Closing A Small Estate In Maryland For Probate

Description

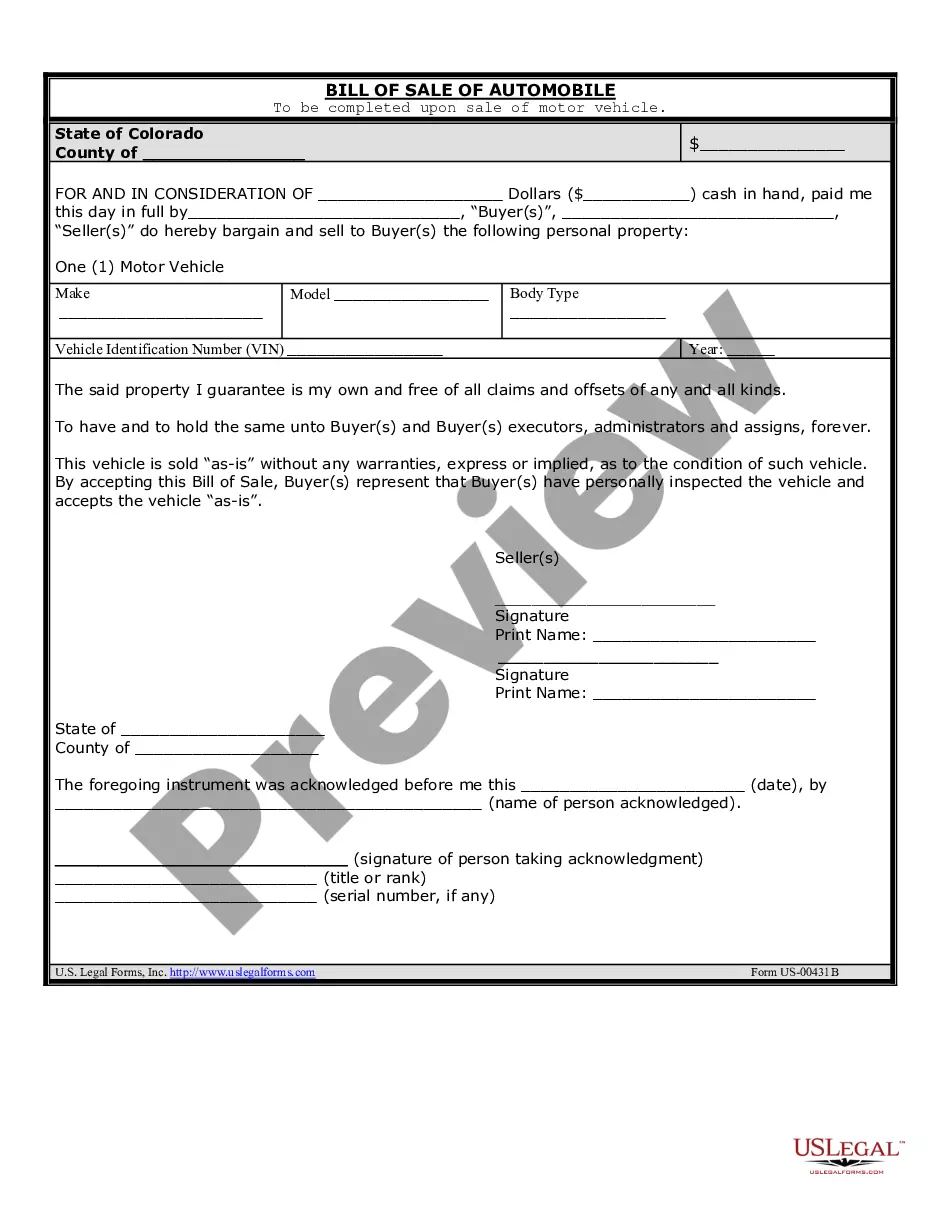

How to fill out Maryland Small Estate Affidavit For Estates Not More Than $50,000 Or $100,000 If Spouse Is Sole Heir?

Regardless of whether it's for corporate objectives or personal affairs, everyone encounters legal matters at some stage in their existence.

Filling out legal documents requires meticulous care, commencing with selecting the right form template.

With an extensive catalog at US Legal Forms available, you don’t need to waste time searching for the correct template online. Utilize the library’s straightforward navigation to obtain the right form for any situation.

- Obtain the template you require using the search bar or through the catalog browsing.

