Fiduciary Trustees Trustors For Llc

Description

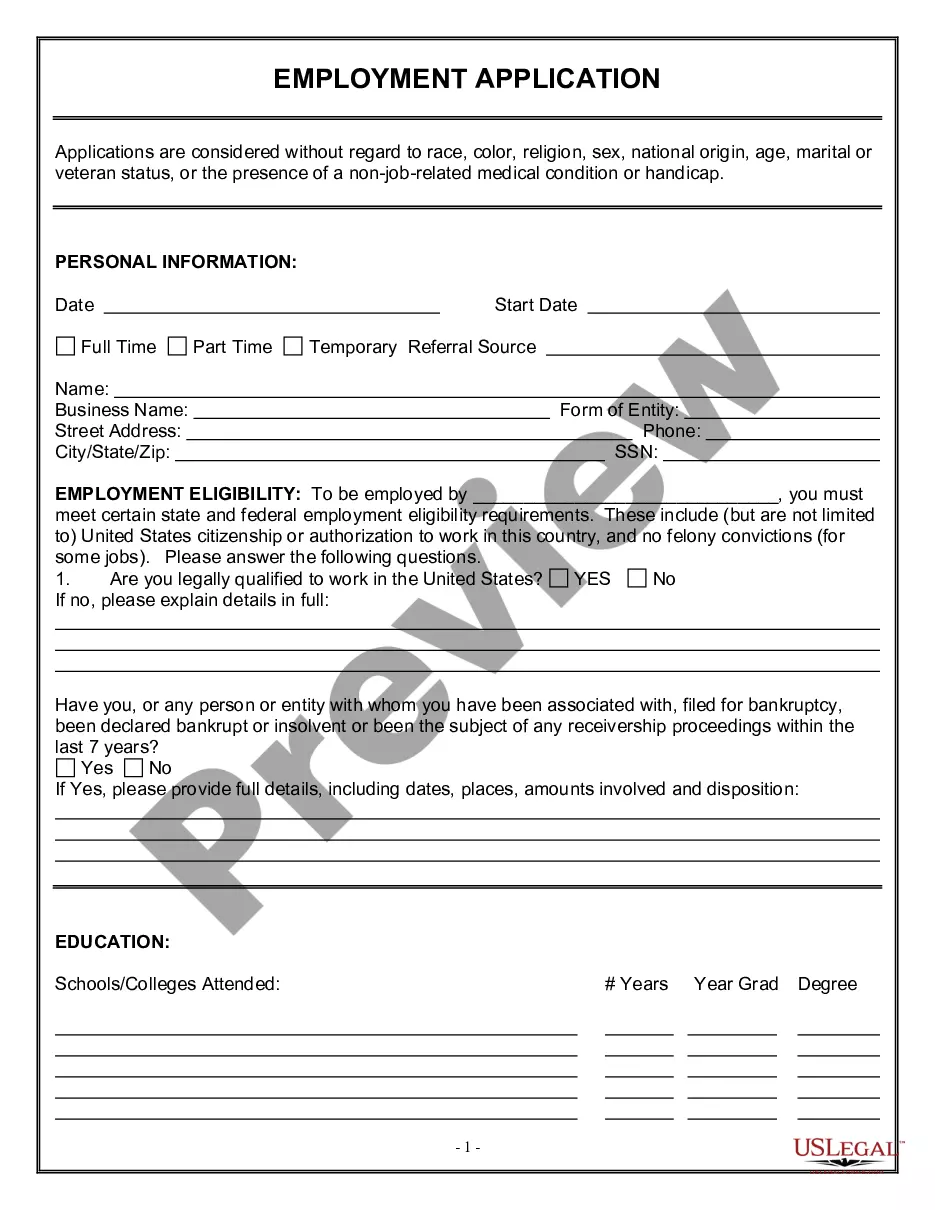

How to fill out Massachusetts Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

- Log into your account. If you’ve previously used US Legal Forms, simply log in and ensure your subscription is current. If it’s expired, renew it accordingly.

