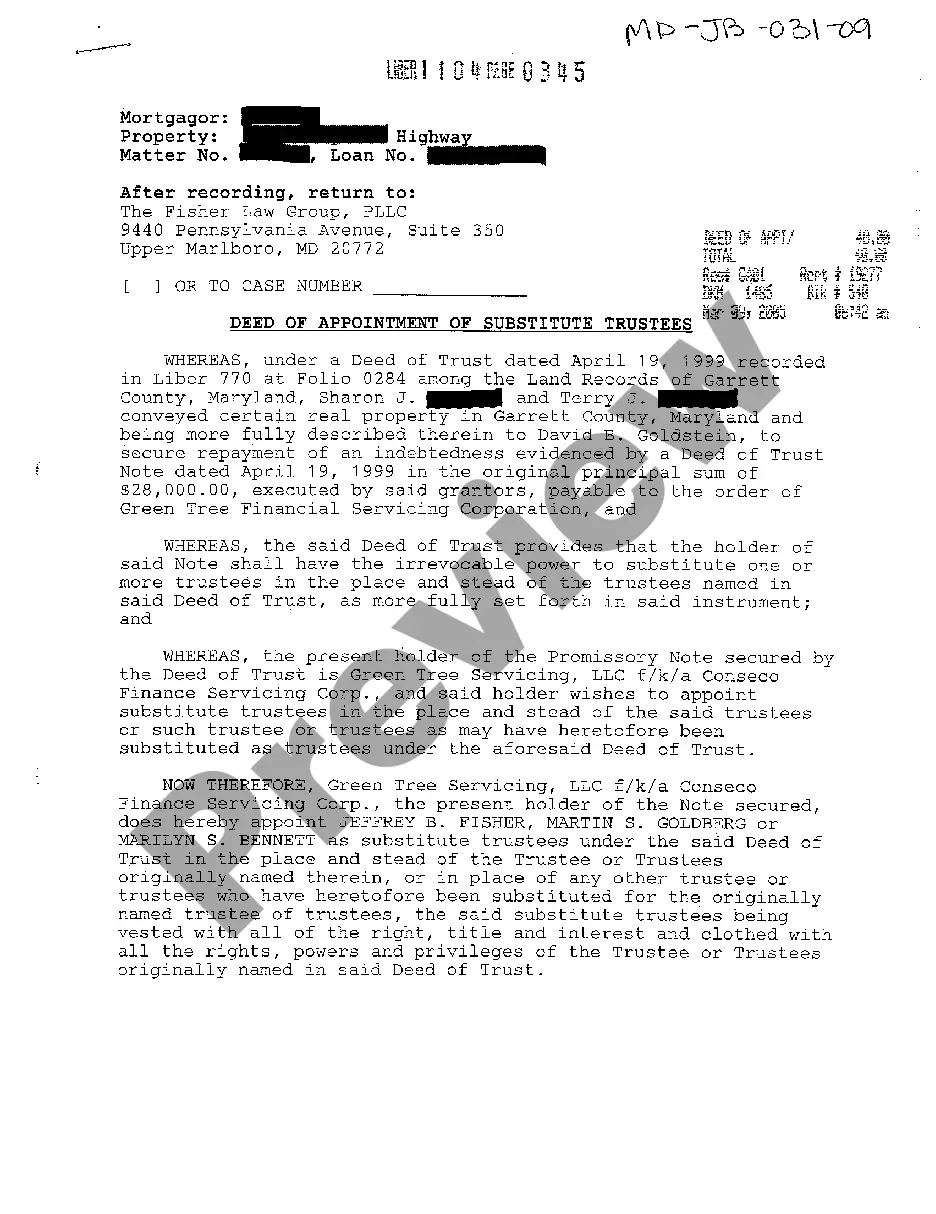

Deed Of Appointment Within 2 Years Of Death

Description

How to fill out Maryland Deed Of Appointment Of Substitute Trustees?

Regardless of whether you handle administrative tasks frequently or you have to file a legal document sporadically, it is crucial to obtain a resource that contains all the examples that are relevant and current.

