Maryland Warranty Deed With Powers

Description

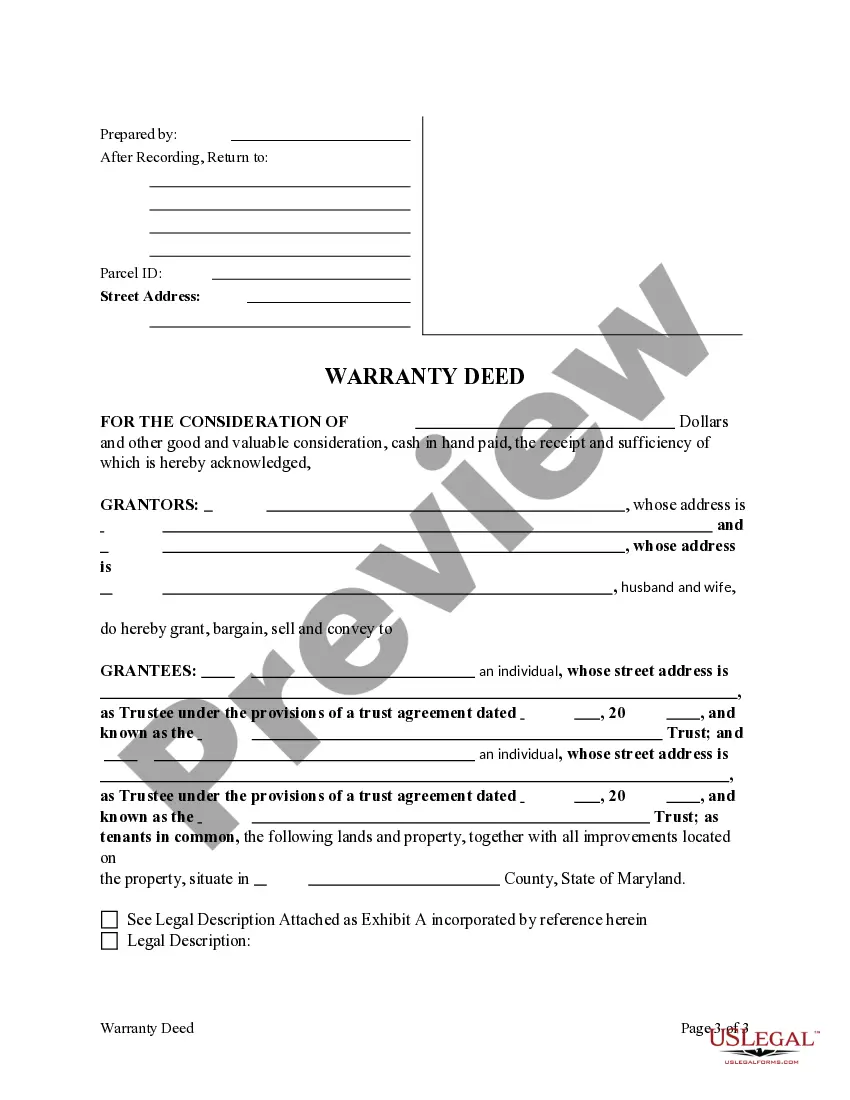

How to fill out Maryland Warranty Deed From Husband And Wife, Or Two Individuals To Two Trusts As Tenants In Common?

Well-prepared official documentation is one of the essential assurances for preventing complications and legal actions, but acquiring it without the assistance of an attorney may require time.

Whether you need to swiftly locate a current Maryland Warranty Deed With Powers or other forms for employment, family, or business situations, US Legal Forms is always available to assist.

The procedure is even more straightforward for current users of the US Legal Forms database. If your subscription is active, you simply need to Log In to your account and click the Download button next to the chosen form. Furthermore, you can retrieve the Maryland Warranty Deed With Powers at any time later, as all documents previously acquired on the platform remain accessible within the My documents section of your profile. Conserve time and funds on preparing official documents. Experiment with US Legal Forms immediately!

