Maryland Grant Deed Form

Description

How to fill out Maryland Grant Deed From An Individual Grantor To Two Individual Grantees?

Managing the complexities of official documents and formats can be difficult, particularly for those who do not engage in this professionally.

Locating the appropriate template for a Maryland Grant Deed Form will be labor-intensive, as it must be legitimate and precise down to the last numeral.

However, you will need to spend significantly less time selecting a suitable template from a reliable source.

Obtain the correct form with a few straightforward steps: enter the document name in the search box, select the appropriate Maryland Grant Deed Form from the result list, review the description of the sample or view its preview, if the template meets your requirements, click Buy Now, choose your subscription plan, use your email to set up a secure password for your US Legal Forms account, pick a payment method via credit card or PayPal, and save the template document on your device in your desired format. US Legal Forms can help you conserve significant time verifying if an online form meets your needs. Sign up for an account to gain unlimited access to all the templates you need.

- US Legal Forms is an online service that streamlines the process of finding the correct forms.

- It acts as a one-stop-shop for the latest form templates, usage guidelines, and downloadable examples.

- The collection boasts over 85,000 forms that cater to a wide array of sectors.

- When searching for a Maryland Grant Deed Form, you will have no doubt about its authenticity as all forms are validated.

- Having an account on US Legal Forms guarantees easy access to all essential documents.

- You can save them to your history or add them to your My documents catalog.

- Access your saved documents from any device by clicking Log In on the library's website.

- If you do not yet have an account, you can always look for the required template.

