Community Property Regime Form Irs

Description

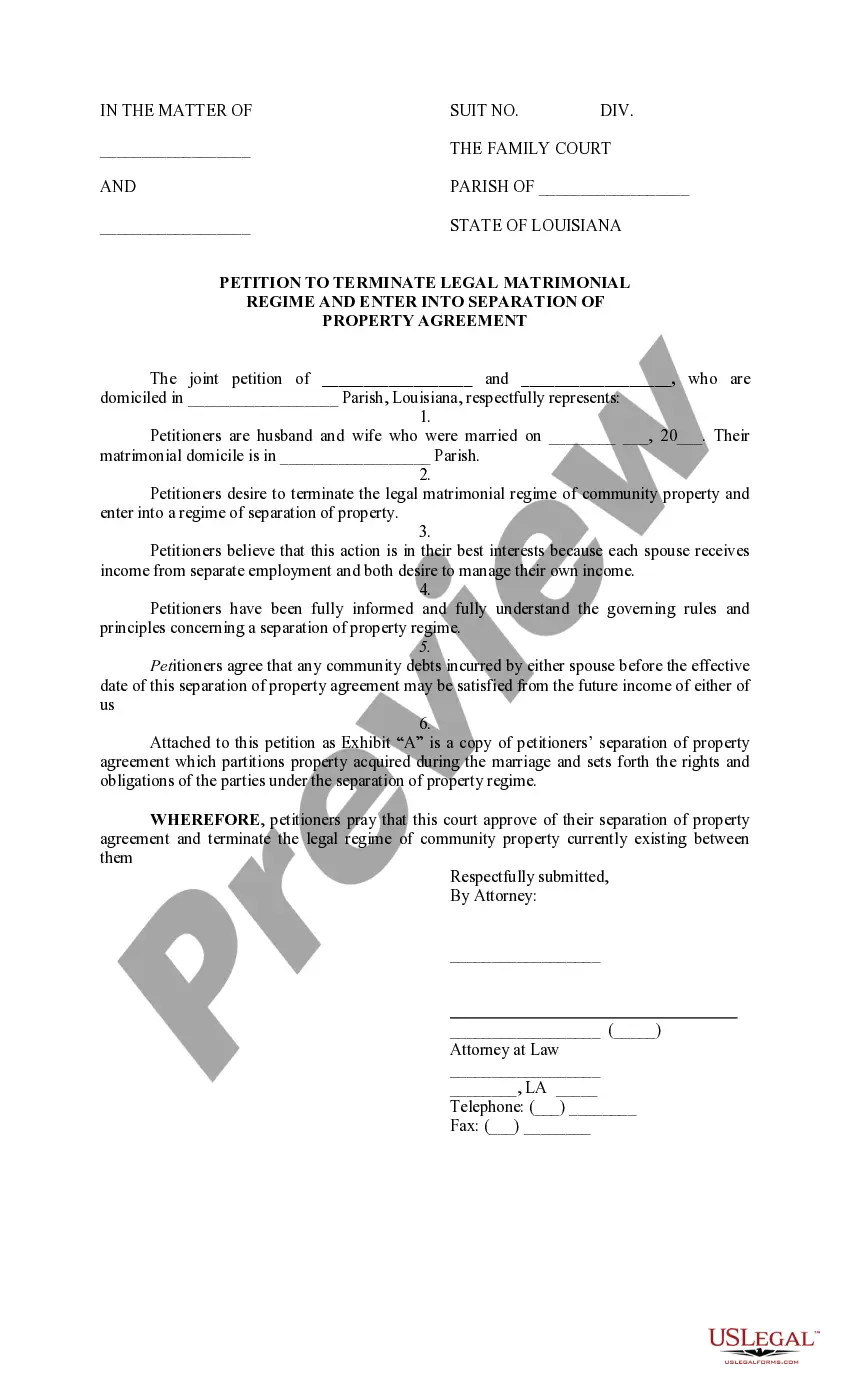

How to fill out Louisiana Joint Petition For Approval Of Matrimonial Regime Of Separation Of Property, With Order?

Properly created official documentation is among the key assurances for preventing issues and disputes, yet obtaining it without the help of a lawyer may require time.

Whether you aim to swiftly discover a current Community Property Regime Form Irs or any other formats for work, family, or business circumstances, US Legal Forms is always available to assist.

The process is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you merely need to Log In to your account and click the Download button next to the selected document. Additionally, you can retrieve the Community Property Regime Form Irs later at any time, as all documents ever obtained on the platform are accessible within the My documents section of your profile. Save time and funds on drafting official paperwork. Experience US Legal Forms immediately!

