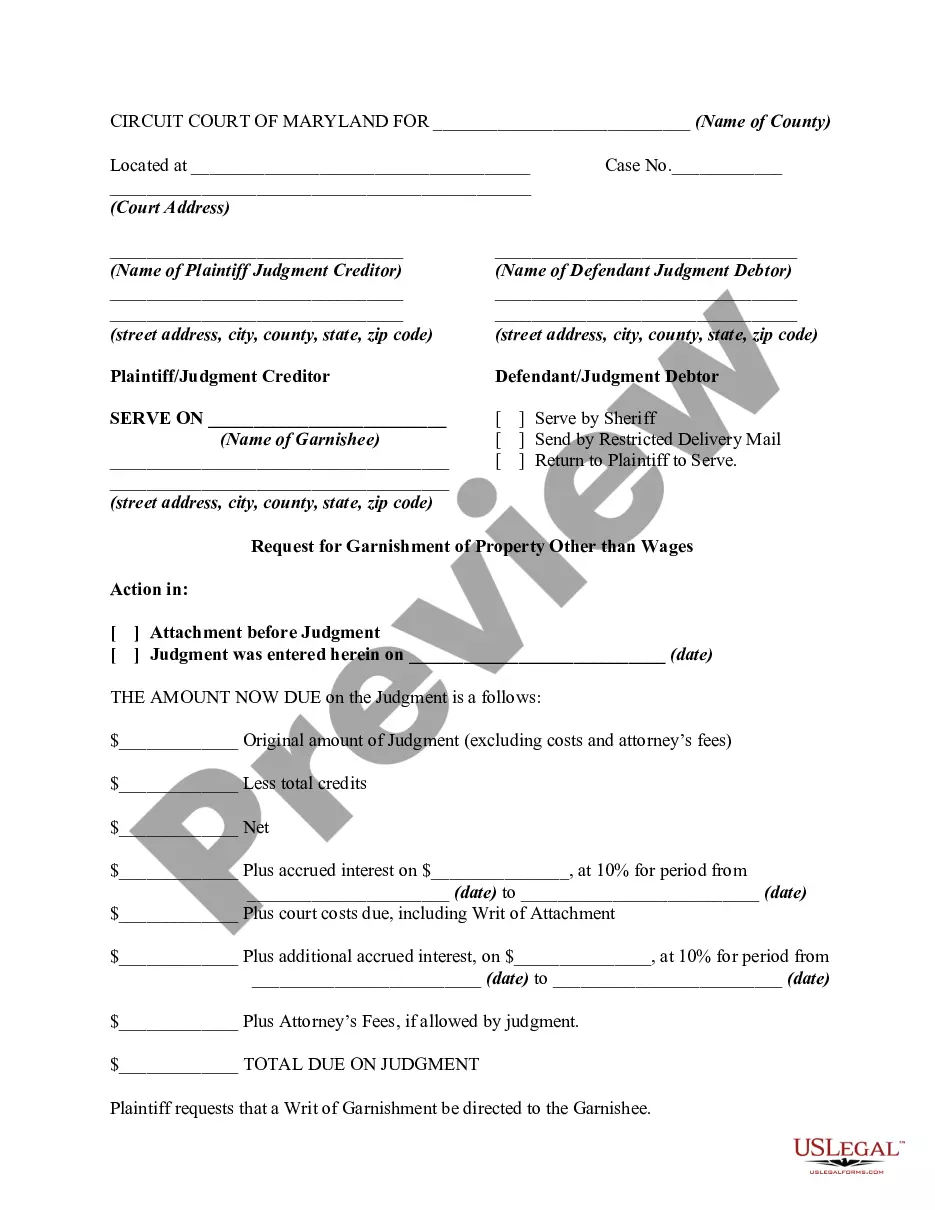

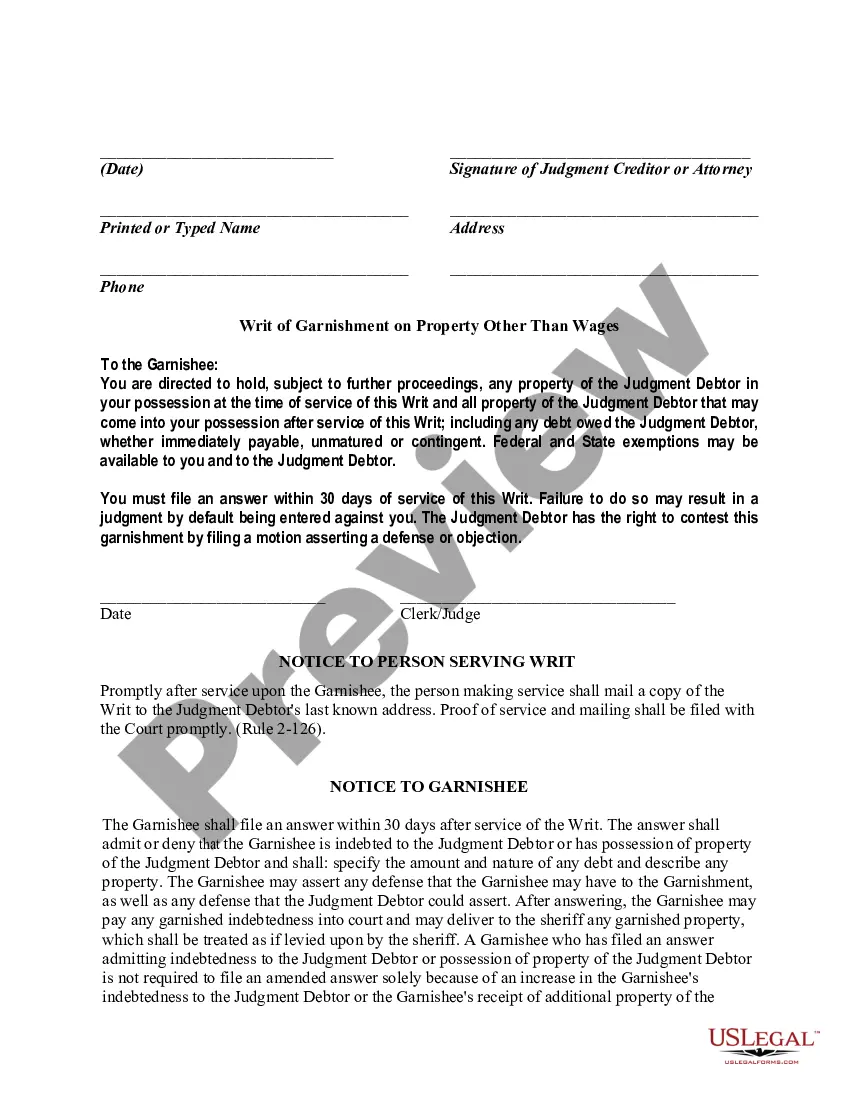

The judgment creditor may obtain issuance of a writ of garnishment by filing in the same action in which the judgment was entered a request that contains (1) the caption of the action, (2) the amount owed under the judgment, (3) the name and last known address of each judgment debtor with respect to whom a writ is requested, and (4) the name and address of the garnishee. Upon the filing of the request, the clerk shall issue a writ of garnishment directed to the garnishee.

Maryland Garnishment Withholding

Description

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

Using legal document samples that comply with federal and regional regulations is essential, and the internet offers many options to pick from. But what’s the point in wasting time searching for the correctly drafted Maryland Garnishment Withholding sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life scenario. They are easy to browse with all documents arranged by state and purpose of use. Our specialists keep up with legislative changes, so you can always be confident your form is up to date and compliant when acquiring a Maryland Garnishment Withholding from our website.

Obtaining a Maryland Garnishment Withholding is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, adhere to the guidelines below:

- Examine the template utilizing the Preview feature or via the text outline to make certain it meets your needs.

- Look for another sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and choose a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Maryland Garnishment Withholding and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and fill out previously saved forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

An earnings withholding order is a court-ordered legal document. It requires an employer to withhold up to 25 percent of an employee's wages. This money is paid to a creditor until the employee pays off their debt.