- Review the form’s details to guarantee it aligns with your situation, jurisdiction, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search feature to find the Closing A Small Estate In Maryland For Probate template you need.

- Acquire the template when it satisfies your criteria.

- If you have a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you have not created an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you desire and download the Closing A Small Estate In Maryland For Probate.

- Once it is saved, you can finish the form using editing software or print it and complete it by hand.

Form popularity

FAQ

To decide whether to file as a regular or small estate, you need to find the ?net value? of the property. To do this, subtract the amount secured debts from the value of assets. If net value is more than $50,000, the estate is a ?regular estate.? If net value is $50,000 or less, the estate is a ?small estate.?

Small Estate - property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir).

Estate Administration ? Step-by-Step Guide and Timeline Decedent dies. Locate Estate Planning Documents. File Petition to Probate the Estate. List of Interested Persons. File Inventory and Information Report. File First Account. Claims Against the Estate. File Subsequent Accounts.

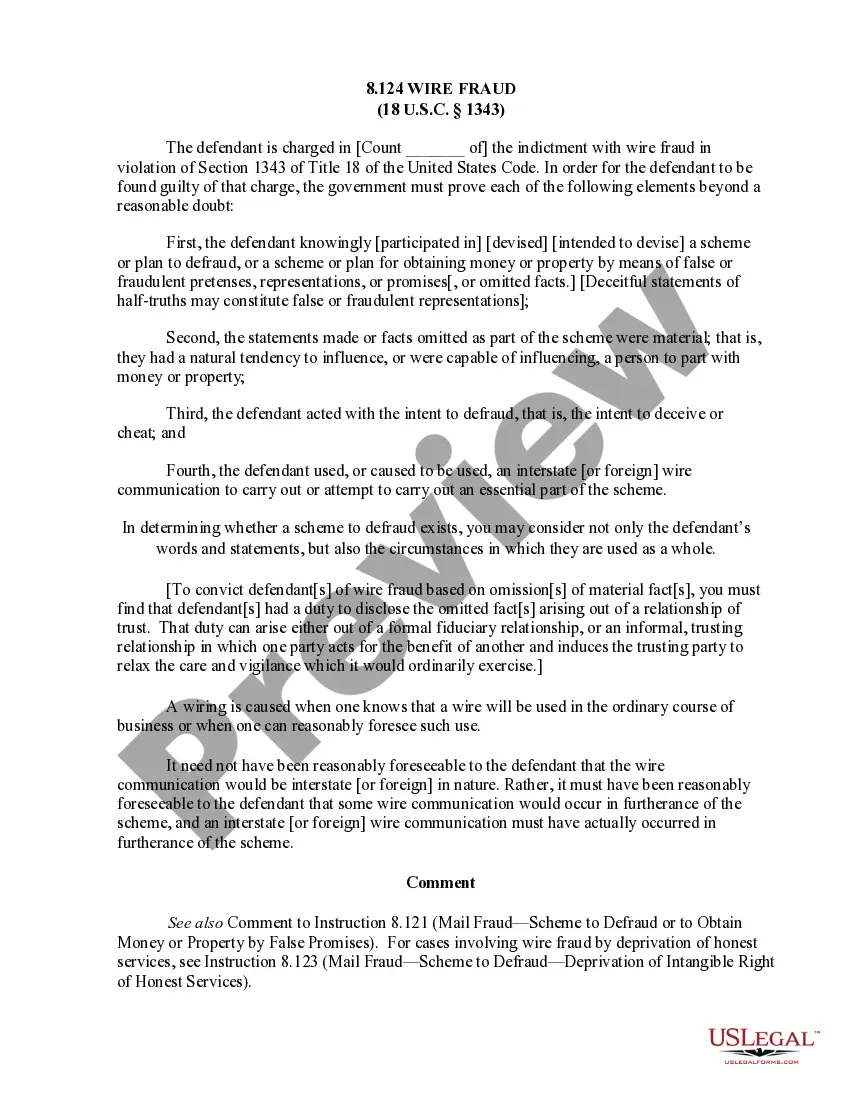

This is done by filing a ?Petition for Declaration of Completion of Administration? along with any supporting documentation. The court will review your petition and, if everything ticks, will issue an Order Closing Estate. With this order, you can distribute any remaining assets to the rightful heirs and beneficiaries.

Yes, if the probate assets are less than $30,000 in value ($50,000 if passing to a surviving spouse), the estate may qualify for statutory ?small estate? proceedings which are often closed within two months.