The first step you should take when using a Deed Of Appointment Within 2 Years Of Death is to ensure that it is indeed the latest version, as it determines its eligibility for submission.

If you wish to streamline your search for the most recent document samples, look for them on US Legal Forms.

To obtain a document without an account, follow these steps: Use the search bar to locate the form you need. Review the preview and outline of the Deed Of Appointment Within 2 Years Of Death to confirm it is exactly what you are looking for. After verifying the document, select Buy Now. Choose a subscription plan that best suits your needs. Create an account or Log In to your existing one. Use your credit card information or PayPal account to complete the transaction. Choose the document format for download and confirm your selection. Say goodbye to the confusion of managing legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a collection of legal documents that includes nearly any sample you might need.

- Search for the forms you require, assess their applicability right away, and learn more about their utilization.

- With US Legal Forms, you can access over 85,000 form samples across a wide array of fields.

- Retrieve the Deed Of Appointment Within 2 Years Of Death samples in just a few clicks and save them in your account at any time.

- A US Legal Forms account will provide you easy access to all the samples you need with greater ease and fewer complications.

- Simply click Log In in the header of the site and navigate to the My documents section where all the forms you require will be at your disposal, eliminating the need to spend time searching for the appropriate template or verifying its accuracy.

Form popularity

FAQ

In the UK, you can inherit up to £325,000 from your parents without incurring Inheritance Tax, thanks to the nil-rate band. If your parents leave you property or assets valued above this threshold, then taxes may apply. Proper use of a Deed of appointment within 2 years of death can help optimize your inheritance, ensuring you receive the maximum benefit while adhering to tax regulations.

UK Inheritance Tax typically applies to your worldwide assets, including foreign property, unless specific exemptions are in place. If you hold assets abroad, it’s essential to understand how they may be affected by UK tax laws. Utilizing a Deed of appointment within 2 years of death can potentially assist in managing tax liabilities more effectively across different jurisdictions.

In the UK, one notable loophole for Inheritance Tax involves the use of a Deed of appointment within 2 years of death. By strategically appointing beneficiaries after death, individuals may reduce the taxable estate and potentially avoid excessive tax charges. This legal maneuver offers a valuable opportunity for individuals to enhance estate planning and maximize the benefits for their heirs.

A Deed of appointment of beneficiary is a legal document that allows an individual to specify how their assets should be distributed after their death. This deed can be executed within 2 years of death, providing flexibility to adjust beneficiary designations according to personal wishes. Utilizing this deed helps ensure that your estate is managed according to your intentions, which can be crucial in reducing potential disputes among heirs.

Section 144 of the Inheritance Tax Act 1984 allows for certain transfers to be exempt from Inheritance Tax when a Deed of appointment within 2 years of death is executed. This section focuses on the circumstances surrounding the appointment of beneficiaries, enabling the deceased to modify their estate distribution. By utilizing this section wisely, individuals can effectively plan their estates to minimize tax implications, ensuring their loved ones receive more.

One potential downside of a discretionary trust is the complexity involved in its management and operation. Trustees must carefully adhere to the trust’s terms while making decisions about asset distribution, which may lead to disputes among beneficiaries. Additionally, tax implications can be more pronounced with discretionary trusts, potentially affecting overall wealth transfer. Therefore, understanding the Deed of appointment within 2 years of death can help mitigate some of these concerns.

A discretionary trust deed is a legal document that establishes a discretionary trust, outlining how assets will be managed and distributed. In this type of trust, the trustee has the discretion to decide how and when to distribute funds to beneficiaries. This flexibility can help address individual needs and circumstances. It's important to consider the implications of the Deed of appointment within 2 years of death when formulating your estate strategy.

When someone with a discretionary trust passes away, the trust typically remains in effect. The appointed trustee manages the trust according to the terms set forth in the trust deed. The trust may distribute assets to beneficiaries or continue to hold them, depending on the instructions provided. It is essential to consider the Deed of appointment within 2 years of death, as this can significantly affect asset distribution.

