Maryland Child Support Formula

Description

How to fill out Maryland Child Support Guidelines Worksheet A?

Legal documents handling can be daunting, even for the most experienced experts.

When you are looking for a Maryland Child Support Formula and do not have the opportunity to invest time searching for the accurate and updated version, the processes can be stressful.

US Legal Forms addresses all your requirements, from personal to business paperwork, all in a single location.

Utilize advanced tools to complete and manage your Maryland Child Support Formula.

Here are the steps to follow after downloading the form you need: Confirm this is the correct form by previewing it and reviewing its details. Ensure that the template is accepted in your state or county. Click Buy Now when you are ready. Choose a monthly subscription plan. Select the file format you prefer, and Download, complete, sign, print, and submit your document. Take advantage of the US Legal Forms online library, supported by 25 years of experience and reliability. Make your daily document management a straightforward and user-friendly process today.

- Access a valuable resource library of articles, guides, and materials pertinent to your situation and needs.

- Save time and effort searching for the documents you require, and utilize US Legal Forms' sophisticated search and Review tool to find Maryland Child Support Formula and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to view the documents you have previously downloaded and manage your folders as desired.

- If this is your first experience with US Legal Forms, create a free account for unlimited access to all the platform's benefits.

- A comprehensive online form repository could be a significant advantage for anyone wanting to manage these matters effectively.

- US Legal Forms is a frontrunner in digital legal documents, offering over 85,000 state-specific legal forms accessible to you at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

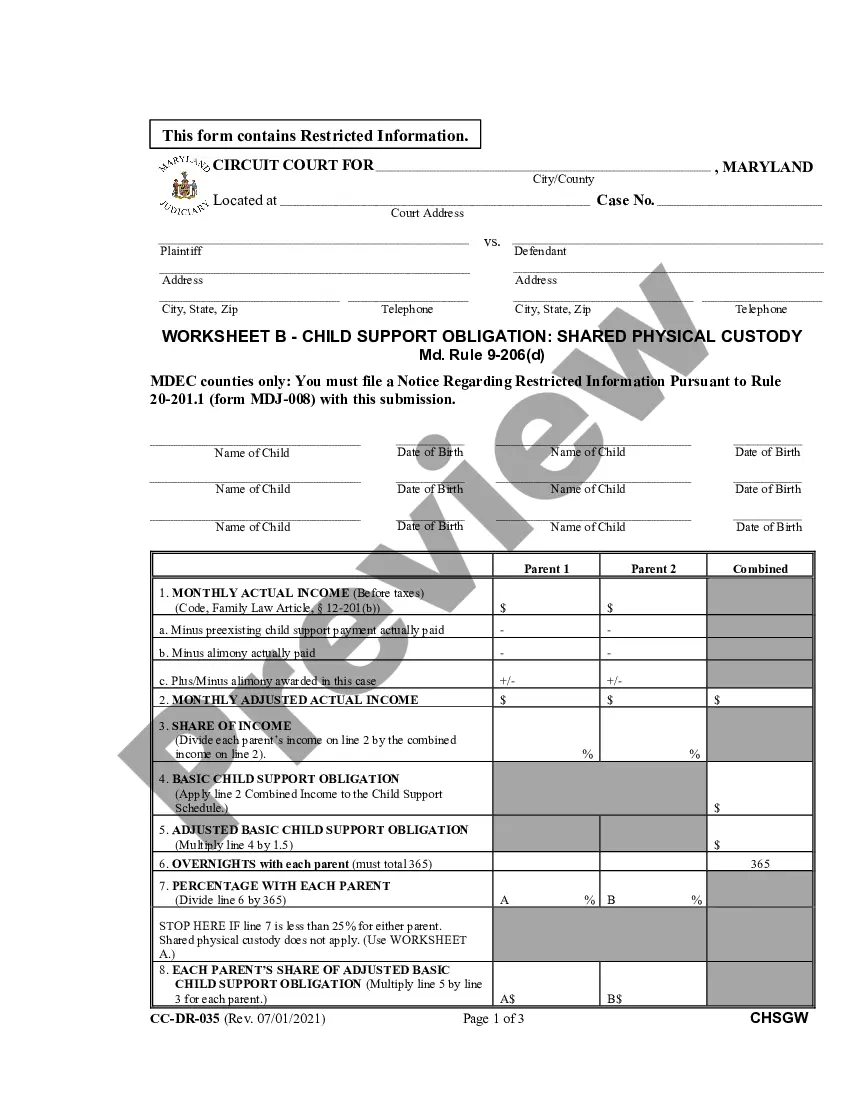

To calculate child support in Maryland, you need to use the Maryland child support formula, which considers both parents' incomes, the number of children, and other relevant expenses. First, determine your combined monthly income and apply the state's guidelines to find the basic support obligation. After that, factor in any additional expenses, such as healthcare and childcare, to arrive at the final amount. For a more accurate calculation, consider using online tools or resources like US Legal Forms, which can guide you through the process.

While Maryland does not have a strict formula for calculating alimony, courts often consider various factors such as the length of the marriage, the financial needs of both parties, and their standard of living during the marriage. Each situation is unique, and outcomes can vary based on individual circumstances. To better understand potential alimony obligations or rights, you can explore resources available at US Legal Forms, which can guide you through the complexities involved.

In Maryland, child support is calculated using the Maryland child support formula, which considers both parents' incomes, the number of children, and specific expenses related to raising the children. The formula aims to ensure that the child's needs are met while balancing the financial responsibilities of both parents. It incorporates various factors such as health insurance costs and child care expenses. For those seeking clarity on this formula, US Legal Forms offers resources and tools to help you navigate the process.

Figure out each parent's actual income. Figure out each parent's adjusted actual income or imputed income. Add up both parents' adjusted actual incomes or their imputed incomes. The combined amount is plugged into the Guidelines chart to determine the "basic child support obligation."

The formula includes each parent's monthly pre-tax income from all sources, including paychecks, tips, bonuses, commissions and rents. Each parent subtracts alimony or child support they already pay, then adds or subtracts alimony payments from the current case.

Child support is based on the monthly gross income of each party (before taxes).

Calculations for child support in Maryland are based on gross income and includes income from any source. These include employee wages, and businesses owned. It also encompasses pensions and other retirement, estates and trust, social security, tax refunds, awards and verdicts, severance pay, and alimony received.

What's the average amount of child support that is paid? As of this writing, the average child support in the state of Maryland is 66.6 percent for the parent who does not have custody of their children. They would pay $666 in child support per month on average.