Maryland Corporation And Associations Code

Description

How to fill out Professional Corporation Package For Maryland?

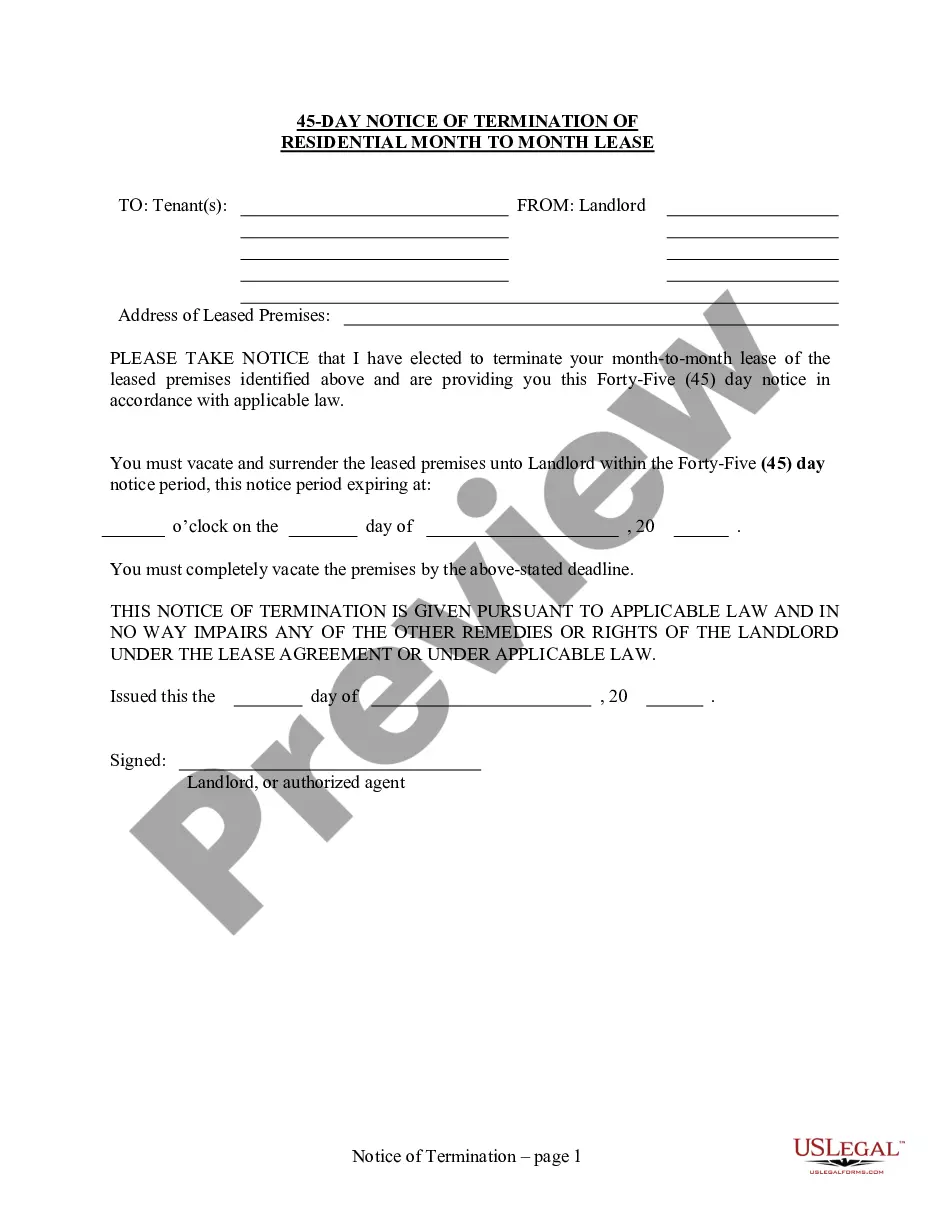

Properly prepared official documentation is one of the essential safeguards to prevent problems and legal disputes, but acquiring it without legal assistance can be time-consuming.

