Living Trust Louisiana For Minor Child

Description

Form popularity

FAQ

Yes, siblings can potentially force the sale of inherited property if there is a disagreement among heirs regarding its management. However, creating a living trust for a minor child can help prevent conflicts, as it outlines ownership and management responsibilities, keeping your child's best interests at the forefront.

Your child can inherit from your estate in Louisiana, regardless of whether you have a will or not. By setting up a living trust for a minor child, you can ensure that your child's inheritance is well-managed and distributed according to your wishes, providing peace of mind for you and security for your child.

In Louisiana, a child is entitled to a share of the parent's estate, which includes both community and separate property. If a trust is established, like a living trust for a minor child, it can specify precisely how your child will receive their inheritance, offering security and clarity during a difficult time.

Louisiana follows unique inheritance laws that are influenced by community property principles. In the absence of a will, state laws determine how property is divided among heirs. A living trust for a minor child can help safeguard your child’s inheritance and outline specific terms for distribution.

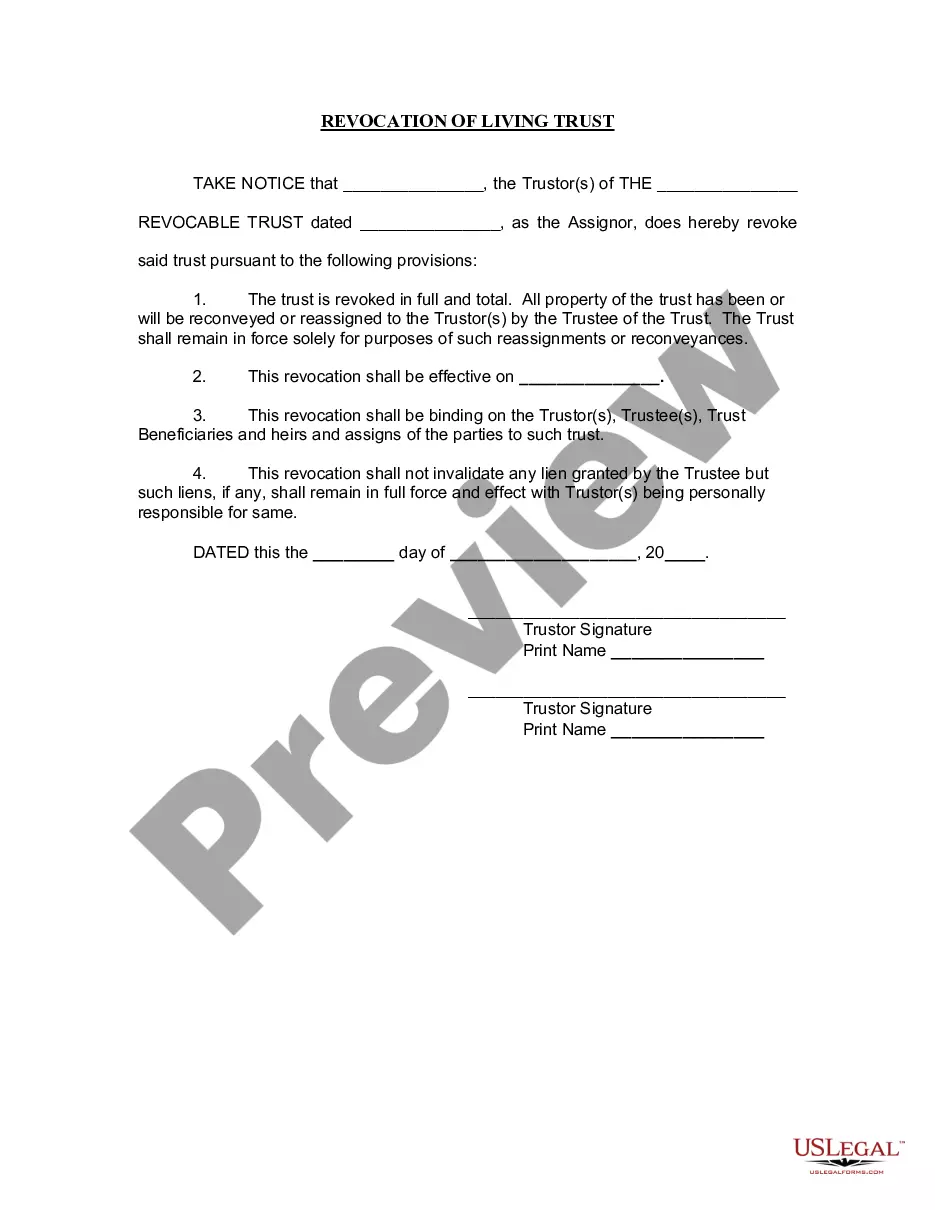

When considering a living trust in Louisiana for a minor child, a revocable living trust often serves as a suitable option. This type of trust allows you to control assets while designating how and when your child receives their inheritance. Additionally, it provides flexibility to adapt to changing circumstances, ensuring the best interests of your child remain a priority.

To create a living trust in Louisiana for a minor child, start by selecting a trustee who will manage the trust assets. Next, you will need to draft the trust document, outlining how assets will be managed and distributed. You can use US Legal Forms to access templates that guide you through this process, ensuring you cover all necessary legal details. Finally, fund the trust with your assets to protect your minor child's future.

To set up a living trust in Louisiana, you need to begin by defining the assets you want to include and identifying a trustworthy trustee. Next, you would create a trust document, clearly outlining the terms and how the trust will benefit your minor child. It's often beneficial to consult legal resources such as USLegalForms to guide you through the specifics of Louisiana laws and ensure your living trust Louisiana for minor child is properly established.

One of the biggest mistakes parents make when setting up a living trust Louisiana for minor child is failing to properly fund the trust. It's crucial to transfer assets into the trust to ensure they are managed according to your wishes. Additionally, many parents overlook updating their beneficiaries, which can lead to undesired outcomes. By utilizing platforms like USLegalForms, you can simplify the process and ensure your living trust is correctly implemented.

A trust for minor children, such as a living trust Louisiana for minor child, functions by holding and managing assets until the child reaches a certain age or condition. The trustee administers the trust according to the terms set by the grantor, ensuring that funds are used for the child's education, health, and general welfare. This structure provides financial security and protects the child's inheritance.

In many cases, a living trust is better than a will in Louisiana because it can avoid probate altogether, allowing quicker access to assets for beneficiaries. Furthermore, living trust Louisiana for minor child offers more privacy since it does not become part of public records. However, the right choice often depends on your specific situation and goals for asset distribution.