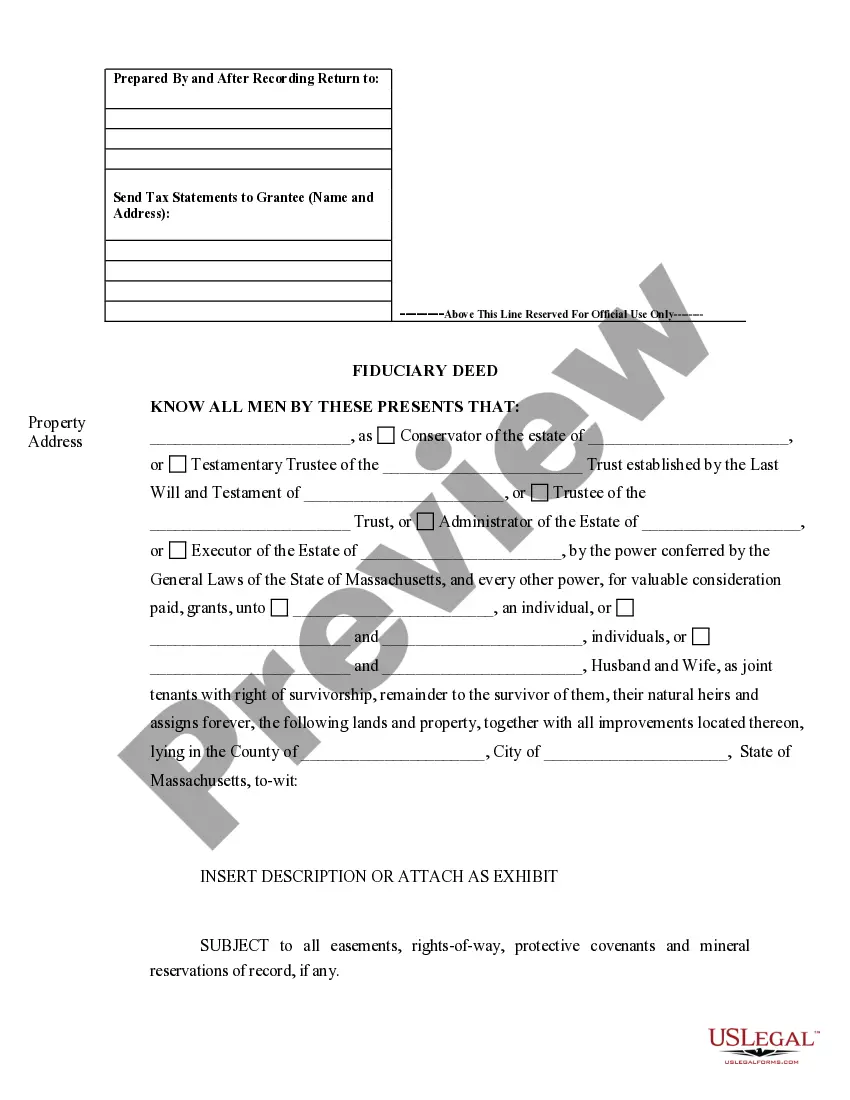

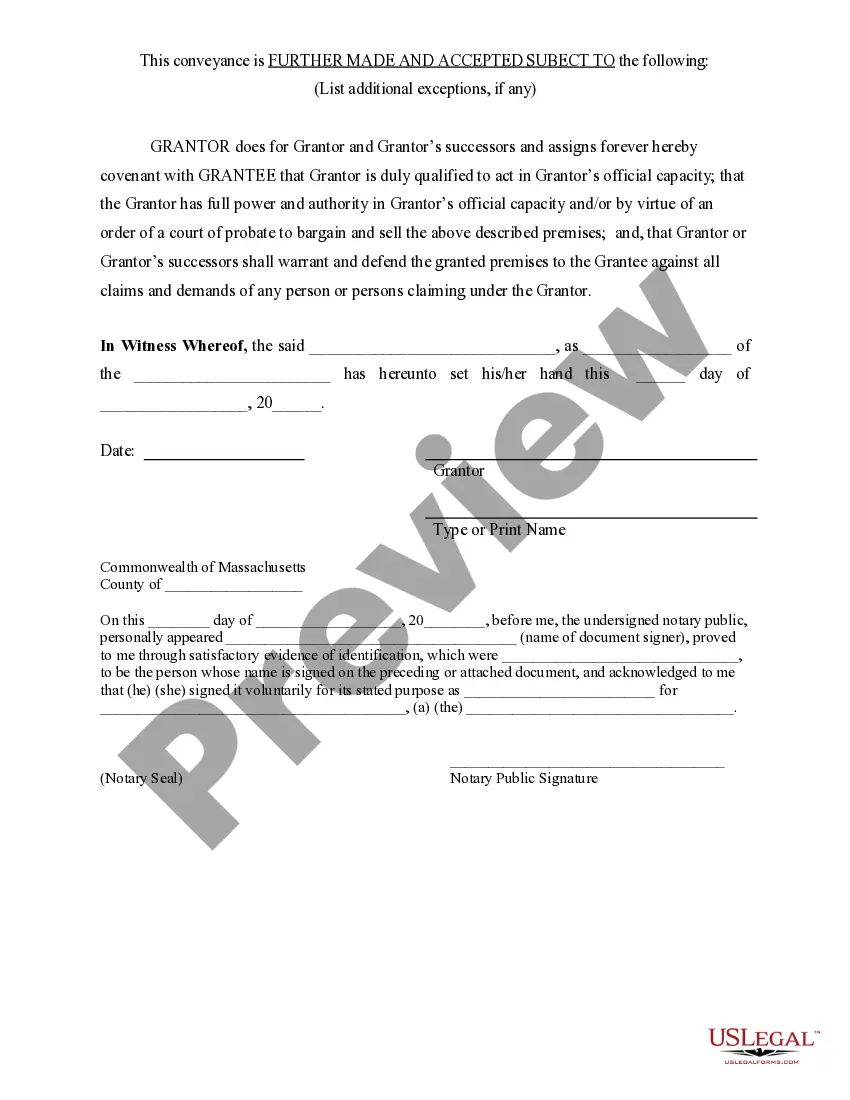

Fiduciary Deed Massachusetts Withdrawal: Understanding the Process and Types In Massachusetts, a Fiduciary Deed withdrawal refers to the legal procedure through which an appointed fiduciary (a person or entity entrusted with the management of property or assets on behalf of others) relinquishes their authority and involvement in the property. This withdrawal is typically executed by submitting a legally binding document known as a Fiduciary Deed to the relevant authorities. There are several types of Fiduciary Deeds that can be utilized for withdrawal purposes in Massachusetts, depending on the specific circumstances involved. These include: 1. Personal Representative's Deed: When the fiduciary is a personal representative appointed to administer the estate of a deceased individual, they may need to file a Personal Representative's Deed to withdraw their involvement from the property. This deed allows for the proper transfer of the deceased person's property rights to the designated beneficiaries or heirs. 2. Trustee's Deed: If the fiduciary is acting as a trustee, responsible for managing and distributing assets held within a trust, they may need to file a Trustee's Deed to withdraw their role. This deed enables the transfer of property held within the trust to the designated beneficiaries. 3. Guardian's Deed: When a fiduciary serves as a guardian, entrusted with managing the assets or property of a minor or legally incapacitated individual, they may need to file a Guardian's Deed for withdrawal purposes. This deed facilitates the transfer of ownership or control of the property to the appropriate individual or entity, ensuring the welfare of the ward. 4. Conservator's Deed: In situations where a fiduciary acts as a conservator, responsible for handling and protecting the assets of an incapacitated individual, they may need to file a Conservator's Deed to withdraw their authority. This deed allows for the transfer of the conservative's property rights to ensure their best interests are met. Regardless of the type of Fiduciary Deed utilized, the withdrawal process typically involves several key steps. Firstly, the fiduciary must prepare the necessary legal documents, ensuring compliance with Massachusetts state laws. These documents should outline the fiduciary's intention to withdraw their involvement and the transfer of property rights to the appropriate parties. Once prepared, the fiduciary must sign the deed in the presence of a notary public. Afterward, the fiduciary must record the executed Fiduciary Deed with the appropriate county registry of deeds in Massachusetts. This recording serves as an official public notice of the transfer and helps establish the legal validity of the withdrawal. The recorded deed should include relevant details, such as the names of all parties involved, a description of the property, and a reference to the appointment or authority granted to the fiduciary. In summary, a Fiduciary Deed Massachusetts withdrawal is a crucial legal process allowing a fiduciary to step down from their responsibilities while ensuring an orderly transfer of property rights. By understanding the different types of Fiduciary Deeds available, including Personal Representative's Deeds, Trustee's Deeds, Guardian's Deeds, and Conservator's Deeds, individuals can navigate the withdrawal process effectively and efficiently.

