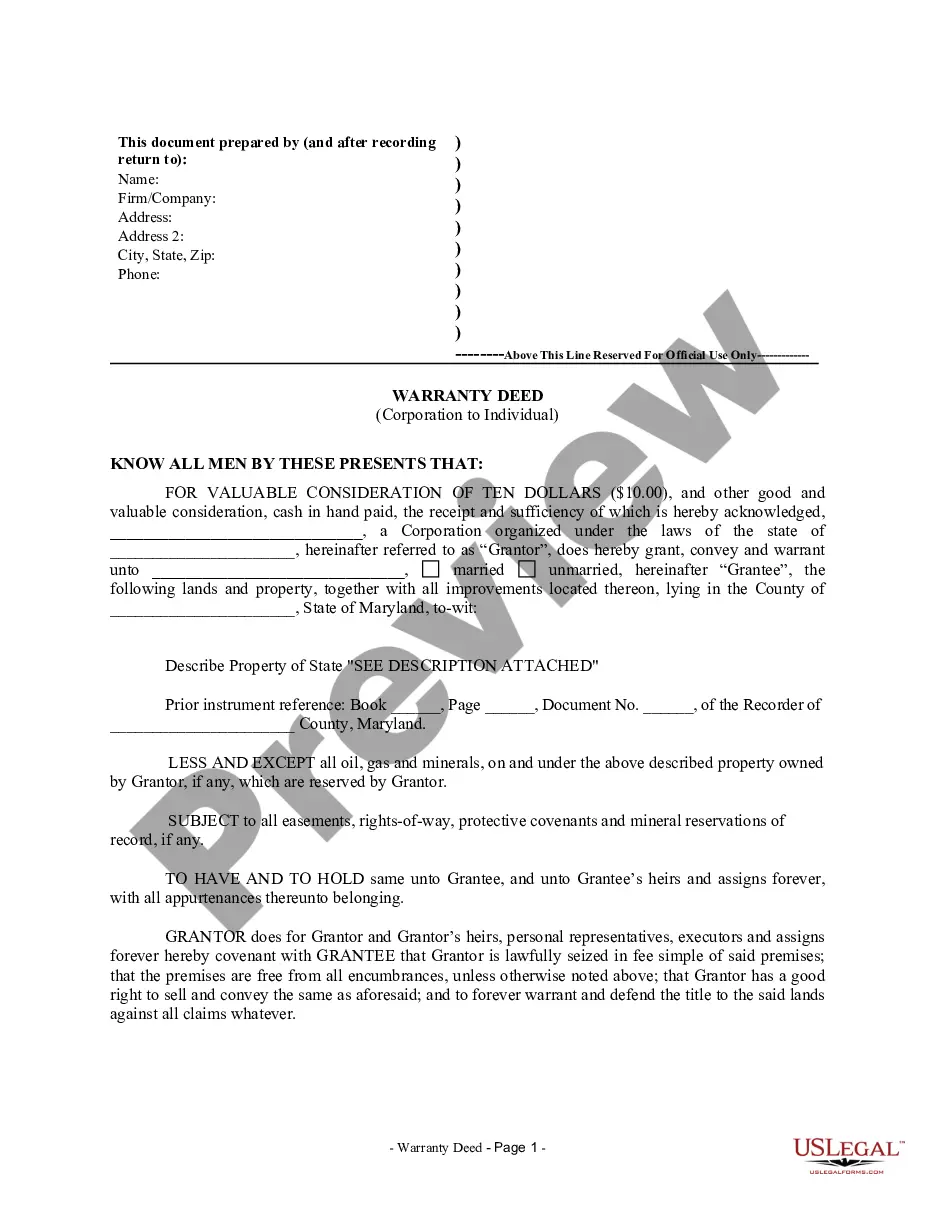

Corporation State Maryland Withholding Form 2021

Description

How to fill out Corporation State Maryland Withholding Form 2021?

When you need to finalize the Corporation State Maryland Withholding Form 2021 that adheres to your local state’s rules, there can be many alternatives to consider.

There's no necessity to scrutinize every document to verify it meets all the legal requirements if you are a US Legal Forms member.

It is a reliable source that can assist you in obtaining a reusable and current template on any subject.

Effortlessly creating professionally drafted formal documents becomes achievable with US Legal Forms. Additionally, Premium users can benefit from the robust integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms is the most extensive online repository with a collection of over 85,000 ready-to-use documents for business and personal legal matters.

- All templates are confirmed to comply with each state’s laws and regulations.

- For this reason, when downloading the Corporation State Maryland Withholding Form 2021 from our platform, you can be assured that you possess a valid and current document.

- Acquiring the necessary template from our platform is incredibly simple.

- If you already have an account, just Log In to the system, verify your subscription is active, and save the selected file.

- In the future, you can access the My documents tab in your profile and retain access to the Corporation State Maryland Withholding Form 2021 whenever needed.

- If it’s your first time using our library, please follow the guidelines below.

- Browse the suggested page and check it for alignment with your needs.

Form popularity

FAQ

A tax clearance certificate in Maryland is an official document confirming that a business has met all tax obligations. This certificate is often required for contracts, permits, or licensing. Obtaining it may be part of your compliance strategy under the Corporation state Maryland withholding form 2021 framework.

Yes, Maryland requires employers to submit state withholding forms, such as the MW507, for all employees. This ensures the correct amount of state income tax is withheld from each paycheck. By following these guidelines, you will fulfill your obligations regarding the Corporation state Maryland withholding form 2021.

A form 510D payment in Maryland refers to the estimated tax payment made by corporations for potential tax liabilities. This payment helps ensure that corporations do not face a large tax bill at the end of the fiscal year. Managing these payments effectively is part of your responsibility under the Corporation state Maryland withholding form 2021.

The Maryland form MW506NRS is a nonresident tax withholding return for employers. It is used to report and remit withholding taxes for nonresidents who earned income in Maryland. For employers seeking to comply with the Corporation state Maryland withholding form 2021 requirements, this form is essential.

Form 510 is specifically for corporate income tax returns, while form 511 is for pass-through entities like partnerships and S corporations. Understanding this distinction is crucial when determining which form to file for your business. Ensure you select the correct form to avoid complications with the Corporation state Maryland withholding form 2021.

The Maryland form 510 is the corporate income tax return for corporations operating in Maryland. This form helps calculate the amount of tax owed based on the corporation's net income during the tax year. Correctly completing this form is vital for fulfilling your Corporation state Maryland withholding form 2021 obligations.

The Maryland form 510 must be filed by corporations that do business within Maryland or earn income from Maryland sources. It is essential for entities to report their income and calculate the tax due. If you operate a corporation, reviewing the requirements ensures compliance with the Corporation state Maryland withholding form 2021.

Filling out the Maryland MW507 form requires accurate personal and financial information. Begin by providing your name, address, and Social Security number. Next, include your filing status and the number of exemptions you are claiming. For assistance, consider using the US Legal Forms platform, which can guide you through the Corporation state Maryland withholding form 2021 process.

You can pick up Maryland tax forms at your local tax office or at designated state offices throughout Maryland. Additionally, many forms, including the Corporation State Maryland withholding form 2021, can be printed from the Maryland Comptroller’s website. This makes it easy for you to obtain the forms you need without any hassle.

To acquire a Maryland withholding number, you need to register your business with the Maryland Comptroller. Completing the registration process will grant you your unique withholding number, which is essential for submitting the Corporation State Maryland withholding form 2021. Timely registration ensures that you remain compliant with state regulations.