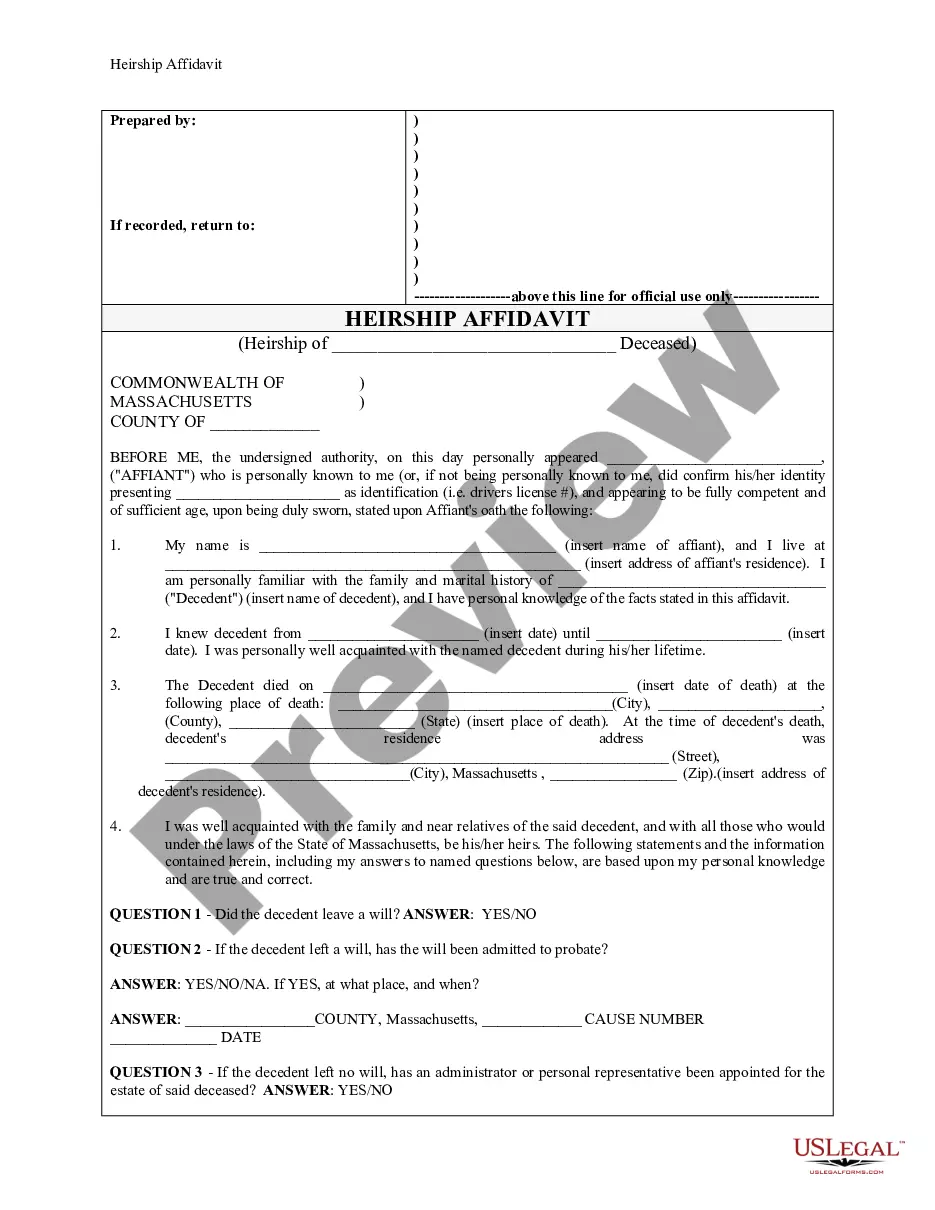

Affidavit Of Heirship Massachusetts Form

Description

How to fill out Massachusetts Heirship Affidavit - Descent?

Individuals typically link legal documentation with a process that is intricate and solely manageable by a specialist. In a sense, this is accurate, as creating the Affidavit Of Heirship Massachusetts Form necessitates considerable knowledge of subject matter requirements, incorporating state and county laws.

However, with US Legal Forms, everything has been simplified: pre-prepared legal templates for various life and business scenarios tailored to state regulations are compiled in one online library and are currently accessible to all.

US Legal Forms provides over 85,000 current forms categorized by state and area of application, making it possible to locate the Affidavit Of Heirship Massachusetts Form or any specific template in just a few minutes.

All templates in our collection are reusable: after purchase, they remain stored in your account. You can access them whenever necessary through the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe now!

- Review the page contents carefully to ensure they fulfill your requirements.

- Read the form description or inspect it through the Preview feature.

- Search for another template using the Search field above if the previous option doesn't fit your needs.

- Click Buy Now once you identify the suitable Affidavit Of Heirship Massachusetts Form.

- Choose the subscription plan that aligns with your needs and financial capacity.

- Create an account or sign in to move to the payment section.

- Complete your subscription payment using PayPal or your credit card.

- Select the format for your document and click Download.

- Print your document or upload it to an online editor for a faster completion.

Form popularity

FAQ

Massachusetts Summary: Under Massachusetts statute, where as estate is valued at less than $25,000, an interested party may, thirty (30) days after the death of the decedent, file a small estate sworn statement.

How to Write(1) Massachusetts County.(2) Name Of Affiant To Massachusetts Estate.(3) Post Office Address And Residential Address.(4) Name Of Massachusetts Decedent.(5) Residential Address.(6) Affiant Description.(7) Date Of Massachusetts Decedent's Death.(8) Names And Address Of Joint Owners To Estate Property.More items...?

ChecklistThe name and address of the deceased party (called the "Decedent")The name and address of the party providing sworn testimony in this affidavit (called the "Affiant")The date and location of the Decedent's death.Whether or not the Decedent left a will and, if so, the name and address of the Executor.More items...

In Massachusetts, creditors have up to 12 months to make claims against the estate to get payment for the debt. The executor reviews these claims and pays the legitimate ones from the estate's assets.

Heirs at law are persons entitled to receive the Decedent's property under the intestacy succession laws if there is no will. For dates of death on or after March 31, 2012, the Massachusetts Uniform Probate Code, G. L. c. 190B, § 2-101, et seq., should be consulted.