Closing A Small Estate In Maryland For Administration

Description

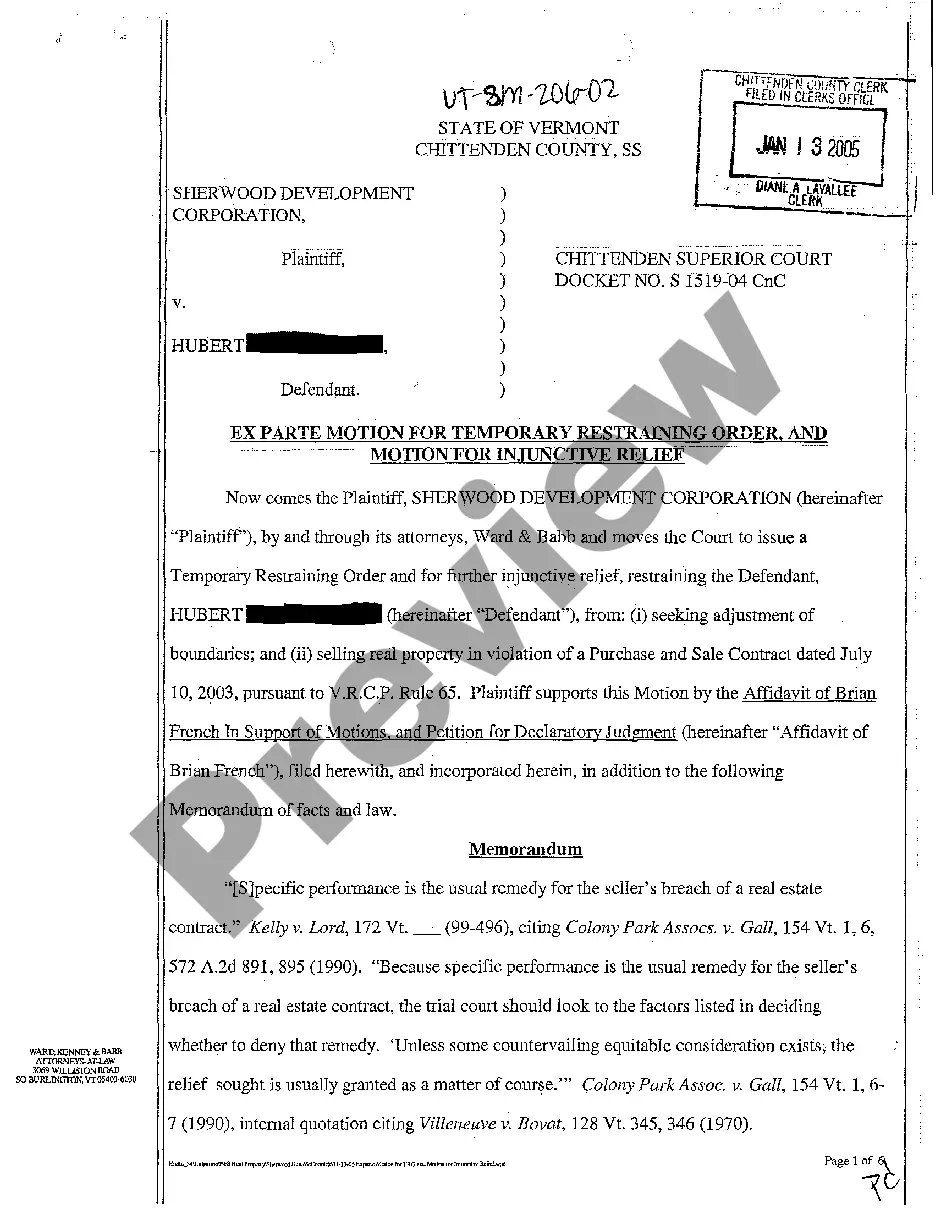

How to fill out Maryland Small Estate Affidavit For Estates Not More Than $50,000 Or $100,000 If Spouse Is Sole Heir?

Creating legal papers from the ground up can often feel a bit daunting.

Specific situations may require extensive research and significant financial investment.

If you’re looking for a more straightforward and cost-effective method of preparing Closing A Small Estate In Maryland For Administration or other documentation without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal papers encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can gain immediate access to state- and county-specific templates expertly crafted for you by our legal specialists.

Review the form preview and descriptions to confirm that you are on the document you need. Ensure that the form you choose meets the standards of your state and county. Select the most suitable subscription plan to obtain the Closing A Small Estate In Maryland For Administration. Download the document, then complete, sign, and print it out. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and make document completion an easy and efficient process!

- Utilize our platform whenever you require dependable services to swiftly locate and download the Closing A Small Estate In Maryland For Administration.

- If you’re familiar with our services and have previously registered an account with us, simply Log In to your account, choose the template and download it or re-download it at any moment in the My documents section.

- Don’t have an account? No worries. It only takes a few minutes to sign up and browse the library.

