Corporation State Maryland Withholding Calculator 2020

Description

How to fill out Corporation State Maryland Withholding Calculator 2020?

There’s no longer a need to squander hours hunting for legal documents to adhere to your local state rules. US Legal Forms has compiled all of them in one location and made them easier to access.

Our website offers over 85,000 templates for various business and personal legal situations organized by state and area of application. All forms are properly drafted and checked for validity, so you can trust in obtaining an up-to-date Corporation State Maryland Withholding Calculator 2020.

If you are acquainted with our service and already possess an account, you must ensure your subscription is active before retrieving any templates. Log In to your account, select the document, and click Download. You can also return to all saved documents at any time by accessing the My documents tab in your profile.

You can print your form to fill it out manually or upload the sample if you prefer completing it in an online editor. Creating legal documents under federal and state regulations is quick and straightforward with our library. Try US Legal Forms now to keep your paperwork organized!

- If you have never utilized our service previously, the process will require a few more steps to complete.

- Here’s how new users can find the Corporation State Maryland Withholding Calculator 2020 in our collection.

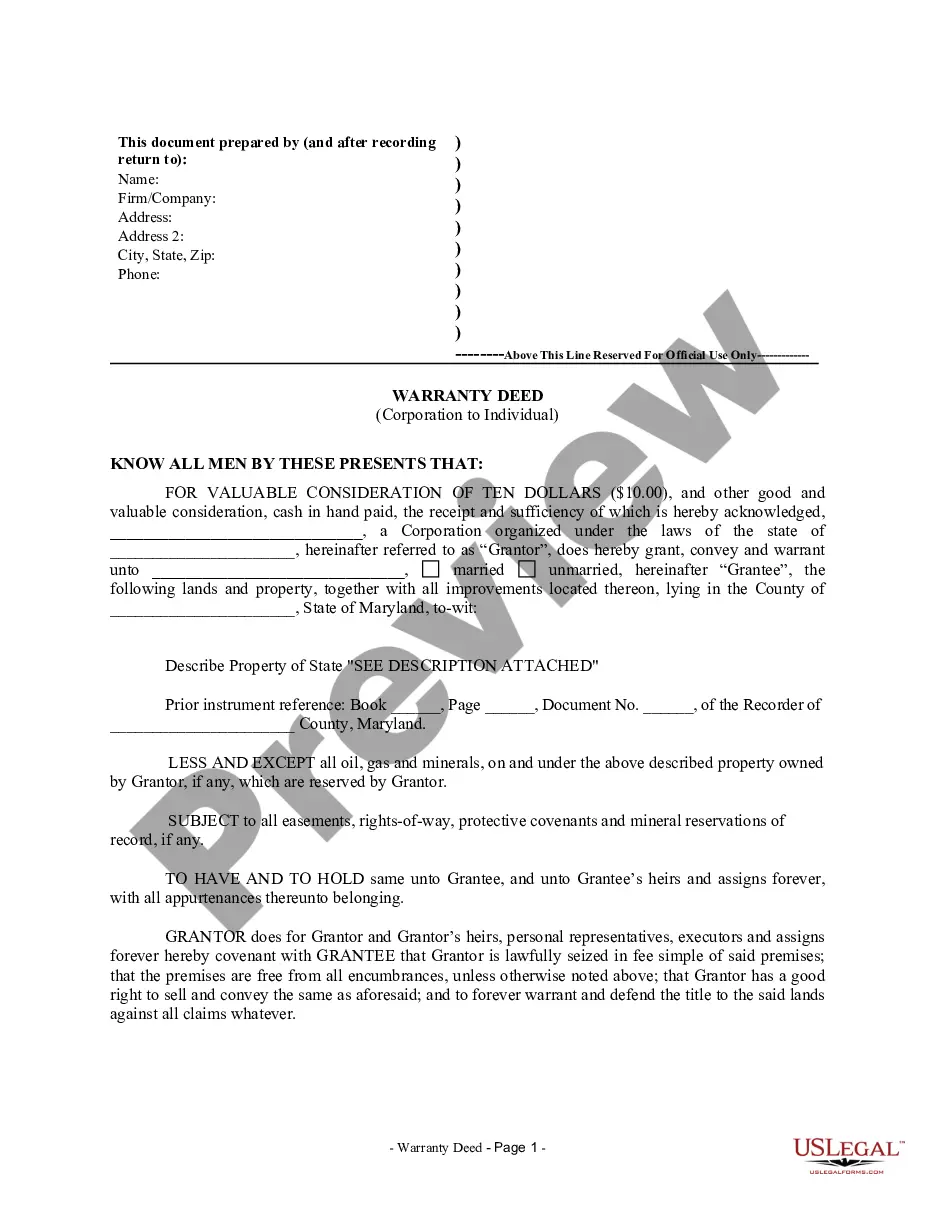

- Read the page content carefully to ensure it contains the sample you need.

- To do this, use the form description and preview options if available.

- Use the Search field above to look for another template if the previous one was not suitable.

- Click Buy Now next to the template title once you identify the right one.

- Choose the most appropriate pricing plan and create an account or sign in.

- Process your subscription payment with a credit card or through PayPal to proceed.

- Select the file format for your Corporation State Maryland Withholding Calculator 2020 and download it to your device.

Form popularity

FAQ

Yes, Maryland recognizes S corporations and grants them the same pass-through treatment found in federal law. This means that income is taxed at the shareholder level instead of the corporate level. To navigate the complexities of taxation effectively, using tools like the Corporation state Maryland withholding calculator 2020 can be beneficial for accurate calculations.

As of now, the Maryland tax rate for 2024 is set to follow the same rates established in previous years, but future changes could occur based on legislative decisions. It's essential to monitor updates from the Maryland comptroller's office for the latest information. For detailed calculations, leverage the Corporation state Maryland withholding calculator 2020, which can help you effectively plan for the upcoming tax year.