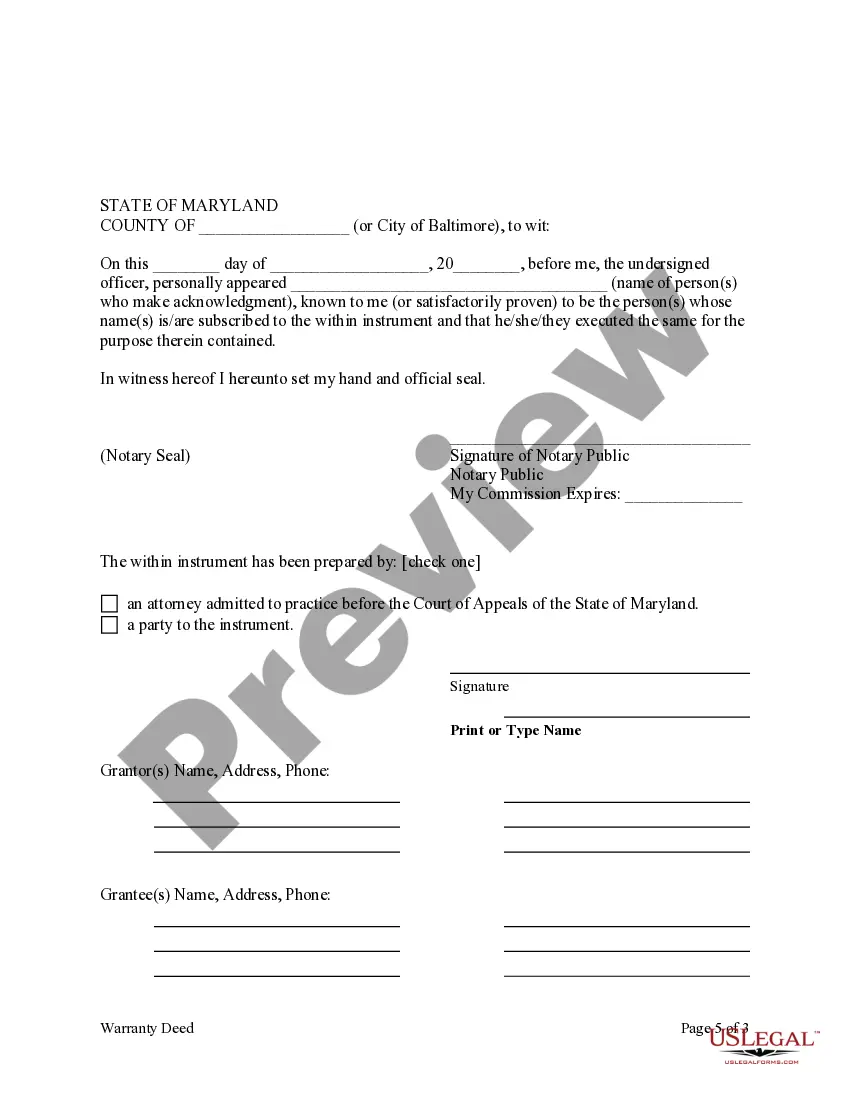

- Verify that the form is appropriate for your needs and location by reviewing the description and visual preview.

- Search for an alternative template (if required) using the Search bar located in the page header.

- Hit Buy Now once you locate the relevant form.

- Select the payment plan, Log In to your account, or create a new one.

- Choose your preferred payment method to purchase the subscription (via credit card or PayPal).

- Pick either PDF or DOCX file format for your Maryland Warranty Deed With Powers.

- Press Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

No, Maryland does not recognize transfer on death deeds. These types of deeds allow for property to transfer to a named recipient as soon as the property owner dies. The purpose of transfer on death deeds is to avoid probate.