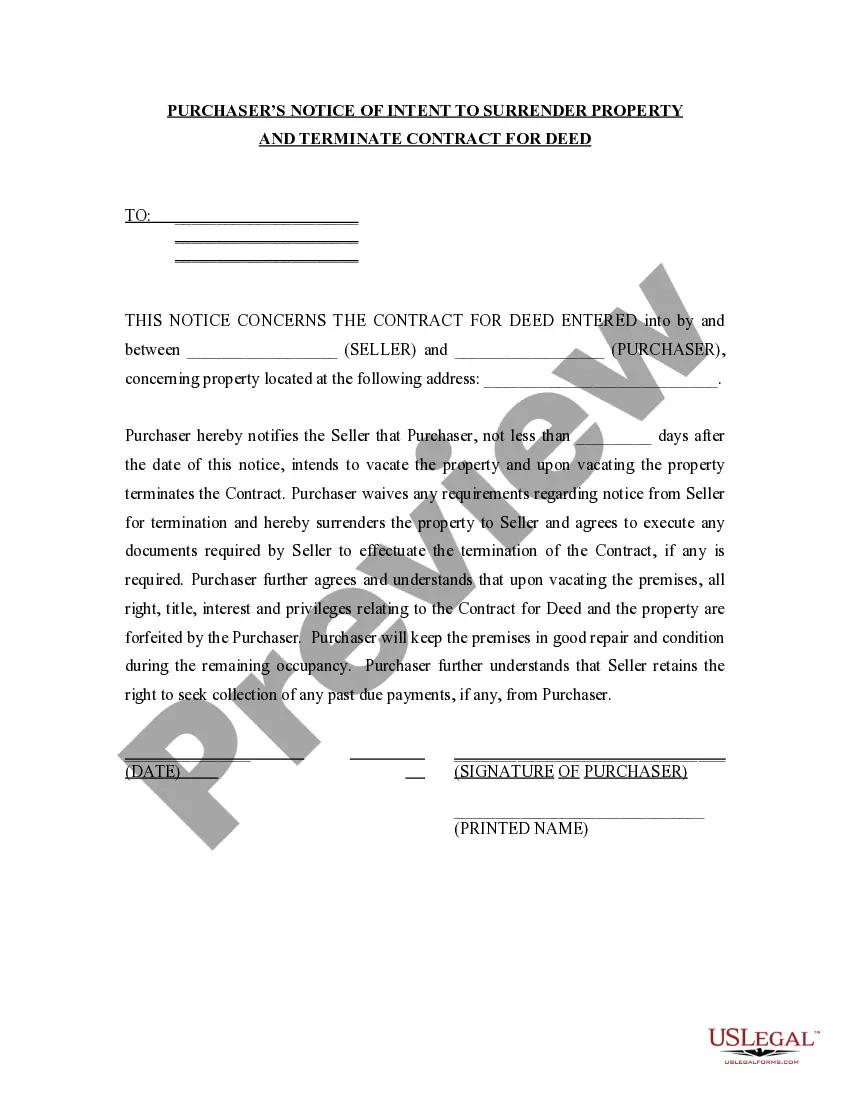

- Ensure that the document is applicable for your circumstance and location by reviewing the description and preview.

- Search for an additional example (if necessary) using the Search bar found in the page header.

- Hit Buy Now once you find the suitable template.

- Select your price plan, Log In to your account or create a new one.

- Choose your desired payment option to purchase the subscription (via credit card or PayPal).

- Select PDF or DOCX file format for your Community Property Regime Form Irs.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Form 8958 is mandatory for taxpayers living in community property states who file jointly with their spouse. This form ensures proper allocation of income and deductions according to community property laws. Failing to complete this form may lead to inaccuracies in your tax filings and potential penalties. Leveraging uslegalforms can provide the necessary support to ensure compliance with this community property regime form for the IRS.

Form 8962 is used to calculate the premium tax credit, which helps individuals afford health insurance under the Affordable Care Act. This form requires information about your household income and can influence your community property regime form for IRS considerations. Filling it out correctly ensures you receive the right credits and maintain compliance. Resources on uslegalforms can help guide you through the process.

To allocate federal amounts to your spouse, you must understand the guidelines provided in your community property regime form for the IRS. This typically involves reporting income and deductions according to ownership of assets and debts, as dictated by state laws. Ensure both you and your spouse agree on the allocations to avoid discrepancies. Using tools from uslegalforms can simplify this process and provide clarity.

Filling out Form 8825 is essential for reporting income and expenses for rental real estate activities. Start by entering basic property information, then detail your income and expenses line by line. Each section of the form corresponds to specific types of income and deductions related to your community property. Using the community property regime form from the IRS ensures you accurately reflect your financial situation.

In a community property state, the IRS form you typically need is Form 8958. This form helps to report income, deductions, and credits between you and your spouse. If you file jointly, it’s essential for accurately allocating your combined income. Understanding this community property regime form for the IRS can streamline your tax process.

Yes, you can file separately in a community property state, but you must follow specific rules related to income allocation. Each spouse must report half of the community income on their individual tax returns. Using Form 8958 will help you appropriately divide the income, ensuring compliance with IRS rules. For assistance in handling these forms, check out USLegalForms for streamlined solutions.

Form 8958 is used to allocate income for taxpayers living in Community Property States, ensuring proper division of community income and expenses. This form is essential for reporting income accurately on your tax return. When completed correctly, Form 8958 supports fair tax liability allocation between spouses. To obtain more information, consider exploring the resources available at USLegalForms.

The IRS considers you unmarried if your marriage ended by divorce or legal separation by the last day of the tax year. This status influences your filing options and the applicable tax benefits. It is vital to correctly determine your filing status to meet IRS regulations. If you need assistance, platforms like USLegalForms can provide helpful insights.

Yes, you can file as Married Filing Separately (MFS) for federal taxes while filing as Married Filing Jointly (MFJ) at the state level. This strategy may provide certain tax benefits depending on your state laws. However, ensure that you comply with both federal and state requirements to avoid penalties. Utilizing resources from USLegalForms can offer clarity on this process.

The primary IRS form for community property income allocation is Form 8958. This form assists you in reporting your separate and community income as required by the IRS. Properly completing Form 8958 is crucial for compliance if you live in a community property state. To learn more about this, consult resources on platforms like USLegalForms.