Fiduciary Deed Massachusetts Withdrawal

Description

How to fill out Fiduciary Deed Massachusetts Withdrawal?

The Fiduciary Deed Massachusetts Withdrawal you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and state laws. For more than 25 years, US Legal Forms has provided people, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, easiest and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Fiduciary Deed Massachusetts Withdrawal will take you only a few simple steps:

- Look for the document you need and check it. Look through the file you searched and preview it or review the form description to ensure it fits your requirements. If it does not, use the search option to get the correct one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Choose the format you want for your Fiduciary Deed Massachusetts Withdrawal (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork again. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

You need to fill out the Petition to Establish Custody or Petition to Modify Custody. You file the petition in the court where the children lived for the last six months before filing. You also send a copy of the petition to the other side.

If you are an individual and want to file a lawsuit for $10,000 or less, you have the option of filing a small claims case or a limited civil case. If you are a business, you can file in small claims court for $5,000 or less.

Filing the Case Before filing a Small Claims case a written or oral demand for payment must be made on the defendant (s). The Plaintiff opens a Small Claims case by filing a Small Claims Affidavit form, which is a sworn statement as to the basic claim information.

Small Claims Court is for money debts, personal injury or property damages up to $6,000. That is the maximum amount you can receive in Small Claims Court.

The amount demanded in the complaint cannot exceed $7,000 excluding costs, and the Defendant must be able to be served within the county issuing the complaint. 2. A written complaint must be prepared and SWORN TO before the Court. A complaint is a brief, concise statement of the facts making up your complaint.

Filing the Case Before filing a Small Claims case a written or oral demand for payment must be made on the defendant (s). The Plaintiff opens a Small Claims case by filing a Small Claims Affidavit form, which is a sworn statement as to the basic claim information.

How much does it cost to file? The fee for filing a Small Claims action is $10, payable to the Circuit Court in the form of exact change, personal or business check, or money order.