Massachusetts Property Tax For Seniors

Description

How to fill out Massachusetts Property Management Package?

Whether for business purposes or for personal affairs, everyone has to deal with legal situations sooner or later in their life. Completing legal papers requires careful attention, starting with selecting the proper form template. For instance, when you select a wrong version of a Massachusetts Property Tax For Seniors, it will be turned down once you submit it. It is therefore important to have a reliable source of legal documents like US Legal Forms.

If you have to get a Massachusetts Property Tax For Seniors template, stick to these easy steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Examine the form’s information to ensure it fits your situation, state, and region.

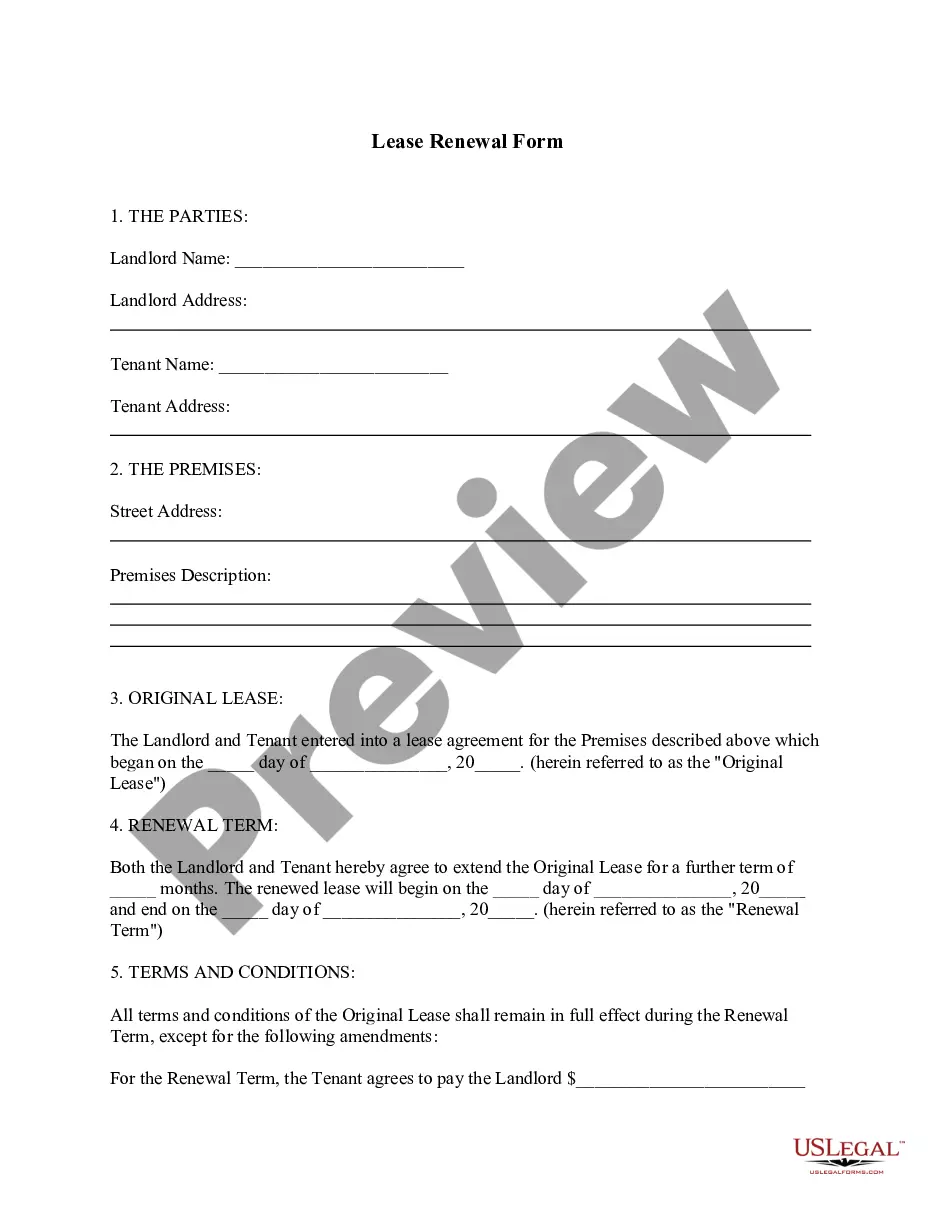

- Click on the form’s preview to see it.

- If it is the wrong document, return to the search function to locate the Massachusetts Property Tax For Seniors sample you require.

- Get the file when it matches your needs.

- If you have a US Legal Forms account, click Log in to gain access to previously saved files in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Finish the account registration form.

- Pick your payment method: you can use a credit card or PayPal account.

- Choose the document format you want and download the Massachusetts Property Tax For Seniors.

- After it is downloaded, you are able to fill out the form by using editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you never need to spend time looking for the right template across the web. Utilize the library’s straightforward navigation to get the appropriate form for any occasion.

Form popularity

FAQ

A property tax deferral does not discharge the tax obligation like an exemption. Instead, it defers payment until the senior sells the property or passes away. A deferral allows seniors to use resources that would go to pay taxes to defray living expenses instead.

You must be 70 or older. For Clauses 41C and 41C½, the eligible age may be reduced to 65 or older, by vote of the legislative body of your city or town. You must own and occupy the property as your domicile.

The Senior Circuit Breaker tax credit is based on the actual real estate taxes paid on the Massachusetts residential property you own or rent and occupy as your principal residence. The maximum credit amount for tax year 2022 is $1,200.

You are 65 years old or older as of July 1 of the fiscal year. You owned and occupied your current property as your domicile as of July 1 of the fiscal year.

The standard deduction for those over age 65 in 2023 (filing tax year 2022) is $14,700 for singles, $27,300 for married filing jointly if only one partner is over 65 (or $28,700 if both are), and $21,150 for head of household.