In Maryland, S corporations are generally not subject to the state's corporate income tax. Instead, income is passed through to shareholders, who then report it on their individual tax returns. This treatment can lead to tax savings for many small business owners. For accurate estimates of withholdings, consider using the Corporation state Maryland withholding calculator 2020.

Maryland is considered a high tax state due to its overall tax burden, which includes property taxes, income taxes, and sales taxes. Residents often face higher personal income tax rates compared to many other states. Understanding how these taxes impact your business can be essential. The Corporation state Maryland withholding calculator 2020 can offer insights into keeping your withholding in check.

The corporate tax rate in Maryland is currently set at 8.25%. This rate applies to corporations formed in Maryland and those doing business in the state. It is crucial for businesses to stay updated, as tax rates can change. Utilizing tools like the Corporation state Maryland withholding calculator 2020 can aid in accurate tax planning.

Maryland state withholding depends on your income level and filing status. Generally, employers must follow the Maryland state withholding tables to determine the appropriate amount. For precise calculations, consider using the Corporation state Maryland withholding calculator 2020. This tool helps simplify the process, ensuring you withhold the correct amounts from your employees' paychecks.

Claiming the correct number of exemptions for Maryland state tax can reduce the amount withheld from your paycheck. By using the Corporation state Maryland withholding calculator 2020, you can evaluate your particular financial situation and determine the suitable number of exemptions. This strategic decision ultimately helps you manage your tax payments more effectively.

To fill out the Maryland W-4 form, first gather necessary information like your income, filing status, and exemptions. The Corporation state Maryland withholding calculator 2020 supports your completion of this form by helping you analyze your withholding selections thoroughly. Accurate completion is essential for optimizing your taxes and financial planning.

The MD state tax withheld from your paycheck is contingent on your earnings and filing status. Using the Corporation state Maryland withholding calculator 2020 facilitates finding the right amount so you adhere to state tax requirements. This prevents surprises during tax season by ensuring your withholdings align with your expected tax liability.

To determine how much to withhold for Maryland state taxes, you need to consider your income level and applicable deductions. The Corporation state Maryland withholding calculator 2020 is an excellent resource for calculating the correct withholding amount, thereby ensuring compliance with tax regulations. This tool allows you to adjust your withholding according to your financial circumstances.