding is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the guidelines below:

- Examine the template using the Preview option or via the text description to make certain it fits your needs.

- Look for another sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve found the suitable form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Affixation Real Estate Withholding and download it.

All documents you find through US Legal Forms are multi-usable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Matthew Rossetti, founder and managing principal of Sentient Law, Ltd., cautions that online legal templates are an outright dangerous idea, and suggests businesses are better off drafting agreements of their own. ?Legal agreements are like prescription glasses.

EForms | The #1 website for free legal forms and documents.

A free legal template is truly only free at the point of 'sale'. Free legal templates are great, until there is a dispute and you are in trouble. Then they are less than great.

There is nothing illegal about selling legal forms. Websites for companies like US Legal Forms and Small Business Legal Forms offer many, for very reasonable prices.

Legal Templates has 2 pricing edition(s), from $0 to $95.88. A free trial of Legal Templates is also available.

Currently it is possible for the user to generate document templates through Microsoft Word, by using a pre-defined list of Legal One tags. These tags are presented and managed by this add in, in which the user can use the available Legal One fields and save the changes in the document template.

Legal Templates headquartered in Greensboro, North Carolina equips businesses with tools to be their own legal advocates, using technology to create free legal documents simply and quickly. At LegalTemplates.net users find the form they need, choose their state, and can then customize the requested document.

The Best Online Legal Services for 2023 Best Overall: LegalShield. Best Free Advice: Avvo. Best Self-Service Documents: . Best for Finding a Lawyer: FindLaw. Best for Complex Needs: Rocket Lawyer. Best for Startup Businesses: Incfile.