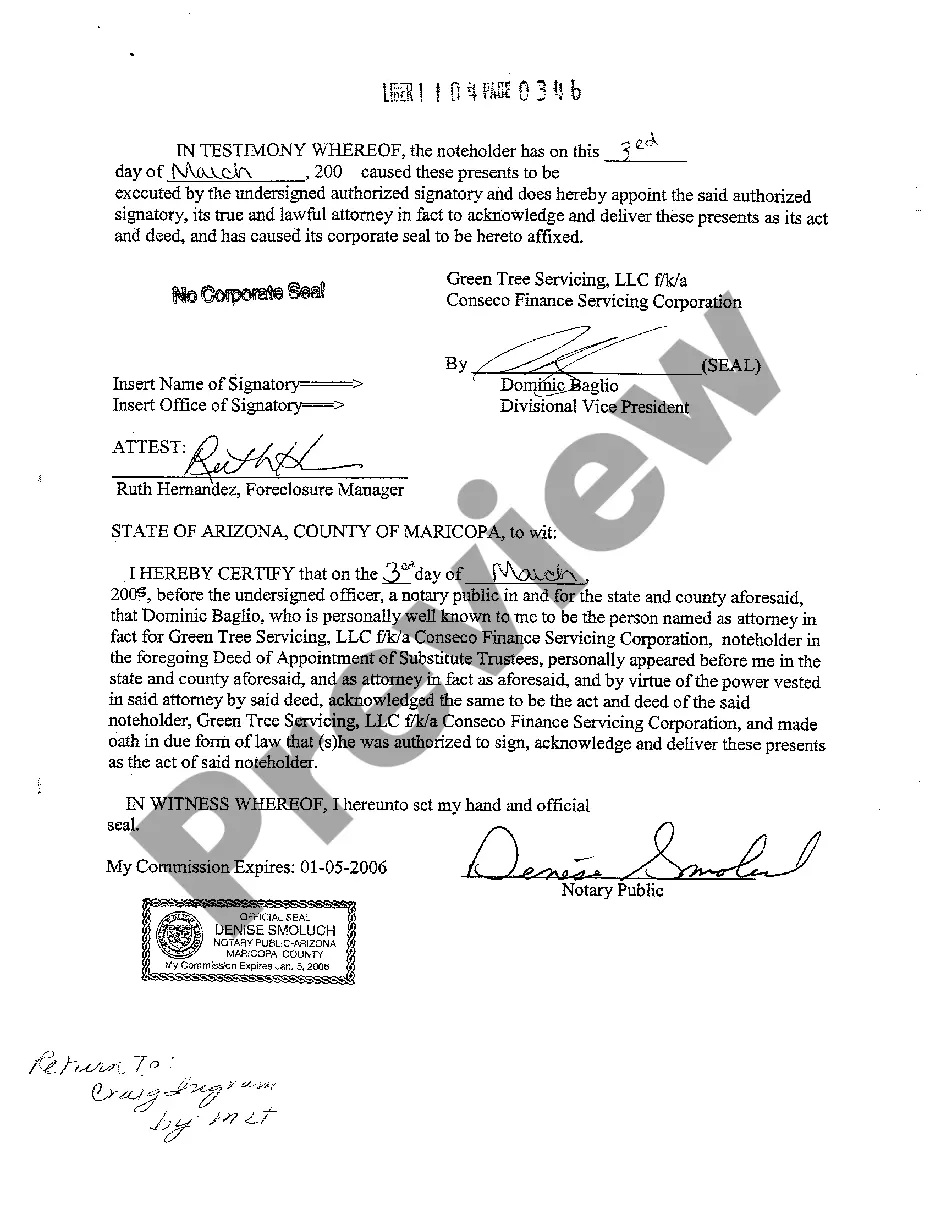

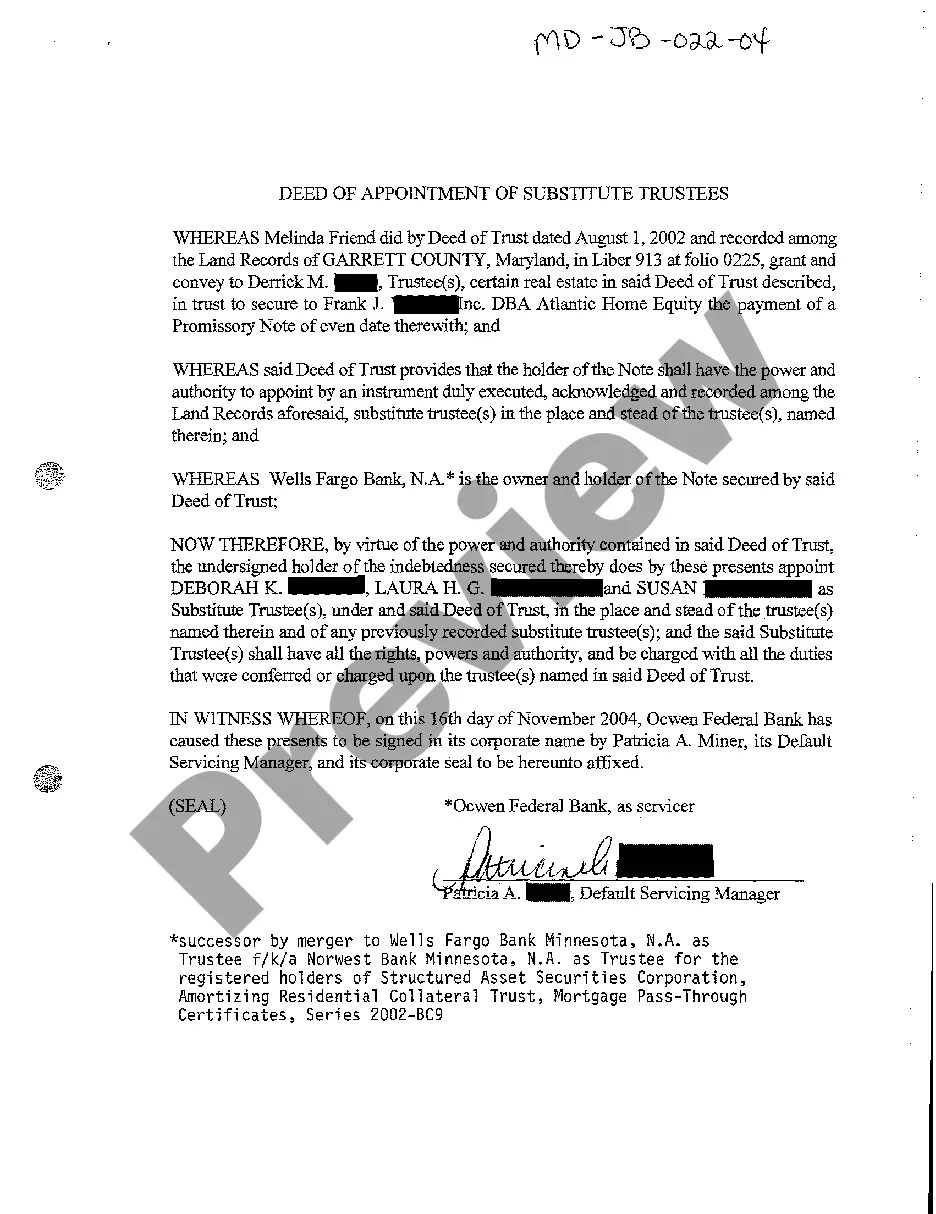

The deed of change of trustee is a formal document that records the removal of one trustee and the appointment of another. This change is vital for effective trust management and should be executed within 2 years of death to ensure compliance with legal standards. Engaging with platforms like uslegalforms can aid in drafting this document efficiently.

The deed of appointment and retirement of trustees is a comprehensive legal document that enables a trustee to both retire and appoint a successor. This dual function is crucial in ensuring the continuity and management of the trust. To comply with regulations and ensure compliance, it is recommended to complete these actions within 2 years of death.