Bank Power Of Attorney Form With Someone With Dementia

Description

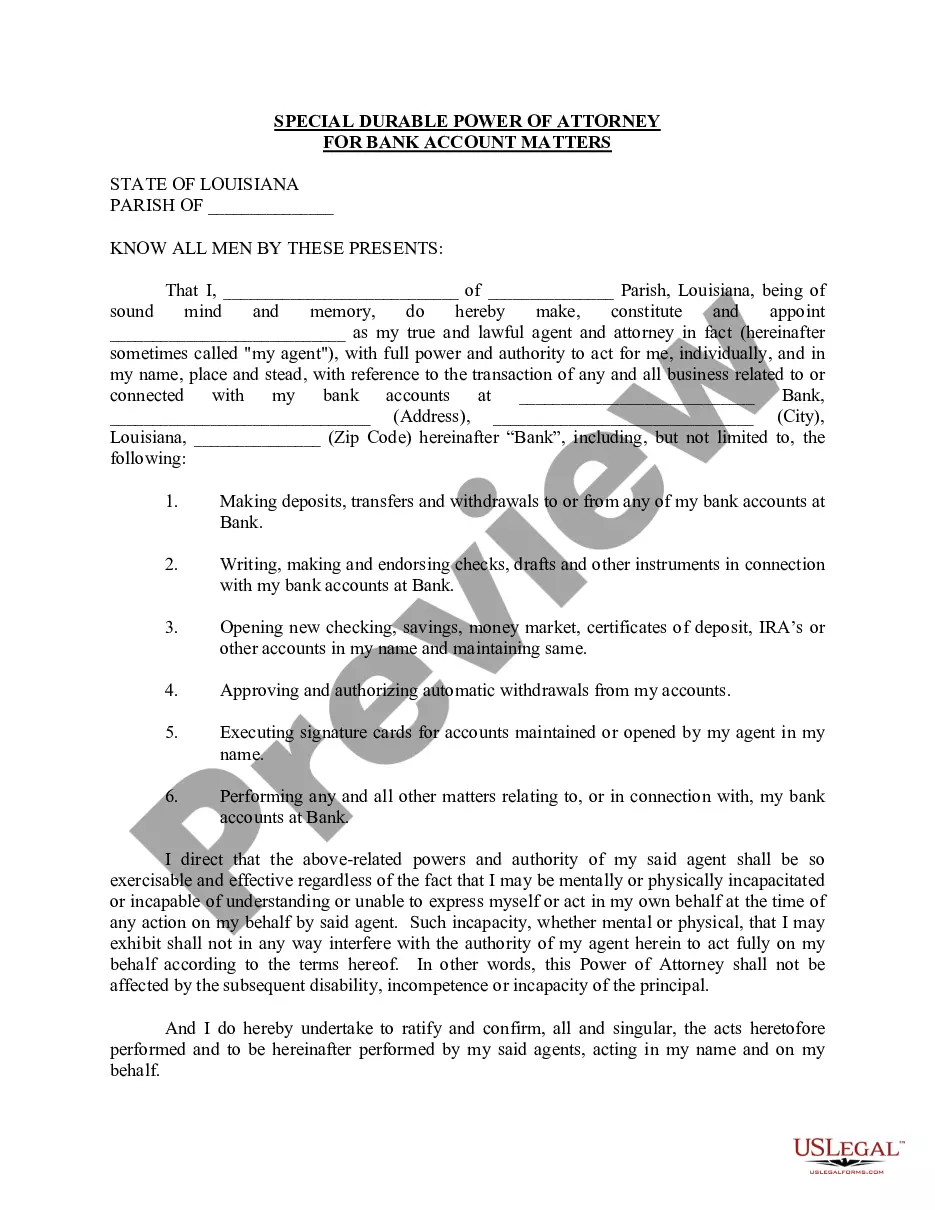

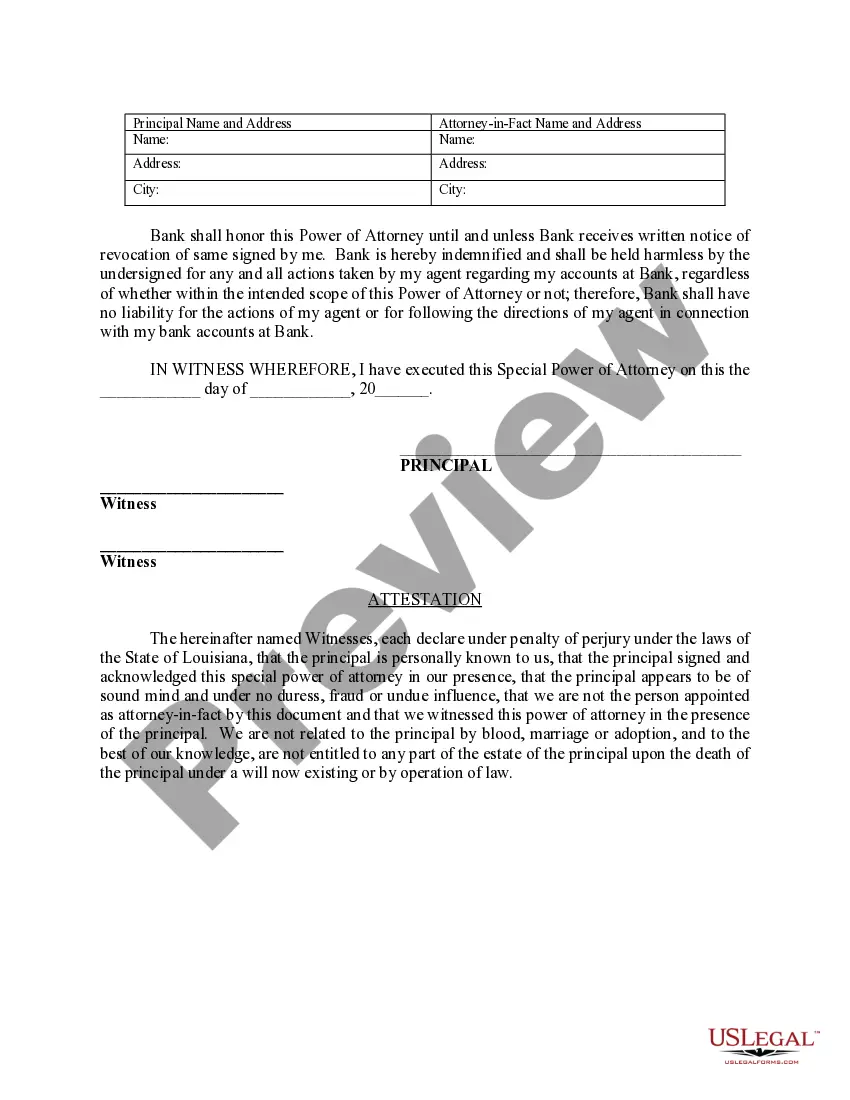

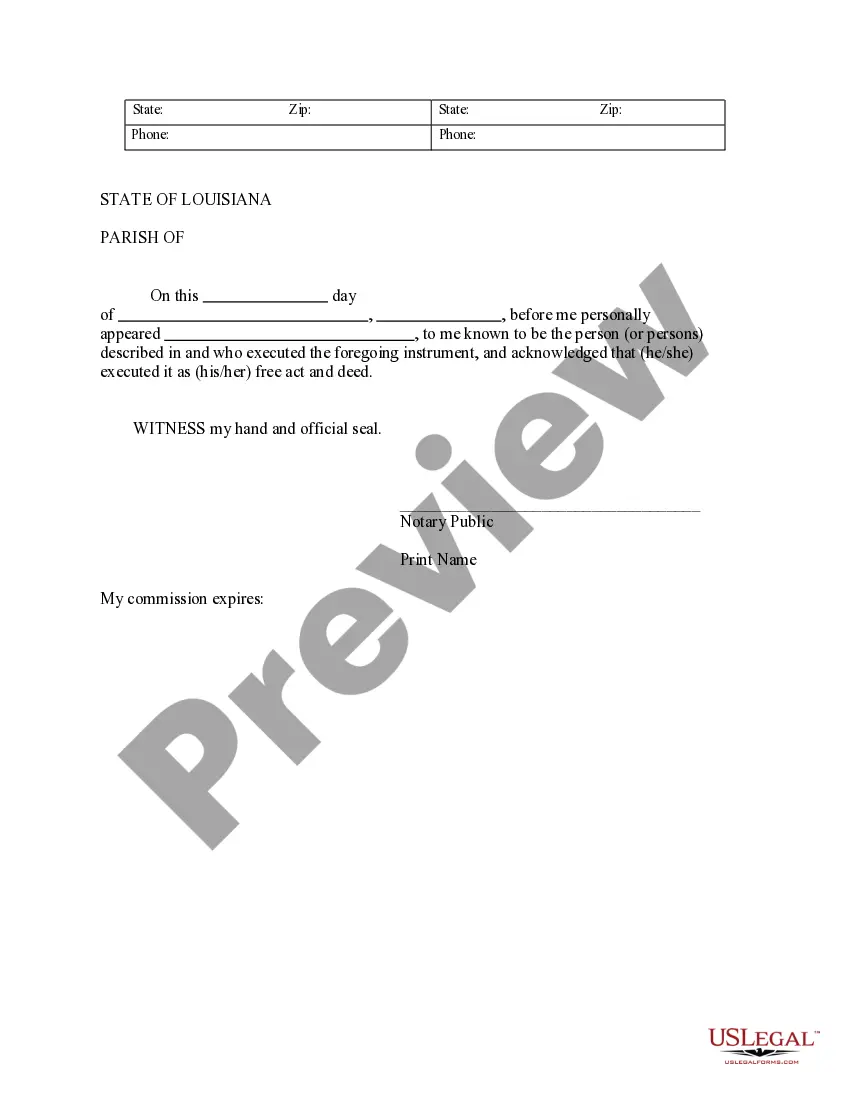

How to fill out Louisiana Special Durable Power Of Attorney For Bank Account Matters?

Navigating through the red tape of traditional documents and formats can be challenging, particularly if one does not engage in that professionally.

Choosing the correct template to obtain a Bank Power Of Attorney Form With Someone With Dementia will be labor-intensive, as it must be accurate and precise to the last digit.

However, you will significantly reduce the time spent selecting a suitable template if it originates from a resource you can trust.

Acquire the correct document in a few simple steps.

- US Legal Forms is a site that streamlines the process of finding the appropriate forms online.

- US Legal Forms is a single destination you need to acquire the latest templates of documents, verify their usage, and download these templates to complete them.