- Select your forms. Review the form preview and descriptions to confirm that it meets your needs and complies with your local jurisdiction.

- Search for additional templates if necessary. Utilize the Search tab to find alternatives if your first choice doesn’t suit your requirements.

- Purchase the document. Click on 'Buy Now' and choose a subscription plan that works best for you. You’ll need to create an account to access the library.

- Complete the payment. Enter your credit card information or use PayPal to finalize your subscription.

- Download your forms. Save the template to your device for completion and access it anytime in the My Forms section of your profile.

By following these easy steps, you can ensure that your fiduciary trusts are in place correctly, allowing your LLC to operate smoothly and within legal parameters.

Don't hesitate—empower yourself with the right forms today and ensure compliance with US Legal Forms!

Form popularity

FAQ

Yes, an LLC can serve as the trustee of a trust. This arrangement allows the LLC to handle trust assets and fulfill fiduciary duties on behalf of the trust. By using an LLC as a trustee, individuals can benefit from increased liability protection and operational efficiency. Choosing fiduciary trustees trustors for LLC ensures effective management and compliance with legal requirements.

Certainly, a trust can be a beneficial owner of an LLC. This means that the trust receives the benefits of ownership, such as profits and distributions, while the trustee manages the LLC's operations. This structure often simplifies asset management and enhances estate planning. Engaging in fiduciary trustees trustors for LLC can streamline these processes effectively.

Yes, a trust can indeed be the only member of an LLC. This setup allows the trust to hold and manage the assets within the LLC. When a fiduciary trustee is appointed, they manage the trust’s interests in the LLC effectively. This arrangement is beneficial for estate planning and asset protection, making fiduciary trustees trustors for LLC a solid option.

Whether your parents should place their assets in a trust depends on their financial situation and estate planning goals. A trust can provide benefits such as avoiding probate and ensuring asset management. However, it's crucial to evaluate their personal circumstances and preferences. Consulting with fiduciary trustees trustors for LLC can provide tailored advice and insight into the best approach for their needs.

One downside of putting assets in a trust is that it may complicate your financial situation. Once assets are transferred to a trust, they no longer belong to you personally, which can affect your control over them. Moreover, if not properly managed, it could lead to tax implications. Engaging fiduciary trustees trustors for LLC can help mitigate these downsides by ensuring that the trust operates efficiently and meets your goals.

A significant disadvantage of a family trust is the lack of flexibility once assets are placed within it. Family trusts can limit the ability to access funds, especially if an emergency arises, making it essential to plan carefully. Additionally, the trust may impose restrictions on beneficiaries, which can lead to conflicts among family members. Understanding the role of fiduciary trustees trustors for LLC can offer guidance in navigating these potential issues.

Structuring your trust and LLC involves understanding the relationship between the two entities. Generally, placing the LLC as an asset within the trust can provide additional legal protections and streamline asset management. It’s also vital to designate fiduciary trustees to manage this relationship effectively. A well-structured trust can enhance your estate planning strategy while utilizing fiduciary trustees trustors for LLC.

Putting an LLC into a trust can be a strategic move, especially for business owners considering future estate planning. With the guidance of fiduciary trustees, trustors can enjoy benefits like reduced probate costs and easier asset distribution. Additionally, this can protect against personal liability and maintain privacy for your business operations. It is wise to consult professionals to see if this fits your needs.

People often place their businesses in a trust to achieve better asset protection and estate planning. By designating fiduciary trustees, trustors can manage their LLC’s assets effectively while keeping them separate from personal liabilities. This setup also simplifies the transfer of ownership, making it easier for the next generation. Overall, a trust can safeguard your business interests.

In a Limited Liability Company (LLC), the assets are owned by the LLC itself, not the individuals who manage it. This means that fiduciary trustees, such as trustors for LLCs, play a crucial role in asset management. They ensure that the assets are handled according to the terms set forth in the operating agreement. Thus, understanding the role of fiduciary trustees can clarify ownership and responsibilities.