Specially Bank

Description

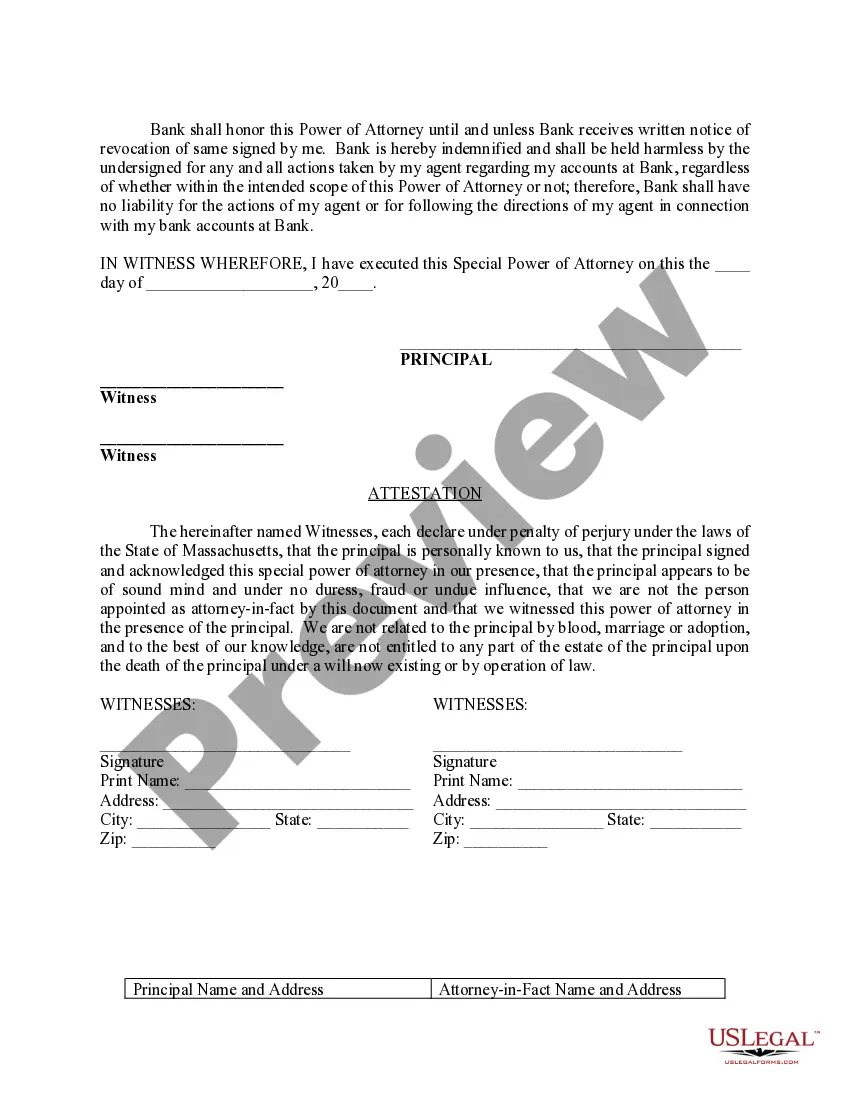

How to fill out Massachusetts Special Durable Power Of Attorney For Bank Account Matters?

- If you are a returning user, log in to your account, ensuring your subscription is current, then click the Download button for the form you need.

- For first-time users, start by exploring the form descriptions and preview mode to verify you have selected the appropriate template that aligns with your local jurisdiction.

- If you don't find the right form, utilize the Search feature to locate another template that better fits your requirements.

- Once you've identified your form, click on the Buy Now button, select your subscription plan, and create an account to unlock access to the complete library.

- Complete your purchase by entering your payment details or using your PayPal account for a smooth transaction.

- After purchasing, download the form directly to your device for easy completion, and you can also retrieve it later from the My Forms menu in your account.

In conclusion, US Legal Forms offers a robust solution to efficiently access and manage legal documents. With premium resources and expert assistance, you can ensure that your forms are completed accurately and legally sound. Start your journey with US Legal Forms today!

Unlock the power of legal simplicity—visit US Legal Forms now!

Form popularity

FAQ

A specified bank refers to an institution designated for particular financial services or transactions. This term may denote banks that comply with specific regulatory or operational requirements. Understanding what a specified bank means can guide you in choosing the right financial partner.

Yes, Schwab Bank is a real bank and is a subsidiary of Charles Schwab Corporation. It offers a variety of financial products, including checking accounts and loans, all designed with customer convenience in mind. Choosing a reputable bank like Schwab can be part of a solid financial strategy.

People often choose specific banks based on factors like services offered, customer service, and convenience. A specially bank may provide unique features, such as lower fees or specialized products, that better meet customer needs. Evaluating options helps individuals make informed choices.

A specialty bank focuses on serving niche markets, providing services tailored to specific sectors or demographics. These institutions may offer specialized financial products, catering to unique customer requirements. Understanding specialty banks can help you find tailored financial solutions.

The four main types of banks include commercial banks, investment banks, retail banks, and central banks. Each type serves different purposes, such as providing loans, managing investments, or overseeing monetary policy. Selecting a specially bank that aligns with your needs can enhance your financial journey.

The specific branch of a bank is typically identified by its unique routing number and physical location. This routing number is essential for processing transactions and ensuring funds are directed correctly. Knowing the location of your specially bank branch can simplify your banking experience.

A specially bank is a financial institution dedicated to providing tailored services aimed at specific customer needs. Various institutions may offer specialized banking products, such as loans or investment services. Understanding these nuances can help you make informed choices regarding your financial needs.

To fill out a bank form, begin by reading the instructions carefully. Accurately enter your personal information, like your name, address, and account details. Review your entries for errors before submitting the form to avoid delays in processing.

A special account in banking is typically designed to meet unique needs or goals, such as saving for specific projects or funds. These accounts may offer tailored terms, like better interest rates or no fees, providing individuals with financial flexibility. Carefully consider what special account suits your requirements.

The seven habit deposits in an emotional bank account include being proactive, beginning with the end in mind, putting first things first, thinking win-win, seeking first to understand then to be understood, synergizing, and sharpening the saw. These habits emphasize collaboration and mutual respect, cultivating rich emotional connections over time.