Under the law, any person who owns a property and is competent to contract can transfer it in favour of another. If the owner gives another individual a power of attorney (POA), that person can sell it under this authority. A POA gives another person the power to act on behalf of the owner.

No, Maryland does not recognize transfer on death deeds. These types of deeds allow for property to transfer to a named recipient as soon as the property owner dies. The purpose of transfer on death deeds is to avoid probate.

A sale deed is an instrument by which right and title of a property transfers to other person. On the other hand Power of Attorney is to authorise someone on your behalf. One can choose which acts power of attorney holder can perform on his/her behalf.

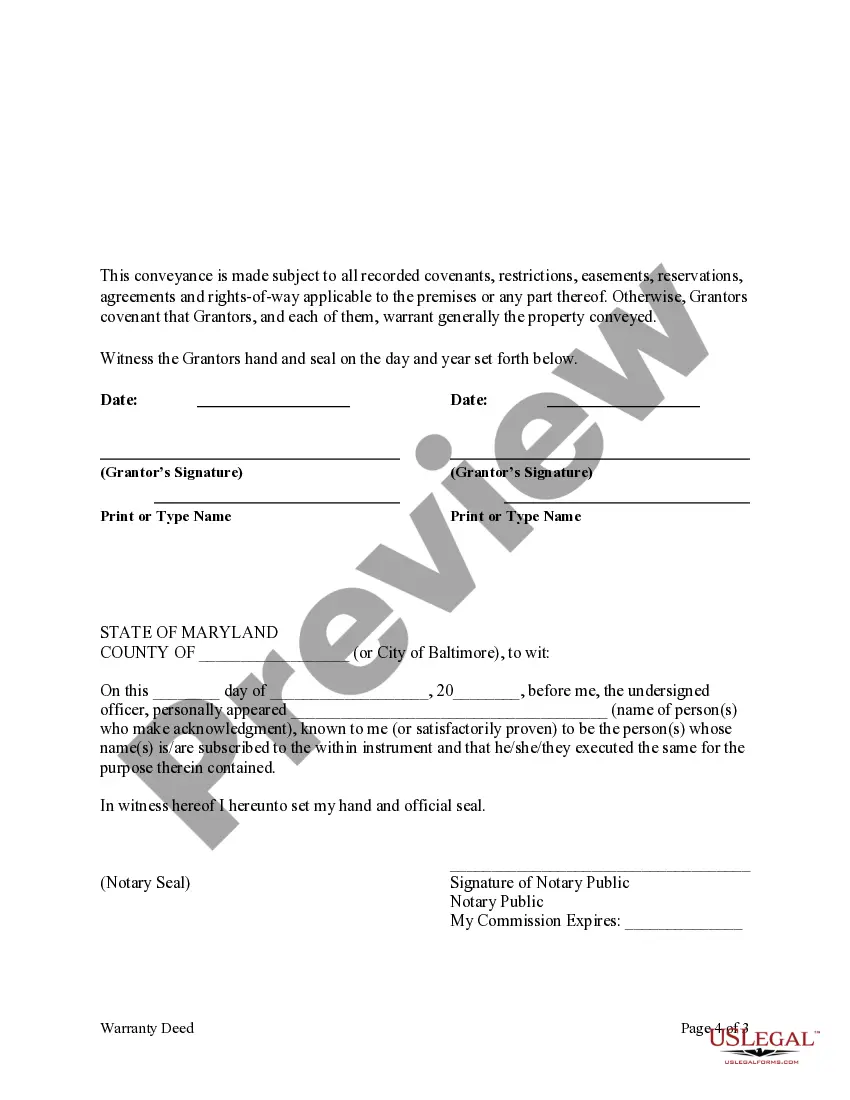

A deed must be notarized (signed in person before a notary public). A "lien certificate" must be attached, if required. This will show any unpaid taxes or liens on the property which must be paid before property can be deeded or transferred. A "State of Maryland Land Instrument Intake Sheet" must be filled out.