Maryland Information Case With Card Holder

Description

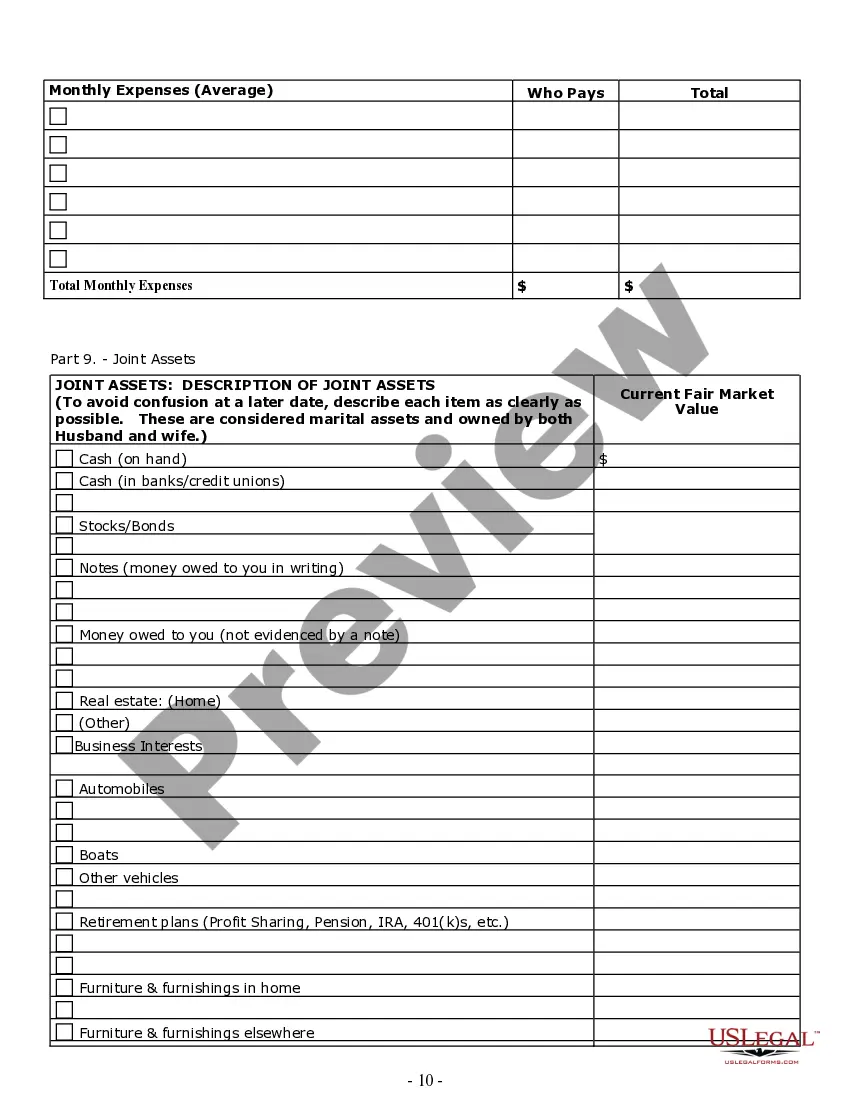

How to fill out Maryland Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

The Maryland Information Case With Card Holder presented on this page is a versatile legal template prepared by expert attorneys in compliance with federal and state laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 authenticated, state-specific documents for any business and personal circumstance.

Register for US Legal Forms to have authenticated legal templates for all of life's situations readily available.

- Search for the document you require and examine it.

- Browse the sample you searched for and preview it or review the form description to confirm it meets your needs. If it doesn't, utilize the search function to find the fitting one. Click Buy Now when you have discovered the template you require.

- Register and Log In.

- Choose the pricing plan that best fits you and create an account. Employ PayPal or a credit card to complete a swift payment. If you already possess an account, Log In and review your subscription to continue.

- Acquire the editable template.

- Select the format you desire for your Maryland Information Case With Card Holder (PDF, DOCX, RTF) and download the sample onto your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, utilize an online multifunctional PDF editor to efficiently and accurately complete and sign your form with an eSignature.

- Re-download your documents as needed.

- Use the same document again whenever required. Access the My documents tab in your profile to re-download any previously acquired forms.

Form popularity

FAQ

Filling out the Maryland W-4 form involves providing your personal information, including your name, address, and social security number. Additionally, you will indicate your filing status and any allowances you are claiming. To ensure accuracy in your employment records, take your time while completing this form, keeping in mind that it connects directly with your income tax, particularly if you are maintaining a Maryland information case with card holder.

To file as head of household, you must: Pay for more than half of the household expenses. Be considered unmarried on the last day of the tax year, and. You must have a qualifying child or dependent.

Your Maryland driver's license and identification card has a Soundex number on it; that is your MVA identification number. It is very important that you make sure the information on your driver's license or identification card is up-to-date.

The unique identification begins with MD and includes 13 characters. The "MD ID" license number is a randomly generated number that will provide enhanced security and protection of personal information for customers. This replaces the number that traditionally started with the first initial of a customer's last name.

How To Add A Name To A Car Title Provide The Existing Title. You need the already existing title to prove your ownership of the vehicle. ... Apply For A New Title. ... Submit Your Application To The DMV. ... Update Your Registration To Reflect The New Owners. ... Update Your Insurance To Cover The New Person.

A Maryland state tax return is only required if you earned money in the state of Maryland in the tax year. For tax year 2019, you would need to file a Maryland State tax return if you earned at least $12,200.