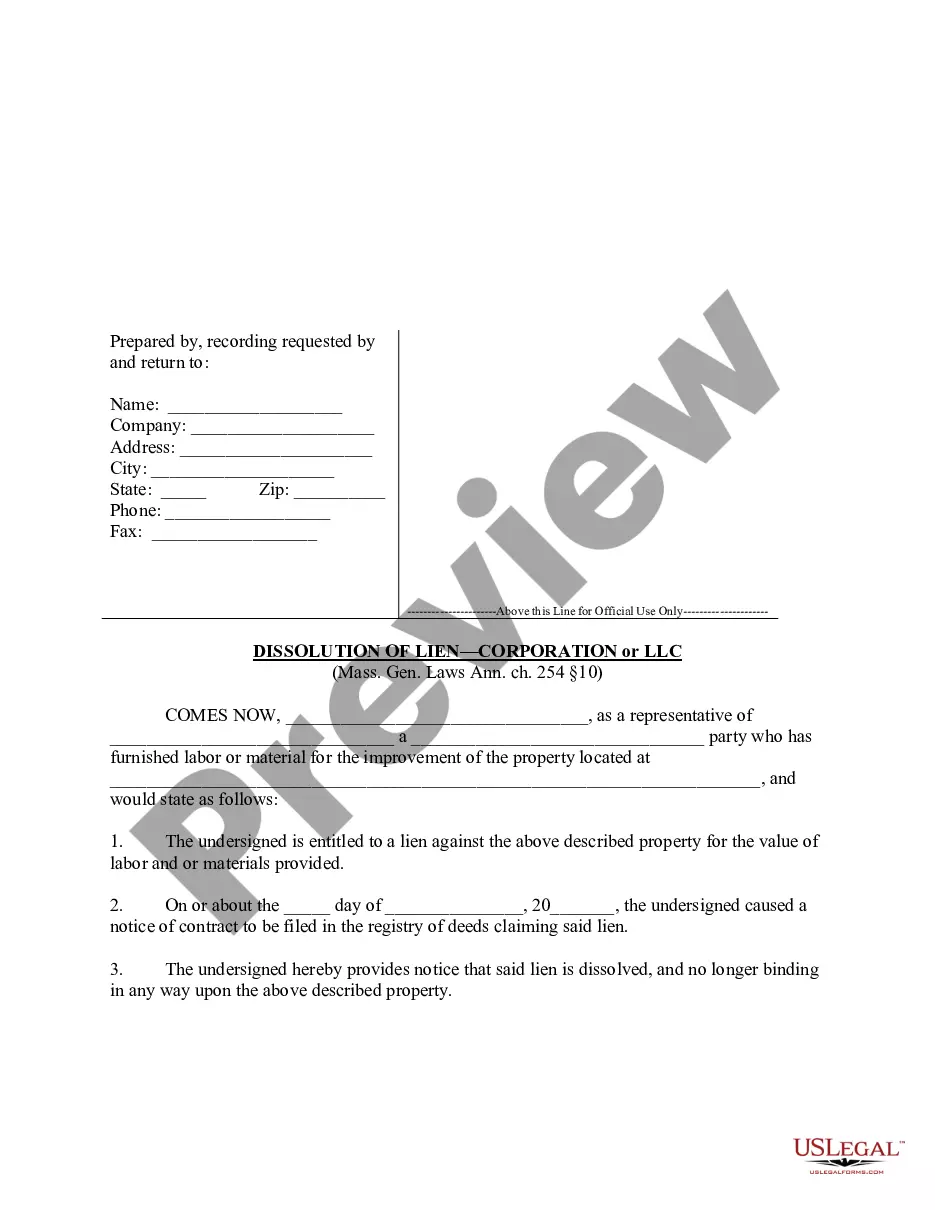

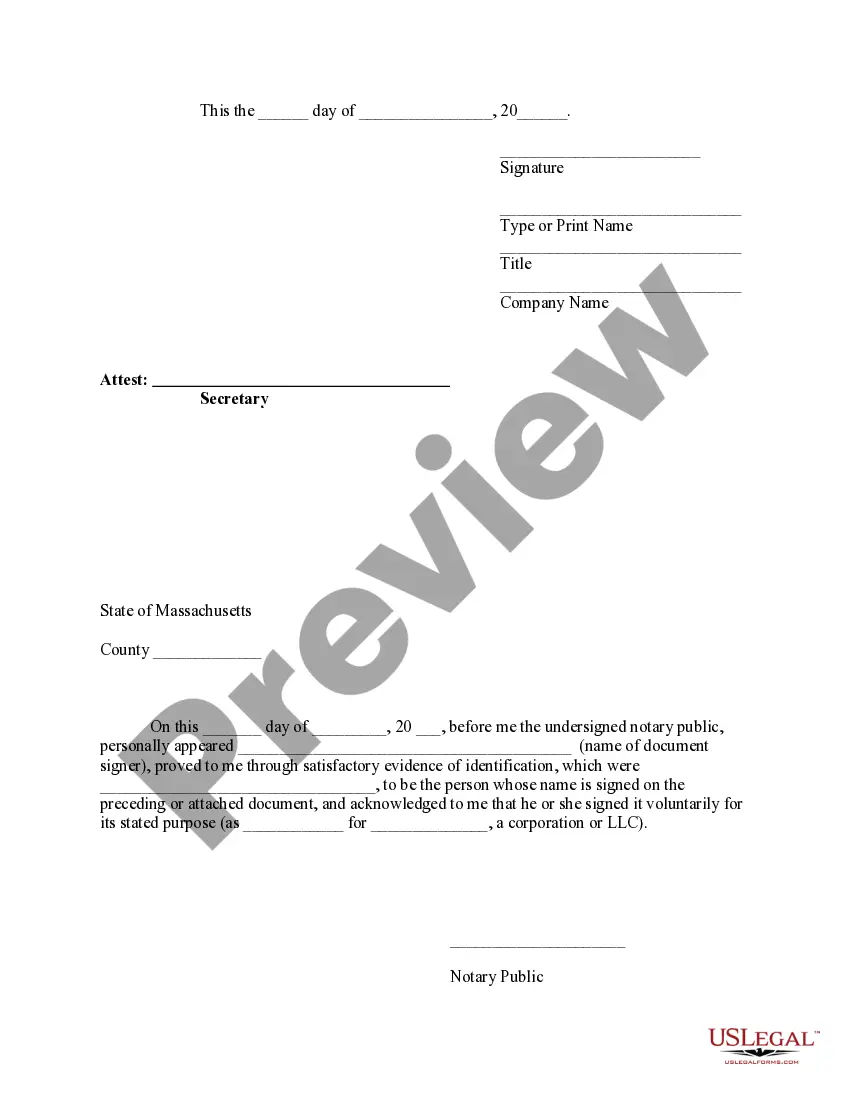

"The lien of any person may, so far as his interest is concerned, be dissolved by a notice signed by him, stating that his lien is dissolved, filed in the registry of deeds where the notice of the contract is filed under which contract the lien is claimed." Mass. Gen. Laws Ann. ch. 254 ?§10.

Massachusetts Dissolution Form For Llc

Description

Form popularity

FAQ

Failing to file an annual report for your LLC in Massachusetts can lead to penalties, including fines and potential dissolution of your LLC. The state requires this report to keep your business in good standing. If you find yourself needing to close your LLC due to missed requirements, you may have to utilize the Massachusetts dissolution form for LLC to proceed with the proper termination process.

Yes, Massachusetts does recognize single member LLCs. This means you can operate your business as a single member while still enjoying the same liability protections offered under LLC laws. If you decide to dissolve your single member LLC in the future, you will need to complete the Massachusetts dissolution form for LLC to officially close your business.

A Professional Limited Liability Company (PLLC) and a Limited Liability Company (LLC) differ primarily in their intended purpose. A PLLC is designed for licensed professionals, such as doctors or lawyers, allowing them to provide services while enjoying limited liability. On the other hand, a standard LLC can be formed for any legal business activity in Massachusetts. Understanding these distinctions is helpful, especially when considering the Massachusetts dissolution form for LLC, should you decide to close your business.

To form an LLC in Massachusetts, you must file a Certificate of Organization with the Secretary of the Commonwealth. You must also appoint a registered agent, prepare an Operating Agreement, and obtain any necessary licenses or permits. Completing these steps correctly is essential, especially when you consider the potential need to later submit the Massachusetts dissolution form for LLC if you choose to close down your business.

Yes, Massachusetts law requires every LLC to have a registered agent. This agent acts as the official point of contact for receiving legal documents and notices. Having a registered agent ensures that your LLC can be reached effectively, which can help streamline the process when completing the Massachusetts dissolution form for LLC. You can choose to act as your own registered agent or hire a professional service.

