Maryland Llc Cost With Ein

Description

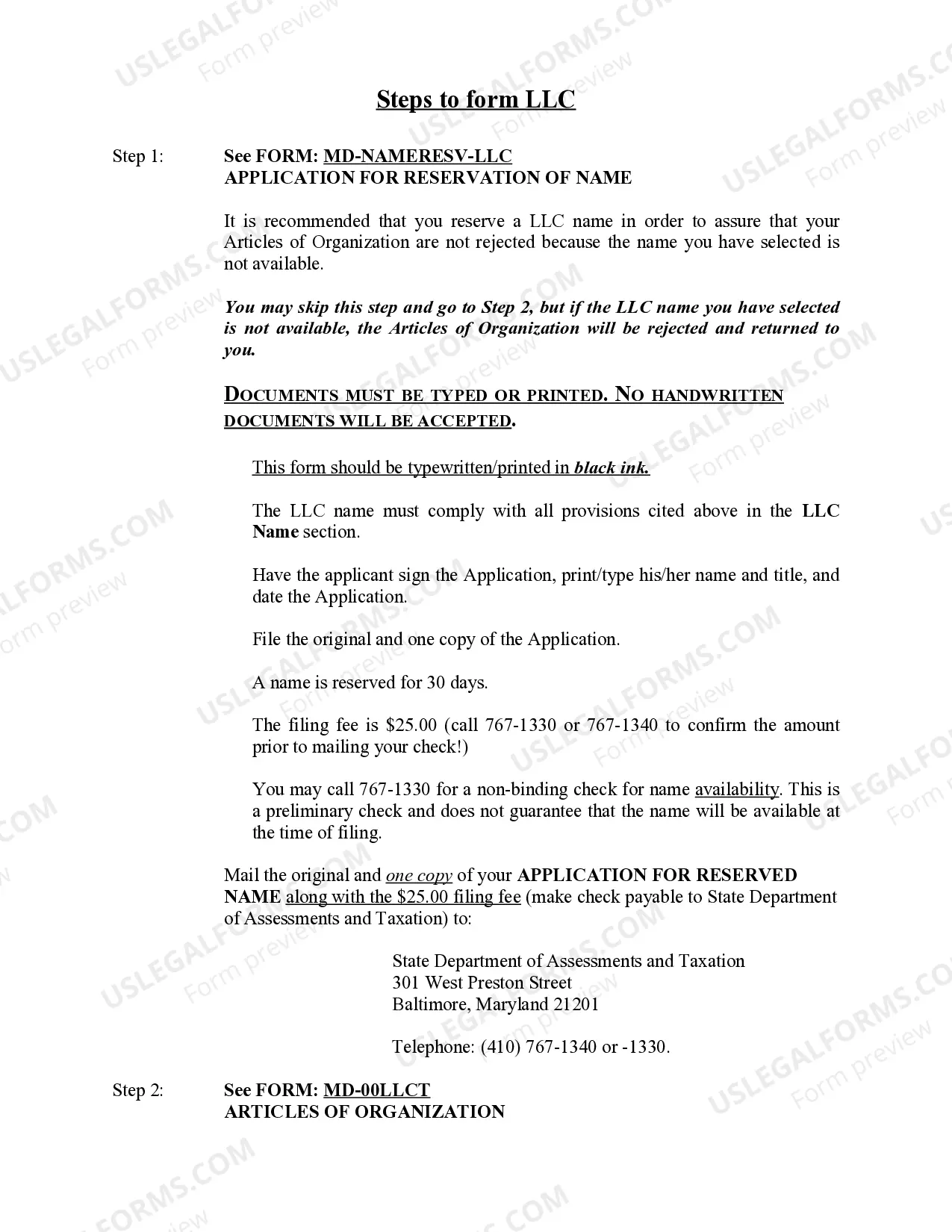

How to fill out Maryland Limited Liability Company LLC Formation Package?

Regardless of whether for commercial objectives or personal matters, everyone must confront legal issues at some point in their lifetime.

Filling out legal documents requires diligent focus, commencing with selecting the appropriate form template.

With an extensive US Legal Forms catalog available, you don't need to waste time searching for the appropriate sample online. Leverage the library's easy navigation to discover the suitable template for any circumstance.

- For example, if you choose an incorrect version of a Maryland LLC Cost With EIN, it will be rejected upon submission.

- Thus, it's imperative to source trustworthy legal documents such as US Legal Forms.

- To acquire a Maryland LLC Cost With EIN template, adhere to these straightforward steps.

- 1. Retrieve the necessary sample using the search bar or catalog browsing.

- 2. Review the description of the form to ensure it aligns with your circumstances, state, and region.

- 3. Click on the preview of the form to inspect it.

- 4. If it turns out to be the wrong document, go back to the search option to locate the Maryland LLC Cost With EIN template you need.

- 5. Obtain the file once it meets your criteria.

- 6. If you possess a US Legal Forms profile, simply click Log in to access previously saved documents in My documents.

- 7. If you haven't created an account yet, you can download the form by clicking Buy now.

- 8. Select the appropriate pricing option.

- 9. Complete the profile registration form.

- 10. Choose your payment method: use a credit card or PayPal account.

- 11. Specify the document format you wish and download the Maryland LLC Cost With EIN.

- 12. Once downloaded, you can either fill out the form using editing software or print it for manual completion.

Form popularity

FAQ

The Maryland LLC Annual Report costs $300 per year. This fee is paid every year for the life of your LLC, and it applies to all Maryland LLCs. And every Maryland LLC must file a Business Personal Property Tax Return.

If you file as a C-corp or elect to pay state taxes at the entity level, your LLC is subject to Maryland's 8.25% corporate income tax.

Most businesses are required to have an EIN, also known as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number (FTIN). However, if your business is a single-member LLC and you do not have any employees, you can use your Social Security number instead.

Maryland LLC Cost. The main cost of starting a Maryland LLC is the fee to file the Maryland Articles of Organization, which is $100 by mail or in person or $155 for expedited online filing. Maryland LLCs also need to pay a hefty $300 annual report fee every year.

How to Start an LLC in Maryland Choose a Name for Your LLC. ... Appoint a Registered Agent. ... File Articles of Organization. ... Prepare an Operating Agreement. ... Comply With Other Tax and Regulatory Requirements. ... File Annual Reports.