Maryland Liens On Property

Description

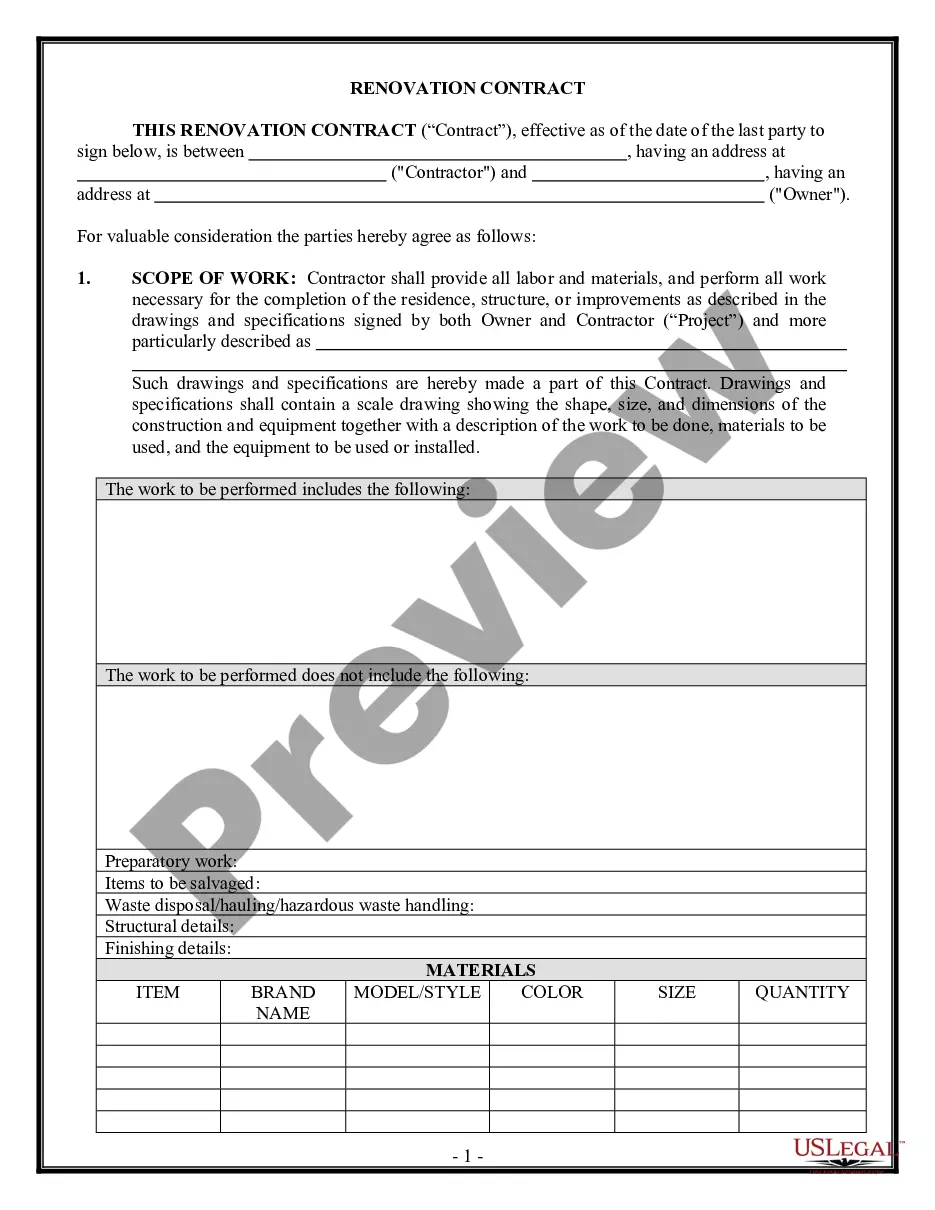

How to fill out Maryland Conditional Waiver And Release Upon Final Payment - Individual?

The Maryland Liens On Property displayed on this page is a versatile official template created by experienced attorneys in compliance with federal and state regulations.

For over 25 years, US Legal Forms has been offering individuals, businesses, and legal practitioners access to more than 85,000 validated, state-specific documents for various business and personal situations. It’s the fastest, most straightforward, and most dependable method to acquire the forms you require, as the service ensures the utmost level of data protection and anti-malware safety.

Select the format you prefer for your Maryland Liens On Property (PDF, Word, RTF) and save the document on your device.

- Search for the document you require and examine it.

- Browse through the file you searched and preview it or check the form description to verify it meets your needs. If it doesn’t, utilize the search feature to locate the correct document. Click Buy Now once you have identified the template you need.

- Register and Log In.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

A judgment for money is a lien for the amount of the judgment and post-judgment interest. If you own property, the court will send the notice of the lien to the circuit court where you have property. The circuit court will record or "attach" the lien to your property to give notice that you owe money to the plaintiff.

How long does a judgment lien last in Maryland? A judgment lien in Maryland will remain attached to the debtor's property (even if the property changes hands) for 12 years.

If you own property, the court will send the notice of the lien to the circuit court where you have property. The circuit court will record or "attach" the lien to your property to give notice that you owe money to the plaintiff. The lien may affect your ability to sell your property or get a loan.

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials. It can be difficult to determine the work completion date. Notice For Subcontractors.

Once a judgment is recorded in court the creditor is able to attach a lien onto any property owned by the debtor. A lien is a right that prohibits the debtor from transferring their interest in a property until a debt is satisfied. The lien may be attached to any property or properties located within Maryland.