Maryland Foreign Llc Registration Form

Description

Form popularity

FAQ

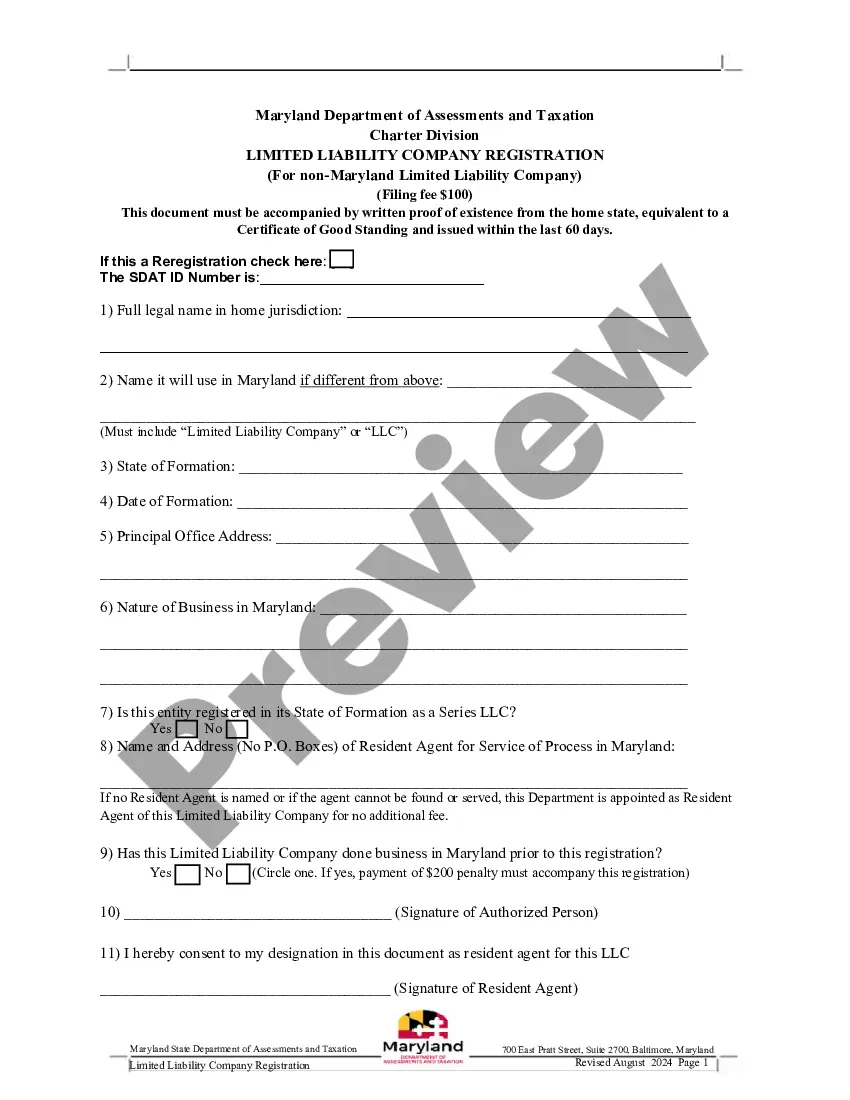

To register a foreign LLC in Maryland, you first need to acquire a copy of your home state's articles of incorporation. Then, complete the Maryland foreign LLC registration form and provide the required documentation, such as a certificate of good standing from your home state. Submit these documents to the Maryland State Department of Assessments and Taxation, along with the necessary fees. USLegalForms can assist you by offering clear instructions and access to the correct forms, making your registration straightforward.

The approval time for an LLC in Maryland typically ranges from a few days to several weeks, depending on the filing method you choose. If you file online, you may receive quicker confirmation compared to paper submissions. Keep in mind that factors like state workload and submission accuracy can influence the timeline. To streamline this process, utilize the Maryland foreign LLC registration form available on USLegalForms, which ensures completeness and accuracy in your application.

Filing for an LLC in Maryland starts with choosing a name for your business that complies with state regulations. Next, you'll need to complete the Maryland foreign LLC registration form, which is crucial if you are expanding your business from another state. You can submit this form online or by mail, along with the required fees. Our platform, USLegalForms, simplifies this process by providing step-by-step guidance and easy access to the necessary forms.

You do not need a lawyer to set up an LLC in Maryland, as the process can be managed independently. However, legal advice may be beneficial if you face complexities regarding your business structure or compliance issues. Utilizing resources such as US Legal Forms can provide guidance and help you accurately fill out the Maryland foreign LLC registration form. This option ensures you meet all requirements while saving time and reducing stress.

To start an LLC in Maryland, first, choose a unique name for your business that complies with state rules. Next, you must complete the Maryland foreign LLC registration form by providing necessary details about your company. Additionally, you’ll need to designate a registered agent who can accept legal documents on behalf of your LLC. Finally, consider using platforms like US Legal Forms to simplify your filing process and ensure accuracy.

The most economical way to register an LLC typically involves doing it yourself. You can find the Maryland foreign LLC registration form online and fill it out without hiring a legal professional. However, consider the value of using a service like uslegalforms to ensure you complete the registration correctly and efficiently.

Forming an LLC in Maryland involves several steps. Start by selecting a unique name for your LLC that complies with Maryland naming requirements. Then, file Articles of Organization with the Maryland Secretary of State and submit the Maryland foreign LLC registration form if you are a foreign entity. This process will legally establish your LLC.

To register a foreign LLC in Maryland, begin by filling out the Maryland foreign LLC registration form. You must provide information about your LLC, including its home state and whether it has a registered agent in Maryland. After submitting the form and paying the required fees, you will receive approval to conduct business in the state.

To obtain an SDAT in Maryland, you need to submit the proper documentation to the State Department of Assessments and Taxation. Start by completing the Maryland foreign LLC registration form, which includes details about your LLC and its principal office. Once submitted, the SDAT will process your information and provide you with a document confirming your registration.

To register a foreign entity in Maryland, you must first gather the necessary documentation, including a Certificate of Good Standing from your state of formation. Next, complete the Maryland foreign LLC registration form with accurate business information. Finally, submit the form and applicable fees to the Maryland State Department of Assessments and Taxation, following state laws for foreign registrations.