Difference Between Gift Deed And Sale Deed

Description

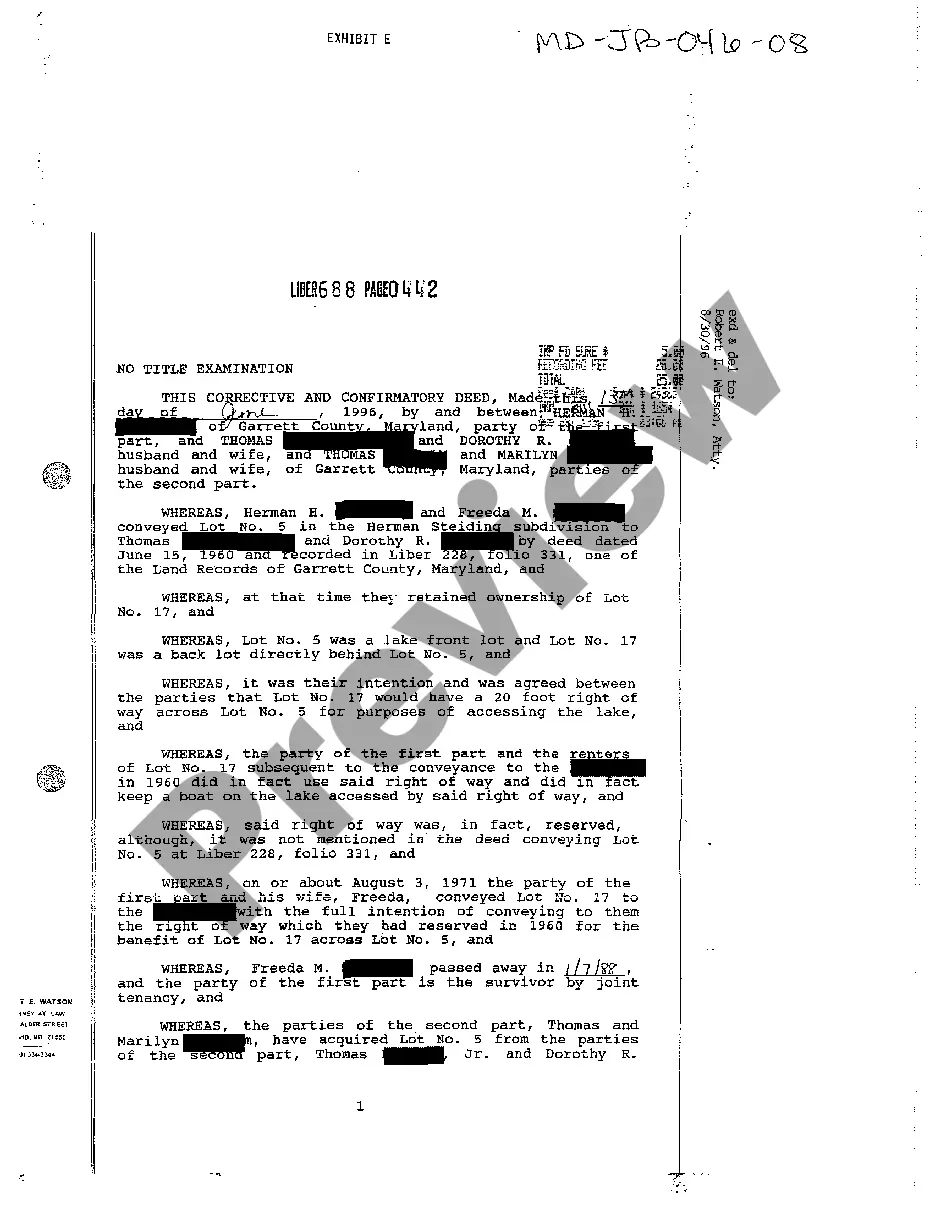

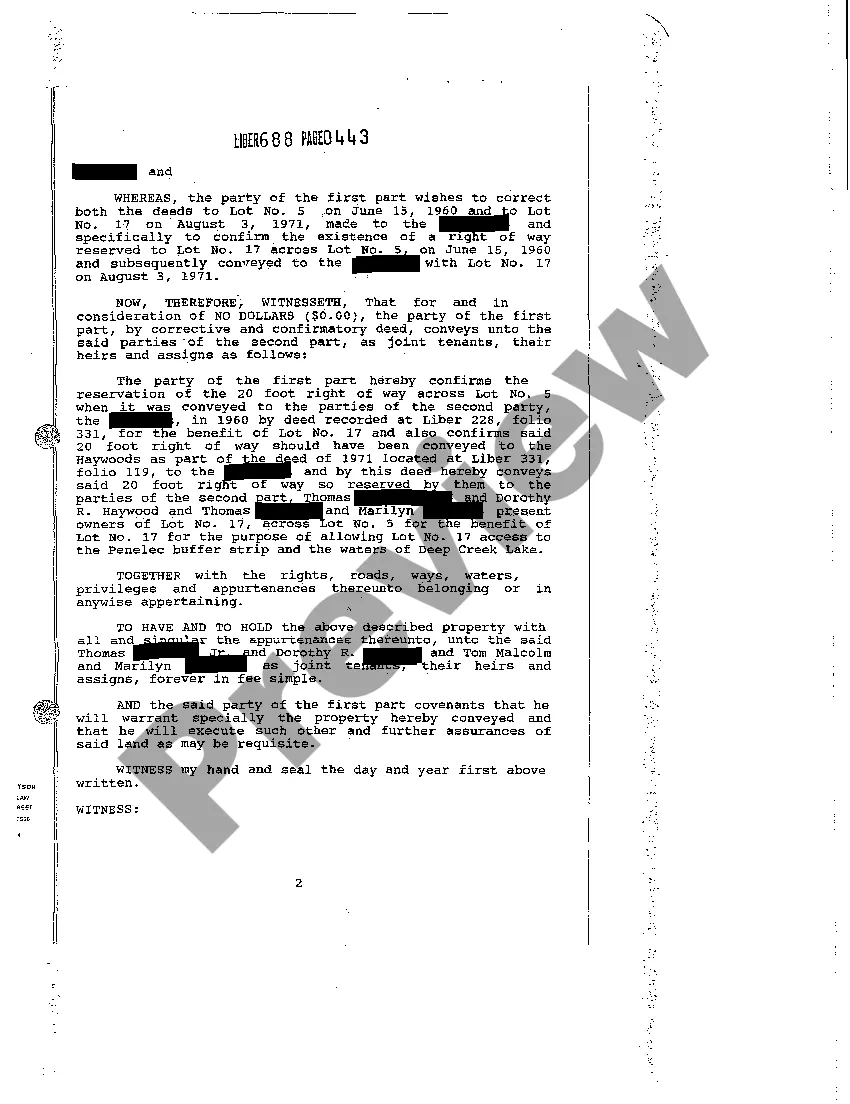

How to fill out Maryland Exhibit E Corrective And Confirmatory Deed - Husband And Wife To Married Couple?

Regardless of whether it is for commercial reasons or personal matters, everyone encounters legal circumstances sometime in their lifetime.

Completing legal paperwork necessitates meticulous consideration, beginning with selecting the correct template.

With an extensive US Legal Forms collection available, you will never have to waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the suitable document for any situation.

- Locate the template you require by leveraging the search box or catalog browsing.

- Review the form’s overview to confirm it aligns with your situation, state, and county.

- Click on the form’s preview to inspect it.

- If it is the wrong template, return to the search feature to find the Difference Between Gift Deed And Sale Deed template you need.

- Download the document if it fulfills your requirements.

- If you have a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you lack an account, you can get the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the account registration form.

- Select your payment method: you may use a credit card or PayPal account.

- Choose the file format you desire and download the Difference Between Gift Deed And Sale Deed.

- Once it is stored, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

To determine whether a gift deed or release deed is better, consider your purpose for the transfer. A gift deed offers genuine intent to give without receiving anything in return, while a release deed typically involves relinquishing claims on a property among co-owners. If you aim to enrich someone without financial transactions, the gift deed is favorable. Thus, understanding the difference between gift deed and sale deed can provide clarity in your decision between these options.

A Gift Deed is a legal document that allows you to transfer ownership of property of monetary or sentimental value to a relative or close friend without charge or consideration.

Draft of a gift deed must include the following details: Place and date on which the gift deed is to be executed. Relevant information on gift deed regarding the donor and the donee, such as their names, address, relationship, date of birth and signatures.

There are different types of deeds, like quitclaim deeds and gift deeds. Quitclaim deeds transfer property ownership between family members or persons with little or no buyer protection. On the other hand, gift deeds are used to transfer ownership of property as a gift. Keep reading to learn more.