Respondeat Superior For Insurance Coverage

Description

How to fill out Maryland Complaint Wrongful Discharge, Intentional Infliction Of Emotional Distress, Respondeat Superior, And Negligent Hiring, Retention, Supervision?

Whether for business purposes or for individual affairs, everyone has to manage legal situations sooner or later in their life. Completing legal paperwork needs careful attention, starting with choosing the appropriate form sample. For instance, when you select a wrong version of a Respondeat Superior For Insurance Coverage, it will be declined when you submit it. It is therefore essential to get a trustworthy source of legal papers like US Legal Forms.

If you have to get a Respondeat Superior For Insurance Coverage sample, stick to these simple steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Check out the form’s information to ensure it fits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect document, get back to the search function to locate the Respondeat Superior For Insurance Coverage sample you need.

- Get the template when it matches your needs.

- If you have a US Legal Forms account, simply click Log in to gain access to previously saved templates in My Forms.

- In the event you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the proper pricing option.

- Finish the account registration form.

- Select your transaction method: you can use a bank card or PayPal account.

- Select the document format you want and download the Respondeat Superior For Insurance Coverage.

- When it is saved, you can complete the form by using editing software or print it and complete it manually.

With a large US Legal Forms catalog at hand, you never have to spend time seeking for the right sample across the web. Make use of the library’s straightforward navigation to find the right form for any occasion.

Form popularity

FAQ

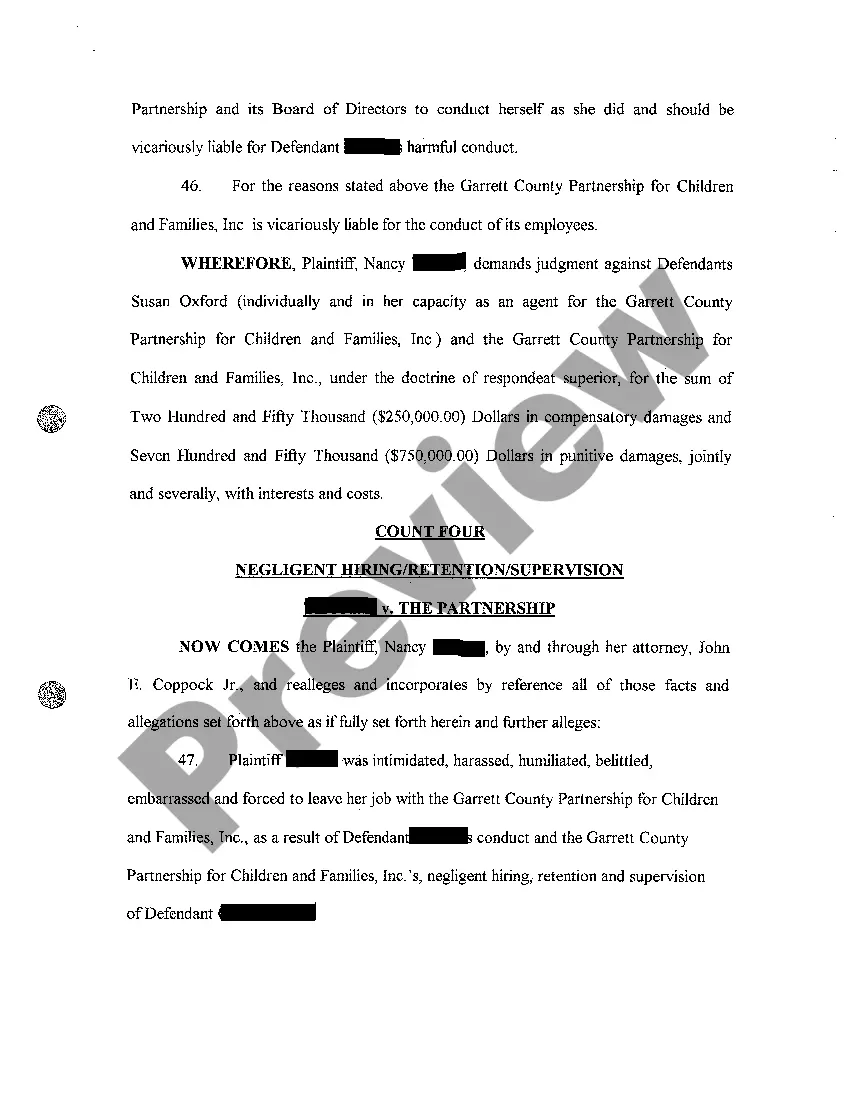

Respondeat superior is a legal doctrine, most commonly used in tort, that holds an employer or principal legally responsible for the wrongful acts of an employee or agent, if such acts occur within the scope of the employment or agency.

An example of Respondeat Superior For example, if there is a personal injury case that involves a situation where a truck driver's negligence results in a truck accident, the injured individual can also try to bring the driver's employer-often the trucking company itself- into the case and hold them liable as well.

Respondeat Superior applies in cases where the plaintiff proves three things: The injury occurred while the defendant was working for the employer. The defendant was acting within the scope of her employment. The defendant was performing an act in furtherance of the employer's interest.

Respondeat Superior comes from the Latin meaning, ?Let the master answer? and is also known as the Master Servant Rule. This legal notion comes into play in the case of medical malpractice when it can be proven that the employer or hospital can be held liable for the actions of doctors or employees.

For example, if a doctor is employed by a hospital, rather than working as an independent contractor, the hospital may be liable under respondeat superior for errors by the doctor that amount to medical malpractice.