Llc Operating Agreement Maryland Withholding

Description

How to fill out Maryland Limited Liability Company LLC Operating Agreement?

Whether for business purposes or for individual matters, everyone has to manage legal situations sooner or later in their life. Completing legal paperwork demands careful attention, beginning from choosing the correct form template. For instance, if you pick a wrong edition of the Llc Operating Agreement Maryland Withholding, it will be turned down once you send it. It is therefore essential to get a reliable source of legal documents like US Legal Forms.

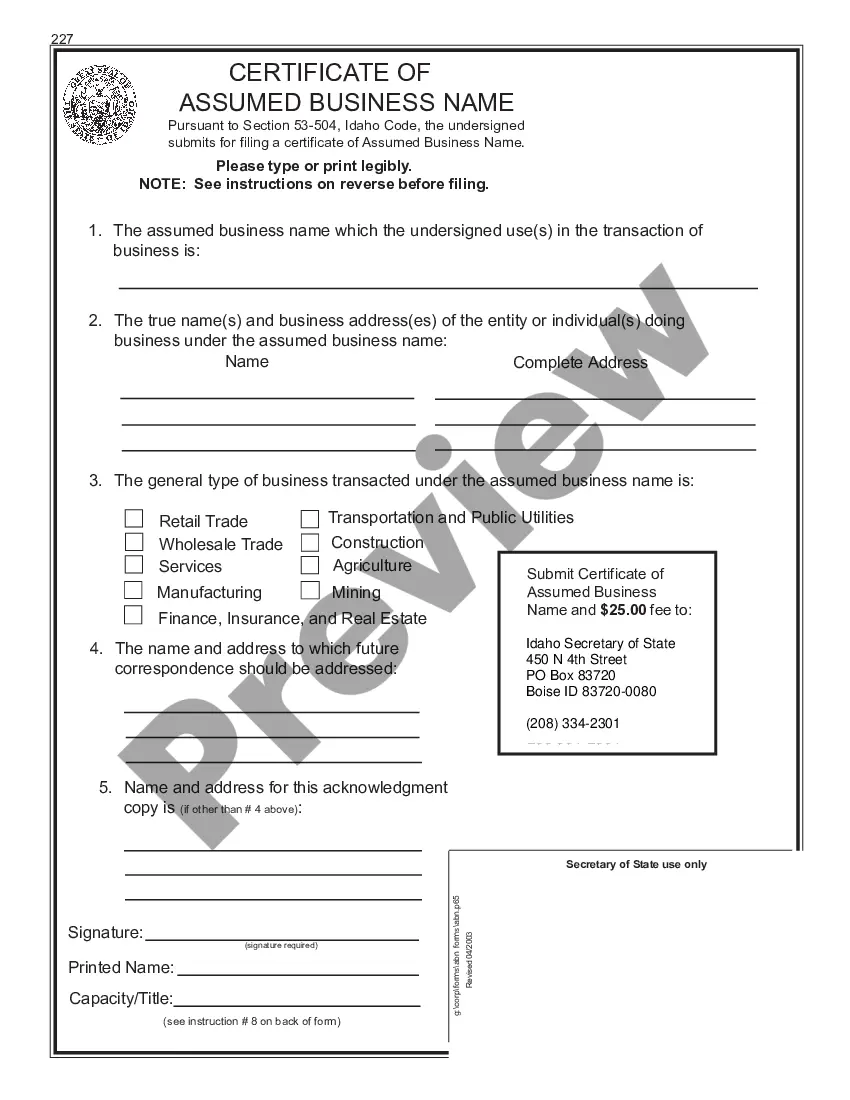

If you need to obtain a Llc Operating Agreement Maryland Withholding template, stick to these simple steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Look through the form’s description to make sure it fits your situation, state, and county.

