Ma Divorce With Withholding Tax

Description

How to fill out Massachusetts No-Fault Agreed Uncontested Divorce Package For Dissolution Of Marriage For People With Minor Children?

Acquiring legal document samples that comply with federal and state regulations is essential, and the internet provides a plethora of choices to select from.

However, what is the advantage of wasting time searching for the suitable Ma Divorce With Withholding Tax sample online when the US Legal Forms digital library already contains such templates organized in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates crafted by attorneys for any professional and personal scenario. They are simple to navigate, with all documents categorized by state and intended use. Our specialists stay updated with legislative changes, ensuring your paperwork is current and meets requirements when obtaining a Ma Divorce With Withholding Tax from our site.

All templates available through US Legal Forms are reusable. To download and complete forms you have purchased before, access the My documents tab in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- Acquiring a Ma Divorce With Withholding Tax is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in the correct format.

- If you are a new visitor to our site, follow the steps outlined below.

- Examine the template using the Preview option or through the text description to ensure it meets your requirements.

- Search for another sample using the search feature at the top of the page if necessary.

- Click Buy Now once you’ve found the appropriate form and choose a subscription plan.

- Create an account or sign in and process your payment using PayPal or a credit card.

- Choose the most suitable format for your Ma Divorce With Withholding Tax and download it.

Form popularity

FAQ

When asked if you are exempt from withholding, be honest based on your current tax situation, particularly after your Ma divorce with withholding tax implications. If you meet certain criteria that allow for exemption, such as low income and no tax liability, you can answer yes. Otherwise, respond no but be sure to indicate any exemptions you do qualify for on your tax forms.

The income statement, balance sheet, and statement of cash flows are required financial statements. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value.

It will help you to get a clear idea of the cost to run your home. Filling in the Financial Statement template. ... Enter your personal details. ... Enter your income. ... Enter your expenditure totals. ... Calculate how much you have left for all debts. ... Enter your debt details. ... Calculate how much you have left for secondary debts.

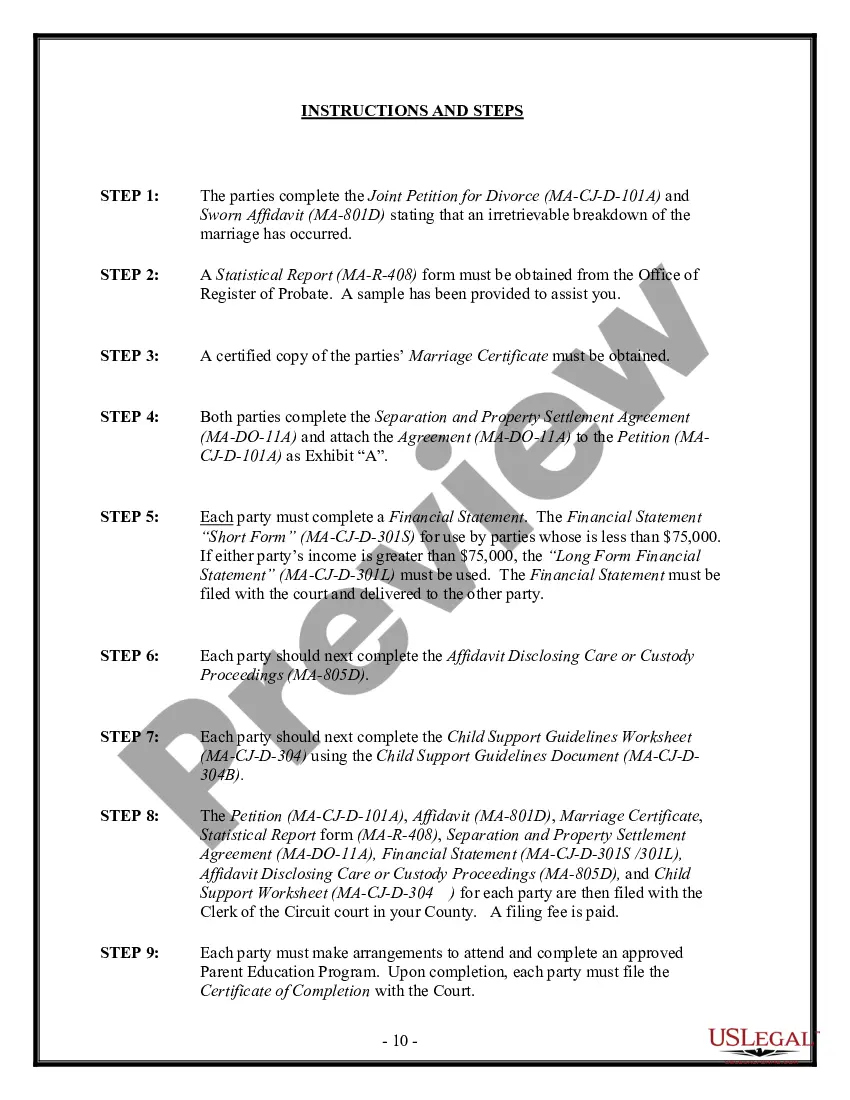

How to complete the Short Form Financial Statement in Massachusetts Section one: personal information. ... Section two: gross weekly receipts. ... Section three: itemized deductions. ... Section four: adjusted net weekly income. ... Section five: other deductions. ... Section six: net weekly income.

Determine whether you need to complete the Short Form or the Long Form. ... Fill in your Personal Information. ... Identify Your Gross Weekly Income. ... Identify the Deductions from your Gross Weekly Income. ... Identify your Weekly Expenses. ... Identify your Assets. ... Identify your Liabilities. ... The Final Review.

The divorce financial statement is a form that lists all assets and liabilities of each person involved in the divorce. Each person must fill one out their portion and submit it to the court in order to explain their financial situation to the court.