Yes, every LLC in Massachusetts must file an annual report. This report is essential to keep your business in good standing and includes important information such as the name and address of the LLC, as well as any changes that may have occurred. If you're unsure about the process, utilizing a Massachusetts dissolution form for LLC can provide clarity. Additionally, staying current with your filings prevents unnecessary penalties or complications for your business.

To dissolve a corporation in Massachusetts, you need to file a Massachusetts dissolution form for LLC, accompanied by a detailed plan for winding up the company's affairs. Begin by obtaining the required forms from the Massachusetts Secretary of the Commonwealth's website. After completing the forms, submit them along with any necessary fees. It’s advisable to notify creditors and settle any outstanding debts to ensure a smooth dissolution process.

Deciding whether to dissolve your LLC or leave it inactive depends on your future business intentions. If you do not plan to use the LLC, dissolving it can reduce ongoing fees and administrative requirements. However, if you intend to resume business in the future, keeping it inactive may be a better option. Consider using the Massachusetts dissolution form for LLC from uslegalforms if you choose to go with dissolution, as they provide helpful resources.

Yes, notifying the IRS is essential when you close your LLC. You must file the final tax return and include the words ‘final return’ at the top. This ensures the IRS is aware that your business is no longer active and allows you to settle any tax obligations. Utilizing tools and templates available at uslegalforms can help you navigate this process more efficiently.

To dissolve an LLC in Massachusetts, you need to file the Certificate of Dissolution with the Secretary of the Commonwealth. Ensure that you have settled any outstanding debts and obligations before proceeding with the dissolution process. Additionally, consider notifying all members and stakeholders to maintain transparency. Using the Massachusetts dissolution form for LLC available on platforms like uslegalforms can simplify this process significantly.