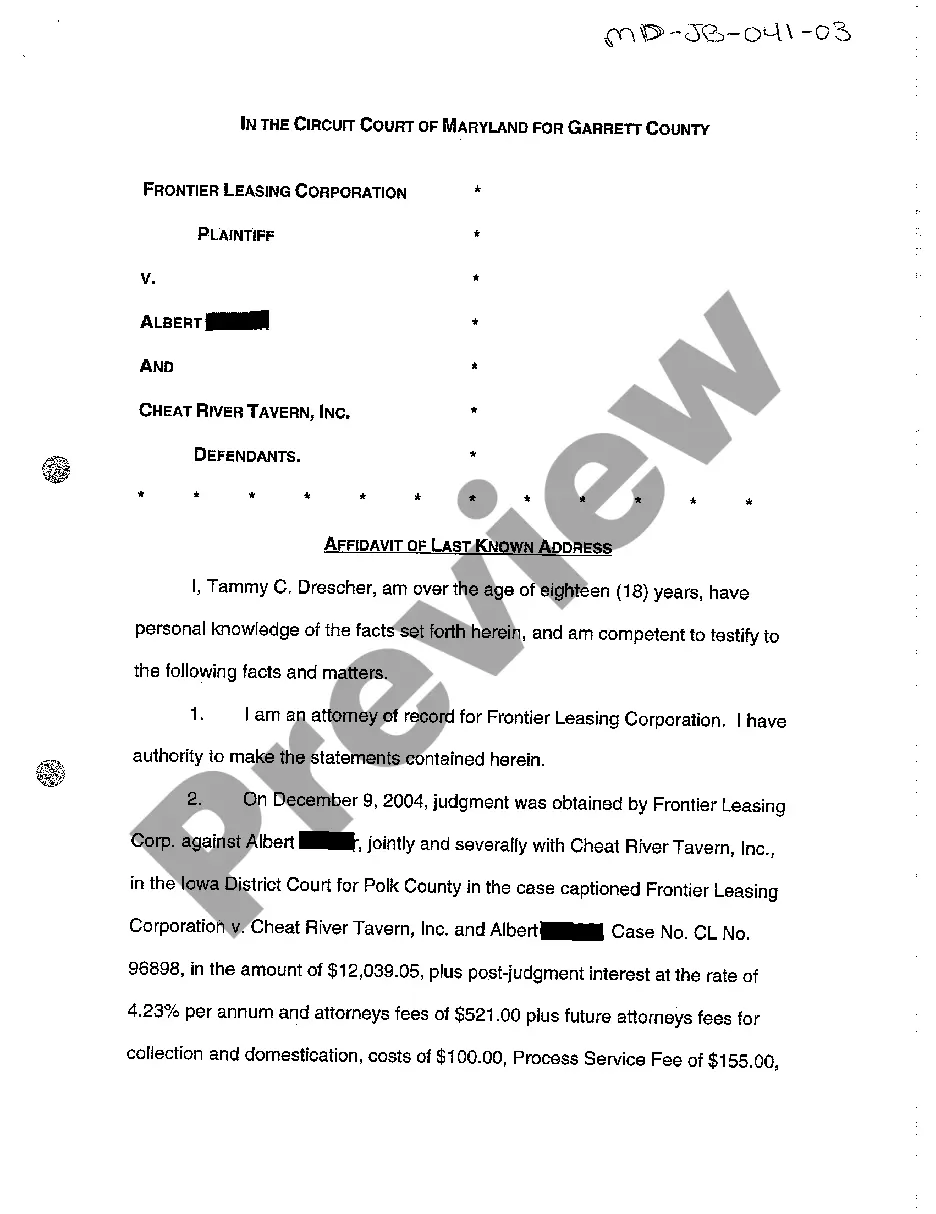

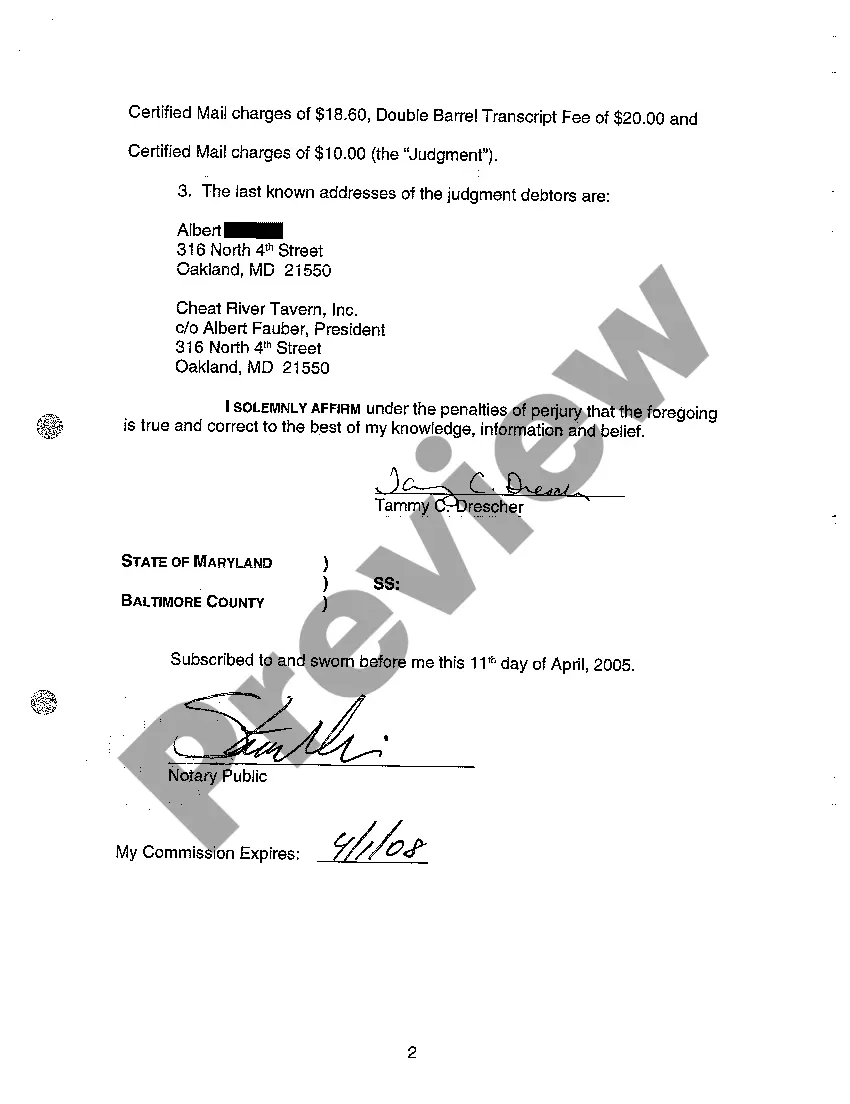

Affidavit Of Last Known Address With Irs

Description

How to fill out Affidavit Of Last Known Address With Irs?

Working your way through the red tape of standard forms and templates can be intricate, particularly if one isn't doing so as a profession.

Finding the appropriate template for an Affidavit Of Last Known Address With Irs can also be a lengthy process, as it must be valid and precise down to the last detail.

However, you will need to spend considerably less time acquiring a suitable template from a source you can rely on.

Acquire the correct document in a few straightforward steps: Enter the document title in the search bar, locate the suitable Affidavit Of Last Known Address With Irs among the results, review the sample outline or view its preview. When the template fulfills your needs, click Buy Now, select your subscription plan, register an account at US Legal Forms using your email and create a secure password, choose a credit card or PayPal for payment, and save the template file on your device in your preferred format. US Legal Forms can save you considerable time assessing whether the form you located online fits your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the task of searching for the correct forms online.

- US Legal Forms is a singular site you need to access the latest examples of documents, verify their usage, and download these documents to complete them.

- This is a compilation of over 85K forms relevant in various sectors.

- When looking for an Affidavit Of Last Known Address With Irs, you won’t have to doubt its authenticity since all forms are authenticated.

- Having an account on US Legal Forms will guarantee you have all the necessary samples at your disposal.

- You can store them in your history or add them to the My documents catalog.

- Access your saved forms from any device by simply clicking Log In at the library site.

- If you still haven't created an account, you can always search for the template you require.

Form popularity

FAQ

To complete the FTC's Identity Theft Affidavit, you need to provide personal data including your Social Security number, address and contact information. You also will need to provide your driver's license number or information from another government-issued ID.

. 02 A taxpayer's last known address is defined in Treas. Reg. § 301.6212-2(a) as the address on the taxpayer's most recently filed and properly processed return, unless the Service has been given clear and concise notification of a different address.

The Form 14039 affidavit should be filed if the taxpayer attempts to file an electronic tax return and the IRS rejects it because a return bearing the taxpayer's Social Security number already has been filed. Or, it should be filed if the IRS instructs the taxpayer to do so.

Form 6166 is a letter printed on U.S. Department of Treasury stationery certifying that the individuals or entities listed are residents of the United States for purposes of the income tax laws of the United States.

The IRS also has a procedure whereby it will update its database of last known addresses by means of using the NCOA database pursuant to Treas. Reg. Section 301.6212-2. The NCOA database is the National Change of Address database which is maintained by the United States Postal Service.