Form popularity

FAQ

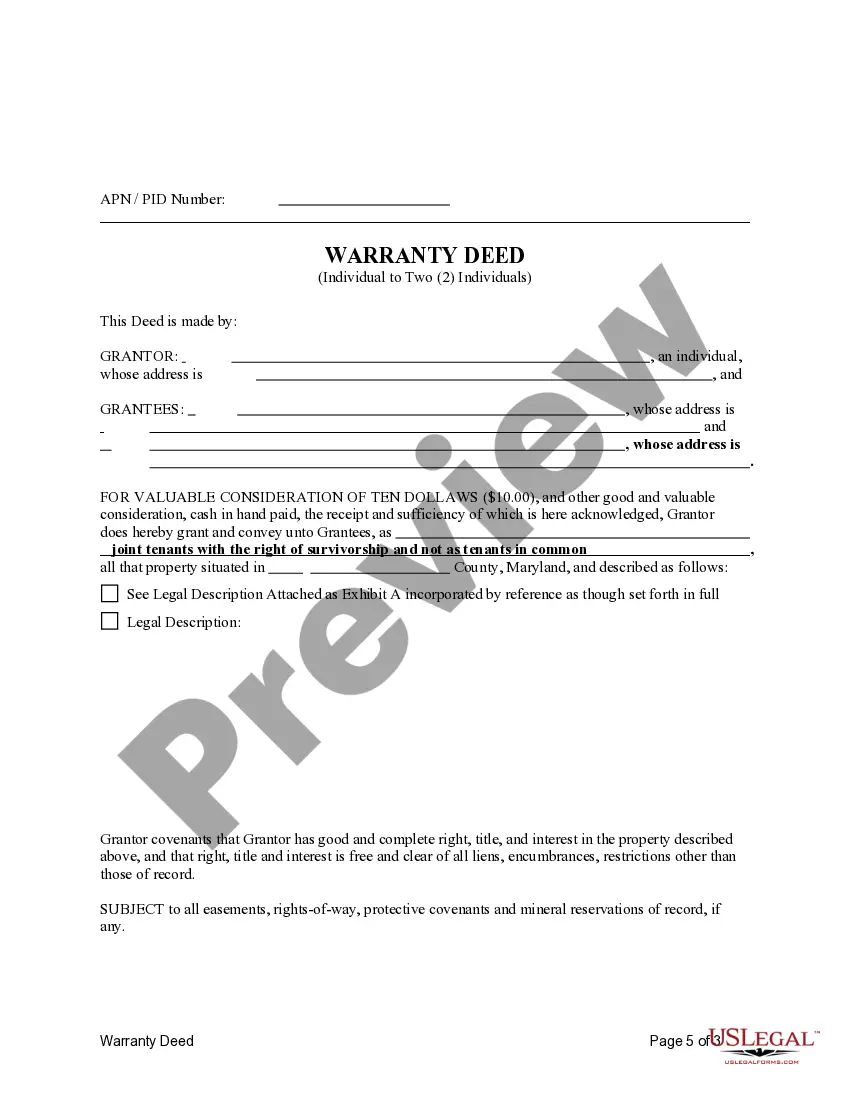

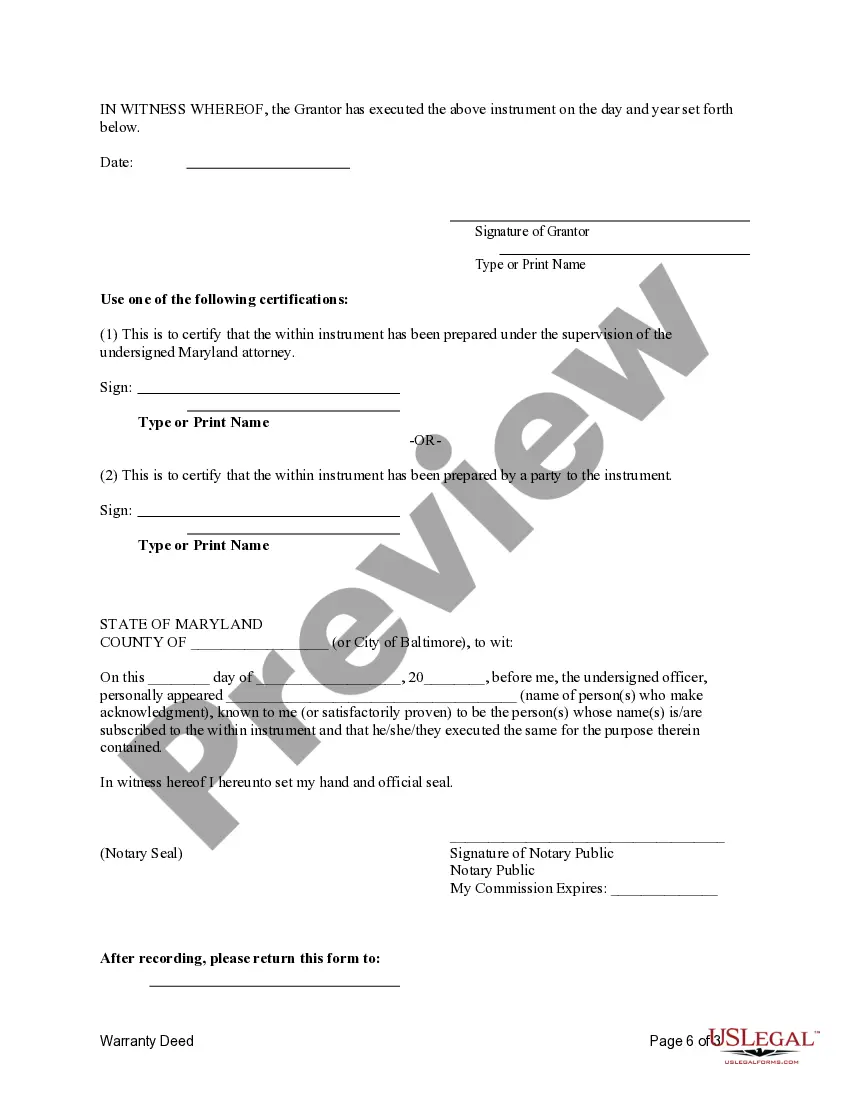

To successfully record a Maryland real estate deed, certain requirements must be met, including a properly completed Maryland grant deed form, notarization of the signatures, and payment of the applicable recording fees. Additionally, the deed must include the property’s legal description to identify it clearly. Make sure you understand these requirements before attempting to file your deed to avoid any delays.

Yes, in Maryland, a deed must be notarized to be legally binding. This requirement ensures that the identities of the parties signing the Maryland grant deed form are verified. After notarization, the deed must be recorded to complete the transfer of property ownership. It is advisable to work with a notary public familiar with real estate transactions for a seamless process.

Recording a deed in Maryland generally takes a few days to several weeks, depending on the volume of submissions at the local land records office. After filing, the office will process your Maryland grant deed form and update public records. You can often check the status of your deed by contacting the office directly. It’s important to record the deed promptly to protect your ownership rights.

To obtain a deed to your house in Maryland, you typically need to complete a Maryland grant deed form and have it signed by the current property owner, known as the grantor. Once signed, file the deed with the appropriate local land records office. If you are purchasing the property, your title company or attorney typically handles this process on your behalf. Ensure the deed is correctly recorded to establish your ownership in public records.

To prepare a new deed in Maryland, start by gathering necessary information such as the legal description of the property, the names of the grantor and grantee, and any exemptions that apply. You can use a Maryland grant deed form available on platforms like US Legal Forms to ensure that you include all required elements. Once you fill out the form, review it for accuracy before signing. Finally, consult with a legal professional if you have any questions.

In Maryland, a deed can be prepared by an attorney, a qualified title company, or even a knowledgeable property owner. However, to ensure that your Maryland grant deed form complies with local laws and requirements, consulting with a professional is recommended. This approach can help avoid pitfalls and streamline the transfer process for everyone involved.

Transferring a house deed in Maryland involves completing a Maryland grant deed form and getting it signed by the current owner. Next, the new owner should have the deed notarized before submitting it to the local land records office for recording. Performing these steps ensures a proper transfer of ownership and protects the rights of both parties involved.

To obtain a copy of your deed in Maryland, you can visit the local land records office where your property is located. You will need to provide details like property description or grantor/grantee names. Alternatively, you can use the online services offered by platforms like US Legal Forms to access and print your Maryland grant deed form for your records.

In Maryland, the recording process for a deed typically takes between a few days to several weeks, depending on the office handling the transactions. Once you submit your Maryland grant deed form, the local land records office will process it. You may confirm the status of your recording by contacting the office directly. Keep in mind that delays can occur during high-volume times.

If your name is on the deed but not on the mortgage in Maryland, you are recognized as the property owner but not responsible for the mortgage debt. This situation can lead to complexities if decisions about the property arise, especially during a sale or refinancing process. It is advisable to consult with a legal professional to ensure your interests are protected. For clarity and expert advice surrounding property and deeds, rely on resources from US Legal Forms.