- It is a compilation of over 85K documents that are applicable in various professional fields.

- When searching for a Bank Power Of Attorney Form With Someone With Dementia, you can be assured of its legitimacy as all forms are authenticated.

- Having a US Legal Forms account will guarantee that you have all the essential templates at your fingertips.

- Store them in your history or add them to the My documents collection.

- You can access your saved documents from any device by simply clicking Log In at the library site.

- If you do not yet have an account, you can always search for the template you need.

Form popularity

FAQ

Typically, as long as dementia is minor or nonexistent, a person in the beginning stages of a dementia-causing disorder will be deemed mentally competent in the eyes of the law.

One way to protect your marital assets is to have your spouse create a durable power of attorney for finance. A power of attorney allows the individual to designate someone to make financial decisions for them should he or she become incapacitated. In the case of a married couple, this is usually the person's spouse.

In most cases, the person with dementia will be expected to pay towards the cost. Social services can also provide a list of care homes that should meet the needs identified during the assessment.

Capacity and Dementia A person is without capacity if, at the time that a decision needs to be taken, he or she is unable by reason of mental disability to make a decision on the matter in question, or unable to communicate a decision on that matter because he or she is unconscious or for any other reason.

In most cases, if a person living with dementia is able to understand the meaning and importance of a given legal document, he or she likely has the legal capacity (the ability to understand the consequences of his or her actions) to execute (to carry out by signing it).