- But before diving directly into downloading Closing A Small Estate In Maryland For Administration, keep these pointers in mind.

Form popularity

FAQ

How to Close an Estate in Maryland: A Comprehensive Guide Open the Probate Process: First, the executor needs to file the will and a petition to open probate with the Register of Wills. ... Take Inventory of the Estate: ... Notify Creditors and Pay Debts: ... Distribute the Assets and Pay Inheritance Taxes: ... Close the Estate: How to Close an Estate in Maryland: A Comprehensive Guide stoufferlegal.com ? blog ? how-to-close-an-... stoufferlegal.com ? blog ? how-to-close-an-...

Estate Administration ? Step-by-Step Guide and Timeline Decedent dies. Locate Estate Planning Documents. File Petition to Probate the Estate. List of Interested Persons. File Inventory and Information Report. File First Account. Claims Against the Estate. File Subsequent Accounts. Estate Administration ? Step-by-Step Guide and Timeline People's Law Library ? estate-administration-st... People's Law Library ? estate-administration-st...

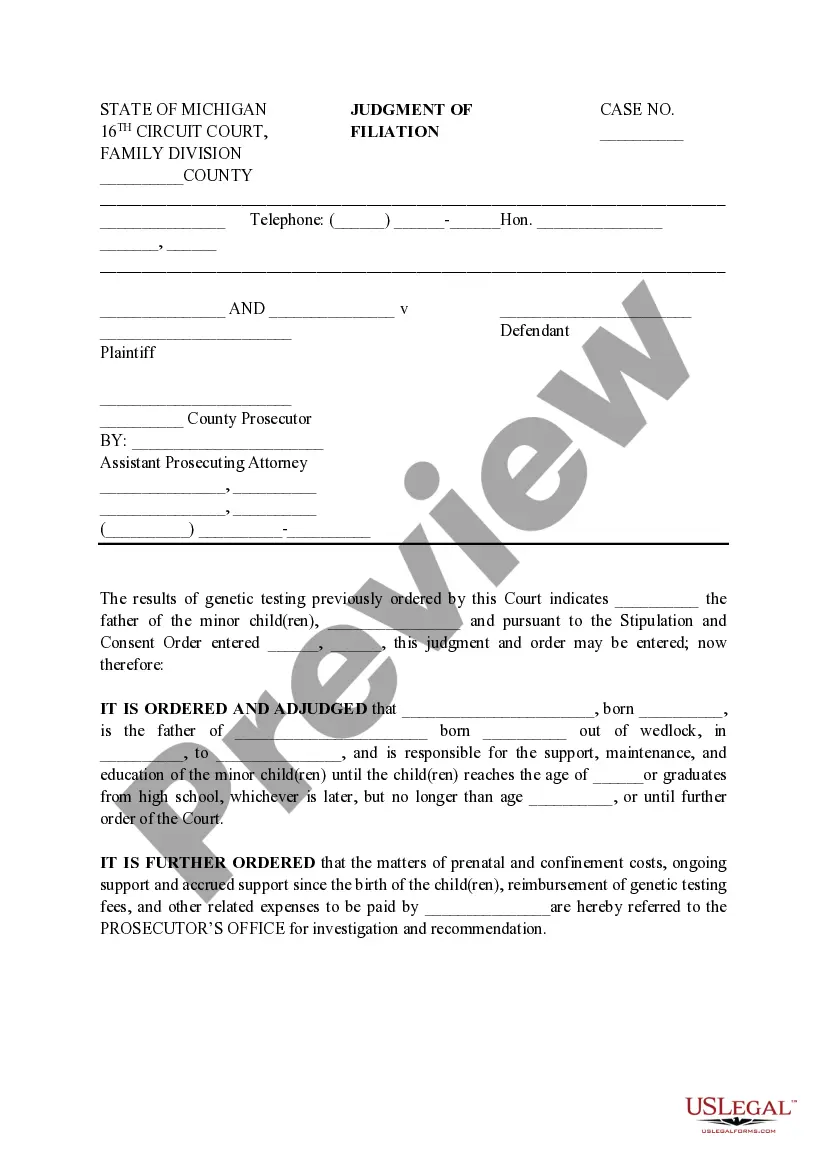

What are Letters of Administration in Maryland? Obtaining Letters of Administration grants the personal representative the authority to handle the deceased person's assets, pay off their debts, address any tax liability, and distribute their remaining assets to the rightful heirs. A Brief Guide to Letters of Administration in Maryland PathFinder Law Group ? letters-of-admi... PathFinder Law Group ? letters-of-admi...

Depending on the number of claims and the state of the deceased's financial affairs, this process can take a few months to over a year. Distributing the Remaining Assets: The final step in the estate settlement process is distributing the remaining assets to the beneficiaries as outlined in the will.

$50,000 or less Small Estate - property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir). Office Of The Register Of Wills - What To Do If You Need To Open An Estate maryland.gov ? publications ? newestate maryland.gov ? publications ? newestate