Tenant Subordination Agreement With Irs

Category:

State:

Maryland

Control #:

MD-844LT

Format:

Word;

Rich Text

Instant download

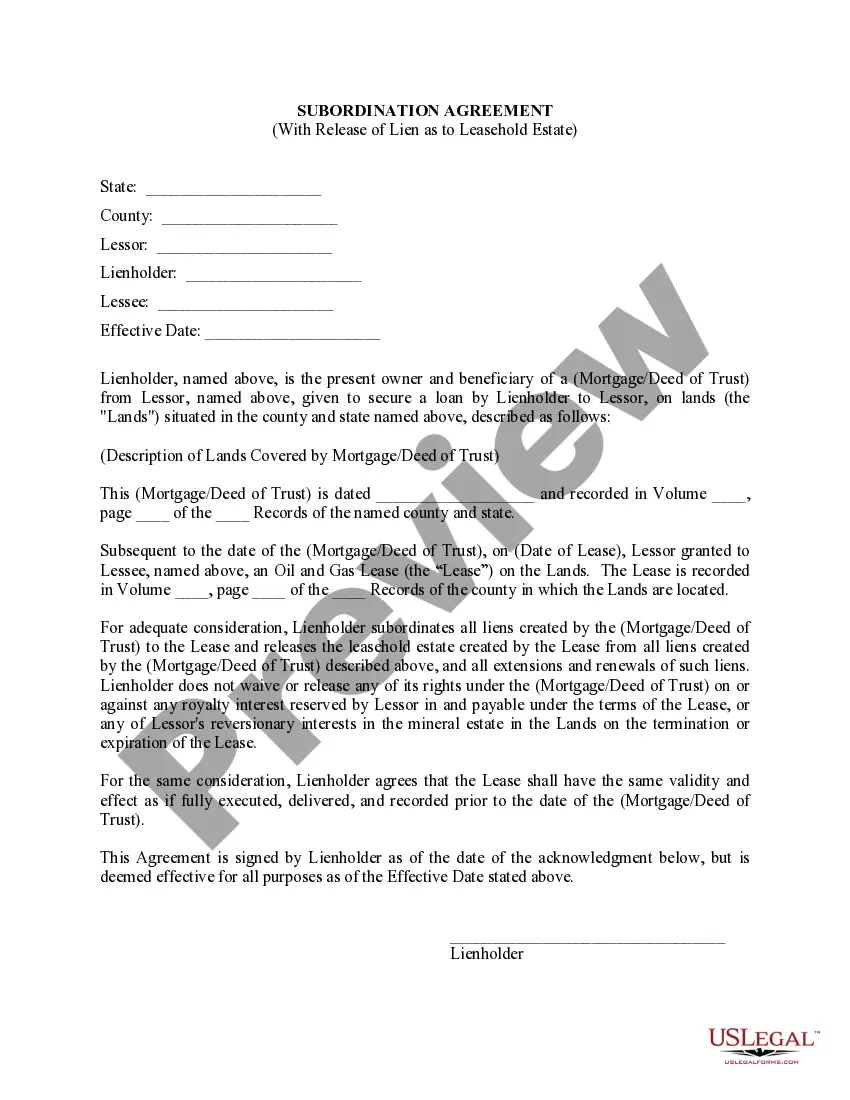

Description

The Tenant Subordination Agreement with IRS is a legal document designed to establish the order in which various interests in property are prioritized, particularly relating to leases and mortgages. This form facilitates the subordination of a lienholder's claim to the rights of a lessee, allowing the leasehold estate to take precedence over existing liens. Key features of this agreement include the release of the leasehold estate from all liens, except for certain rights of the lienholder related to royalty interests and mineral estates. Filling out this form requires careful attention to detail, including the effective date, names of the parties involved, and descriptions of the relevant properties. It is essential for parties to ensure all necessary information is accurate to avoid future legal disputes. Attorneys, partners, owners, associates, paralegals, and legal assistants can utilize this form in various real estate transactions, particularly those involving oil and gas leases. Use cases include securing financing while maintaining leaseholder rights, negotiating favorable terms for lessees, and ensuring compliance with IRS regulations. Proper usage of this form can enhance clarity in property agreements and protect the interests of all involved parties.

How to fill out Maryland Lease Subordination Agreement?

Bureaucracy requires exactitude and precision.

If you do not manage the completion of documents such as the Tenant Subordination Agreement With Irs on a regular basis, it might lead to some confusion.

Choosing the appropriate sample from the outset will guarantee that your document submission will proceed smoothly and avert any problems associated with re-sending a file or starting the same task entirely from scratch.

Locating the correct and current templates for your documentation is a task of mere minutes with an account at US Legal Forms. Eliminate the bureaucratic issues and simplify your form management.

- Find the template utilizing the search feature.

- Verify that the Tenant Subordination Agreement With Irs you have found is applicable to your state or locality.

- Access the preview or review the description that includes details on how to use the template.

- If the result aligns with your inquiry, click the Buy Now button.

- Select the suitable option from the proposed subscription packages.

- Log In to your account or create a new one.

- Finalize the purchase using a credit card or PayPal payment method.

- Save the document in your preferred format.