After you obtain a judgment, you file a Request for Writ of Garnishment of Wages (DC-CV-065). To complete the form, you need to know the name and address of the debtor's employer, the amount of the judgment and any additional money owed (such as court costs and interest.)

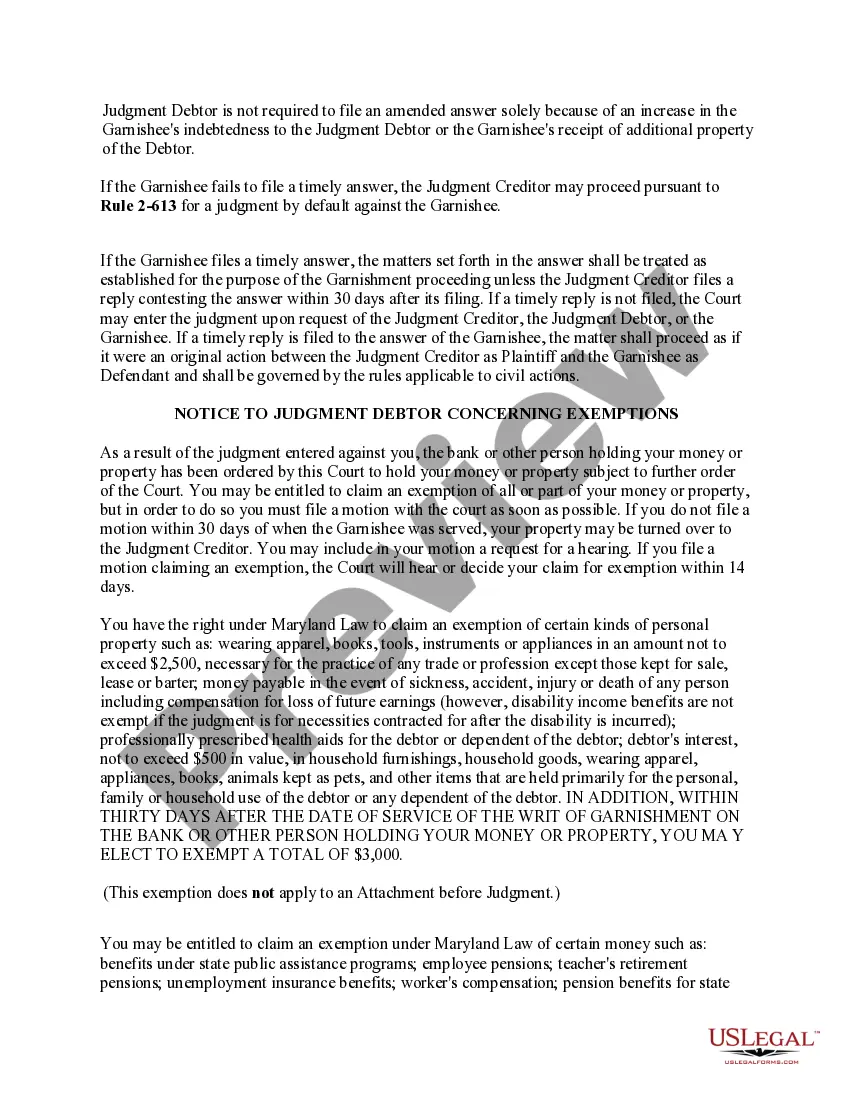

You may request an exemption to the garnishment. You must make your request within 30 days of when the garnishment was served on the bank. Use the form Motion for Release of Property from Levy/Garnishment (DC-CV-036).

The EDD may issue an earnings withholding order to your employer for benefit overpayments if a summary judgment was filed. Your employer may withhold up to 20 percent of your wages and is required to submit the amount withheld to the EDD to comply with the order.

Wages cannot be garnished if the judgment debtor's disposable wages are less than 30 times the federal minimum hourly wage per week ($217.50 per week). In any event, no more than 25% of your disposable wages for a week can be garnished.