Whether you need to swiftly locate an updated Maryland Corporation And Associations Code or any other forms for employment, family, or commercial circumstances, US Legal Forms is always available to assist.

The procedure is even easier for current users of the US Legal Forms library. If your subscription is active, you only need to sign in to your account and click the Download button adjacent to the desired file. Moreover, you can retrieve the Maryland Corporation And Associations Code at any time later, as all documents previously acquired on the platform are accessible within the My documents section of your profile. Conserve time and financial resources on preparing official paperwork. Experience US Legal Forms today!

- Verify that the form aligns with your circumstances and locality by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the header of the page.

- Click Buy Now when you discover the suitable template.

- Choose the pricing option, sign in to your account or establish a new one.

- Select your preferred payment method to procure the subscription plan (using a credit card or PayPal).

- Decide on PDF or DOCX file format for your Maryland Corporation And Associations Code.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

The minimum tax rate for corporations in Maryland is currently a flat rate of 8.25% on taxable income. It’s essential for business owners to calculate their taxable income accurately to determine their tax obligations under the Maryland corporation and associations code. Keeping abreast of tax updates can save your corporation from potential penalties and ensure compliance with state laws.

The Maryland Code is a comprehensive collection of laws and regulations that governs various aspects of life and business in Maryland, including the Maryland corporation and associations code. This code outlines the rules for establishing and operating businesses, covering everything from corporate structure to taxation. Familiarity with the Maryland Code is key for any business owner looking to navigate the legal landscape effectively.

To start a corporation in Maryland, you begin by selecting a unique name for your business, ensuring it complies with the Maryland corporation and associations code. Next, you need to appoint a registered agent and file the Articles of Incorporation with the state. It’s also important to draft corporate bylaws, hold an organizational meeting, and then apply for an EIN to complete the setup process.

Incorporating in Maryland typically takes about 5 to 10 business days once your Articles of Incorporation are submitted. This timeframe may vary depending on the workload of the state processing office. For quicker results, you can opt for expedited services. Familiarizing yourself with the Maryland corporation and associations code can help you prepare the necessary documents efficiently.

To set up a corporation in Maryland, you need to file Articles of Incorporation with the Maryland State Department of Assessments and Taxation. This document includes essential information such as the corporation’s name, address, and the purpose of the business. Additionally, obtaining an Employer Identification Number (EIN) from the IRS is necessary for tax purposes. The Maryland corporation and associations code will guide you through each step of the process, ensuring compliance.

The code 6 202 in Maryland refers to a specific section within the Maryland corporation and associations code that governs certain aspects of corporate governance. It details the requirements for maintaining corporate records and ensuring compliance with state regulations. Understanding this code is vital for businesses to operate effectively and stay in good standing with state authorities.

Filing taxes for an LLC in Maryland starts with understanding how the Maryland corporation and associations code classifies your LLC for tax purposes. Depending on your situation, your LLC may be taxed as a sole proprietorship, partnership, or corporation. You will need to complete the necessary state and federal tax forms, which can be complex. Using resources from US Legal Forms can help simplify this task by providing comprehensive tax filing guides tailored for Maryland LLCs.

To convert an LLC to an S Corporation in Maryland, you first need to ensure your LLC meets the eligibility requirements set by the Maryland corporation and associations code. Next, you must file Form 2553 with the IRS to elect S Corporation status, while also submitting the necessary documents to the Maryland State Department of Assessments and Taxation. It is often beneficial to seek guidance through platforms like US Legal Forms, which provide templates and support for such conversions.

The term 'city code' for Maryland may refer to specific municipal laws applicable within cities throughout the state. Each city has its own unique code that complements the Maryland corporation and associations code by covering local regulations. For business owners, understanding both state and local laws is key to successful compliance and operational management.

The Maryland county code consists of specific regulations and statutes that apply within the counties of Maryland. It includes local laws that govern various aspects, including zoning, licensing, and land use. Familiarizing yourself with the county code is beneficial for businesses operating at a local level, especially when aligned with the Maryland corporation and associations code.