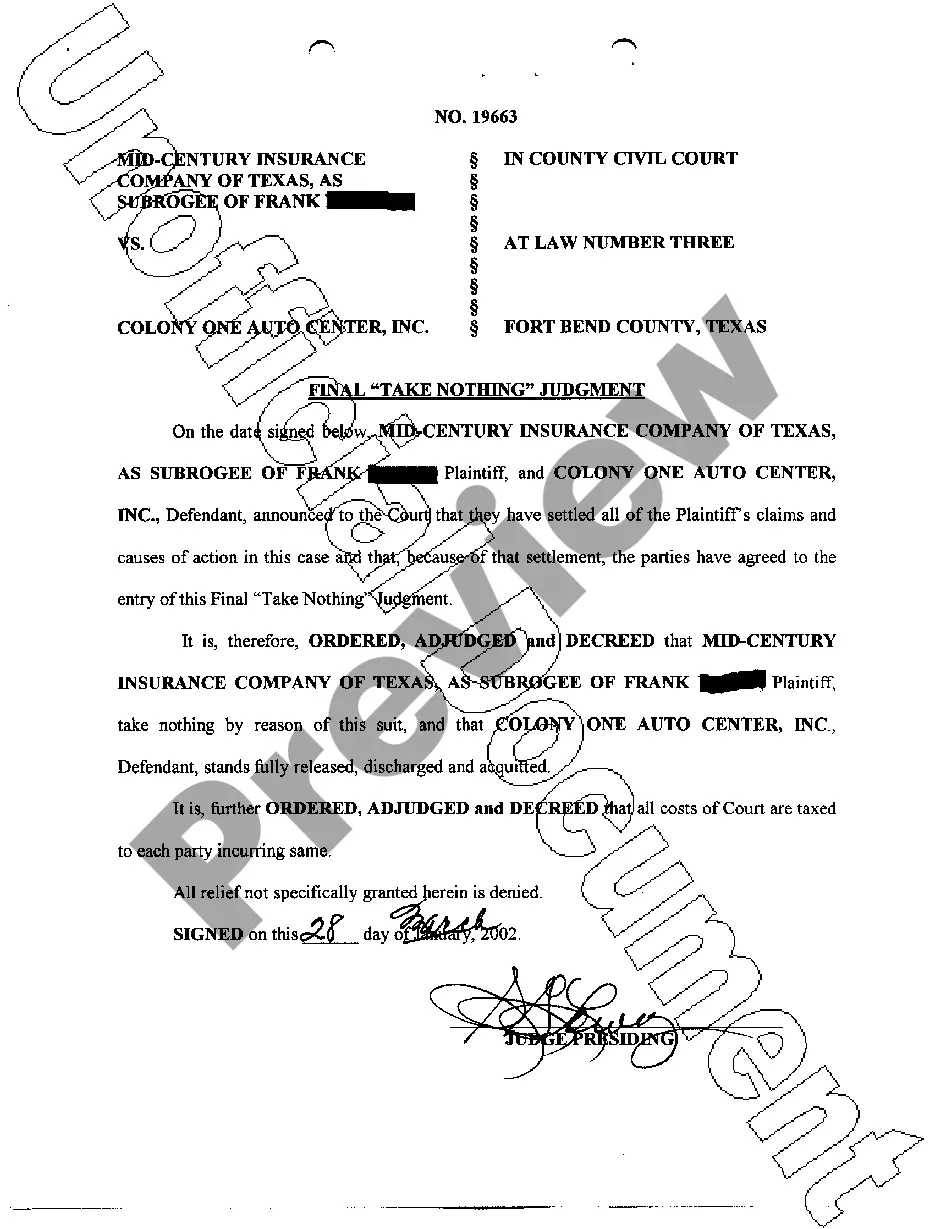

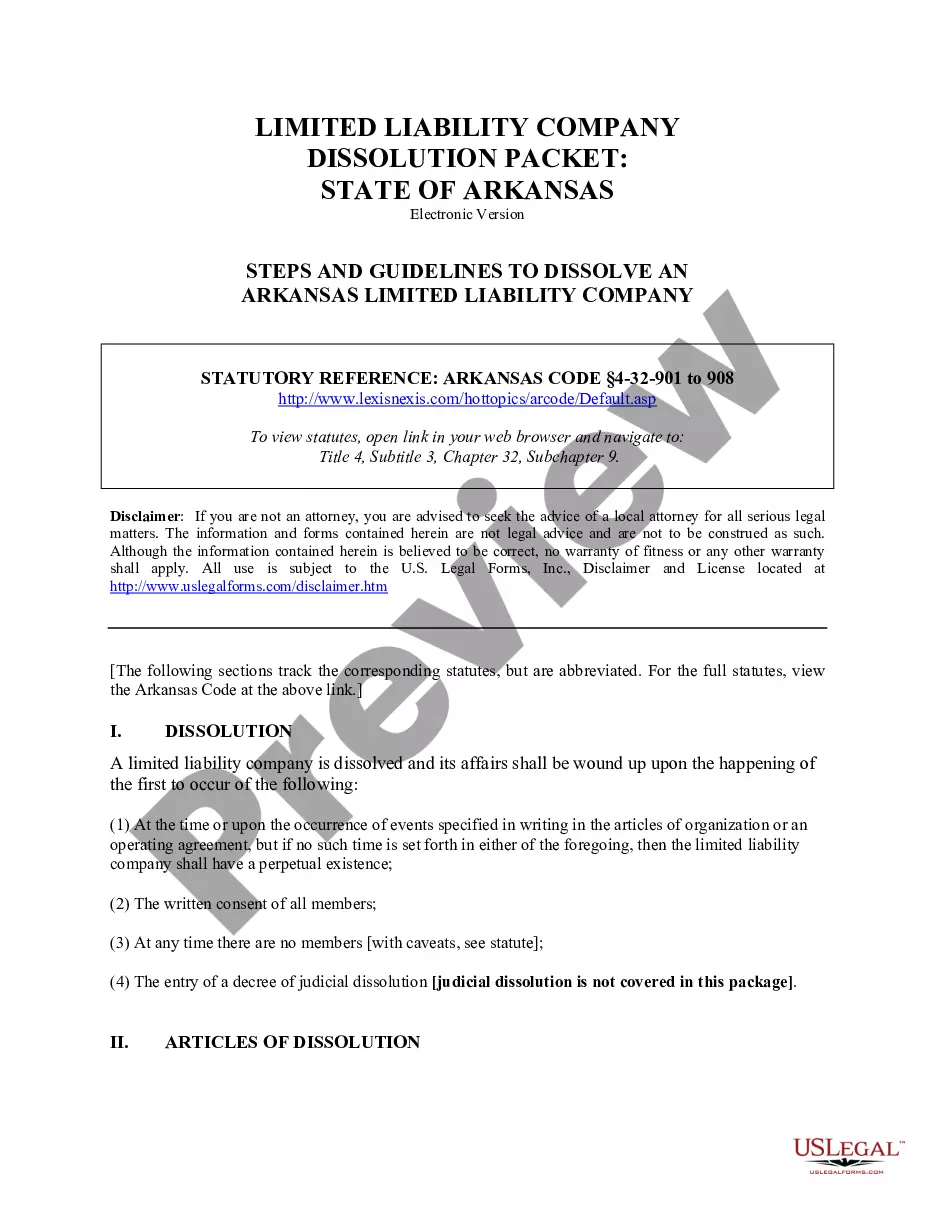

- Click on the form’s preview to see it.

- If it is the wrong document, return to the search function to find the Llc Operating Agreement Maryland Withholding sample you need.

- Get the file when it matches your requirements.

- If you already have a US Legal Forms account, simply click Log in to gain access to previously saved documents in My Forms.

- In the event you do not have an account yet, you may download the form by clicking Buy now.

- Pick the appropriate pricing option.

- Finish the account registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Pick the document format you want and download the Llc Operating Agreement Maryland Withholding.

- After it is downloaded, you can complete the form by using editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you do not need to spend time searching for the appropriate template across the web. Take advantage of the library’s straightforward navigation to find the correct template for any situation.

Form popularity

FAQ

To terminate a Maryland Limited Liability Company (?LLC?) "Articles of Cancellation" must be submitted to: Department of Assessments and Taxation, Charter Legal Department, 301 W. Preston Street, Room 801, Baltimore, MD 21201.

There is no Maryland state law requiring an LLC to have an operating agreement. However, if you don't have one, your LLC will be governed by Maryland's default LLC statutes, and you may run into difficulty if you need to prove your ownership of the LLC or if you face a lawsuit.

There is no Maryland state law requiring an LLC to have an operating agreement. However, if you don't have one, your LLC will be governed by Maryland's default LLC statutes, and you may run into difficulty if you need to prove your ownership of the LLC or if you face a lawsuit.

To close your withholding account, please call 410-260-7980 or 1-800-638-2937, Monday ? Friday, am to pm. You can also close your withholding account by completing Form MW506FR, or by completing and resubmitting the Final Report Form in your withholding coupon booklet.

Maryland LLCs are required to file both state and federal taxes. However, LLCs are ?pass-through? tax entities, so the individual LLC members must pay these income taxes, rather than the LLCs themselves. This means LLC owners are required to pay sales, self-employment, and maybe even payroll taxes to the state and IRS.